This article will analyze the market performance during the current Bitcoin halving cycle, exploring the changes and causes of its cyclical patterns.

I. Introduction: The "Change and Constancy" of Cyclical Patterns

Bitcoin undergoes a halving approximately every four years, which shapes the cyclical fluctuations of the cryptocurrency market. However, since the fourth halving was completed in April 2024, the performance of Bitcoin and the entire crypto market has exhibited new characteristics unlike before. Historically, halvings often signal the bottom of a bear market, followed by a new bull market peak for Bitcoin within about a year. Yet, the 2024-2025 cycle has left many investors puzzled—while Bitcoin's price did reach a historical high, the market did not experience the same kind of fervent enthusiasm as in the past; instead, the upward trend appeared slow and gentle, with reduced volatility, leading many to question whether the four-year cycle theory has failed.

What are the different characteristics of this cycle, and which aspects of the four-year cycle theory still hold true? What factors have led to the changes in the rhythm of this cycle? Amidst the shifting macro environment, the influx of institutional funds, and the fading enthusiasm of retail investors, what direction will Bitcoin's future trajectory take? This article will analyze the market performance during the current Bitcoin halving cycle, explore the changes and causes of its cyclical patterns, and forecast the price trends for the end of 2025 and 2026, attempting to provide investors with comprehensive and insightful analysis.

