In 2025, as regulations become clearer and institutional funds accelerate their inflow, the crypto prediction market is transitioning from a marginal experiment to an important tool for information pricing—reflecting the on-chain collective intelligence's real-time gaming and risk management of future uncertainties. From macroeconomic indicators to technological innovations, the probability judgments that once relied on single channels may now be rapidly and accurately repriced by on-chain funds. This change is influencing how we understand information and market signals.

In simple terms, the prediction market in the crypto industry is a platform where users can bet on future events using cryptocurrencies, such as predicting whether a certain coin's price will rise or fall, or who will win a competition; if they guess correctly, they can make money, and if they guess wrong, they will lose.

OKX Ventures will continue to focus on this sector, outlining the overall landscape of "prediction markets." Our research report is for learning and communication reference only and does not constitute investment advice.

I. Origins and Development of Prediction Markets

As an information mechanism that aggregates "collective intelligence," prediction markets are entering a new stage driven by Web3 technology. After 2000, this industry has continuously evolved through academic innovation, regulatory games, and shifts in technological paradigms, presenting a new pattern of rapid growth and structural transformation by 2025.

The modern model of prediction markets originated from the Iowa Electronic Markets (IEM) in 1988, which first proposed the idea of "price as probability," aggregating participants' divergent judgments on event outcomes through trading financial contracts. During the 1988 U.S. presidential election, IEM achieved accurate predictions under small-scale operations. Subsequent studies showed that IEM's election prediction accuracy was higher than 74% compared to opinion polls from 1988 to 2004 and could display predictive advantages 100 days before the election. In 1993, the CFTC's exemption for IEM established a policy foundation for event-based contract markets, allowing academic experiments to test commercialization.

Starting in the 2000s, a wave of commercialization in prediction markets emerged, but it faced multiple challenges from gambling/financial regulations. Representative platforms like Betfair and Intrade grew rapidly but were also limited or even shut down due to their gambling nature and compliance difficulties. Although PredictIt initially received a "no-action letter," it was later withdrawn and fell into litigation, highlighting the high difficulty of institutionalizing external compliance market systems. In contrast, internal prediction markets like Inkling avoided regulation and became important tools for corporate decision-making.

In the 2020s, the industry experienced two major structural transformations. First, Kalshi received CFTC approval, becoming a compliant "event contract" exchange, marking formal regulatory recognition, but the 2023 election market case still highlighted sensitivity to topics and regulatory boundaries. Second, with the intervention of Web3 technology, prediction markets achieved trustless settlement through blockchain smart contracts, significantly enhancing censorship resistance and lowering compliance operational thresholds. In October 2025, the parent company of the New York Stock Exchange, ICE, planned to invest approximately $2 billion in the decentralized platform Polymarket, which the industry viewed as top financial infrastructure recognition of the Web3 model, signaling a paradigm shift for the entire industry.

Prediction markets (information markets, decision markets, event derivatives) allow participants to bet with funds, with market prices directly reflecting the probability of events occurring. Their theoretical foundations include the efficient market hypothesis and the principle of collective intelligence: the former posits that market prices can approximate probabilities, while the latter emphasizes that under diverse, independent, and decentralized participation mechanisms, collective market decision-making is superior to individual decision-making.

Taking the probability of interest rate cuts as an example, we compare professional data with prediction market data.

Tools like CME FedWatch derive probabilities from derivative prices, representing institutional expectations but are influenced by tool design and capital structure. In contrast, open prediction markets like Polymarket and Kalshi determine probabilities directly through bets from all participants, theoretically making them more transparent and democratic; the higher the platform's activity, the more fully the information is reflected.

Overall, since the Iowa Electronic Markets (IEM) validated price as probability in 1988, prediction markets have undergone a long regulatory tug-of-war until 2020, when Kalshi's compliance and Web3 technology intervention marked the beginning of a paradigm shift characterized by institutionalization and decentralization. Driven by the resonance of Web3 and traditional financial capital, prediction markets are currently in a window of industry explosion and mechanism evolution. The parallel of decentralization and institutionalization will reshape the global financial information aggregation and price discovery system.

II. Market Growth and Platform Strategy Analysis

(A) Macroeconomic Market Overview: Dual-Headed Structure and Capital Inflow

Catalyzed by the 2024 U.S. election and the influx of institutional capital, the prediction market is experiencing a structural explosion in 2025. The market has shifted from being driven by single events to continuous financial trading activities, with both capital depth and user base reaching historical highs.

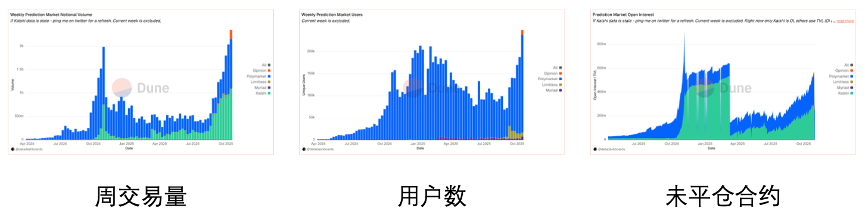

Transaction Volume Peaks: The market has experienced two significant peaks. The first was driven by the U.S. election from October to November 2024, with weekly trading volumes approaching $2 billion. The second explosion began in July 2025 and reached a historical high in October 2025, with weekly trading volumes exceeding $2.5 billion, surpassing the peak during the election period.

User Growth: Market activity and trading volume are highly positively correlated. In October 2025, the total number of weekly active users across the market exceeded 225,000, indicating a continuous and genuine influx of new users.

Capital Depth (Open Interest OI): OI (Open Interest) represents the real capital locked in the market. During the 2024 election, the total market OI peaked at nearly $800 million, then fell back due to settlements. Entering the second half of 2025, the total market OI has steadily rebounded and stabilized in the range of $500 million to $600 million. This marks a departure from pure short-term speculation, establishing a capital base composed of institutional and long-term participants.

Competitive Landscape: The market is characterized by a duopoly between Polymarket and Kalshi. In 2024, Polymarket held about 90% of the absolute dominant share. However, by October 2025, the compliant platform Kalshi's market share had risen to nearly 60%, surpassing Polymarket in total volume. Despite the concentration at the top, second-tier platforms like Opinion, Limitless, and Myriad still captured the remaining market and secured stable liquidity during specific time windows (such as token issuance periods).

(B) Head Platform Data Breakdown

1. Polymarket: From Election Windfall to Multi-Category Retention.

As the leader in decentralized prediction markets, Polymarket's data exhibits strong "event explosiveness" and has maintained high user retention through category expansion after the election.

