Value capture is undergoing a migration from the foundational layer → application layer → user aggregation layer, which is beneficial for users, but they should not pay a premium for it.

Written by: Santiago Roel Santos

Translated by: AididiaoJP, Foresight News

The Dilemma of Network Effects in Cryptocurrency

My previous viewpoint on "cryptocurrency trading prices far exceeding their fundamentals" has sparked heated discussions. The strongest opposing voices are not against usage or fees, but stem from ideological differences:

"Cryptocurrency is not a business"

"Blockchain follows Metcalfe's Law"

"The core value lies in network effects"

As a witness to the rise of Facebook, Twitter, and Instagram, I am well aware that early internet products also faced valuation challenges. But the pattern has become increasingly clear: as users join social circles, product value experiences explosive growth. User retention strengthens, engagement deepens, and the flywheel effect is clearly visible in the experience.

This is the true manifestation of network effects.

If we argue that "cryptocurrency value should be assessed from a network rather than a business perspective," then we should delve deeper into the analysis.

Upon further investigation, an undeniable issue emerges: Metcalfe's Law not only fails to support current valuations but also exposes their fragility.

Misunderstood "Network Effects"

The so-called "network effects" in the cryptocurrency space are mostly negative effects:

User growth leads to a deterioration of experience

Transaction fees soar

Network congestion intensifies

The deeper issues include:

Open-source characteristics lead to developer attrition

Liquidity is profit-driven

Users migrate across chains based on incentive measures

Institutions switch platforms based on short-term interests

Successful networks have never operated this way; the experience never declined when Facebook added millions of users.

But new blockchains have solved throughput issues

This indeed alleviates congestion but does not address the fundamental issues of network effects. Increasing throughput merely eliminates friction and does not create compound value.

The fundamental contradictions still exist:

Liquidity may dissipate

Developers may relocate

Users may leave

Code can be forked

Value capture capability is weak

Scalability enhances usability, not necessity.

The Truth Revealed by Fees

If L1 blockchains truly possess network effects, they should capture most of the value like iOS, Android, Facebook, or Visa. The reality is:

L1 occupies 90% of total market value

Fee share plummeted from 60% to 12%

DeFi contributes 73% of fees

Valuation share is less than 10%

The market is still pricing according to the "fat protocol theory," but the data points to the opposite conclusion: L1 is overvalued, applications are undervalued, and ultimately, value will converge towards the user aggregation layer.

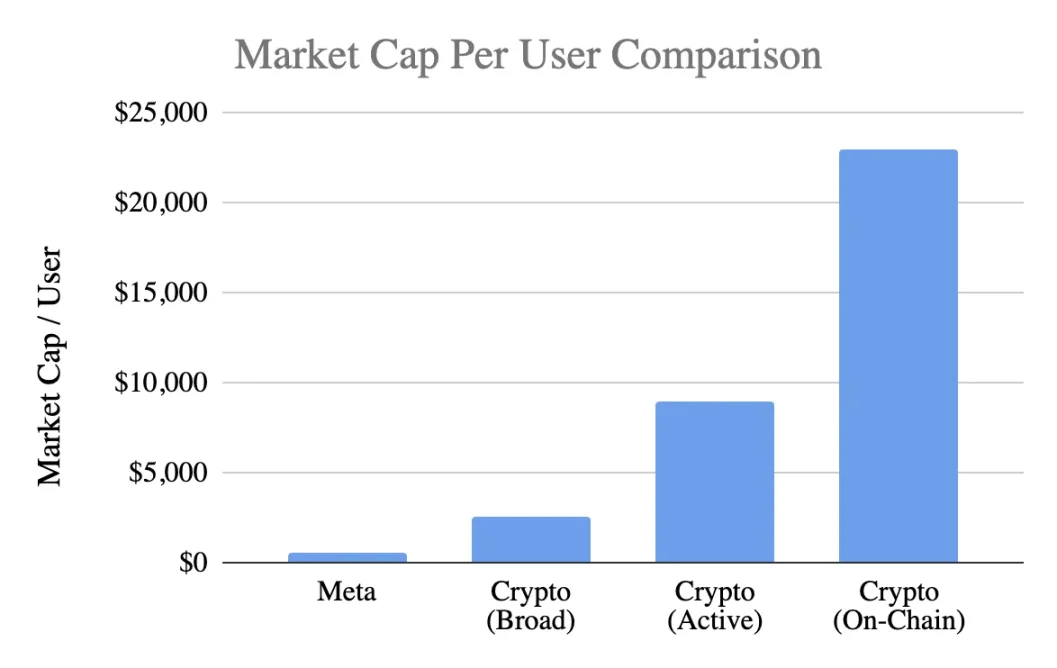

User Valuation Comparison

Using common metrics, the market value per user:

