The end of the explosive growth in computing power is a string of encrypted codes. Nvidia's latest financial report is impressive, but the capital market's reaction has been tepid, with the stock price plummeting over 7% shortly after the report was released.

Meanwhile, Google's breakthrough with its self-developed TPU chips has raised questions about Nvidia's future position. A debate about the AI bubble is unfolding in the capital market. A research report from MIT has further fueled this debate—up to 95% of companies have failed to achieve measurable returns on their investments in AI.

1. Nvidia's "No-Win Situation"

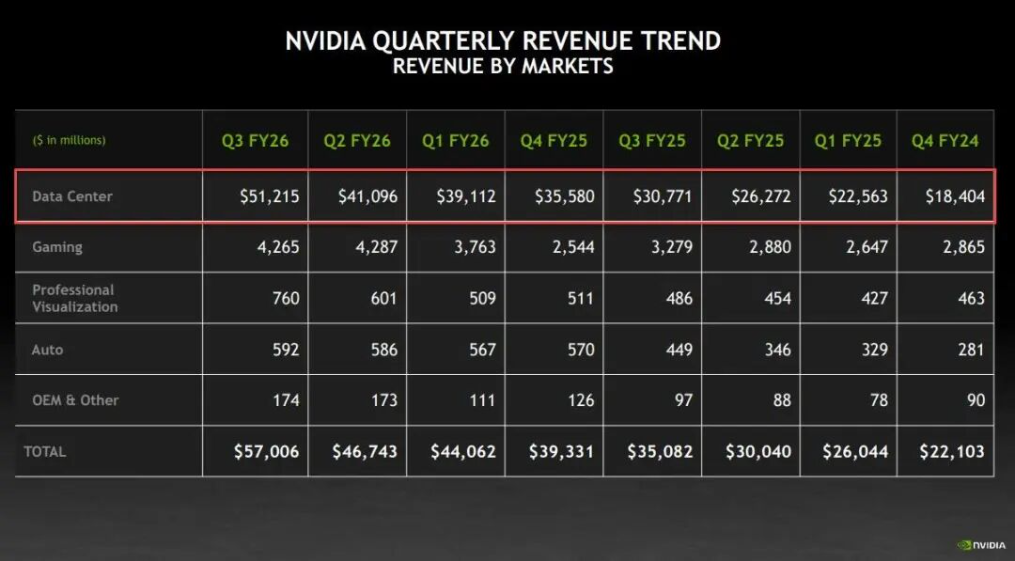

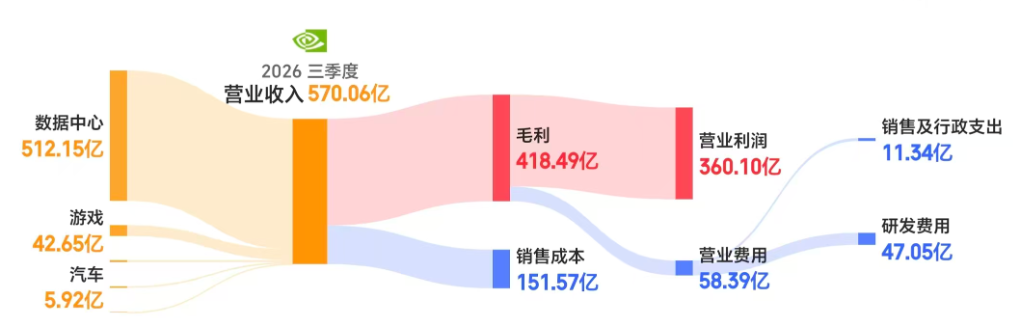

● Nvidia delivered an astonishing report for the third quarter of fiscal year 2026: revenue of $57 billion, a year-on-year increase of 62%, and net profit of $31.91 billion, a year-on-year increase of 65%.

● The data center business has become the absolute mainstay, with revenue reaching $51.2 billion, accounting for nearly 90% of total revenue.

● CEO Jensen Huang excitedly stated after the earnings report that sales of Blackwell architecture chips far exceeded expectations, and cloud GPUs are completely sold out.

● However, the capital market reacted very differently. Nvidia's stock price fell sharply after a brief surge, with a market value evaporating by over $800 billion from its peak.

Huang candidly admitted in an internal meeting that the company is in a "no-win situation": "If we deliver a poor quarterly report and appear a bit unstable, the whole world will collapse. But even if we deliver an excellent quarter, some will say we are just fueling the bubble."

2. The AI Bubble Debate

● The market's enthusiasm for AI is showing signs of retreat. MIT's "2025 Business AI Status Report" reveals a harsh reality: despite companies investing as much as $40 billion in generative AI, 95% of companies have failed to achieve measurable returns on their investments.

● Research shows that only 5% of organizations have successfully crossed the "generative AI chasm," creating substantial value through integrated AI pilot projects. The vast majority of companies are stuck in pilot projects that are stagnant and unable to make a significant impact on performance.

● Even more concerning is the emergence of a massive "shadow AI economy"—over 90% of employees prefer to use personal tools like ChatGPT to complete their work rather than the AI systems provided by their companies.