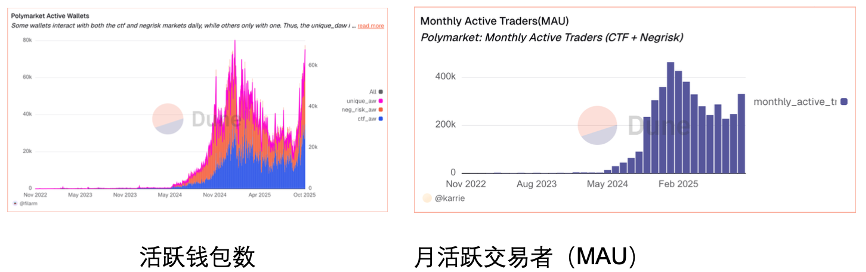

In terms of user data, active wallets reached a historical peak of nearly 80,000 by the end of 2024. Although there was a decline after the election, by October 2025, it remained stable above 60,000, significantly higher than early 2024 levels. Monthly active traders (MAU) peaked at 450,000 in January 2025, and despite the waning excitement of the election, it maintained over 260,000 continuously active users, demonstrating strong long-tail stickiness. Daily active users (DAU) reached a single-day peak of 58,000 on October 19, 2025, growing from an early 10,000 to 58,000, an increase of nearly six times.

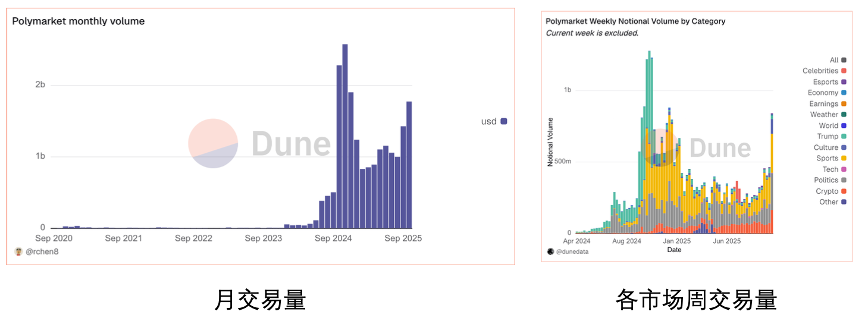

In terms of trading volume, the historical cumulative trading volume has surpassed $18.1 billion, with the monthly peak occurring during the November 2024 election, reaching $2.63 billion, approximately 1,000 times higher than early data from December 2020. After the election, monthly trading volume fell to about $1.9 billion, a decrease of about 30%-40%, but still far above 2023 levels. In terms of growth rate, the year-on-year growth in July 2024 reached 5,270%, and in October 2025, it soared to 26,000%, mainly due to the low base from the same period last year; on a month-on-month basis, trading volume also achieved explosive growth of about 750% from October to November 2024.

In terms of market structure and categories, during the peak of the 2024 election, "political/economic" transactions accounted for over 60%, with weekly transaction volumes exceeding $1 billion at one point; by 2025, the trading focus gradually shifted towards "sports" and "crypto assets," with Super Bowl-related contract trading volume around $1.1 billion, and Bitcoin prediction markets, such as "Bitcoin price in 2025," exceeding $15.5 million. Meanwhile, market supply is also expanding, with the number of newly created prediction markets in April 2025 exceeding 7,000, setting a historical high.

2. Kalshi: Exponential Growth Driven by Compliant Channels

Kalshi demonstrated the strongest growth momentum in 2025, leveraging its compliance advantages to tap into Web2 channels, with all core indicators achieving multiple growth.

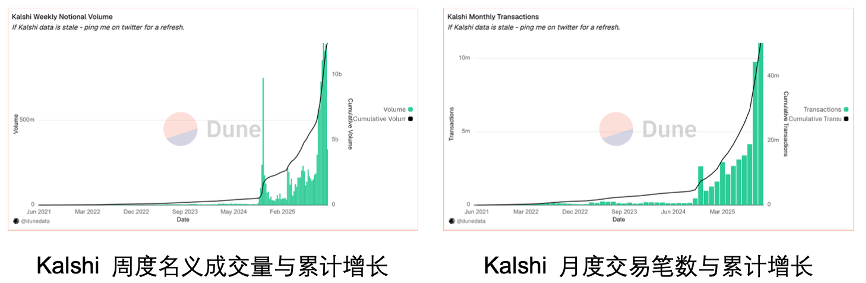

In terms of trading and scale, from the end of 2024 to the beginning of 2025, Kalshi's trading volume and number of trades exhibited explosive growth, with cumulative transaction volume surpassing $10 billion and cumulative trades exceeding 40 million, with an average transaction price of about $250–300, showing clear retail user characteristics. Weekly performance saw nominal transaction volume rise from $150 million to $200 million in Q4 2024 to over $850 million in Q2 and Q3 of 2025.

In terms of market share and ranking, as of October 2025, Kalshi's weekly transaction volume accounted for 55%–60% of the entire market, officially replacing Polymarket as the most liquid prediction market platform. In terms of total contribution, from September to October 2025, the total weekly transaction volume across the industry exceeded $1.5 billion, with Kalshi contributing $800 million to $900 million weekly, representing over five times year-on-year growth compared to 2024.

In terms of position and user structure, open interest surged from less than $50 million at the end of 2024 to over $200 million in the third quarter of 2025; the number of monthly active users (MAU) expanded from 80,000–100,000 at the end of 2024 to over 400,000 in the latter half of 2025. The market structure is highly concentrated, with sports accounting for about 45%, politics about 30%, and these two sectors contributing over 75% of the open interest, while economic categories account for about 10%. On the supply side, the number of effective markets expanded from about 300 to over 1,200 by October 2025.

(C) Performance of Emerging/Vertical Platforms

In addition to the two giants, platforms like Opinion Lab, Myriad, and Limitless have also produced noteworthy data under specific incentives or vertical scenarios.

- Opinion Lab: Explosive Launch on Mainnet

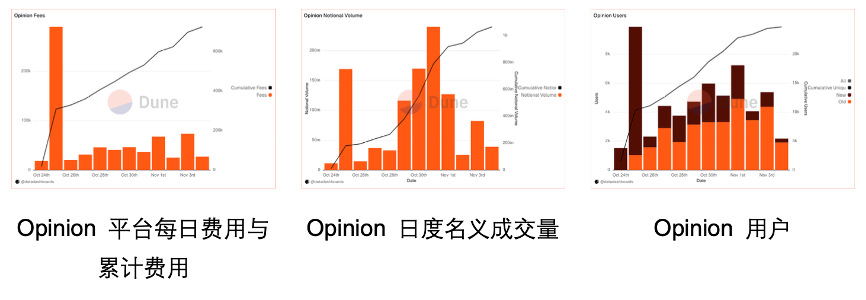

The daily transaction fees on the Opinion platform saw an explosive surge on October 25, exceeding $200,000 in a single day, rapidly pushing cumulative transaction fees from nearly zero to about $320,000, with cumulative transaction fees surpassing $600,000 by November. On the launch day (October 25, the day the mainnet incentive was activated), nominal transaction volume, number of trades, and user count all reached daily peaks, with Opinion accounting for about 15%–20% of the nominal trading share in the entire market. In terms of funds, the total value locked (TVL) on the platform peaked at $50 million on October 30, indicating that large amounts of capital briefly stayed after the incentive activities.