II. Performance and Characteristics of the Current Bitcoin Halving Cycle

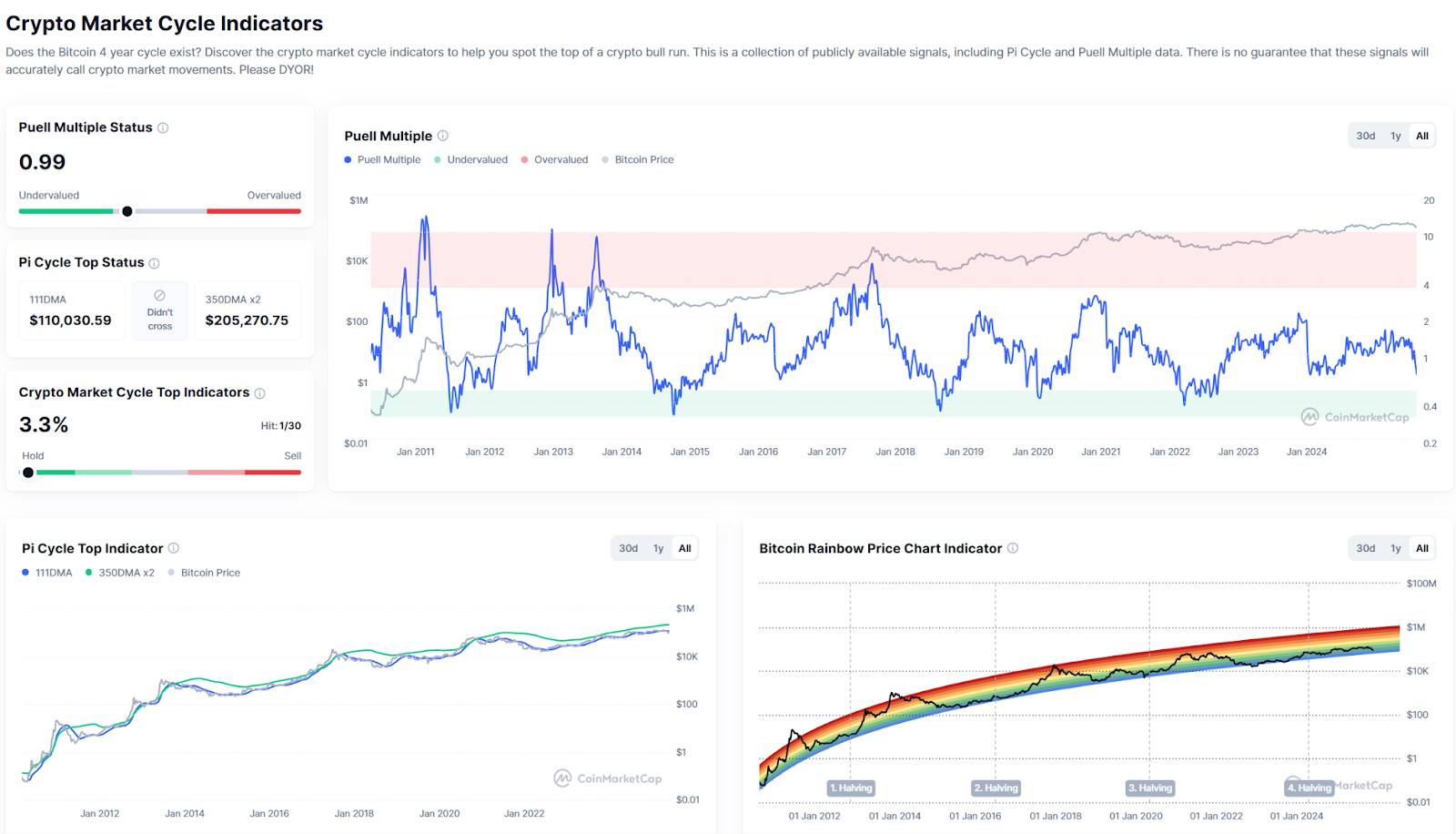

Source: https://coinmarketcap.com/charts/crypto-market-cycle-indicators/

On April 19, 2024, Bitcoin completed its fourth block reward halving, reducing the block reward from 6.25 BTC to 3.125 BTC. According to past cyclical rhythms, halvings typically occur at the end of a bear market, followed by a bull market within 12-18 months. However, the developments in 2024-2025 exhibit both a repetition of cycles and distinct "differences."

Price Trend Overview: New highs emerge, but the rise is tepid. On the day of the halving, Bitcoin's price closed around $64,000. In the following months, the market fluctuated, but overall maintained an upward trajectory: by mid-November 2024, Bitcoin broke through the $90,000 mark; propelled by the conclusion of the U.S. presidential election and a flurry of positive news, on December 5, 2024, Bitcoin surpassed the $100,000 milestone, setting a new high at that time. Entering 2025, Bitcoin's price continued to climb, reaching a historical peak of around $126,270 on October 6, 2025. This peak occurred approximately 18 months after the halving, seemingly similar to past cycles. However, the current upward trend is relatively slow and gentle, lacking the explosive fervor seen in the later stages of previous cycles. From the bear market low in 2022 (~$15,000), Bitcoin's peak represents an increase of about 7-8 times, while from the halving in 2024 (~$64,000), it has grown by less than two times. In contrast, during the 2017 bull market, Bitcoin surged nearly 20 times from the bear market bottom, and in the 2021 bull market, it increased by about 3.5 times. Clearly, the slope and magnitude of the price increase in this cycle have significantly converged, exhibiting "slow bull" characteristics.

