I. Background: Aptos Enters the Era of Yield Layer

- Shift in the Race: From "Performance Competition" to "Yield Competition"

The competition among public chains is entering a new phase. From the early "performance competition" to the subsequent "liquidity battle," the current focus has shifted to who can build a more efficient and sustainable yield layer. Ethereum has set the benchmark for yield infrastructure with its LST and LSDfi models; Solana has formed a more open liquid staking ecosystem under the multi-polar competition of protocols like Jito, Sanctum, and Marinade.

Aptos, known for its high performance and parallel execution, is at a similar turning point. The ecosystem's TVL has surpassed $680 million, and core modules such as DEX, stablecoins, and lending are becoming increasingly refined. However, it still lacks a core hub that can integrate capital and unleash the potential of compound interest—a "yield enhancement engine" for Aptos.

- Restructuring of Capital Structure: The Demand for "Long-Term Compound Interest" of Stable Capital

The expansion of Aptos's ecosystem is driving a deep restructuring of its capital structure. Early funding primarily came from ecosystem incentives and trading liquidity. Now, with the continuous inflow of long-term capital such as stablecoin reserves, RWA assets, and cross-chain institutional capital, the core demand for capital has shifted from "capturing volatility" to "pursuing stable compound interest + flexible liquidity."

However, the current yield system on Aptos remains fragmented. There is a lack of linkage between staked assets and strategy layers, and a large amount of APT is still stuck in the "passive lock-up" phase, unable to form a unified compound interest path within the ecosystem and participate in the real yield cycle. Therefore, a "linkage layer" for capital is needed to drive Aptos from a "transaction-driven" to a "yield-driven" new cycle.

- Experience Upgrade: From "Active Trading" to "Passive Income"

The biggest barrier to DeFi is its complexity. Users must frequently adjust liquidity ranges, monitor funding rates, and execute rebalancing operations, leading to capital being forced to "lie flat," disrupting the compound interest effect. The future of Aptos should allow all users to achieve "passive income" through a single "Stake."

Liquid Staking Tokens (LST) are the key to this realization, as they can convert staking positions into composable assets, maintaining DeFi activity while ensuring base yields. However, the current LST on Aptos only offers about 6.5% base staking yield, lacking differentiation and ecosystem integration, resulting in low capital efficiency.

Thus, a yield hub that can integrate capital, streamline strategy yields, and allow all APT to participate in the compound interest cycle is precisely what the Aptos ecosystem currently needs. This is the significance of Goblin Finance's emergence.

II. GoAPT: Enhanced LST Empowering the Yield Layer of Aptos

Goblin Finance is Aptos's native enhanced yield infrastructure, aiming to unify, amplify, and deliver yield opportunities scattered across different protocols and markets to users in the simplest form through a multi-strategy Yield Hub and yield-enhanced LST.

Therefore, we are launching the first enhanced liquid staking token on Aptos: GoAPT. This allows APT to earn base staking yields (approximately 6.5% APR) while also stacking additional yields from the strategy vault GoVault, currently raising the overall annualized yield up to 1.3 times the original, with further enhancements expected as the strategy system opens and assets collaborate. Additionally, GoAPT holders will automatically participate in Goblin's points incentive program, with points potentially earning Goblin's airdrop rewards in the future.

This is a true entry point for yield. Goblin has optimized the traditional LST model in its product mechanism:

Automatic Appreciation: The exchange ratio of each GoAPT automatically increases with staking and strategy yields, forming an embedded compound interest curve;

Simplified Structure: Adopting a single-token model, it is easy to understand and seamlessly integrates with ecosystem DeFi protocols.

These designs make GoAPT not just a "staking certificate," but a liquidity protocol layer that can efficiently circulate between internal and external capital within Aptos.

- The Strategy Engine Behind Enhanced Yields: GoVault

The core supporting this system is Goblin's strategy hub—GoVault. It is a one-stop vault system that integrates various professional strategies, with all operations automated, allowing users to enjoy institutional-level strategy returns with just one click to deposit:

Automated Liquidity Management (ALM): Operating on Hyperion's V3 pool, dynamically rebalancing to maximize fee income while mitigating impermanent loss.

