Original source: Binance

In the rapidly changing cryptocurrency market, traders' requirements for capital management are no longer satisfied with merely profiting from trades; they seek higher capital efficiency. As a widely circulated saying in the community goes, "BFUSD won't make you rich overnight, but it will keep you at the table longer." This unique reward asset is quietly changing the capital allocation strategies of professional traders, allowing every bit of your "ammunition" to have the ability to generate continuous returns through Binance Wealth Management.

(Image source: Chain Research Society)

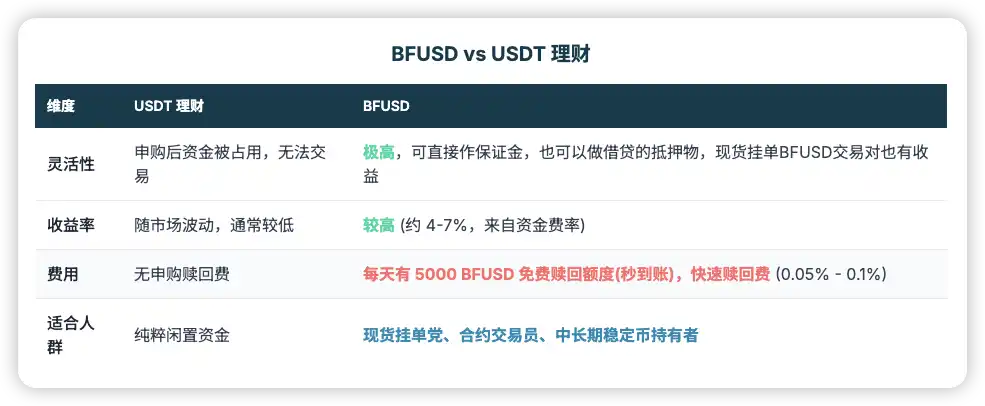

The core value of BFUSD lies in its perfect integration of high-yield wealth management and trading tool attributes. When you exchange USDT for BFUSD, you receive a "composite asset" that can earn interest without affecting your trading. In the current market, the average annualized yield of BFUSD over the past 30 days is approximately 4.5%, a performance that far exceeds most similar stablecoin wealth management products. More importantly, holders do not need to lock up their assets; returns are distributed daily, and even BFUSD in spot orders can enjoy these returns. This means that whether it's funds for contract profit-taking or residual margin after a contract stop-loss, they can continue to work in the account, truly achieving "high annualized returns without affecting contract trading."

Behind this high capital utilization rate is the advantage of BFUSD over traditional stablecoin wealth management. It can serve as margin for contract accounts, collateral for Portfolio Margin, and collateral for VIP Loans, enjoying a 99.9% high collateral value ratio (CVR) under a joint margin or unified account model. In contrast, when you allocate USDT to a wealth management account, those funds become occupied and cannot be used for trading. On-chain interest-bearing assets often come with smart contract vulnerabilities and de-pegging risks. BFUSD, however, is backed by the Binance platform and maintains a fixed index price (1:1), offering higher security and completely eliminating de-pegging concerns.

Therefore, from an asset allocation perspective, BFUSD can take on three key responsibilities in capital management strategies: it can act as a defensive layer, stabilizing portfolio risk in high volatility ranges; it serves as a liquidity reserve, readily available for seizing arbitrage or trend opportunities; and it is also an important yield buffer, providing additional returns through principal-protected wealth management, effectively enhancing overall investment returns. It empowers traders with a new capital management philosophy: "Hold, open positions, borrow, and take profits" without any delays.

(Image source: Chain Research Society)

The growth momentum of BFUSD is strong. To give back to the community for recognizing this efficient asset, Binance Wealth Management has launched a limited-time exclusive event. From November 3, 2025, to December 2, 2025, the first 1,000,000 BFUSD will enjoy an additional +5% increase in APR on top of the base APR as a limited-time benefit. This is an excellent window of opportunity to let your margin serve you with higher efficiency. Please check your account immediately and don't miss the chance to let your "bullets" multiply rapidly.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。