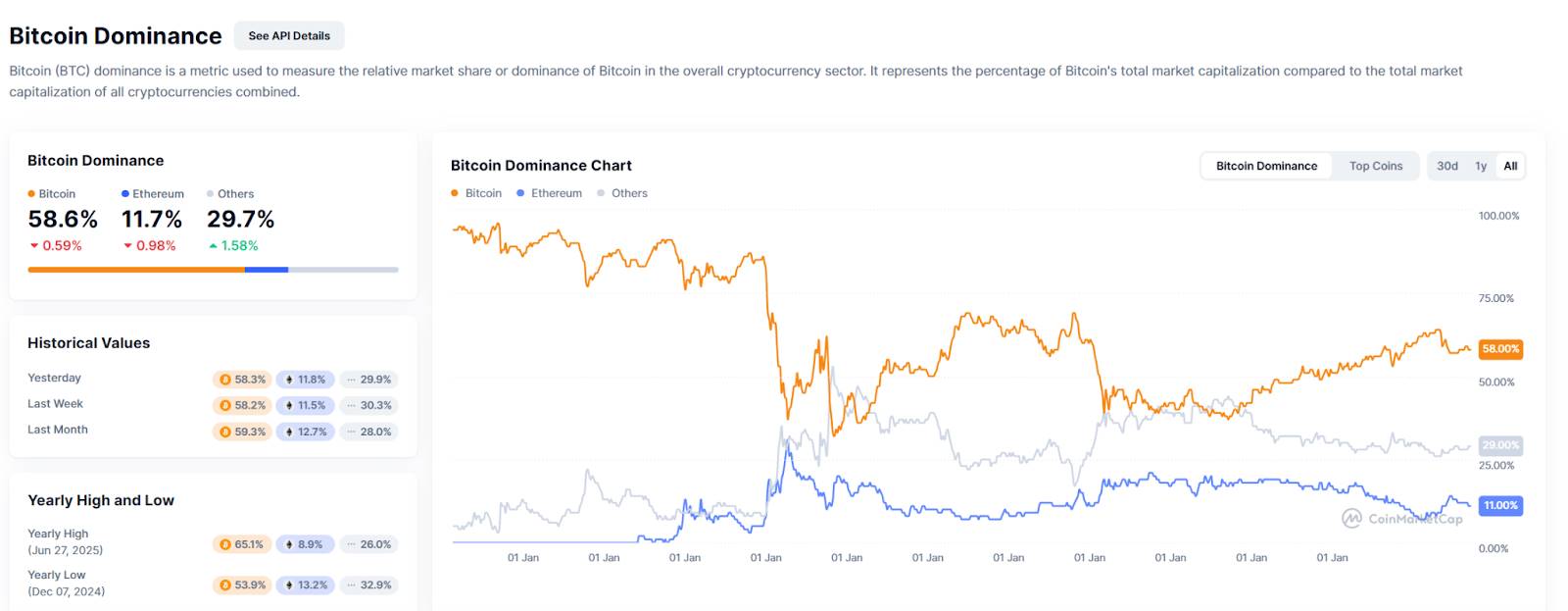

Market Sentiment and Volatility: Absence of frenzy, volatility eases. While prices reached new highs, the market did not exhibit the kind of fervent enthusiasm seen in previous bull markets. At the peaks of the bull markets in late 2017 and late 2021, there was widespread discussion about cryptocurrencies and a flourishing of altcoins. This time, even when Bitcoin's price broke $100K, public sentiment remained relatively calm, failing to trigger a buying frenzy akin to 2017 or the widespread discussions surrounding NFTs and Dogecoin in 2021. On-chain data shows that during this bull market, funds were primarily concentrated in major coins like Bitcoin, with market share approaching 60%, while many speculative altcoins struggled to rebound. Market volatility has also significantly decreased, with annual volatility gradually declining from early highs of over 140%; during the pullback in the second half of 2025, while Bitcoin's short-term volatility increased, the overall movement lacked the dramatic rollercoaster-like fluctuations of the past, making the entire upward trend appear restrained and slow.

Multi-phase gentle ascent, lacking "final explosive surge." Notably, the bull market peak of 2024-2025 was not a one-time bubble but reached in phases. From the end of 2024 to the first half of 2025, Bitcoin faced multiple resistance points around the $100K mark before reaching new highs: in January, MicroStrategy announced a massive purchase, pushing the price to $107K; after a peak in August, Bitcoin quickly fell back below $118K due to disappointing U.S. inflation (PPI) data. By early October, the market's final surge pushed the price to $126K, but there was no "final frenzy" as seen in past cycles: immediately after the peak, selling pressure emerged, leading to a nearly 30% drop over six weeks, reaching a seven-month low of about $89,000 by mid-November. It can be said that while this bull market saw prices repeatedly hitting new highs, it lacked explosive acceleration, and the overall rising phase appeared uneventful, with the subsequent pullback occurring rapidly and sharply.

Partial alignment with the four-year cycle rhythm: time window from low to high. Despite many unusual aspects of this cycle, if viewed solely from the perspective of time and path, it still roughly aligns with the classic "four-year cycle" outline. Bitcoin bottomed out at around ~$16,000 at the end of 2022, exactly one year after the previous peak (November 2021 at $69,000); the halving in April 2024 roughly marks the end of the bear market; the peak of this cycle (October 2025) occurs about 18 months after the halving, similar to the duration from halving to peak in historical bull markets of 2013, 2017, and 2021. Therefore, from the broader framework of "halving -> bull market -> peak -> bear market," this cycle has not completely derailed. As the analysis points out: "From the halving in April 2024 to the new high of $125K in October 2025, it took nearly 18 months. If we only look at this path, it seems to still follow the cyclical pattern: the halving marks the bottom, the peak occurs about a year later, and then enters a correction period."

In summary, while the market performance post-halving has indeed set new price highs and the overall time window of the cycle aligns with expectations, the quality of the market and the experience of participants have clearly differed from the past. Consequently, an increasing number of investors are beginning to question whether Bitcoin's traditional four-year cycle has become ineffective. Which parts of the traditional cycle theory still hold true, and which aspects are changing?

III. Is the Four-Year Cycle Theory Still Valid?

Despite the apparent chaos, a deeper analysis reveals that the core logic of Bitcoin's "four-year cycle" has not completely vanished. The supply-demand changes brought about by halving continue to support price increases in the long term, and the cyclical mindset of investor greed and fear still recurs, albeit in a more subdued manner this time.

