Author: Tulip King, Messari Analyst

Compiled by: Felix, PANews

The prediction market has not yet been fully understood by the public, but this is your opportunity. We are currently witnessing a complete transformation in how markets operate, how information is priced, and how the future is formed.

"iPhone Moment"

Every technological revolution goes through a fascinating period during which the public, hindered by old thinking patterns, fails to recognize the disruption. In 2007, Nokia executives remarked upon seeing the iPhone, "It doesn't even have a keyboard." They compared the iPhone to existing mobile phones, overlooking its comparison to computers. The iPhone did not compete with existing phones; it disrupted the concept of single-function devices.

The prediction market is similar today. When people see Polymarket, they think it is just a strange betting site with poor liquidity. They compare it to sports betting sites like DraftKings or derivatives trading markets like CME and find it lacking. This is akin to the mistake made in the Nokia case. Polymarket is not a better betting site; it is replacing the entire concept of professional financial markets. Imagine, when stripped of the complexities of each financial instrument, what they actually are:

- Options: A bet on whether future price levels will be reached

- Insurance: A bet on whether a disaster will occur

- Credit default swaps: A bet on whether bankruptcy will happen

- Sports betting: A bet on the outcome of a sporting event

A vast industry worth trillions of dollars has been built around essentially binary questions, each with its own infrastructure, regulatory framework, and monopolistic intermediaries profiting from it.

Polymarket distills all of this down to a fundamental element: creating markets for any observable event, allowing people to trade, and resolving when reality determines the outcome. It is not superior to DraftKings in sports betting, nor is it more excellent than the Chicago Mercantile Exchange (CME) in derivatives. What it fundamentally does is reduce all markets to basic units and then rebuild on that foundation. Polymarket is the "iPhone"; everything else is just "apps."

Multidimensional Trading

When all trades occur in the same place, more possibilities are unlocked. Imagine if five years ago you wanted to build a position expressing the following view: "I think the Fed will raise interest rates, but tech stocks will still rise because Trump will make some positive comments about AI." You would have to open accounts at different institutions, deal with different regulatory frameworks, and different forms of leverage. Moreover, the part of this trade mentioning Trump would have no market at all.

On Polymarket, it takes just three clicks. More importantly, these are not three independent bets but a coherent worldview expressed through interconnected positions. You can buy "The Fed will pause interest rate hikes" as "No," buy "The Nasdaq will hit an all-time high" as "Yes," and simultaneously buy "Trump will mention AI in his next speech" as "Yes." This interconnection is the trade itself.

