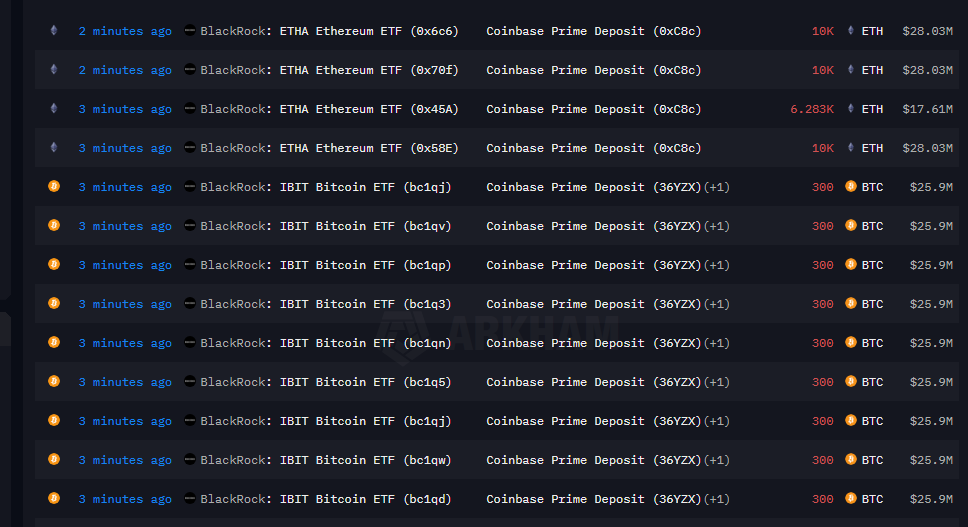

On-chain data reveals a massive Bitcoin transfer from BlackRock to exchanges, sending shockwaves through the market, yet it is unaware that this is merely the tail end of a sell-off, not the beginning.

Recently, a series of large Bitcoin transfers from BlackRock to Coinbase have garnered widespread attention from cryptocurrency investors, many of whom interpret it as a signal of institutional dumping. Wintermute founder Evgeny Gaevoy pointed out that this is actually a highly lagging indicator.

The real sell-off has already occurred in the ETF market, and the on-chain transfers are just the final step in the entire process.

1. Market Misinterpretation: Panic Triggered by Lagging Indicators

● The market's misinterpretation of BlackRock's large transfers stems from a lack of understanding of the ETF operational mechanism. The so-called "BlackRock large transfers" specifically refer to the cryptocurrency transfers from the reserve address of BlackRock's spot Bitcoin ETF (IBIT) to the Coinbase Prime custody address.

● Behind the transfers is actually a step in the process where large market makers hedge around the ETF when there is a net outflow from the ETF.

● When investors see on-chain transfers, they often believe this is a signal that institutions are about to sell, unaware that the real market selling pressure has already occurred. This misunderstanding leads investors to make irrational decisions amid market volatility, exacerbating market panic.

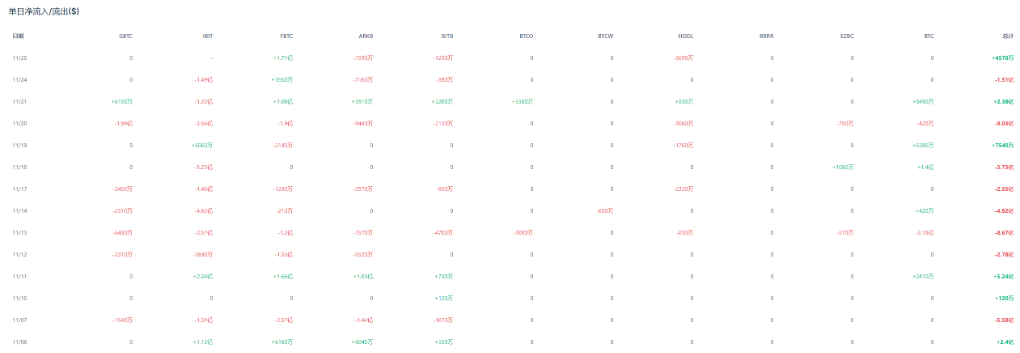

● Since November, investors have withdrawn $3.5 billion from Bitcoin ETFs, nearly matching the historical record of $3.6 billion set in February for the highest monthly outflow. Among these, BlackRock's Bitcoin ETF (IBIT) has seen redemptions of $2.2 billion this month, and unless there is a significant reversal, it will set its worst single-month performance.