The long-term effects of supply contraction remain. Bitcoin's halving every four years means that new supply continues to decrease, which is the fundamental logic behind past bull markets. Even though the total supply of Bitcoin is now close to its limit of 94%, and the marginal reduction in supply is shrinking with each halving, the market expectation of "scarcity" still exists. In past cycles, the belief in long-term bullishness post-halving was evident, with many investors choosing to hold rather than sell. The same is true this time: the halving in April 2024 reduced new coin issuance from 900 coins per day to 450 coins, and despite significant price fluctuations, most long-term holders chose to continue holding their coins, not selling off large amounts due to relatively limited price increases. This indicates that the tightening effect of supply contraction is still at play in the market, although the force of supply-demand rebalancing driving prices upward has weakened compared to before.

On-chain cyclical indicators still dance to the rhythm. The behavior of Bitcoin investors continues to exhibit a typical "accumulation—profit-taking" cycle, with many on-chain indicators showing cyclical fluctuations. For example, the MVRV (Market Value/Realized Value Ratio) often falls below 1 at the end of a bear market and rises to overheated levels during a bull market. In the 2024 bull market, MVRV peaked at around 2.8, then fell back below 2 during the adjustment in early 2025. SOPR=1 is seen as the dividing line between bull and bear markets; below 1 indicates that most are selling at a loss, while above 1 indicates that most trades are taking profits. During the 2024-2025 bull market phase, this indicator remained above 1 for most of the time, consistent with historical bull market scenarios. Additionally, the RHODL indicator, which measures the ratio of short-term to long-term holders' funds, also reached a cyclical high in 2025, suggesting that the market structure is entering a later stage, with signs of a peak. Overall, typical on-chain indicators like MVRV, SOPR, and RHODL continue to operate according to their inherent cycles; although their absolute values have changed, the emotional cycles of investor greed and fear still depict similar trajectories on-chain.

Historical data: Diminishing returns but the trend remains. From a broader perspective, the diminishing returns at each cycle peak are an inevitable phenomenon following the expansion of market size and do not imply the disappearance of cycles. Historically, the peak return rates have indeed decreased with each cycle: in 2013, the peak rose about 20 times relative to the previous peak, in 2017 it rose about 20 times (relative to the end of 2013), and in 2021 it only rose about 3.5 times relative to the 2017 peak. In this cycle, from the 2021 peak of $69,000 to the 2025 peak of $125,000, it only increased by about 80% (0.8 times). The marginal convergence of returns is normal: as the market size grows, the marginal driving force of new funds weakens, so the diminishing increase is not evidence of cycle ineffectiveness but rather a natural result of a mature market.

In conclusion, the underlying driving forces of the traditional four-year cycle (supply contraction, investor behavior patterns) continue to play a role in this cycle, with halving still bringing supply-demand turning points, and the market still following the cyclical rhythm of "fear—greed." However, at the same time, a series of new factors are interfering with and rewriting the "surface form" of cyclical performance, making the external rhythm of the cycle difficult to grasp.

IV. The Truth of Cycle Imbalance: Surge of Variables and Fragmentation of Narratives

If the intrinsic logic of the halving cycle still exists, why is this round of market behavior so difficult to understand? The fundamental reason lies in the fact that the previously dominant single rhythm (halving-driven) has now been disrupted by multiple forces. Various factors interact, weaving a complex new pattern.