Thinking about prediction markets

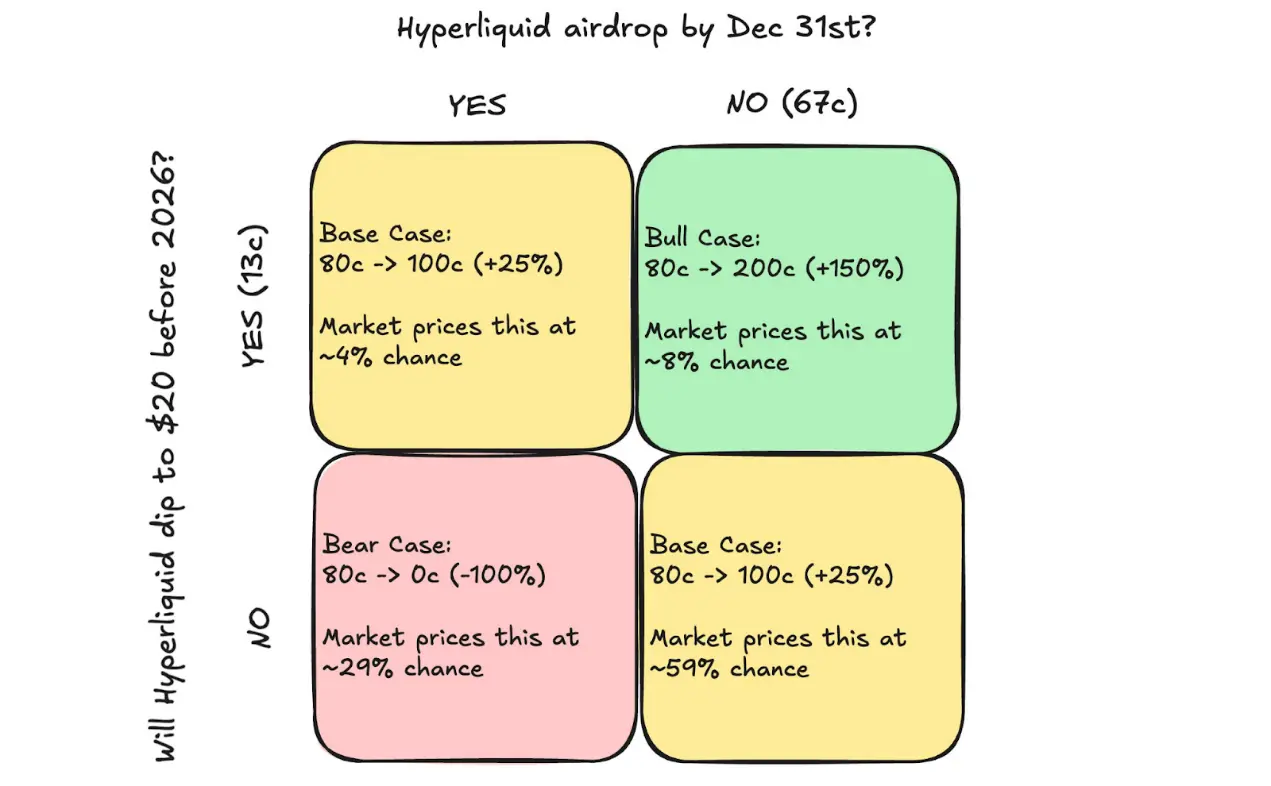

For those who are still not quite understanding, here is a real case. Last month on Polymarket, you could build a position like this: buy "Hyperliquid will not airdrop before December 31" as "No" for 67 cents, while simultaneously buying "Hyperliquid will drop to $20 before 2026" as "Yes" for 13 cents. Consider the various outcomes:

- Maximum profit: Hyperliquid neither airdrops nor drops to $20 this year. Given the current market conditions, this view seems reasonable, and its pricing should be higher than the current 8% market rate. You buy in at this low price for the outcome.

- Small profit: Hyperliquid airdrops, and the price drops to $20, or the price drops to $20 but there is no airdrop. These scenarios are the most likely outcomes, with a probability of 63%.

- Total loss: Hyperliquid airdrops, and the price stays above $20. Given the market's significant concern about new supply from the team unlocking, it seems that introducing more supply through an airdrop would receive a very negative reaction. The probability of this outcome should be less than 29%, so you are selling this outcome at a high price.

This sounds like hedging, but it is more than that. It expresses a complex view of how the market handles new token supply, a view you cannot express anywhere else.

Traditional markets force you to compress a complex worldview into rough directional bets. You might have a complex argument that Nvidia's earnings will exceed expectations but still sell the stock due to market expectations (the good news is priced in). In the options market, you can only choose between call options and put options, or perhaps construct some less-than-ideal spread combinations to barely express your view, but you have to pay high option premiums for that. On the Polymarket platform, you can precisely express your view by simply buying the "Nvidia earnings will exceed expectations" and "Nvidia stock will drop 5% after earnings report" as two "Yes" options.

The real brilliance lies in your ability to start thinking about those cross-market correlations that shouldn't exist but do. A hurricane is about to hit Florida, and the Tampa Bay Buccaneers are set to play in Detroit. Traditional thinking assumes these two events are unrelated. But you have this argument: if the hurricane truly ravages Florida, NFL referees will surely favor the Buccaneers to create an inspiring story. So you bet 60 cents that the Buccaneers will not win while betting 20 cents that a hurricane will hit Florida. You are not betting on a specific outcome; you are betting on a structure of correlation. You profit from your understanding of how narratives influence referee decisions.