- Myriad: Media Traffic Conversion and Retention

In terms of user conversion, registered users exceeded 513,000, but active trading users were only 30,000 (USDC traders), resulting in a registration-to-trading user ratio of about 17:1, reflecting the conversion funnel from content readers to financial traders, with approximately 30,000 active wallets. In terms of trading scale, cumulative trading volume reached $12 million (USDC), with a peak daily transaction volume close to $2 million during the explosive period from September to October 2025, and weekly peaks exceeding $6 million. Regarding capital retention, total value locked (TVL) approached $800,000 in mid-October, showing an overall increase of about 300% since August, while open interest (OI) peaked at $500,000 in early October, representing a month-on-month growth of about 2.5 times. In terms of revenue capability, cumulative fee income was about $400,000, with a peak daily fee of about $6,000.

- Limitless: Data Volatility Under High-Frequency Incentives

In terms of trading volume, there was an explosive period from August to September 2025, with trading volume surging about 25 times; by mid-October, trading volume exceeded $100 million in just half a month, with cumulative total surpassing $500 million. The first season of incentives attracted about 34,000 active traders, completing 750,000 trades. Despite the cumulative trading volume reaching $500 million, the total value locked (TVL) peaked just above $1 million, indicating a very low TVL/Volume ratio, showing that users primarily engaged in ultra-short-term high-frequency trading. After the airdrop ended, the 24-hour trading volume quickly fell by 34.7% to $7.56 million, with data gradually returning to normal.