Source: https://coinmarketcap.com/charts/bitcoin-dominance/

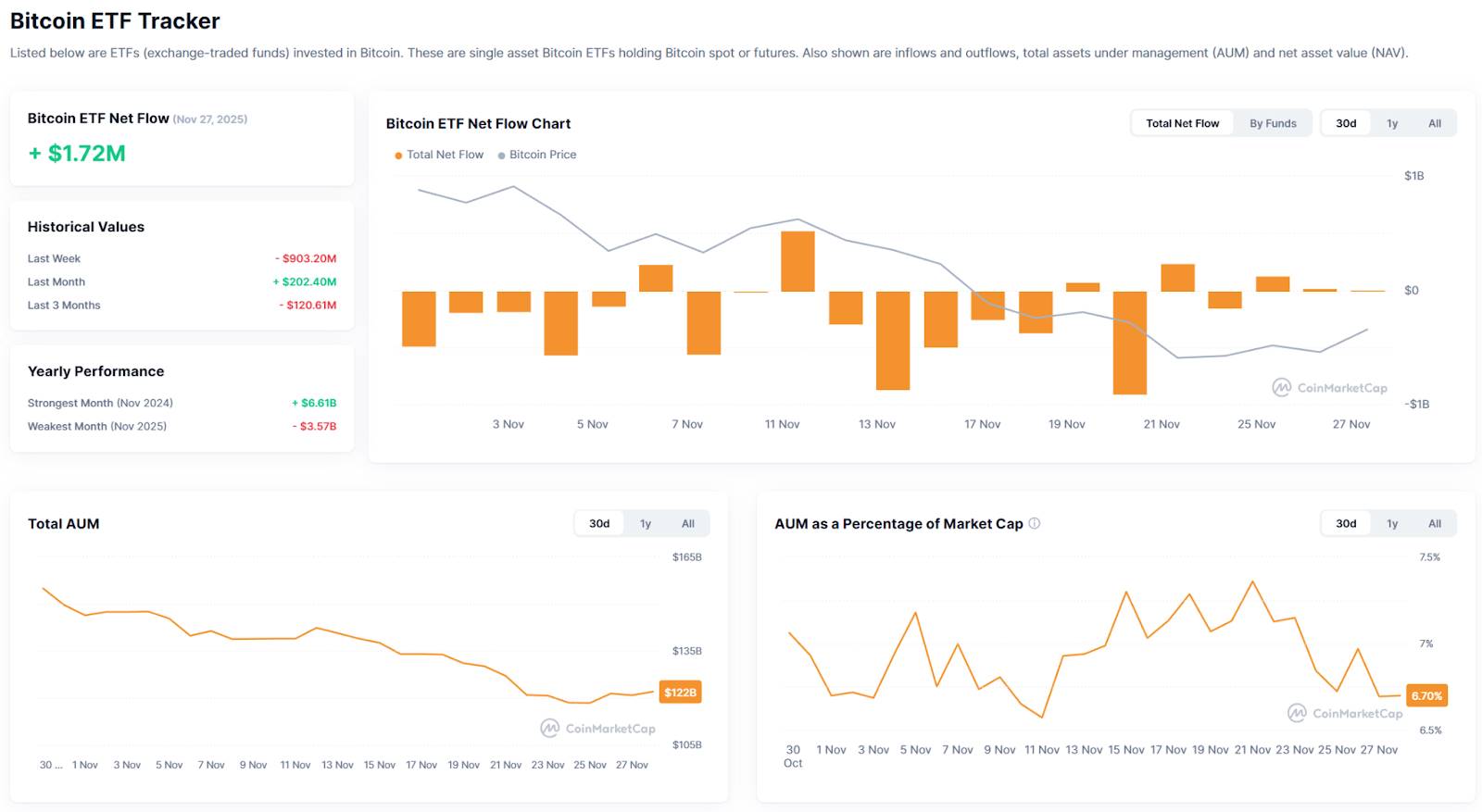

- Structural impact of ETFs and institutional funds. Starting in 2024, Bitcoin spot ETFs were approved and listed in the United States, introducing a continuous influx of institutional funds. This changed the market's previous game rules, which were primarily dominated by retail and leveraged funds, bringing in a large amount of incremental capital. As of October 2025, the total assets held by Bitcoin ETFs listed in the U.S. reached $176 billion. The entry of institutional funds not only pushed prices higher but also increased market stability: data shows that the average entry cost for ETF investors is around $89,000, which has become an effective support level for the market. However, when market sentiment reverses, a large number of ETF positions can turn into selling pressure, leading to unprecedented rapid liquidity shocks. Since late October 2025, with the emergence of macroeconomic headwinds, institutional funds have withdrawn on a large scale. Since October 10, approximately $3.7 billion has flowed out of U.S. spot Bitcoin ETFs, with $2.3 billion occurring in November. It is evident that the market structure in the ETF era is "more stable yet more fragile": while the slow bull market has reduced volatility, once key support levels (like the average cost of $89K) are breached, the subsequent decline can be more severe.