This is why prediction markets do not compete with existing markets: they operate on entirely different levels of abstraction. All other markets give you a single lever to pull. Polymarket gives you countless levers, and more importantly, it allows you to pull specific combinations of levers that match your view of how the world actually works.

Why Are Savvy Investors Wrong Again?

The first criticism you always hear about prediction markets is about liquidity. "You can't make large trades"; "The spreads are too wide"; "These are just gamblers betting their lunch money." This is not a bug; it is your opportunity.

Individuals do not dislike Kel, but liquidity issues will ultimately be resolved by existing market incentives.

Let’s think mechanically about why liquidity will explode. Traditional market-making is relatively simple: you are usually making a market for things that have clear correlations with other things. Stock options are related to stock prices, futures are related to spot prices. Everything has hedging mechanisms, correlations, and reliable models. This is why a few companies like Citadel and Jane Street can make markets for thousands of instruments.

Prediction markets are harder. Each type of market requires specialized intelligent systems:

- Sports markets need models that can update with every score, every injury report, and every weather update.

- Political markets need natural language processing to parse polls, speeches, and social media sentiment.

- Event markets need machine learning systems that can calculate baseline rates from historical data.

- Mention markets need language models trained on thousands of text records.

You cannot have a market maker monopolize all markets because each market requires completely different expertise.

In the long run, this is actually good for liquidity. It will no longer be a few giants controlling all market-making; instead, there will be many specialized market makers. Some quantitative analysts will become the world's best experts in pricing Mention markets. Other teams will dominate weather-related events, while others will focus on celebrity behavior. What seems like a disadvantage in fragmentation will actually create resilience and depth.

In the next five years, a brand new type of financial company will emerge: prediction market experts. They will not make markets in stocks or bonds but will make markets in reality itself. The first company to successfully do this on a large scale will become a fortress in the new financial system.

Unsettling Truths About Truth

Prediction markets are not really about prediction; they create an economic incentive mechanism for truth. We are currently in a strange moment: everyone has an opinion on everything, but no one has a real stake. Your favorite analyst has been wrong twice in a row in predicting a recession. The number of accounts ruined by those commentators on CNBC is countless. Yet, they can keep their platforms, maintain their audiences, and continue to be wrong without consequences.