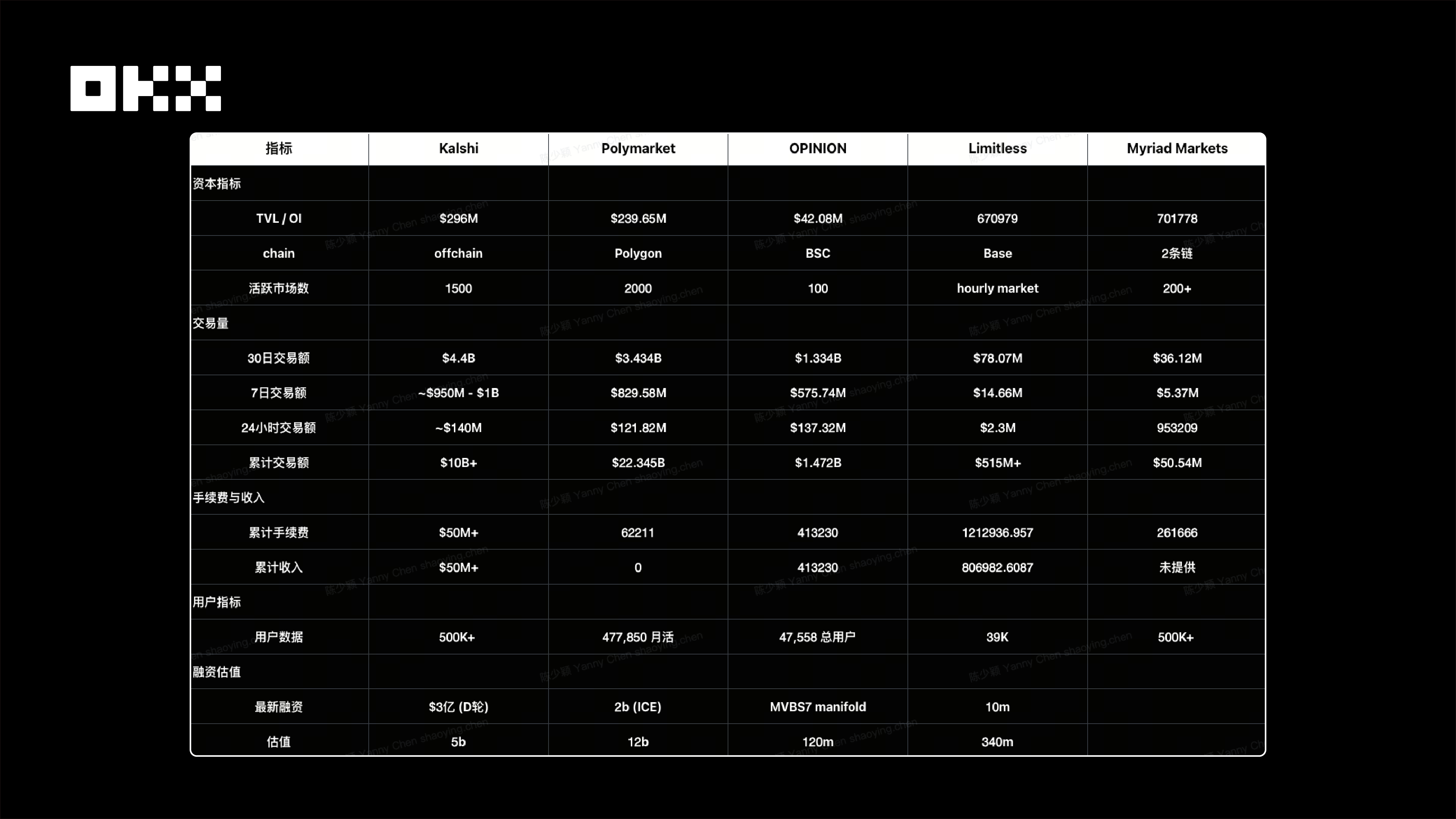

(D) Core Data Horizontal Comparison Table

From different indicators

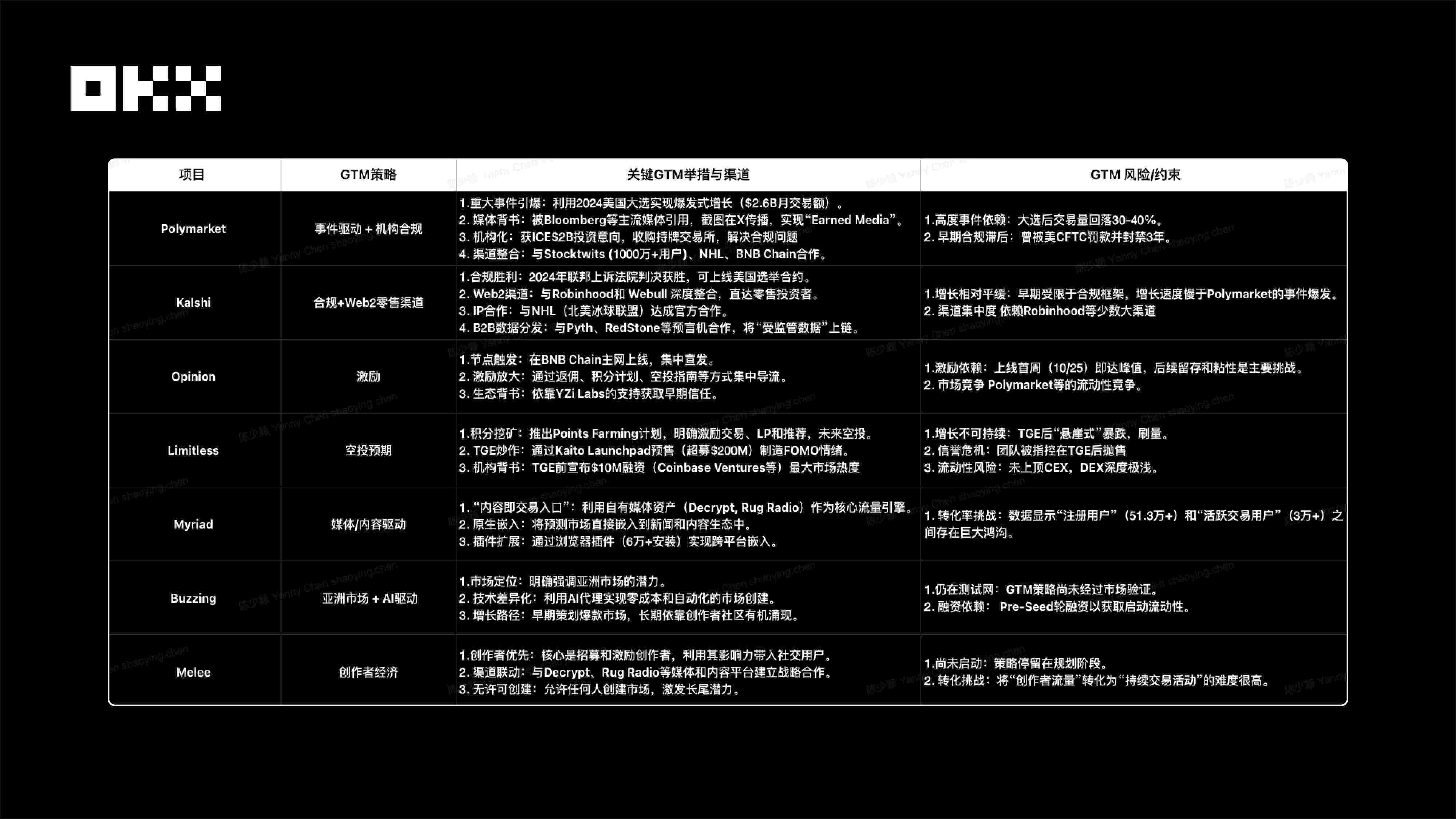

From the GTM perspective

The growth quality brought by GTM strategies shows a clear hierarchy: Structural growth quality is highest from channel integration (like Kalshi); followed by cyclical explosions driven by events (like Polymarket); then high-friction growth from content conversion (like Myriad); while growth driven by airdrop expectations declines quickly.

Compliance is the "underlying anchor" for growth: The evolution of Polymarket (event-driven → compliance pain → institutional compliance) proves this point. Although it exploded due to the 2024 election (450,000 MAU), it missed the U.S. market for three years due to early compliance issues. The intention to invest from ICE in 2025 and the acquisition of a licensed exchange mark that top players must ultimately return to the "compliance" path.

## III. Industry Structure Analysis

(A) Track Mapping

1. Infrastructure is gradually modularizing, evolving from "integrated platforms" (like early Augur) to "composable Lego modules":

Infrastructure protocols like Azuro, UMA, and Gnosis Omen have significantly lowered the technical barriers for new projects, supporting multi-chain deployment and plugin-based frontends, enriching the general track and providing entrepreneurs with plug-and-play product foundations, fostering more long-tail innovative scenarios, such as AI-driven and community-based gameplay. Gnosis (Omen) / CTF provides an industry-standard asset issuance framework, while Azuro Protocol offers plug-and-play betting middleware, allowing new projects to focus on frontend experience without needing to build liquidity pools and odds engines from scratch.

This modularization has greatly reduced the startup threshold for new applications, promoting the prosperity of numerous segmented tracks, including sports and gamification, bringing more innovation and diversified development possibilities to the entire prediction market ecosystem.

2. Vertical track opportunities are abundant: Sports and creator economy become growth points

In addition to general-purpose and top platforms, projects in tracks such as sports, music, pre-IPO, knowledge verification, social gaming, AI prediction, and Telegram Bots are rapidly emerging. Viral growth mechanisms such as social media/UGC, creator revenue sharing, and community interaction have become common features of new projects, enhancing user participation and diffusion speed.

The window for general-purpose platforms is closing, and opportunities for new projects are gradually concentrating in vertical directions. Data mapping shows that sports betting and creator/social economy are currently the two fastest-growing vertical tracks. Sports betting, as an independent track, has already spawned dedicated public chains (like SX Network), middleware (Azuro), proprietary protocols (Overtime), and even phenomenal applications like Football.fun, which reached a TVL of $10 million in just two weeks.

In the creator and social economy track, project models are no longer about "creating markets themselves," but rather driving growth through "empowering KOLs." Platforms like Melee offer a 20% revenue share for creators, while Index.fun provides a 30% creator revenue share, transforming prediction markets from mere information tools into instruments for creators and opinion leaders to monetize their influence, further expanding the diversity and application scenarios of the ecosystem.

3. AI is a standard feature for new projects: Automated creation and settlement

AI shows great potential in market generation, event analysis, content production, settlement, sub-gaming, and risk control scenarios. Combined with AI agents or Copilots, it can assist in information archiving, automatic market setting, and even predicting outcomes, thereby enhancing user experience and operational efficiency. Artificial intelligence is transitioning from an auxiliary tool to a core product positioning for some new platforms, addressing fundamental pain points in cost and efficiency faced by traditional prediction markets. For example, OpinionLabs and BuzzingApp both position "AI agents" as core, achieving zero-cost creation, unlimited supply, and automated settlement, fundamentally disrupting Polymarket, which relies on UMA, and Kalshi, which depends on manual compliance.