Source: https://coinmarketcap.com/etf/bitcoin/

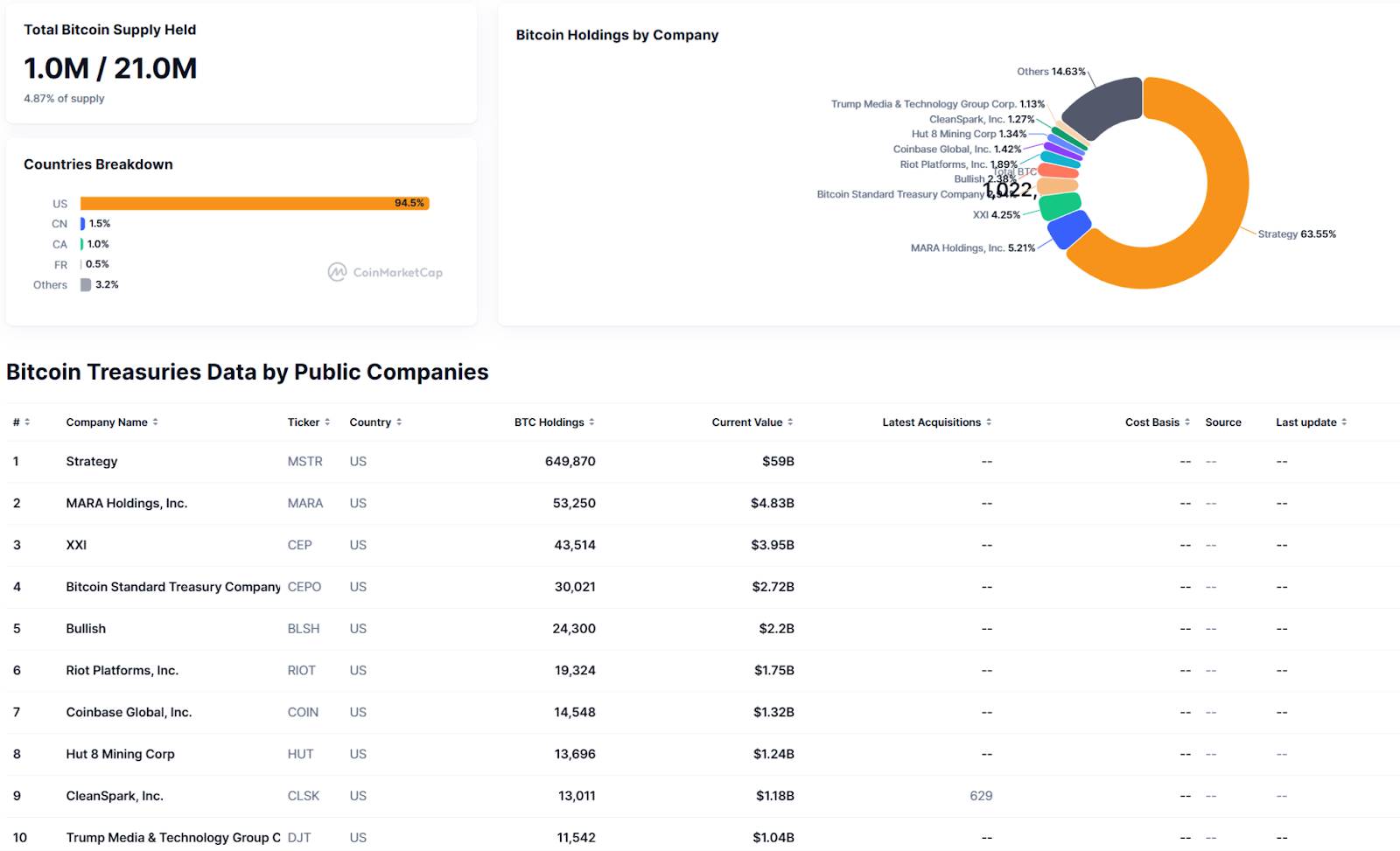

Source: https://coinmarketcap.com/charts/bitcoin-treasuries/

- Fragmentation of narratives and accelerated rotation of hot topics. In the previous bull market of 2020-2021, the market formed a sustained main storyline around DeFi and NFTs, facilitating an orderly flow of funds from Bitcoin to higher-risk assets. However, the current market's hot topics are characterized by fragmentation and fleeting moments. The rapid rotation of narratives has led to high-frequency fund switching, making it difficult for capital to remain in any particular sector for long. The traditional correlation of "Bitcoin leading altcoin rallies" has been broken. Looking back at 2023-2025, hot topics have emerged one after another, but there has been a lack of a strong overarching narrative throughout:

Late 2023 to early 2024: The anticipation of Bitcoin ETF approvals ignited the market, followed by a surge in Bitcoin Ordinals inscriptions;

Mid-2024: The Solana ecosystem rose strongly, and some meme coins (like Dogecoin) briefly gained popularity;

Late 2024 to early 2025: AI concepts began to intersperse with hype (AI Meme, AI Agent, etc. became topics in rotation);

Throughout 2025: InfoFi, Binance Meme, new public chains, x402, and other smaller projects gained popularity, but their durations were all limited.