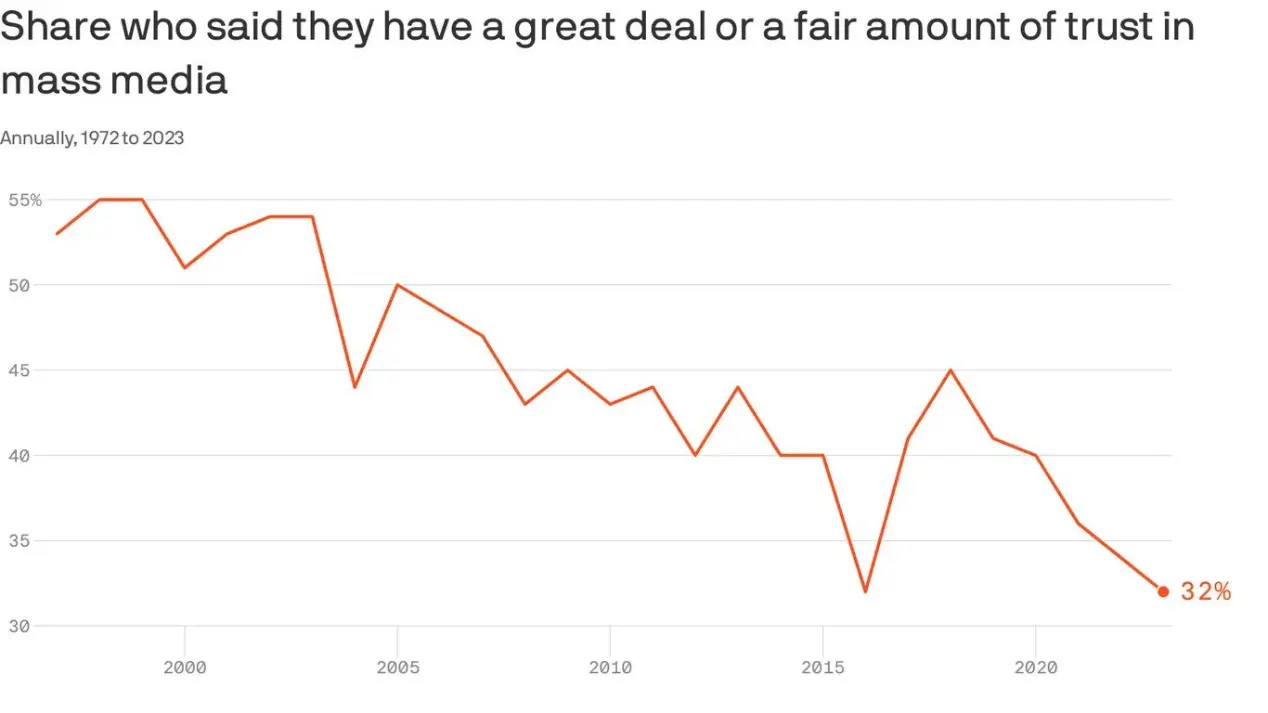

Trust in the media has declined, but that’s all.

This situation is unsustainable, and everyone deep down knows it. Society has constructed an information ecosystem that rewards engagement rather than accuracy. Being loud is more important than being correct, and social media exacerbates this issue. Nowadays, the hottest opinions can become "correct" regardless of their accuracy. The person with the most followers becomes the expert, and the so-called experts are those who can garner the most likes.

Prediction markets completely overturn this model. Suddenly, being correct has value, and being wrong has a cost. The market does not care whether you graduated from Harvard, whether you have a blue V verification, or whether you have written a book about the market. It only cares whether you are correct. When you create a system that rewards only accuracy, something wonderful happens: accurate people suddenly have a reason to speak up, while wrong people finally shut up.

But this is not just about transferring wealth from the wrong to the right. Prediction markets are building a parallel information system that operates on mechanisms entirely different from the existing media ecosystem.

- In the old world: Information spreads through social networks, depending on its virality.

- In prediction markets: Information is priced based on reality.

These are fundamentally different selection mechanisms that will yield fundamentally different results.

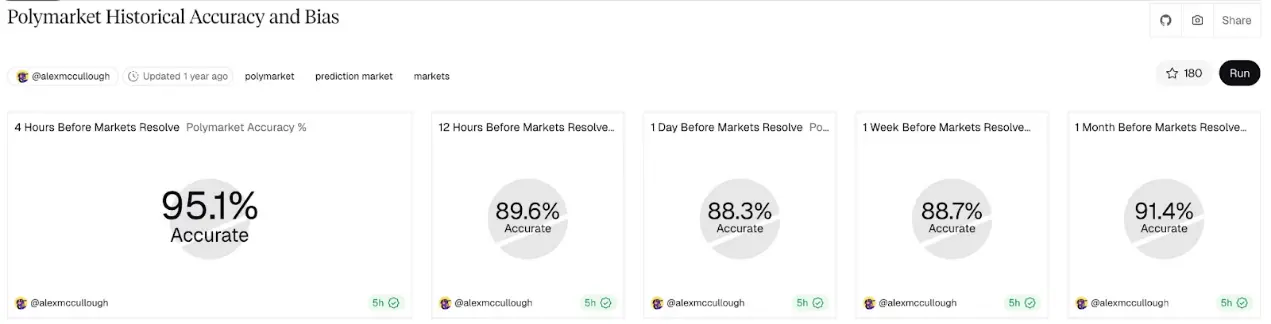

Polymarket is still in its infancy, but its accuracy is astonishing. The political market is more predictive than any poll aggregator. The Fed market has shown volatility before any economist updates their predictions. This is not because the traders in prediction markets are smarter, but because the incentive mechanism ensures correct predictions rather than pursuing entertainment.