2. Operational Mechanism: Decoding the ETF Redemption Process

To understand BlackRock's operational mechanism, we need to delve into the complete process when there is a net outflow from the ETF.

Cash Redemption Model

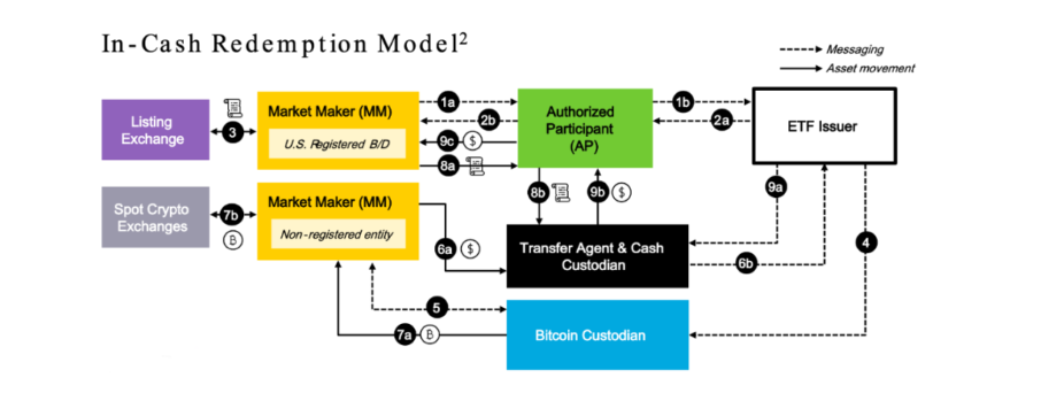

● BlackRock ultimately adopted a "cash creation" model for its Bitcoin ETF redemptions, aligning with the stance of U.S. financial regulators. Under the "cash-only" redemption mechanism, when investors wish to redeem their ETF shares, they need to use cash.

● BlackRock will sell Bitcoin and distribute the cash to redeeming shareholders. This method eliminates the possibility of participants directly exchanging Bitcoin for ETF shares.

Redemption Process

● Market makers buy shares from ETF sellers, then submit a redemption request to BlackRock to exchange ETF shares for BTC. This process typically has a 1-day delay.

● The key point is that market makers have simultaneously completed hedging operations when purchasing ETF shares, meaning they sell the corresponding amount of cryptocurrency in the external market.

● Gaevoy explained: "The real selling pressure does not occur when retail investors see on-chain transfers; it occurs when market makers are taking on ETF sell orders while simultaneously selling in the external market for hedging." Due to the typical 1-day delay in the redemption process, actual selling pressure may have occurred a day earlier.

● Specifically, in the cash/USD model, the redemption process is as follows: market makers first repurchase ETF shares from the U.S. stock market, sell BTC in the crypto market (the recovered USD is immediately handed over to the cash custodian). The next day (T+1), market makers and TA settle: market makers hand over the repurchased ETF shares to TA, and TA returns the USD to market makers.

3. Model Differences: Why the SEC Insists on the Cash Model

In choosing the creation and redemption model for the ETF, BlackRock initially preferred the physical model, but the U.S. Securities and Exchange Commission (SEC) insisted on using the cash model.

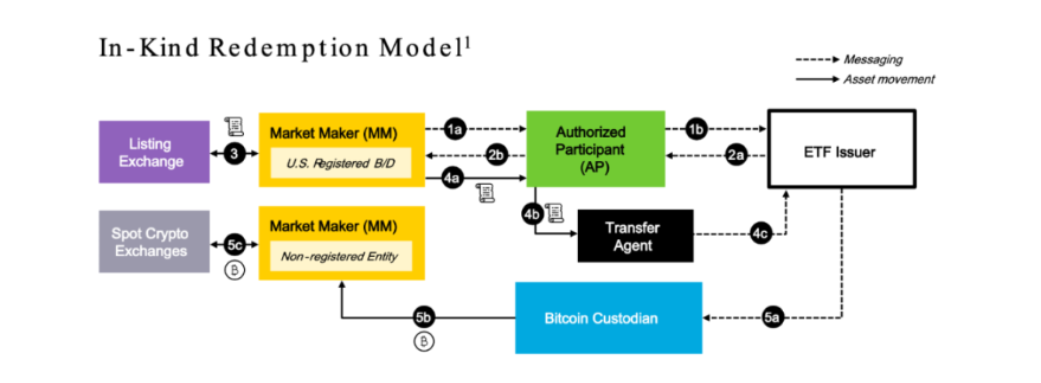

● The physical model (also known as the BTC model) directly links the quantity of ETF shares to BTC; redeeming ETF shares means selling an equivalent amount of BTC. This is a very intuitive and straightforward model. Under the physical/BTC model, the ETF issuer only needs to manage the correspondence and accounting between ETF shares and BTC, without worrying about the constantly fluctuating USD price in the market.

