Author: Louis, Trendverse Lab

Introduction:

In the past, the global capital markets had clear boundaries in terms of structure and participants: stocks and ETFs belonged to the brokerage system, crypto assets were carried by exchanges, and foreign exchange was primarily operated by professional traders. Different assets relied on different applications, sources of liquidity, and analytical frameworks, with limited interaction among them.

Starting in 2024, these boundaries have begun to loosen significantly. Information dissemination has concentrated on the same set of platforms, allowing themes and narratives to spread across markets; multiple trading platforms have integrated stocks, derivatives, and crypto assets into a single account, reducing investors' market-switching costs; at the price level, NVDA's earnings report, Bitcoin's volatility, or changes in macro liquidity have started to elicit synchronized responses across different asset classes. Markets that once operated independently are increasingly connected by common variables.

This change is not driven by a single policy or technology but is a structural result of multiple accumulated factors: a unified information entry point, more integrated trading tools, and more frequent cross-market linkages are changing how investors move between different assets. Rather than saying investors are "cross-border trading," it is more accurate to say that their decision-making paths are no longer entirely constrained by traditional market classifications.

This article will analyze the causes of this trend from the perspective of retail investor behavior and platform structure, and further explore the potential evolution of the market.

I. The End of the Fragmented Era—Retail Decision-Making is Becoming More Integrated

In the previous cycle, the typical behavior pattern of retail investors was "use the tool corresponding to the market."

Stocks, crypto assets, and foreign exchange relied on independent applications and trading systems, clearly separating investors' attention and operational paths. However, in the past two years, this pattern has experienced systematic loosening, driving retail investors to gradually shift from single-market trading to narrative-centered cross-asset decision-making.

The most direct change comes from the centralization of information entry points.

Regardless of whether investors ultimately trade stocks, ETFs, or crypto assets, their channels for obtaining information are highly overlapping: Twitter, Reddit, Discord, and YouTube have become common discussion centers. The organization of content is no longer segmented by market but forms continuous discussion chains around themes such as AI, BTC, and macro liquidity. In such an environment, narratives naturally possess characteristics of cross-market dissemination, making different assets' responses to the same theme more aligned.

Image source: OxChainMind Twitter & OurCryptoTalk Twitter

The phenomenon of synchronized cross-market sentiment has thus become more pronounced.

In the past year, the AI theme has simultaneously influenced both the US tech sector and on-chain AI concept tokens; Bitcoin's volatility is often reflected in the price performance of MSTR and COIN; changes in macro data can trigger phenomenal discussions across stocks, crypto, and related derivatives. Information and sentiment no longer flow through market channels but move rapidly within thematic chains.

Changes on the tool side further reinforce this trend.

Operations that previously required switching between different applications are now being replaced by unified interfaces. Robinhood integrates stocks, options, and crypto assets within the same account; Bybit and OKX allow users to participate in multiple product types through a unified margin system, using a single pool of funds. These changes have reduced the switching costs between markets, making it easier for retail investors to establish or adjust positions across different asset classes.

Chart explanation: Comparison of BTC and MSTR stock prices

On a conceptual level, the "hierarchical distinction" between different assets is also fading.

Stocks are no longer necessarily viewed as more stable, and crypto assets are no longer equated with high volatility risks. Investors are more inclined to build portfolios around themes; for example, an AI theme may simultaneously include NVDA and TAO; a theme about Bitcoin may be expressed collectively by BTC, MSTR, and COIN. The role of assets in portfolio logic depends more on their relevance to the theme rather than their market affiliation.

These factors combined are gradually shifting retail decision-making from "market segmentation" to "narrative integration." Markets are no longer understood as mutually independent sectors but more like a continuous structure linked by themes. Fragmented investment behavior is decreasing, and a more holistic perspective is beginning to form naturally.

II. The Multi-Asset Competition of Global Platforms

Retail investors' cross-market behavior is not an isolated phenomenon; structural changes on the platform side are reinforcing this trend. In the past, brokerages, crypto exchanges, and new financial applications served different asset classes with clear boundaries between them. However, in the past two years, these platforms have begun to pursue multi-asset integration through different paths, making "participating in more markets through the same entry point" a more common direction in the industry.

Robinhood's transformation is a typical starting point.

Image source: Robinhood official website

As a lightweight brokerage that started with stocks and ETFs, it has gradually added options, crypto assets, and some income-generating products between 2021 and 2024. Although user activity and asset allocation are influenced by multiple factors, the platform structure has expanded from a single category to a cross-asset entry point, reflecting retail users' preference for a centralized experience: fewer application switches and a more consistent account structure.

Crypto-native platforms are also pushing the same trend in the opposite direction.