The rapid rotation of sectors means that funds are frequently chasing short-term hot topics, lacking depth, resulting in altcoin sectors failing to experience a comprehensive explosion. Many mid- and small-cap coins peaked and fell early, while Bitcoin, despite its modest gains, has consistently dominated market capitalization. This "fragmented market" has led to a lack of widespread enthusiasm in the later stages of the bull market. Therefore, the peak of this bull market occurred under the steady rise of Bitcoin itself, rather than alongside a frenzied surge of the entire crypto ecosystem, making it relatively "quiet."

Self-fulfilling cycles realized in advance. As the "four-year halving cycle" has become widely recognized, the behavior of market participants has begun to change the rhythm of the cycle. Everyone knows that prices will rise after a halving, so they position themselves in advance, and when prices reach a certain level, they sell off. Many veteran players have positioned themselves early in this bull market and have taken profits earlier than usual. At the same time, major players such as ETF holders, market-making institutions, and miners have adjusted their strategies based on cyclical signals: as prices approach "theoretical highs," they collectively reduce their positions to hedge against risks, exacerbating market selling pressure. The bull market may have been artificially "snuffed out" before it could truly go wild, resulting in a cycle peak that is earlier and lower than historical patterns.

Macroeconomic and policy variables: Intertwined external indicators. Compared to the past, regulatory and political environments, along with macro factors represented by Federal Reserve policies and geopolitical risks, have had an unprecedented impact on the crypto market in this cycle, becoming significant variables that disrupt the cycle. After Trump took office, a series of policies favorable to Bitcoin and the crypto industry were implemented, but the pace did not meet expectations. By the end of 2024, the market was betting on a new round of easing, benefiting crypto assets broadly. However, entering the second half of 2025, the macroeconomic winds shifted abruptly: U.S. inflation data fluctuated, and the economic outlook became uncertain, leading to repeated changes in expectations for future interest rate cuts by the Federal Reserve. Particularly in October 2025, U.S.-China trade tariff frictions triggered a stock market crash, causing the market to begin questioning whether the Federal Reserve would slow down its rate cuts. The uncertainty surrounding interest rate prospects has put overall pressure on risk assets, and Bitcoin has also retreated in line with risk-averse sentiment.

The dual impact of Digital Asset Treasuries (DAT). Since 2024, a new phenomenon has emerged where an increasing number of institutions and publicly listed companies have included Bitcoin and other crypto assets on their balance sheets, forming Digital Asset Treasuries (DAT). Large companies like MicroStrategy have continuously increased their Bitcoin holdings as company reserves; even many small companies unrelated to the industry have announced purchases of cryptocurrencies to enhance their market value. These institutional holders have provided continuous buying support during the bull market, acting as a "reservoir," and their active allocation has helped the market rise. However, DAT also harbors risks: most of these companies have built positions at high prices, and if prices fall significantly, their assets could incur unrealized losses, potentially facing pressure from investors or even being forced to reduce holdings. Although large-scale sell-offs have not yet occurred, the presence of DAT holders adds a layer of concern regarding price bottoms. The rise of DAT is a new element in this cycle, reinforcing Bitcoin's "digital gold" attribute, but it also means that cyclical fluctuations are more closely tied to traditional finance.

In summary, multiple variables such as ETFs/institutional funds, fragmented narratives, reflexivity of expectations, macro policies, and DAT have collectively shaped the "anomalous" cycle of 2024-2025, necessitating a more macro and complex perspective. Simply applying past cyclical rules may not be sufficient to address the current situation; a deeper understanding of the driving factors behind the cycle and the new changes in market structure is required.

V. Outlook and Conclusion

As 2025 draws to a close, Bitcoin stands at a critical crossroads after experiencing a rapid pullback: is this the end of the current bull market, the beginning of a bear market, or a consolidation phase preparing for the next upward movement? There are significant divergences in market opinions regarding this. Looking ahead to December 2025 and 2026, we need to consider both cyclical patterns and the influence of new variables, referencing multiple viewpoints to form rational expectations.

Cyclical perspective: Is the bull market's endpoint already visible, with the bear market beginning to show signs? Analysts who favor cyclical theories believe that according to classic four-year cycle projections, the historical peak of $126K in October 2025 is likely the top of this bull market, and the market will enter a prolonged adjustment period until the next halving (around 2028) before a new bull market can begin. Given the lack of a frenzied bubble at this peak, the decline may be relatively mild. Some also suggest that this bear market may be characterized by a "slow decline" rather than a waterfall-like crash. The reasoning is that institutional funds have enhanced market resilience; for instance, after falling to the $50K-$60K range, the market may enter a prolonged consolidation phase, allowing time to complete the bear market. Others argue that the traditional four-year model is no longer applicable, suggesting that the bear market began six months ago and is currently in its later stages. Overall, qualitative analysis of the cycle leans towards the idea that the pullback starting in Q4 2025 marks a turning point between bull and bear markets, with the main trend in 2026 likely to be weak, but the magnitude and pace of declines may be milder than in historical bear markets, with the possibility of a prolonged bottoming process.