4. The interaction layer is being reconstructed: "Bots" and "Aggregators" become key entry points

Frontend tools and Telegram bots are significantly reducing user experience friction for underlying protocols, thus creating new interaction layer opportunities. For example, bots like Flipr and Noise simplify complex prediction trading operations from cumbersome web interfaces to one-click orders within tweets or group chats, becoming key GTM strategies for reaching socially driven markets; simultaneously, aggregators like Flipr and XO Market address the liquidity fragmentation issues of top platforms (Polymarket, Kalshi) and add enhanced features like leverage and stop-loss that native platforms lack, precisely meeting the needs of professional traders.

5. Prediction markets are becoming a part of DeFi Lego: Composable infrastructure

Prediction markets are gradually evolving from isolated platforms to true "DeFi Lego." On one hand, some projects (like Index.fun) are beginning to package different prediction outcomes (based on Gnosis CTF standards) into tradable "creator indices"; on the other hand, this data (like Kalshi connecting to Pyth) is provided to other DeFi protocols (like Gondor) through oracles, becoming new source data for on-chain derivatives, insurance, or lending protocols.

6. Prediction markets can be seen as financial derivatives: Convergence from "event prediction" to "high-frequency trading"

Product design is rapidly converging from "predicting events" to "financial derivatives." For example, Limitless's 30-minute ultra-high-frequency contracts are used as volatility trading tools, Flipr's 5x leverage transforms it into futures, and Touchmarket's price range predictions evolve into structured options, indicating that the entire track is quickly developing from its initial purpose of information aggregation to a new branch of high-frequency DeFi derivatives trading.

7. Middleware opportunities are worth noting, such as data and cross-chain solutions

Middleware and data tools are forming a complete prediction market infrastructure, significantly enhancing trading efficiency and user experience. For instance, Polysights provides services similar to a "Bloomberg terminal for prediction markets," aggregating decentralized data from platforms like Polymarket, Kalshi, and Limitless, tracking smart money movements and generating advanced arbitrage signals; in the betting and sports track, Azuro has proven the opportunity of "backend as a service," packaging liquidity pools, odds engines, and sports data oracles (Chainlink), allowing new projects to focus on user experience and GTM promotion.

At the same time, cross-chain liquidity and order aggregation are becoming key, with markets distributed across Base (Limitless), Polygon (Polymarket), and Solana (Melee). Flipr aggregates order flow, routes odds, and resolves cross-chain settlements, playing the role of "1inch for prediction markets"; additionally, the opportunities for GTM and interaction layer middleware lie in embedded tools, such as Flipr and Noise, injecting trading functions (like one-click orders and leverage) into Telegram Bots, X platform tweets, or content wallets, capturing traffic and trading behavior the moment users express trading intent.

(B) Comparison of Top Projects

(C) Regional Analysis of Track Investments

1. North American Market: Compliance and Data-Driven

- Compliance Finance Dominance (Kalshi): Kalshi leads the U.S. compliance market with its CFTC license, monopolizing regulated macro data trading such as economic indicators and Federal Reserve interest rate decisions, with its market share once surpassing Polymarket at 60%.

- Political and Event Segmentation (Duopoly): High-profile political events are contested by Polymarket (global funds) and Kalshi (U.S. compliant funds), creating a clear geographical and funding attribute distinction.

- Avoiding Platform Competition (Extremely High GTM): The barriers for top platforms have been established, and blindly establishing new compliant exchanges is too costly and unlikely to succeed; the idea of directly challenging Kalshi/Polymarket should be abandoned.

- Capitalizing on the "Auxiliary Layer" (Tool Opportunities): The real opportunity lies in serving the giants, such as developing frontend analytical tools for Robinhood/Kalshi channels (Polysights model) or becoming institutional compliance data distributors.

2. Global/Offshore Market: Sports as a Necessity and Product Shortage

- Sports as a Necessity (Largest Vertical): Sports is the most certain growth track globally, with 92% of Kalshi's recent growth coming from sports; high TVL of on-chain protocols like Azuro/Overtime validates its offshore necessity.

- Middleware Strategy (Shovel Business): Investing in liquidity and odds middleware like Azuro is the best strategy, as they provide underlying infrastructure for all frontend sports betting apps, achieving "plug-and-play."

- Solving the "Parlay" Pain Point (Missing Piece): Top platforms lack the "parlay" feature due to compliance avoidance; platforms that can implement this function in a decentralized manner will create a significant siphoning effect on highly engaged betting users.

- Crypto-Native Short-Term Betting (Limitless): High-frequency crypto price volatility predictions targeting DeFi traders (like Limitless model) represent another necessary niche market, satisfying short-term speculative demands.

3. Asian Market: Social Viral Growth and Long-Tail Micro

- Mobile-First and Social-Driven (Market Characteristics): The Asian market is an underdeveloped blind spot, with users preferring mobile operations, social sharing, and high-frequency interactions, contrasting sharply with the institutional style of Europe and the U.S.

- Abandoning Grand Political Narratives (Localization): Asian users lack interest in and are sensitive to Western macro politics, so the strategy of replicating Polymarket's political betting should be completely abandoned.

- Telegram Bots as Kings (Best Entry Point): Building lightweight entry points based on Telegram bots (like Flipr, okbet) significantly lowers the entry barrier, perfectly aligning with Asian users' social and payment habits.

- Micro-Entertainment Topics (Long-Tail Strategy): Focus on long-tail micro-events like esports, KOL gossip, and meme prices, utilizing a Melee-style "creator revenue sharing" mechanism to stimulate KOL self-promotion and viral growth.