Binance has added stock tokens, indexed products, and income-generating tools in some markets on top of its traditional crypto trading; OKX has integrated different categories into the same fund pool through a unified margin system, allowing users to switch between spot, perpetual, and options at a lower cost. Although the scale of these features still shows a significant gap compared to core crypto products, their existence itself indicates that platforms are reorganizing product boundaries around "multi-asset exposure."

On-chain data also provides consistent evidence in this direction.

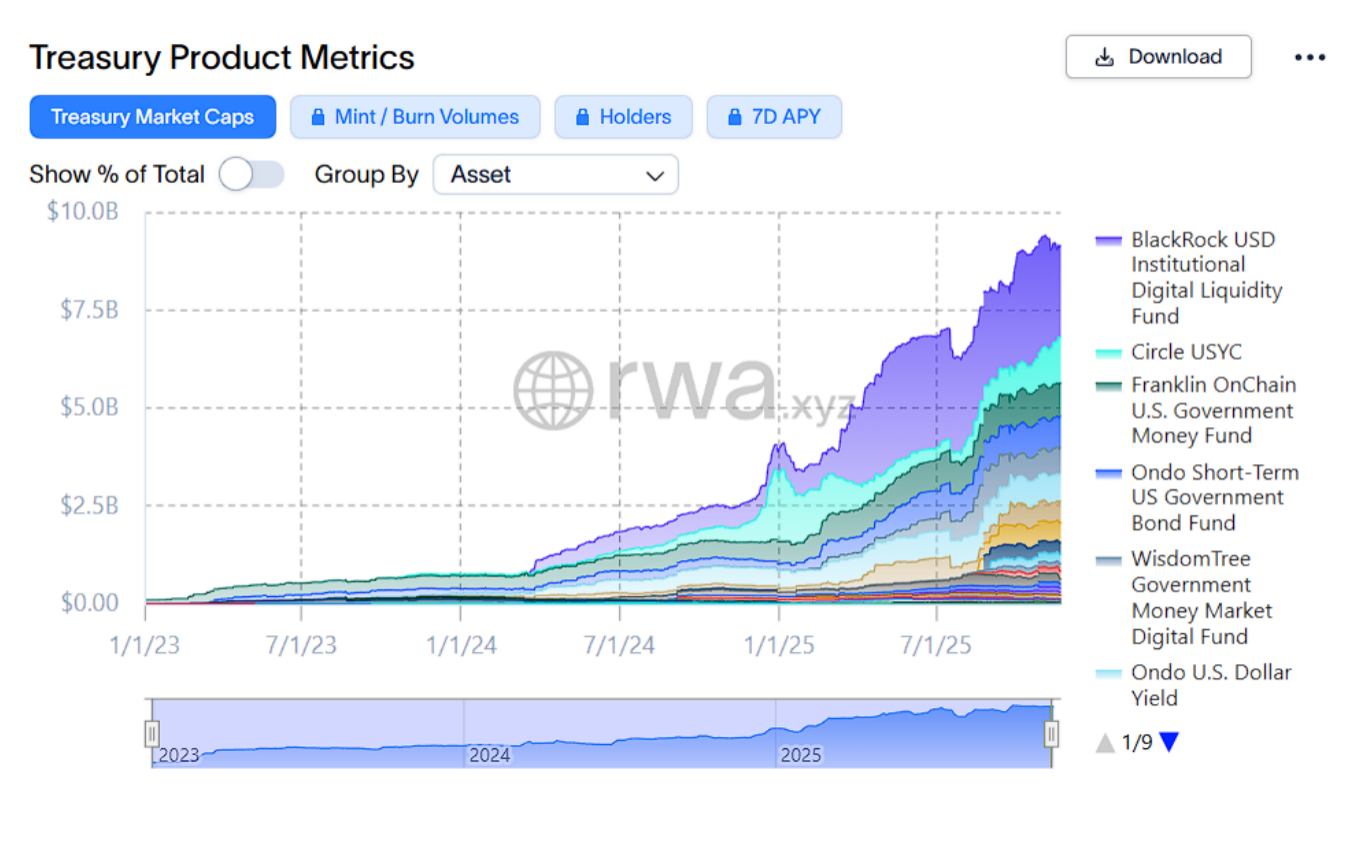

Data source: RWA.xyz

Changes in the on-chain ecosystem further confirm this direction.

According to market size charts published by RWA.xyz, tokenized treasuries have grown from less than $500 million at the beginning of 2023 to several billion dollars by 2024, approaching the $10 billion level by 2025, driven by multiple institutions including BlackRock, Franklin, Securitize, and Ondo. This growth does not indicate that traditional assets are migrating on-chain but rather shows that crypto users' interest in obtaining off-chain yield structures on-chain is increasing, and cross-asset allocation is extending from platform interfaces to the on-chain layer.