Bounty Markets, Not Prediction Markets

The public today refers to "prediction markets," much like calling Bitcoin "digital gold"—technically correct but completely overlooking a more important point. True prediction markets are passive observers. They price probabilities but do not intervene in outcomes. However, Polymarket is not passive, and that is the key: any market with human participants inherently contains incentives to change outcomes.

Let’s explain this in detail. When there is a market predicting whether someone will throw a green object in a WNBA game, someone calculated the following:

- Buy $10,000 worth of YES shares at 15 cents each

- Throw the object themselves

- Collect $66,000 when the market determines "YES"

- After deducting legal fees and the cost of a lifetime ban, net about $50,000

The theoretical balance of this WNBA disruption event should be: compensation = criminal charges + social humiliation + lifetime ban + effort required.

If the compensation is too high, it will attract imitators; if too low, no one will care. The market will find an equilibrium accurate price.

Charlie Munger: "Show me the incentive and I will show you the outcome."

But "prediction markets" have turned into bounty markets—they are not predicting whether someone will throw an object but offering a specific amount as a bounty for someone to make it happen. This is not a loophole or manipulation; it is the most important characteristic of prediction markets that no one mentions.

Imagine this thought experiment. I decide to run for mayor of New York City. The market gives odds that are quite reasonable, only 0.5%. At these odds, I can buy 20 shares, each worth $5,000, totaling $100,000. If I win, each share can bring in $1 million. When I put these shares in escrow as compensation for my campaign team, things get interesting. I hire 20 hitmen, promising them $1 million each if they succeed.

The above experiment creates something that should not exist: a market-funded political campaign, with stakes increasing as the odds decrease. The market is essentially saying, "This outcome is too unlikely; we give you 20 to 1 odds to make it happen." Prediction turns into a bounty. The market is not just observing reality; it is also funding a specific future.

Some events will not be affected by the bounty mechanism at all. The value of becoming president is so high that no bounty from any prediction market can significantly increase its incentive. But for thousands of other events—from corporate decisions to cultural phenomena to sports outcomes—the bounty mechanism is real and active.

Today, we do not see the kind of future prediction market envisioned by Robin Hanson (the core designer of modern prediction market mechanisms) that is guided by wisdom. Instead, we are witnessing some stranger phenomena: markets will pay those who facilitate specific futures.

Conclusion

My personal prediction is that within ten years, the Polymarket model will consume most areas of traditional finance. This is not just because it is a lower-cost, more efficient trading platform, but because it integrates all markets into a single primitive platform and then rebuilds on that foundation, which is more efficient than maintaining thousands of specialized market structures.

The dominoes will fall in the following order:

- DraftKings—sports betting is essentially a prediction market with worse odds

- Chicago Board Options Exchange—options are just complex binary bets on price levels

- Insurance—merely a prediction market for unilateral trades

- Credit markets—bankruptcy predictions plus additional steps

Each vertical will resist and regulate, but ultimately they will yield, as they will realize they are not competing with a better product but with a superior principle.

What we are witnessing is a complete restructuring of how markets operate. You are no longer betting on prices, interest rates, or volatility; you are betting on events, the correlations between events, and most importantly, the probabilities that can change those events.

Savvy investors should now prepare for this. It is not just about buying tokens or trading markets, but considering what happens when any observable event has a liquid market. What happens when every company's decision has a prediction market? What happens when every piece of legislation has odds? What happens when every cultural trend has a price?

Prediction markets are not just building better markets; they are constructing a machine that incentivizes people to create the future.

Related reading: Prediction Markets and Emerging Original Language: Regulation, Liquidity, Oracles

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。