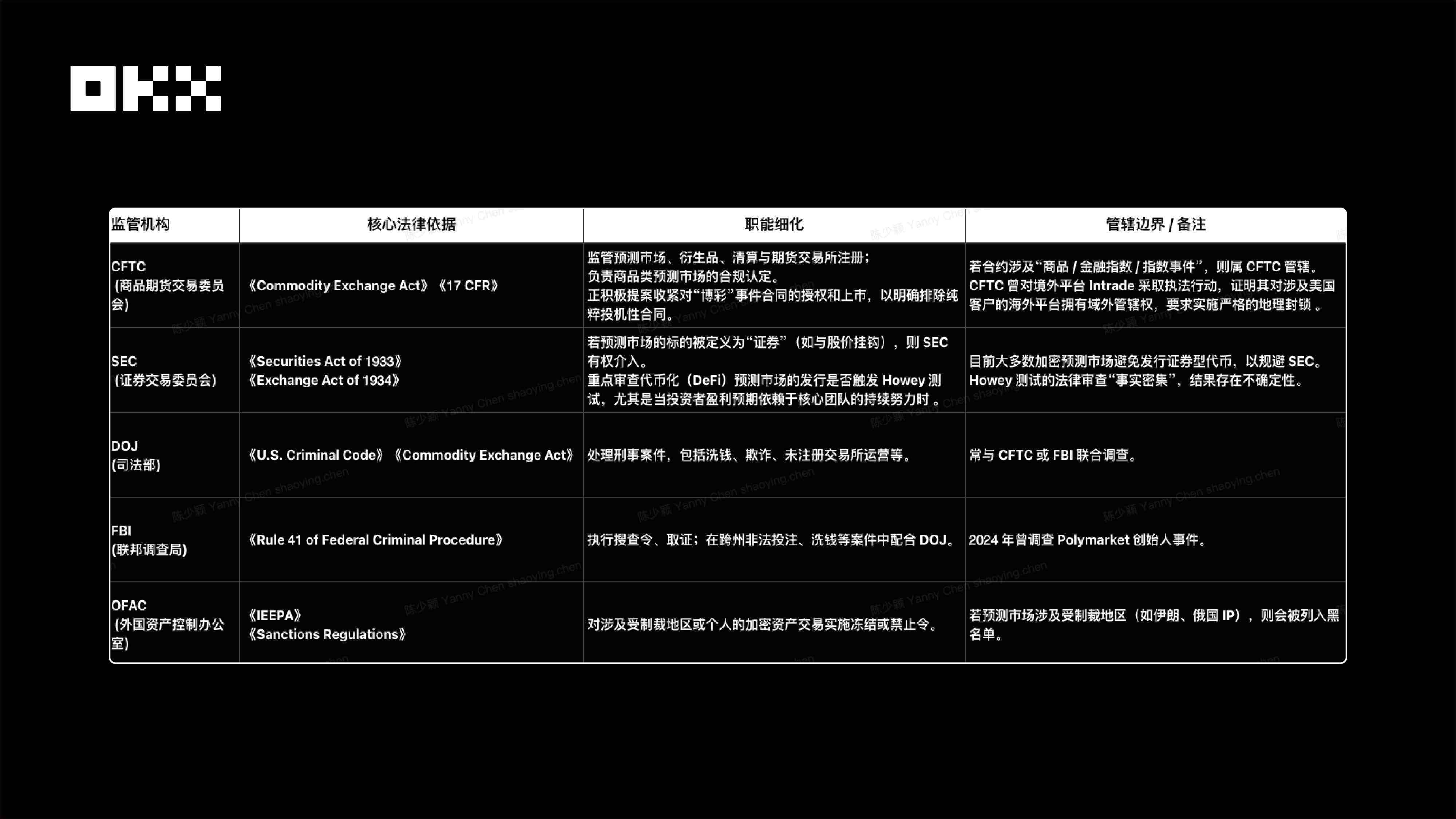

## IV. Analysis of Regulatory Agency Status

(A) Current Status of the U.S. Regulatory System

The current status of federal-level (Federal) regulation can be referenced in the following diagram.

State and local (State Level) regulatory status.

1. The "Federal vs. State" jurisdictional battle in the U.S. is the most heated battlefield, and its outcome will have a decisive impact on the industry.

Kalshi and the CFTC argue that the Commodity Exchange Act has federal exclusive jurisdiction, claiming that its "event contracts" fall under financial derivatives and should take precedence over state law; meanwhile, the gaming commissions of at least eight states, including New York, believe this is merely regulatory arbitrage, a "backdoor" to evade state gaming licenses and taxes. This dispute is not only a matter of legal interpretation but also a struggle for regulatory power and financial interests. The ruling in the Kalshi case will be a watershed: if Kalshi wins, it will clear the biggest obstacle for federal financial regulation; if it loses, all prediction markets may be forced to accept fragmented gaming regulation led by 51 states, with compliance costs that are unimaginable.

2. Case Study: Kalshi vs. NYGC Lawsuit

The conflict between Kalshi and the New York State Gaming Commission stems from the core legal contradiction between the Commodity Exchange Act (federal law) and various state gaming laws. The incident began when the New York State Gaming Commission issued a cease-and-desist order to Kalshi, accusing it of offering unauthorized sports betting. Kalshi subsequently filed a lawsuit in federal court, claiming that federal law has exclusive jurisdiction over its event contracts and emphasizing that federal jurisdiction should take precedence over state gaming laws to avoid the regulatory chaos brought about by "51 different and conflicting state laws." The complexity of the case is further increased by tribal litigation, involving Kalshi's partner Robinhood, with a California tribe also filing a lawsuit and citing the Indian Gaming Regulatory Act (IGRA), expanding the jurisdictional issue to a three-dimensional federal, state, and tribal level, significantly increasing the legal and regulatory uncertainty of the case.

Current regulatory status in various countries.

The "borderless" or "decentralized" characteristics relied upon by prediction markets (especially DeFi platforms) are viewed as ineffective by regulators. Regulatory agencies in various countries are actively employing measures such as geographic blocking, payment channel blocking, and ISP bans to enforce their domestic jurisdiction.

The global (non-U.S.) regulatory trend for prediction markets is clearly tightening. Regulatory agencies are not letting them go unchecked due to their "innovative" nature; instead, they are rapidly incorporating them into existing regulatory frameworks (either financial or gambling) and firmly rejecting overseas operators attempting to evade domestic licensing.

Frankly speaking, the current regulatory situation is extremely chaotic, and it is almost impossible to unify in the short term. Different classifications will lead to vastly different compliance requirements and legal consequences. First, if classified as commodities or derivatives, the regulatory agency would be the federal-level CFTC (Commodity Futures Trading Commission), whose logic is that the market is used to hedge risks of future events (such as interest rates, political events), functioning similarly to futures, serving price discovery and risk management; the Kalshi platform is striving to develop along this path and has already obtained CFTC authorization.

Second, if classified as gambling or betting, the regulatory agencies would include various state gaming commissions (like the New York State Gaming Commission) and international gaming institutions (like France's ANJ and the UK's UKGC), whose logic is that the market is used for "betting" on future event outcomes, primarily for entertainment rather than economic risk management; real-world cases include New York State accusing Kalshi of offering unauthorized sports betting and countries like Belgium directly banning Polymarket.

Finally, if classified as securities, the regulatory agency would be the federal-level SEC (Securities and Exchange Commission), primarily targeting DeFi platforms. When a platform's profit expectations depend on the ongoing efforts of its core team or the underlying asset is linked to stock prices, it may trigger the Howey Test and be regarded as an investment contract; real evidence includes the SEC's ongoing scrutiny of token issuance in DeFi prediction markets.