● The cash model (also known as the USD model) converts ETF shares into the corresponding amount of BTC through USD; redeeming ETF shares requires first converting to USD, then converting USD into BTC.

● The SEC prefers the cash/USD model because it isolates the risks of the two markets, making it easier to regulate them separately, ensures the dominant status of the USD as a pricing currency, and facilitates taxation of participating entities.

For end-market investors, there is not much difference in experience between the two schemes. ETF investors in the U.S. stock market buy ETFs with USD and receive USD when selling ETFs.

4. Market Impact: Capital Outflow and Price Volatility

The Bitcoin ETF market is experiencing significant capital outflows, which have had a substantial impact on Bitcoin prices.

● Data shows that U.S.-listed Bitcoin ETFs are facing the most severe monthly capital outflow in nearly two years. This not only adds greater pressure to an already weak cryptocurrency market but also reshapes the way capital flows in and out of this asset class.

● Since its launch in January 2024, the spot Bitcoin ETF has become a barometer of sentiment in the cryptocurrency market, creating a self-reinforcing feedback loop: capital accelerates inflow when prices rise and intensifies outflow when prices fall.

● Citigroup's research team quantified this phenomenon: for every $1 billion that flows out of Bitcoin ETFs, prices average a 3.4% decline, and vice versa. Citigroup analyst Alex Saunders stated that this mechanism explains Bitcoin's recent pullback.

● Bitcoin's price fell to $80,553 over the weekend; although it slightly rebounded over the weekend, as of November 24, the cryptocurrency was priced at $86,020, with a year-to-date decline of 8%.

● From a broader financial market perspective, various high-risk assets, from AI concept stocks and meme stocks to high-volatility momentum trading, are experiencing pullbacks. The S&P 500 index is facing its worst monthly performance since March, while the short-term correlation between Bitcoin and tech stocks reached an all-time high earlier this month.

5. Role of Market Makers: Risk Transfer and Market Stability

In the operation of Bitcoin ETFs, market makers play a crucial role. BlackRock plans to transfer risk to cryptocurrency market makers after obtaining approval for its Bitcoin spot exchange-traded fund (ETF) to facilitate easier participation from Wall Street banks.

● The plan includes a novel way of redeeming ETF shares. Under the cash/USD creation model, the use of USD separates the two markets. Market makers act more like "tools," simply trading ETF shares/USD and BTC/USD in both markets without much thought.

● If time differences in operations between the two markets or price discrepancies lead to arbitrage or losses, market makers do not need to bear such inter-market risks under the cash model.

● The revised model addresses an important gap. BlackRock did not specify the exact method but stated that the new process provides "superior resistance to market manipulation," reflecting the SEC's main concerns about the product.

● Enabling large institutions (managing billions of dollars in assets for clients) to redeem shares more quickly and with lower risk may mean more institutional capital flowing into Bitcoin spot ETFs.

6. Investment Insights: Focus on Correct Indicators and Long-Term Trends

For rational investors, understanding BlackRock's operational mechanism directly means mastering how to correctly interpret market signals.

● Investors should pay more attention to daily ETF inflow and outflow data, as this is the real-time indicator reflecting market capital movements. On-chain transfers are merely a settlement step in the standard operational process of ETFs, and the selling pressure they represent generally occurred before the transfer, not after.

● Relevant data will be presented more clearly and comprehensively in daily ETF inflow and outflow monitoring, eliminating the need to reinterpret it as an additional bearish signal, which could cause unnecessary panic.

● When there is a net inflow into the ETF, market makers will simultaneously sell ETFs to buyers while buying cryptocurrency and sending it to the ETF issuer. Although there are no redemption time constraints here, thus the lag time will be shortened, there will still be some delay.

● Nick Ruck, director of LVRG Research, pointed out: "The outflow of IBIT confirms that the market's euphoric sentiment earlier this year has been exhausted." This understanding helps investors grasp market cycles from a more macro perspective rather than overreacting to every piece of on-chain transfer data.

BlackRock's Bitcoin ETF has become one of the most important Bitcoin-holding institutions in the market. Its capital flows have a profound impact on market sentiment, but understanding the essence of this mechanism is crucial. When the market sees on-chain data of BlackRock transferring to exchanges again, it should understand that this is merely the tail end of a massive operational mechanism, not the beginning.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。