Meta (Facebook)

3.1 billion monthly active users

$1.5 trillion market value

Value per user: $400-500

Cryptocurrency (excluding Bitcoin)

$1 trillion market value

400 million general users → $2,500 per person

100 million active users → $9,000 per person

40 million on-chain users → $23,000 per person

Valuation levels reach:

Most optimistic estimate premium: 5 times

Strict standard premium: 20 times

Based on real on-chain activity premium: 50 times

And Meta is considered the most efficient monetization engine in the consumer technology sector.

Discerning Development Stages

The argument that "Facebook was the same in its early days" is debatable. Although Facebook also lacked revenue in its early days, its product had already built:

Daily usage habits

Social connections

Identity recognition

Community belonging

Value enhancement from user growth

In contrast, the core product of cryptocurrency remains speculation, leading to:

Rapid influx of users

Even faster attrition

Lack of stickiness

No established habits

No improvement with scale

Unless cryptocurrency becomes "invisible infrastructure," a bottom-layer service that users are unaware of, network effects will struggle to self-reinforce.

This is not a maturity issue but a fundamental product issue.

Misuse of Metcalfe's Law

While the law describes value ≈ n² beautifully, its assumptions are flawed:

Users need to interact deeply (which is rare in practice)

The network should have stickiness (which is actually lacking)

Value should aggregate upwards (which is actually dispersed)

There should be switching costs (which are actually very low)

Scale should build a moat (which has yet to manifest)

Most cryptocurrencies do not meet these prerequisites.

Insights from the Key Variable k

In the V=k·n² model, the k value represents:

Monetization efficiency

Level of trust

Depth of participation

Retention capability

Switching costs

Ecological maturity

The k values for Facebook and Tencent range from 10⁻⁹ to 10⁻⁷, small due to the massive scale of the network.

Calculating the k value for cryptocurrency (based on a $1 trillion market value):

400 million users → k≈10⁻⁶

100 million users → k≈10⁻⁵

40 million users → k≈10⁻⁴

This implies that the market presumes each cryptocurrency user is worth far more than a Facebook user, despite their lower retention rates, monetization capabilities, and stickiness. This is no longer early optimism but an overextension of future potential.

The Current State of Real Network Effects

Cryptocurrency actually possesses:

Bilateral network effects (users ↔ developers ↔ liquidity)

Platform effects (standards, tools, composability)

These effects exist but are fragile: easily forked, slow to compound, and far from achieving the n²-level flywheel effects of Facebook, WeChat, or Visa.

A Rational Perspective on Future Prospects

The vision that "the internet will be built on cryptographic networks" is indeed enticing, but it needs to be clarified:

This future may be achievable

The present has not yet arrived, and the existing economic model fails to reflect it

Current value distribution shows:

Fees flow to the application layer rather than L1

Users are controlled by exchanges and wallets

MEV captures value surplus

Forking weakens competitive barriers

L1 struggles to solidify the value created

Value capture is undergoing a migration from the foundational layer → application layer → user aggregation layer, which is beneficial for users, but they should not pay a premium for it.

Characteristics of Mature Network Effects

A healthy network should exhibit:

Stable liquidity

Concentrated developer ecosystem

Enhanced fee capture at the foundational layer

Continuous retention of institutional users

Growth in cross-cycle retention rates

Composability defending against forking

Currently, Ethereum shows early signs, Solana is poised for growth, but most public chains are still far from this.

Conclusion: Valuation Judgments Based on Network Effect Logic

If cryptocurrency users:

Have lower stickiness

Find monetization more difficult

Experience higher attrition rates

Then their unit value should be lower than that of Facebook users, not 5-50 times higher. Current valuations have overextended the yet-to-form network effects, and market pricing seems to assume that a powerful effect already exists, which is not the case, at least not yet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。