Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

On November 27, the Thanksgiving holiday led to the closure of the U.S. market, with U.S. stock index futures remaining flat. Crude oil rebounded due to OPEC+'s continued pause on production increases, but the prospects of Russia-Ukraine talks triggered a flash drop during trading. Spot gold was boosted by expectations of a Federal Reserve rate cut in December, briefly breaking through $4,190. Institutions such as Wells Fargo Investment Institute analyze that the potential dovish shift of the Federal Reserve, a weaker dollar, and changes in investment logic for popular sectors like AI may create favorable conditions for alternative assets like gold. Looking ahead, despite concerns about economic slowdown, expectations of policy shifts also bring potential opportunities for risk assets, with global investors closely watching the Federal Reserve's next moves and the potential market reshaping that may follow.

As November comes to a close, Bitcoin's price has risen to nearly $92,000 after experiencing volatility. Multiple analysts point out that this rebound is primarily driven by short covering rather than strong spot buying support. For instance, KillaXBT has begun to position short at $91,400, planning to add at $93,100, with a stop loss set at $95,000, warning that if the closing price cannot break through $108,000 in the next four weeks, it will confirm a bear market, with a target price potentially dropping to $60,000. Additionally, data from Glassnode shows that Bitcoin's market structure remains fragile, with the cost line for short-term holders (around $104,600) becoming a key resistance level, and there are dense supply zones between $93,000 to $96,000 and $100,000 to $108,000. If liquidity does not improve, Bitcoin's price may further test the "real market average" near $81,000. Key support must remain solid above the $84,000 cost cluster, which involves about 400,000 BTC. Analyst Ali views $84,570 as critical support, with $112,340 as the upper limit, while also reminding that the bear market phase could bring a 70% decline.

Despite facing resistance, bullish views also exist. Veteran trader Alessio Rastani believes that historical data shows a 75% probability of a short-term rise given the current pattern. Analysts like Michaël van de Poppe and Daan Crypto Trades are focusing on the liquidity accumulation zone between $97,000 and $98,000, believing that if resistance around $93,000 can be broken, the price may move towards $100,000. Man of Bitcoin also points out that if it can hold above $91,521, it is likely to test $96,897. Overall, the market is waiting for clearer signals, needing to see sustained spot demand and increased buying power to confirm a structural recovery in the trend.

Regarding Ethereum, although the price rebounded 15% from a low of $2,623 and briefly surpassed $3,000, on-chain and derivatives data indicate that the bullish sentiment among large investors has not fully recovered, making it more difficult for the price to reach $4,000. Currently, Ethereum's network TVL has dropped from nearly $100 billion to $72.3 billion, and network fees have decreased by 13% over the past week. The long-short ratio of top traders on OKX also shows a bias towards bearish positions. Analysts have differing views: Scient believes ETH's structure is stronger than Bitcoin's, and if it can hold the $2,800 support, it may aim for $3,390; while Lab Trading's analyst Ken warns that unless it can effectively hold above $3,000, it may drop to $2,600. Meanwhile, Kingpin Crypto anticipates a "Christmas rally for Ethereum" in December, targeting the $3,300 range. Daan Crypto Trades suggests investors pay attention to the range fluctuations between $2,600 and $3,000, with a breakout above $3,000 potentially leading to $3,300 to $3,400, while a drop below $2,600 could see it test the $2,000 low. Additionally, Simon Kim, founder of venture capital firm Hashed, recently launched a real-time Ethereum valuation dashboard, estimating Ethereum's fair value at $4,747.4, which is about 56.9% undervalued compared to the current price of $3,022.3.

In market dynamics, the hacking incident at South Korean crypto exchange Upbit on November 27 has become a recent focus. This attack resulted in the theft of approximately 54 billion Korean won (about $36.81 million) in assets related to the Solana network, involving various tokens such as SOL, JUP, PYTH, and RENDER. South Korean authorities highly suspect that this incident was carried out by the North Korean hacker group Lazarus Group, which is also linked to the Ethereum theft case at Upbit six years ago. Following the incident, some affected low-market-cap Solana ecosystem tokens on the Upbit platform saw prices surge, with ORCA and MET2 rising nearly 100%. Upbit has currently suspended all deposit and withdrawal services, transferred assets to cold wallets, and promised to fully compensate users for their losses.