(B) Mechanism Analysis: Business Model, Trading Mechanism, and Oracles

- Business Model Analysis

Prediction markets are evolving from purely B2C transaction fee monetization to a B2B DaaS model that extracts data value, ultimately moving towards a hybrid model embedded in media and creator ecosystems to minimize customer acquisition costs.

- Kalshi's Compliance Revenue Strategy: The platform relies on regulatory licenses as a moat, adopting a high-fee centralized model to directly capture B2C transaction revenue, aiming to dominate the compliant financial market trusted by institutions and conservative traders.

- Polymarket's Market Share Priority Strategy: The project utilizes capital support to maintain extremely low fees to prioritize market share and data assets, building barriers through network effects and focusing on extracting long-term data value from B2B DaaS.

- Limitless's Protocol Value Strategy: The platform adopts a DeFi-native model, using an economic flywheel to repurchase tokens, directly empowering the platform's value to the protocol tokens, relying on token incentive mechanisms to compete for high-frequency liquidity in the crypto space.

- Cultivate Labs' B2B Stability Strategy: This model avoids speculative markets, focusing on providing SaaS solutions for large enterprises and governments to assist decision-making, locking in predictable recurring revenue through solid customer relationships.

- Potential and Challenges of Hybrid Models: Embedded models represented by Melee and Myriad have the largest potential market size by reaching a broad internet user base, but still need to address the challenge of transforming entertainment-based predictions into a sustainable economic model.

- Trading Mechanism Analysis: Liquidity, Matching, and Capital Efficiency

From theoretical models (CLOB, LMSR) to specific platform implementations (Polymarket, Kalshi, etc.), a systematic comparison of their differences in matching mechanisms, architecture, position mechanisms, capital efficiency, and risk characteristics has been conducted.

- How to trade off between "efficiency" and "decentralization"

- Capital Efficiency (Advantage of CEX): Models like CLOB (Central Limit Order Book) have extremely high capital efficiency, providing low slippage and deep liquidity. This is a necessary condition to attract professional traders and high trading volumes.

- Decentralization (Soul of DeFi): Models like AMM (Automated Market Maker) are permissionless and censorship-resistant. This is the core value of prediction markets as a "global information market."

- Current market leaders do not perfectly achieve both. They all make compromises:

- Kalshi: 100% efficiency, 0% decentralization. (Fully embraces regulation and centralization)

- Gnosis/Omen: 100% decentralization, 0% efficiency. (LMSR efficiency is too low, no one uses it)

- Polymarket: Mixed compromise. (Exchanges off-chain matching for efficiency but sacrifices some decentralization and brings regulatory risks)

- Limitless: Technical compromise. (Attempts to forcibly implement on-chain CLOB with L2 speed but still relies on professional market makers)

- The holy grail of the industry is to find a model that has the efficiency of CLOB and the passive and decentralized characteristics of AMM.

- The old AMM's "clumsiness" lies in its uniform distribution of liquidity across the entire range from 0% to 100%, resulting in 90% of funds "asleep" in a 50/50 market, leading to extremely low efficiency.

- "Concentrated liquidity" (the core concept of Uni v3) is the holy grail to solve this contradiction, allowing liquidity providers (LPs) to "smartly" concentrate 100% of their funds in high-probability trading ranges like 40%-60%.

- This new model perfectly combines the two major advantages: it achieves capital efficiency and low slippage akin to CLOB while retaining the permissionless, passive "set and forget" decentralized soul of AMM.

- Therefore, the future of the market is a "smart AMM" tailored for prediction markets, centered around "concentrated liquidity," and may utilize Uni v4's "Hooks" to add advanced features like dynamic fees.