Macroeconomic perspective: Policy easing may serve as a buffer, and risk assets still hold potential. From a macro perspective, the environment for Bitcoin in 2026 may be much friendlier than in 2022-2023. Major central banks around the world are expected to end their tightening cycles in 2024-2025, with the Federal Reserve anticipated to begin a rate-cutting cycle by the end of 2025. The market currently assigns an approximately 85% probability to a 25 basis point rate cut in December and expects multiple rate cuts in 2026. Low interest rates and ample liquidity are favorable for Bitcoin and other anti-inflation assets, suggesting that even if the cycle enters a downward phase, macro easing may help prevent significant price declines. If this assessment is correct, 2026 could see a "spring in the bear market": as rate cuts take effect and the economy stabilizes, risk appetite may rebound, leading some incremental funds to re-enter the crypto space, resulting in a temporary market rebound. A possible scenario is that Bitcoin forms a U-shaped or L-shaped bottom in 2026: continuing to oscillate and build a bottom in the first half, then gradually rising in the second half under the effects of rate cuts. However, potential risks at the macro level must be monitored: if the global economy falls into a severe recession or geopolitical tensions escalate, the benefits of rate cuts may be offset by risk-averse sentiment, leading to fluctuating Bitcoin prices. Overall, the expectation of easing brings hope for 2026, but the path to market reversal may be tortuous and repetitive.

Market structure perspective: Institutional competition and rational pricing become the norm. After the 2024-2025 period, the structure of market participants has changed significantly, which will also influence the trajectory in 2026. The increased proportion of institutional funds means that future price fluctuations will be more driven by fundamentals and data, with short-term emotional impacts relatively diminished. The ETF holding cost (around $89K) will become an important technical level: if prices remain below this cost line, it may trigger further outflows from ETF funds, suppressing the height of any rebounds; conversely, if the market stabilizes and rises above this line, a new round of capital may enter. Regarding Digital Asset Treasuries (DAT), differentiation may emerge in 2026: some companies holding Bitcoin may be forced to reduce their holdings if their stock prices are sluggish or their finances are under pressure, but it is also possible that more companies will take advantage of lower prices to add Bitcoin to their asset reserves, leading to a dynamic interplay. Miners, as long-term sellers, will also influence the bottom with their production costs (estimated in the $40K-$50K range): if prices fall below cash costs for too long, miners may reduce production or shut down, which could shrink supply and help establish a bottom. Thus, the Bitcoin market in 2026 is expected to be more mature and rational, which does not mean a lack of trading opportunities, but rather that the dramatic wealth gains and losses will be harder to replicate.

However, many top institutions still have high confidence in the long-term prospects of Bitcoin. ARK Invest has reiterated its vision target of $1.5 million by 2030, providing a belief support for the market through long-term optimism. In the short to medium term, however, investors are more concerned about the actual path in 2026. The year 2026 may be a test of patience.

Conclusion

In summary, the four-year cycle of Bitcoin has not truly failed but is undergoing a transformation. The market from 2024 to 2025 tells us that the halving supply shock is still present, with the invisible hand driving the long-term trend; however, the entry of institutional funds, the intervention of the macro environment, and changes in investor expectations have collectively shaped a more complex and unpredictable new cycle. Yet, we also see the rise of rational forces, advancements in infrastructure, and the accumulation of long-term value.

For crypto investors, this means the need to upgrade their cognition and strategies: embrace data-driven analysis, embrace long-term value investing, and embrace structural opportunities. More importantly, it is essential to respond rationally to the cycle: remain calm during the exuberance of a bull market and maintain faith during the lows of a bear market. After all, Bitcoin has experienced several cycles and continues to reach new highs, with its underlying value and network effects only increasing. The cycle may be extending, and the amplitude may be converging, but the long-term upward direction remains unchanged. Each adjustment is a process of survival of the fittest, allowing truly valuable assets to accumulate; every innovation will give rise to new growth points, enabling the industry to continue evolving.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Research Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate the cycles and seize the value opportunities of Web3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。