Neutral Strategy (Delta-Neutral, coming soon): Deployed on perpetual contract DEXs like Decibel, capturing funding rate differentials for profit while maintaining hedged exposure.

CeDeFi Stable Yield Strategy (coming soon): Providing stable low-risk returns through independent custodial accounts, combining on-chain transparency with institutional-level liquidity.

Thanks to this multi-dimensional structure, Goblin's yield performance is highly competitive: in stablecoin trading pairs (like USDT–USDC), the average annualized yield can exceed 20%; while in volatile trading pairs (like APT–USDC), through dynamic compounding and algorithmic range rebalancing, annualized yields can be boosted up to 50%.

All actual yields generated by the strategies will flow back to the GoAPT token through contracts, continuously increasing the value of staked assets and forming a new paradigm of "staking equals yield, holding equals compounding."

- Working Principle: Self-Reinforcing Compound Interest Flywheel

Thus, the Goblin system is based on a self-reinforcing yield cycle model: the vault generates strategy yields → yields flow to GoAPT stakers → higher GoAPT yields attract more staking TVL → larger TVL, in turn, enhances the strategy vault → the vault generates more yields → the cycle continues.

This flywheel mechanism creates a win-win compound interest engine for the entire ecosystem: users receive continuously growing yields; the protocol gains stable capital flow and deeper liquidity; and the Aptos ecosystem forms a sustainable yield layer closed loop within this cycle.

Over time, GoAPT is expected to become the standard asset for liquidity in the Aptos ecosystem, connecting staking, liquidity, and strategy yields to form a unified yield layer.

In summary, GoAPT is not just a simple staking certificate, but a liquidity protocol layer with LST as the entry point. It connects the staking relationship between validators and users, as well as the capital circulation between vault strategies, liquidity markets, and stablecoin systems. In other words:

GoAPT is the "entry for yield" (deposit)

GoVault is the "engine for yield" (generate)

Goblin Protocol is the "pathway for yield" (route)

III. GoAPT Operation Guide

Users can directly stake APT and mint GoAPT on the Goblin platform, immediately starting to accumulate dual yields. The process of using GoAPT is very simple:

1) Visit the Goblin Finance official website and connect your Aptos wallet.