Third-party surveys also corroborate this direction from the perspective of user behavior.

The BCSC's 2024 report on "DIY Investing" shows that younger retail investors prefer lightweight platforms that allow them to operate multiple asset types within the same application rather than splitting accounts among multiple service providers.

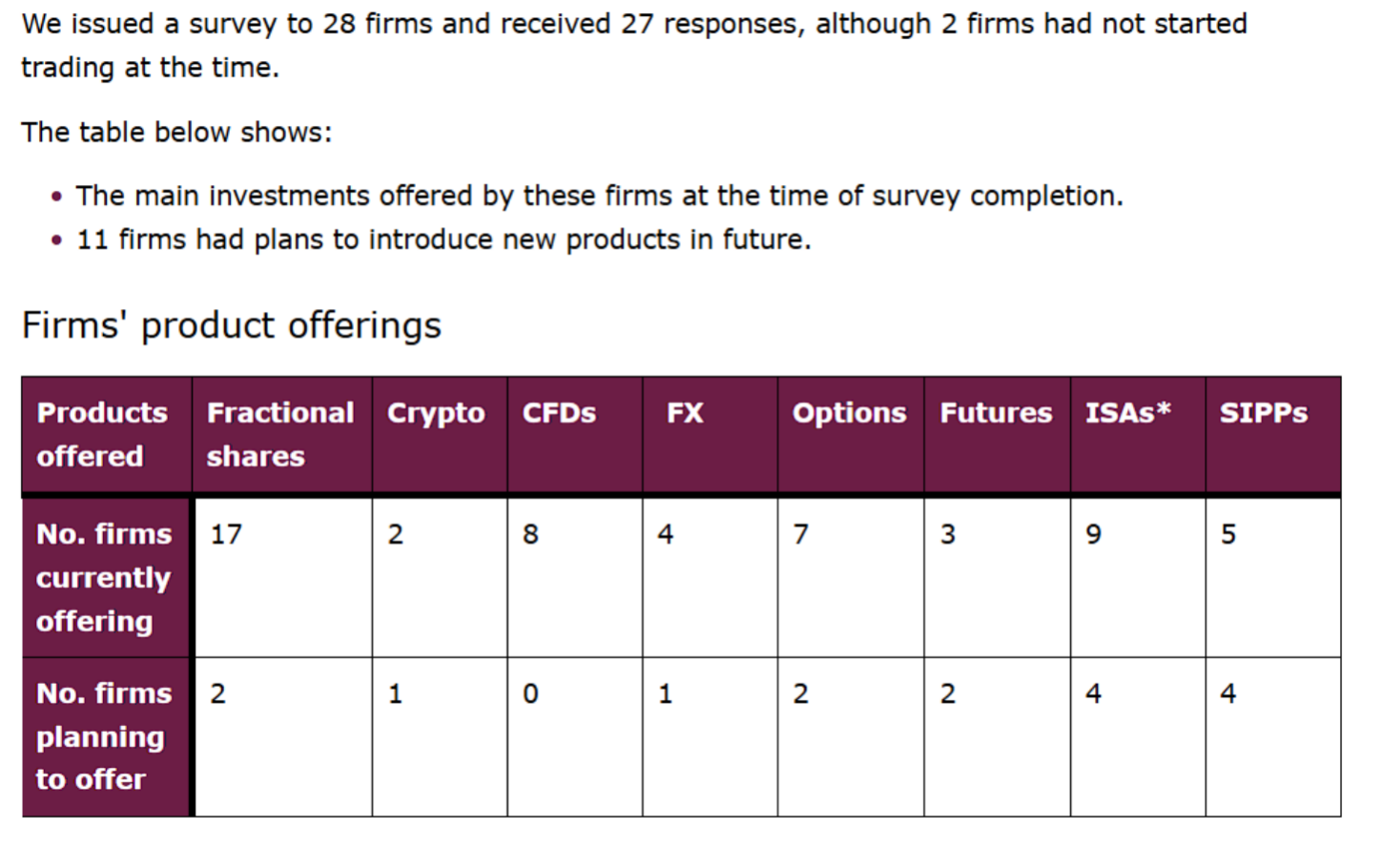

The UK FCA's cross-institutional review of 17 applications with trading functions also reached similar conclusions: most platforms now offer fractional stocks, crypto, CFDs, forex, options, and futures simultaneously, with over 10 more planning to continue expanding their asset lines to reduce users' switching costs between different markets.

Data source: FCA multi-firm review of trading apps

In medium-sized platforms and emerging applications, the trend towards multi-asset integration is even more pronounced.