2. Key Data (as of November 26, 13:00 HKT)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $91,318 (YTD -2.43%), daily spot trading volume $5.163 billion

Ethereum: $3,010 (YTD -9.82%), daily spot trading volume $1.454 billion

Fear and Greed Index: 25 (Fear)

Average GAS: BTC: 1.02 sat/vB, ETH: 0.067 Gwei

Market share: BTC 58.5%, ETH 11.5%

Upbit 24-hour trading volume ranking: ORCA, XRP, BTC, MET2, TRUST

24-hour BTC long-short ratio: 49.37% / 50.63%

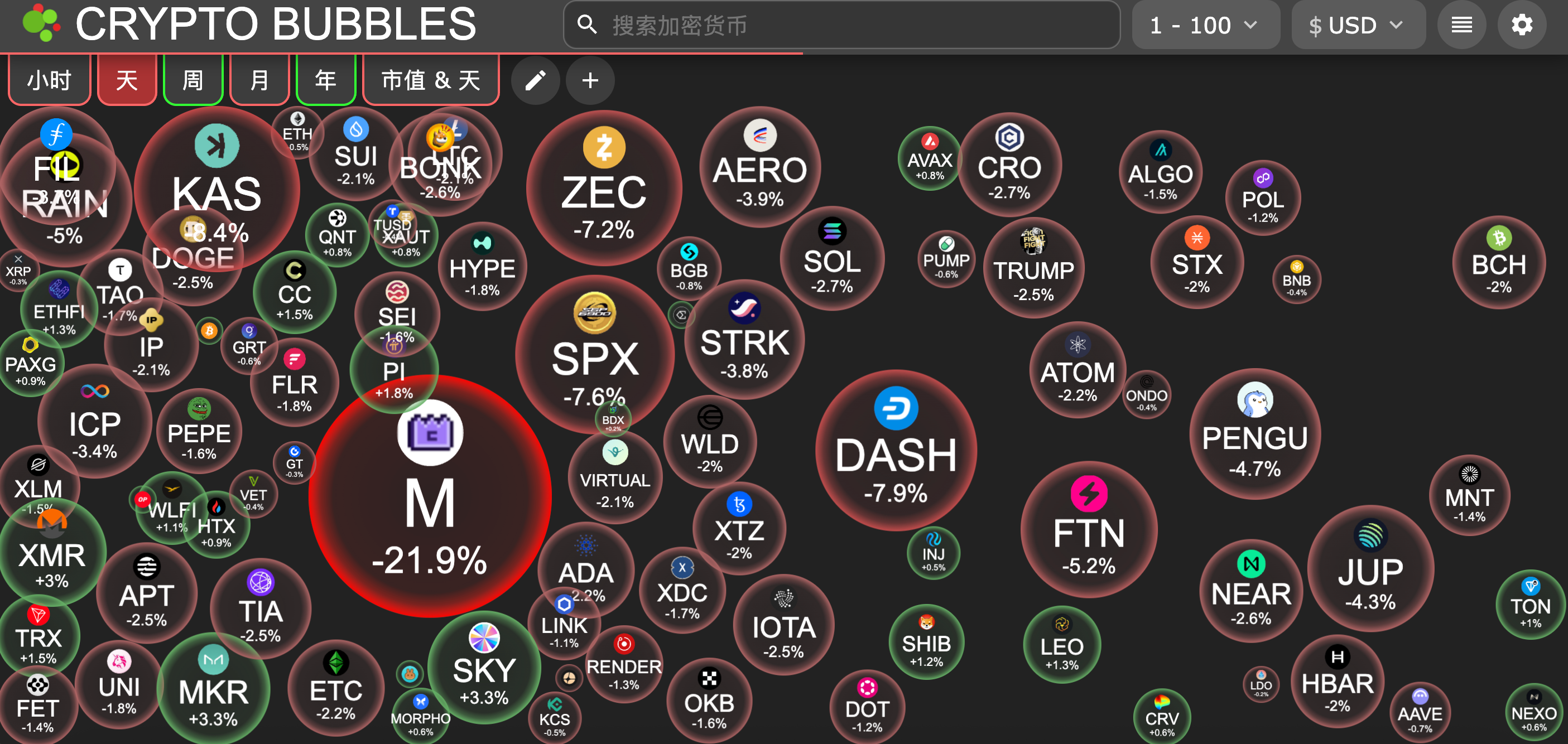

Sector performance: Meme sector down 2.78%, L1 sector down 1.87%

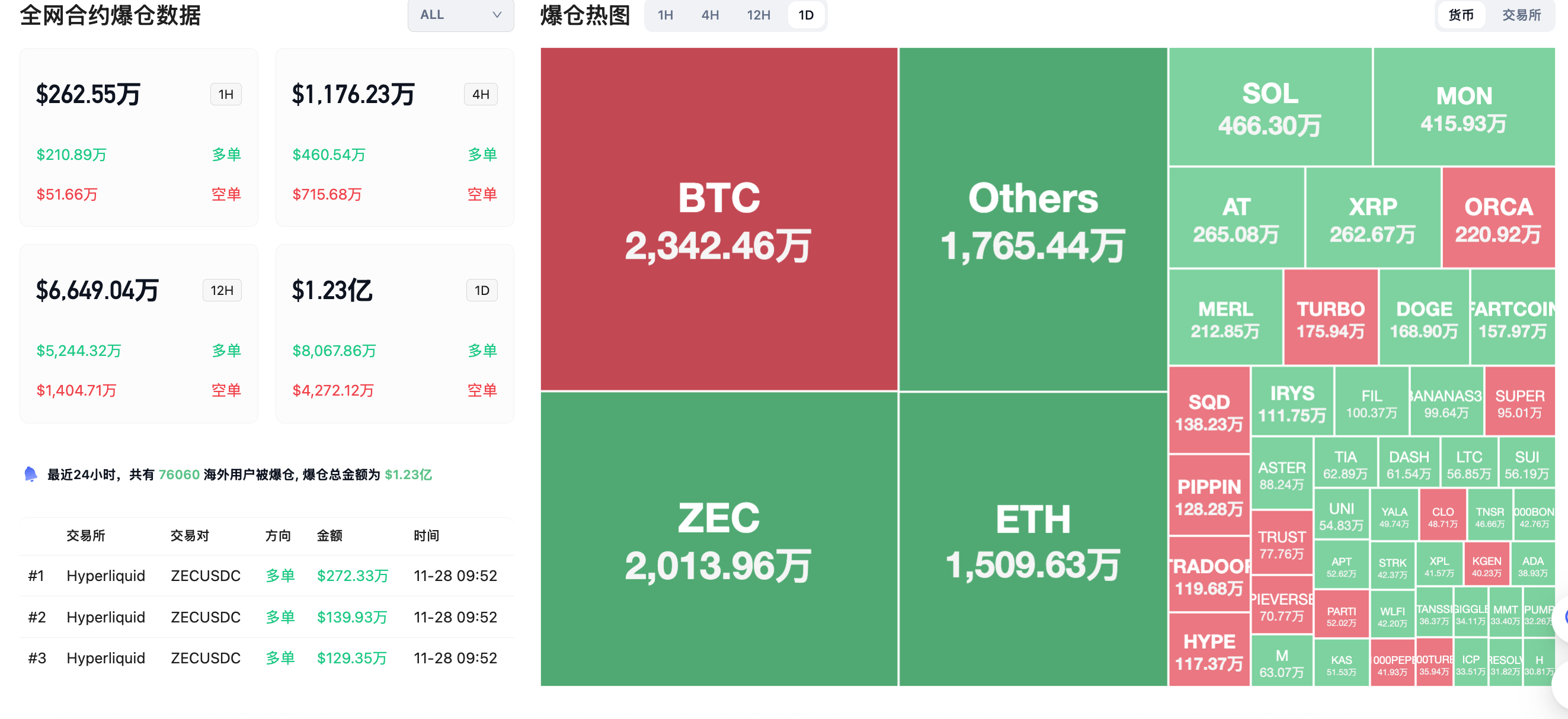

24-hour liquidation data: A total of 76,060 people were liquidated globally, with a total liquidation amount of $123 million, including $23.42 million in BTC, $20.13 million in ZEC, and $15.09 million in ETH.

3. ETF Flows (as of November 27)

Bitcoin ETF: Thanksgiving holiday

Ethereum ETF: Thanksgiving holiday

Solana ETF: Thanksgiving holiday

4. Today's Outlook

Binance will remove BMT/FDUSD, GMT/BTC, ME/BTC, and TOWNS/FDUSD spot trading on November 28

Binance will delist PONKE, SWELL, and QUICK U perpetual contracts

Jupiter (JUP) will unlock approximately 53.47 million tokens at 12:00 PM Beijing time on November 28, accounting for 0.76% of the total supply, valued at about $12.5 million.

Sahara AI (SAHARA) will unlock approximately 133 million tokens at 8:00 AM on November 27, accounting for 1.33% of the total supply, valued at about $10.4 million;

The largest declines among the top 100 cryptocurrencies today: MemeCore down 21.4%, Kaspa down 8.5%, Dash down 7.9%, SPX6900 down 7.5%, Zcash down 7.3%.

5. Hot News

Animoca executive: Plans to expand business focus to stablecoins, AI, and DePIN by 2026

Wormhole Foundation announces purchase of $5 million worth of W tokens

SpaceX has transferred 1,163 BTC to a new address, worth approximately $105 million

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。