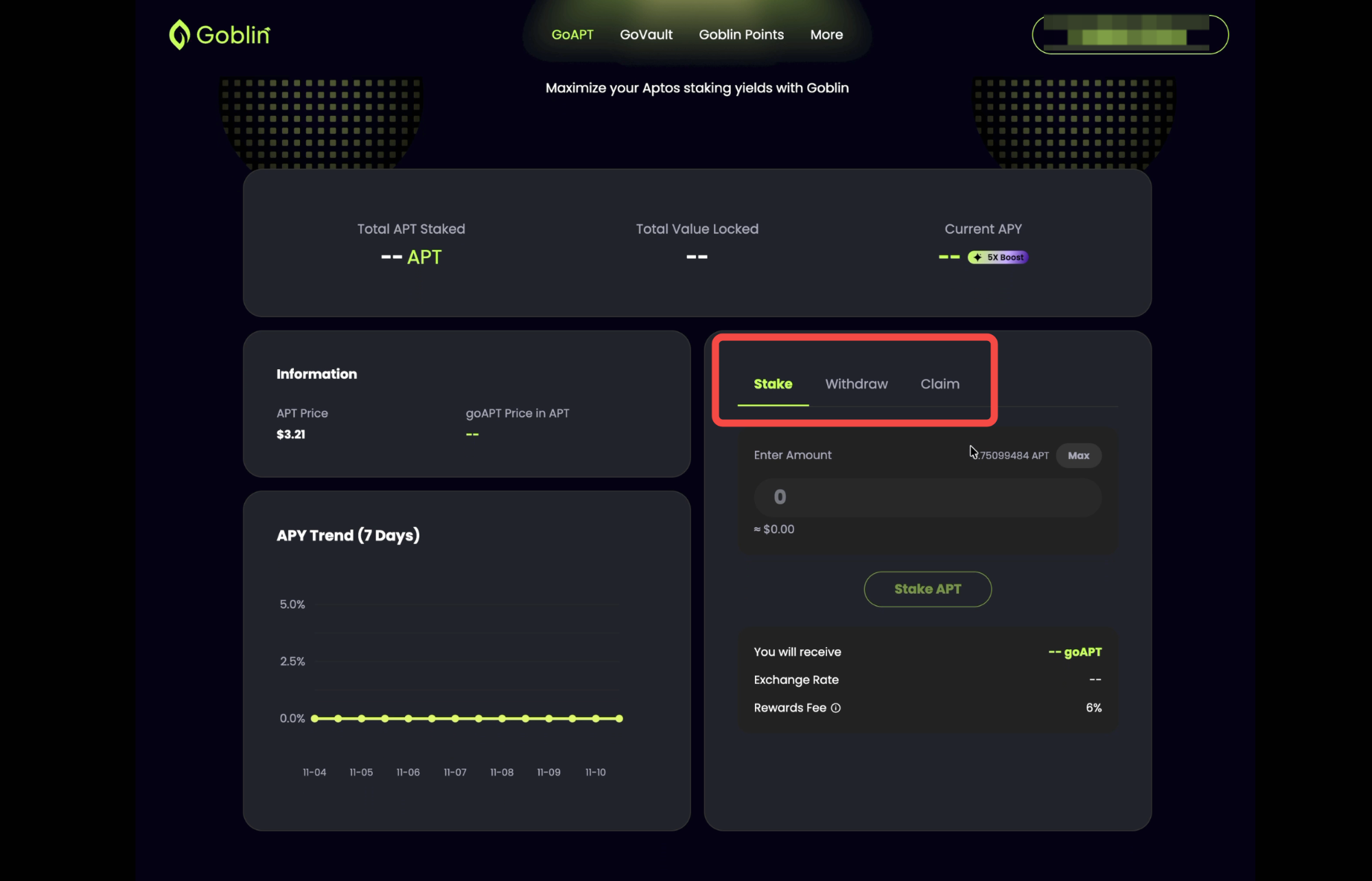

2) Select the "GoAPT" entry at the top of the homepage. The top of the page will display core data: Total APT Staked, TVL, Current APY, and the current points multiplier.

The left information area displays the current price of APT, the exchange price of GoAPT (GoAPT Price in APT), and the APY trend chart for the past seven days, helping users track yield changes.

The right functional area is divided into three main sections: Stake, Withdraw, Claim.

3) Users can choose Stake on the right side to stake the corresponding amount of APT (minimum 10 APT). Yields are automatically settled daily and reflected in the GoAPT exchange ratio, with the entire process requiring no frequent operations or monitoring.

4) Withdraw and Claim

Withdraw:

Unstake: Users can submit a redemption request, and the system will calculate the amount due based on the current GoAPT/APT exchange rate, completing the unlock after approximately 14 days.

Claim: After the regular redemption is completed, users can one-click claim APT on the Claim tab, with the interface clearly showing the status of each request (Pending / Ready / Claimed).

The entire process is transparent and traceable, with every operation completed on-chain. For users, staking equals yield, holding equals compounding, and they can also receive future airdrop rewards from Goblin—this is the "seamless yield experience" that Goblin hopes to bring to Aptos users.

Launch Special Event: Earn-to-Boost Incentives Now Live

To celebrate the launch of GoAPT, Goblin will simultaneously launch a phased incentive event. During the event, all GoAPT stakers will receive additional points multiplier rewards:

Regular users can enjoy an 8x points bonus

Active users can enjoy up to a 12x points bonus!

Points can be used for future airdrop incentive distribution and ecosystem governance. For details, please follow updates on the official website and community.

IV. Future Outlook

The launch of GoAPT marks the official entry of Aptos into a new phase of yield layer construction. In the future, Goblin Finance will continue to expand the strategy matrix of GoVault and deepen the yield infrastructure of Aptos, introducing more automated on-chain yield models and deeply integrating with native lending and stablecoin protocols to build a transparent, real-time, and traceable yield dashboard system, making all yield flows publicly verifiable.

Goblin's vision is clear: to make Aptos the most yield-efficient ecosystem in the Web3 world.

Goblin Finance - Building the Native Yield Layer of Aptos

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。