Public.com started from a stock community and expanded to cover stocks, ETFs, treasuries, and crypto assets while maintaining a single account structure; Revolut has added stock and crypto trading to its payment app, allowing fund management and investment decisions to be completed within the same interface. On-chain protocols like Synthetix provide cross-market price exposure through synthetic assets, and although the paths differ, the goal is similarly aimed at lowering the barriers to cross-asset participation.

Different platforms vary in regulation, product architecture, and business focus, but they are showing a converging direction during the same period: reducing switching between accounts and interfaces, weakening the technical boundaries of asset categories, and restructuring entry points around user investment behavior.

The result is that platforms are gradually shifting from "classifying by market" to organizing products based on "the asset combinations users wish to express."

III. Future Trends: Cross-Market Integrated Platforms = Retail Investors' "Super App"

The changes in retail behavior and the multi-asset integration on the platform side are forming an interactive relationship: users are reducing market switching, while platforms are responding to this behavior with more unified structures. This "two-way push" is gradually shifting trading entry points from product classification to organizing around investment intentions. Although the technical and regulatory environments of each platform differ, their evolutionary paths exhibit several common characteristics.

The first phase will start from the most intuitive aspect: the interface will be redefined.

Image source: Antier—Beyond Robinhood

As stocks and crypto assets are presented side by side in the same account, the traditional interface layout that distinguishes by market is giving way to a presentation based on themes or strategies. Unified Account, Unified Margin, and multi-asset dashboards enable users to manage different assets within the same view, no longer starting operations based on "market categories." The integration of the interface is the most intuitive change and the first adjustment direction perceived by users on the platform.

The second phase of change occurs in areas that are not visible to the naked eye: the execution layer begins to operate "based on intent."

As the interface logic becomes more unified, trade execution starts transitioning to an "intent-based" approach. Users no longer need to explicitly choose where the trade occurs; instead, they express outcome goals, and the underlying system automatically completes cross-market routing. For example, the execution engine may split orders based on available prices and liquidity, hedge risks across multiple markets, or complete asset reallocation. This change in the execution layer makes cross-market trading a more default capability for retail investors.

The third phase brings a qualitative change in the objects of trading: assets give way to strategies.

As execution capabilities improve, platforms begin to present structured products based on strategy combinations rather than single assets. For example, thematic strategies around AI, macro interest rates, or Bitcoin may be composed of multiple assets, allowing users to trade the strategy itself directly rather than building underlying asset combinations one by one. On-chain standards like ERC-4626 or ERC-8004 have been used in some ecosystems for such combinations, enabling automatic rebalancing and yield distribution, making strategies easier to standardize and circulate.

The fourth phase sees the intelligent layer take center stage: AI becomes the default operational logic of trading systems.

The role of AI in trading tools is shifting from providing auxiliary information to participating in portfolio management. Models can generate foundational combinations based on user preferences, suggest risk exposures, or rebalance under event-driven conditions. Although the implementation methods vary across platforms, most are exploring the use of AI as an auxiliary layer for trading decisions to shorten the decision chain from information to action.

The fifth phase transforms platforms from "tools" into "ecosystems": incentives begin to drive the entire strategy cycle.

Once platforms possess strategy supply, user participation, and execution capabilities, value distribution starts evolving towards a more ecological form, including revenue sharing for strategy authors, incentives for signal providers, a points system for user engagement, and more common tokenized incentive models in on-chain ecosystems. The mechanisms adopted by different platforms vary, but the core objective remains the same: to maintain strategy supply, enhance user retention, and promote continuous growth in trading and liquidity.

These changes are still at different stages but collectively point to a structural trend:

Trading platforms are shifting from a collection of tools categorized by type to a multi-asset system organized around investment intent. The boundaries between assets are weakening, the interface and execution logic are becoming unified, and strategies and intelligent capabilities are becoming further integration directions.

This trend is not driven by a single technology but is the result of user demand, platform structure, and cross-market linkages shaping the landscape together.

IV. Conclusion: Moving from Market Segmentation to a Broader Asset Structure

The changes in retail behavior, the integration paths of platforms, and the more frequent linkages between assets collectively outline an emerging market structure: different assets are no longer categorized but are observed within the same system through narratives, tools, and liquidity. Cross-market attention and trading behavior are gradually replacing the past segmented participation approach.

This process does not mean that the market is being redefined; rather, traditional boundaries are becoming less critical in practical use. For investors, the way to understand the market is increasingly relying on shared themes and structural variables rather than the classifications of the assets. These changes constitute the most noteworthy features in the current environment and provide a more holistic perspective for observing future market behavior.

In a market where boundaries are continually loosening, what truly matters is no longer where assets are placed, but how they connect with each other.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。