● "Big Short" Michael Burry criticized the circular trading around Nvidia by tech companies, pointing out, "The real end demand is extremely small, and almost all customers are funded by their distributors."

3. The Power Dilemma: The Ultimate Bottleneck for AI Growth

● As the demand for AI computing power explodes, power supply has become an undeniable bottleneck. Analysis shows that to meet the combined demand of new data centers, electric vehicles, and industrial reshoring, the U.S. now needs to add about 80 gigawatts of power generation capacity each year. OpenAI CEO Sam Altman publicly stated: "The two currencies of the future will be computing power and energy, and AI technology depends on breakthroughs in energy."

● High-energy-consuming AI computations directly conflict with global green energy transition goals. To achieve higher computing power, more energy and higher energy consumption are required, which may lead to more carbon emissions.

● In response to this challenge, tech giants are taking action. In 2023, Amazon announced that its total corporate power purchase agreements reached 8.8 GW; Meta announced a 3 GW corporate power purchase agreement; in May 2024, Microsoft signed over $10 billion in clean energy purchase agreements.

4. RWA and DePIN: New Financial Infrastructure for the AI Era

● In the face of inadequate traditional financing channels, a new capital formation mechanism is emerging—Real World Asset Tokenization (RWA) and Decentralized Physical Infrastructure Networks (DePIN).

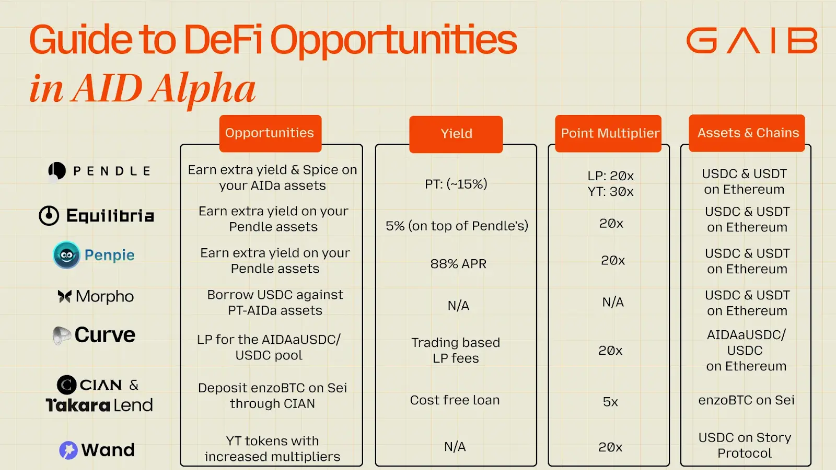

● In the AI infrastructure field, high-performance hardware like GPUs is gradually evolving into strategic assets. The RWAiFi path proposed by the GAIB protocol provides a new solution for "on-chain financialization of AI infrastructure."

● GPUs, with their high standardization, clear residual value, and active second-hand market, have become the primary entry point for RWA.

● Specifically, GAIB collaborates with global cloud service providers and data centers, using GPU clusters as collateral to design three types of financing agreements: debt model (fixed interest payments), equity model (sharing GPU or robot income), and hybrid model (interest + revenue sharing).

● In the energy sector, DePIN projects like Daylight and Arkreen demonstrate how to coordinate distributed energy—rooftop solar, home batteries, electric vehicle charging stations—into a software-defined power plant.

● Daylight's "flexible proof" mechanism pays tokens when smart devices commit to adjusting consumption or charge/discharge behavior during future peak times; energy companies burn tokens to purchase access to flexible capacity.

5. From Kilowatt-Hours to AI Tokens: The Value of the Crypto Bridge

If DePIN and RWA successfully combine, a complete traceable value chain from energy to computing power will be created.

● On the supply side, kilowatt-hour related outputs can be tokenized, representing claims to specific renewable energy generation flows.

● In the midstream, infrastructure can be expressed as tokenized RWA: equity and debt of data centers, grid connection upgrades, power generation and storage, GPU clusters.

● On the demand side, energy and computing can be linked with AI-native tools: GPU hour tokens, inference second credits, and even application-layer "AI service" tokens.

Thus, every marginal kilowatt-hour used by AI models, from its origin to its consumption in GPU racks, and then to its monetization in AI applications, is traceable, priceable, and hedgeable.

This does not require every link to be on the same chain or priced in the same token. Rather, it means that the state of each link is machine-readable and can be stitched together by smart contracts and agents.

If achieved, it essentially creates a new form of capital: any investor, anywhere, can choose where to take risks in this chain—energy, grid, data centers, GPUs, AI applications—and purchase tokenized exposure of corresponding scale and duration.

The dilemma of power and capital is giving rise to a revolution in financial infrastructure.

When every kilowatt consumed by AI models, from the origin of rooftop solar to conversion in GPU racks, and then to value realization in AI applications, can be traced, priced, and traded through blockchain, a brand new capital network is quietly taking shape.

The balance sheets of mega-corporations will not disappear, but they will no longer be the only way to warehouse risk. Long-tail, distributed, programmable capital may be the answer to AI's breakthrough of the power and capital bottleneck.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。