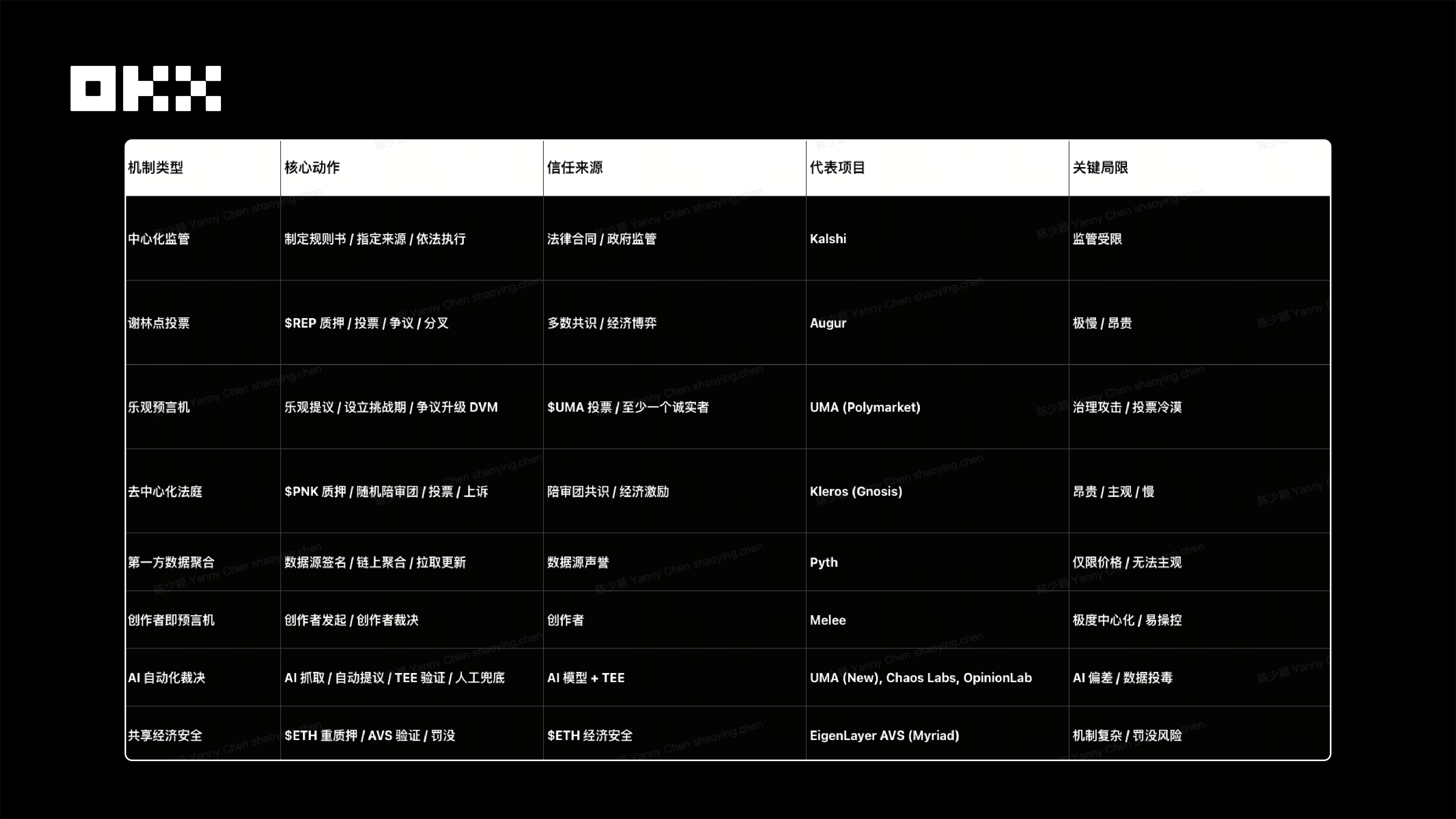

3. Oracle Mechanism: Trust in Outcome Judgments, Security, and Settlement Efficiency

- Authoritarian Epistemology: Centralized Regulatory Model (Kalshi)

- Mechanism: Based on legal rulebooks, a single authoritative data source (e.g., Department of Labor reports) is designated by the platform for adjudication.

- Source of Trust: Legal contracts and CFTC regulation.

- Advantages: High legal certainty, suitable for institutions.

- Limitations: Adjudication scope is limited by regulatory permissions (e.g., previously banned political predictions).

- Consensus Epistemology: Decentralized Schelling Point Model (Augur, UMA)

- Mechanism: Utilizes the Schelling point principle to incentivize token holders to vote on outcomes.

- Augur: REP token holders vote, triggering forks in case of disputes (very slow, very expensive).

- UMA (Polymarket): Optimistic oracle model. Defaults to passing without disputes; disputes escalate to DVM voting.

- Security Assumption: Cost of Corruption (CoC) > Profit from Corruption (PfC).

- Limitations: Risk of governance attacks. In 2025, UMA was manipulated by whales in the Ukrainian market, proving that token voting is vulnerable to attacks under low participation.

- Judicial Epistemology: Decentralized Arbitration Court (Kleros)

- Mechanism: Randomly selects jurors to adjudicate complex/subjective disputes, similar to an on-chain court.

- Advantages: High expressiveness, capable of handling ambiguous/unstructured disputes.

- Limitations: High costs, slow speed.

- Emerging Mechanism Evolution

- Pyth Network (Pull Model): Top institutions directly sign on-chain, high frequency, low cost, suitable for objective price data (e.g., Limitless).

- AI + TEE (Opinion/Buzzing): AI agents automatically fetch/judge, TEE hardware ensures process trustworthiness, community underwrites. Solves long-tail market adjudication costs.

- AVS Shared Security (EigenLayer): Utilizes re-staked ETH to provide economic security, addressing attack risks due to insufficient market cap of single oracle tokens.

- Creators as Oracles (Melee): Allows creators to customize rules and adjudicate, adapting to social/entertainment long-tail markets.

- For Protocol Developers: Reject "Universal Oracles," Embrace Specialization

- Financial/Price Markets: Choose first-party data source models like Pyth or Chainlink, pursuing extreme performance and fidelity. Avoid using voting mechanisms to adjudicate high-frequency prices.

- Objective/Binary Events: Adopt optimistic models based on EigenLayer AVS, ensuring "corruption costs" always exceed "corruption profits."

- Subjective/Ambiguous Events: Integrate decentralized arbitration systems like Kleros, or accept Kalshi's centralized "rulebook" model.

- Long-Tail/Social Markets: Adopt Melee's "creators as oracle" model, clearly positioning it as a social entertainment product.

- For Bettors and Investors, Incorporate Oracle Risks into Core Considerations

- Primary Risk Control: Before trading, read and fully understand the market's adjudication mechanism.

- Clarify Bets: Ask yourself, "Am I betting on the event outcome, or on the voting behavior of a group of anonymous token holders?" The 2025 Polymarket attack proves that the two can be completely at odds.

- Risk Pricing: For markets relying on crypto-economic consensus, the risk of oracle manipulation must be factored into your odds and position models as a core element.

- From "Truth Machines" to "Verifiable Automation"

- The development of prediction market oracles is a history of moving from idealism to pragmatism, and then to specialization and modularization.

- The initial "truth machines" (like Augur) failed due to their complexity and inefficiency.

- More pragmatic "optimistic models" (like UMA) were breached due to their isolated economic security flaws.

- Regulated "authoritative models" (like Kalshi) are technically robust but face strict limitations in application scope.

- The future will not be entirely centralized or purely decentralized, but a combination of hybrid and specialization.

- Hybrid: Integrates AI automation (to enhance efficiency), human oversight (to ensure security), and shared economic security (to address economic vulnerabilities), forming a "human-machine loop" composite system.

- Specialization: Embraces specialized models like Pyth (focusing on prices) and Melee (focusing on social), achieving their core value by sacrificing universality.

Ultimately, the "oracle problem" will not be "solved" by a single mechanism but will be "managed" by an evolving ecosystem composed of multiple mechanisms. This ecosystem will provide different trade-offs for various types of "truth" based on the four dimensions of security, speed, cost, and expressiveness.

5. Compliance as a Growth Anchor

2025 marks the paradigm shift of prediction markets from marginal experiments to financial infrastructure. Under the dual catalysis of capital and regulation, the track has formed a duopoly of Kalshi (compliant finance) and Polymarket (offshore DeFi), with the business logic transitioning from single transaction fees to B2B data distribution and embedded traffic monetization.

Compliance has become a growth anchor, and regulatory classification will determine the market ceiling. The industry is gradually differentiating into institutional paths relying on licenses and censorship-resistant paths relying on code; infrastructure is also developing in specialization, with matching mechanisms evolving from AMM to CLOB to enhance capital efficiency, and oracles upgrading from simple token voting to a hybrid defense system of "AI automation + AVS shared security" to address governance attack risks.

Looking ahead, the window for generalized platforms has closed, and growth will break through towards verticalization and socialization. One end is the deep institutionalization of sports and macro derivatives, while the other end is the "attention financialization" combined with the creator economy. The ultimate landscape will present a coexistence of high-frequency compliant data flows and long-tail social betting.

Disclaimer

This article is for reference only. It represents the author's views and does not reflect the position of OKX. This article does not intend to provide (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professionals regarding your specific circumstances. You are solely responsible for understanding and complying with applicable laws and regulations in your locality.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。