Original Author: Liu Honglin

Event Summary

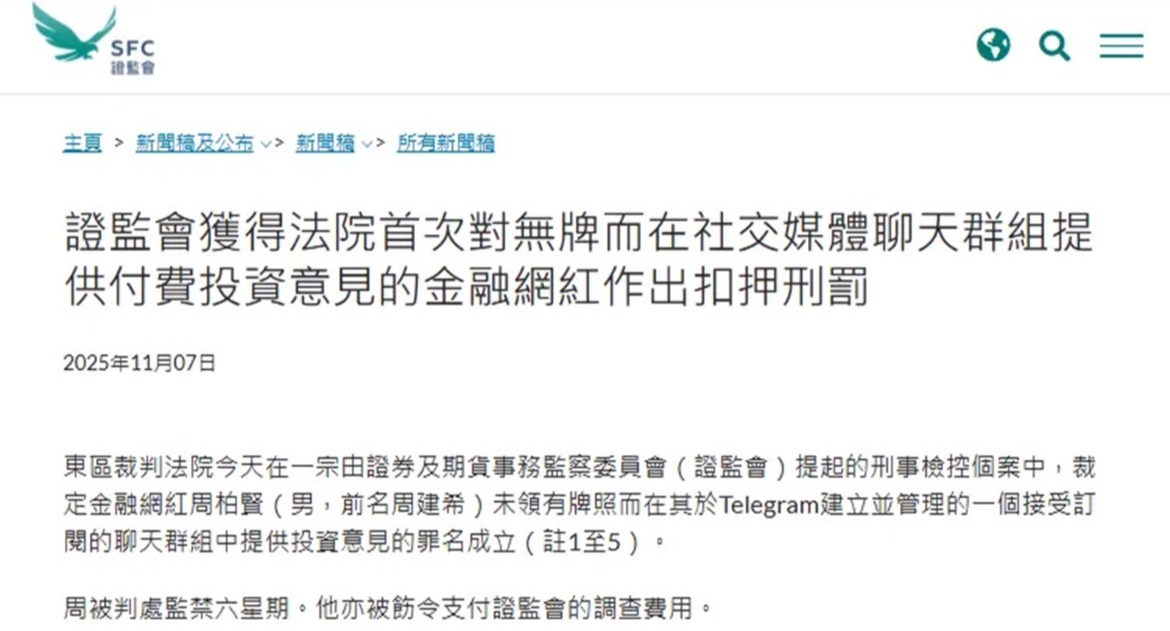

On November 7, 2025, the Eastern District Court of Hong Kong ruled that financial influencer Zhou Baixian (formerly known as Zhou Jianxi) was guilty of providing investment advice in a paid Telegram group without a license. He was sentenced to six weeks in prison and ordered to bear the costs of the Securities and Futures Commission (SFC) investigation. This case marks the first instance in Hong Kong of criminal liability being pursued against an unlicensed financial influencer, signaling the end of the "wild growth" era of social media investment consulting.

The judgment in this case is based on the Hong Kong Securities and Futures Ordinance. Zhou Baixian's actions "provide opinions on securities" fall under the fourth category of regulated activities, which requires prior licensing from the SFC. The determination of his actions is based on three key points:

The judgment in this case is based on the Hong Kong Securities and Futures Ordinance. Zhou Baixian's actions "provide opinions on securities" fall under the fourth category of regulated activities, which requires prior licensing from the SFC. The determination of his actions is based on three key points:

- Profitability: Aimed at profit, the charging model (such as subscription fees) constitutes a commercial activity;

- Continuity: Regularly publishing analyses and responding to specific questions;

- Targeting: Providing clear recommendations on specific securities (such as Nasdaq stocks), going beyond "general opinion sharing."

Zhou Baixian operated the Telegram subscription group "Futu True. Financial Private Group" under the name "Futu Major Shareholder," providing specific securities commentary, target prices, and Q&A services to Hong Kong subscribers without obtaining a license from the SFC. By charging a monthly fee (200 USD or 1560 HKD), he illegally profited 43,600 HKD, meeting the criteria for "providing opinions on securities."

This case also reflects Hong Kong's twofold compliance requirements for unlicensed financial influencers: on one hand, the platform is not an excuse; whether through Telegram, Discord, or emerging social platforms, as long as it constitutes investment advice, a license is required; on the other hand, the audience determines jurisdiction; even if the server is overseas, as long as the target audience is Hong Kong investors, it is subject to regulation.

In previous similar cases involving financial influencers in Hong Kong, licensed representative Huang Mouzhong had his license temporarily suspended for 16 months for operating a paid group in a personal capacity. However, this case is the first to apply criminal penalties, highlighting the upgrade in Hong Kong's regulation of unlicensed financial influencers providing investment advice.

The ruling in this case is also consistent with the global trend of strengthening regulation of "financial influencers." As financial markets develop, regulators in various countries are increasingly focusing on investor protection and maintaining market integrity, becoming more vigilant about the risks of misleading investors through harmful content on social media.

The ruling in this case is also consistent with the global trend of strengthening regulation of "financial influencers." As financial markets develop, regulators in various countries are increasingly focusing on investor protection and maintaining market integrity, becoming more vigilant about the risks of misleading investors through harmful content on social media.

The UK's Financial Conduct Authority (FCA) has established a clear regulatory framework for financial promotional activities, especially those targeting cryptocurrencies and financial influencers, requiring all investment promotions conducted on social media to be pre-approved, prohibiting financial institutions from promoting "improper" investment behaviors, and emphasizing that financial promotional activities must ensure "fairness, clarity, and non-misleading" content, with violations facing criminal penalties and fines.

The U.S. Securities and Exchange Commission (SEC) has been cracking down on unlicensed financial promotional activities, imposing fines on companies and individual influencers that violate rules or engage in other types of market manipulation, with fines reaching millions of dollars. The SEC once imposed a fine of 1.75 million USD on an investment management company for failing to disclose the promotional role of a social media influencer and the fee structure linked to the growth of its exchange-traded fund (ETF).

Regulatory bodies in mainland China, such as the Cyberspace Administration, are also continuously addressing the chaos of illegal stock recommendations and other financial information, legally dealing with accounts and websites that spread false information about the capital market, engage in illegal stock recommendations, and hype virtual currency trading.

It is evident that financial influencers and their promotional activities are being comprehensively integrated into a stricter and more international regulatory perspective, and all relevant participants need to pay more attention to compliance risks.

Implications of This Case for Cryptocurrency KOLs

Although this case directly involves traditional securities investment advice, the regulatory signals it conveys will also impact the field of crypto assets.

On one hand, the judgment's rationale is rooted in the principle of investor protection, which is equally important in the more complex risk characteristics of the virtual asset market.

In recent years, issues of investor protection in the crypto asset field have gradually emerged. A 2025 VISTA study indicated that 58% of Generation Z (born 1995-2009) and millennials (adults in the 21st century) prioritize self-directed investing, but many lack the expertise to assess the risks of unregulated investment opinions and are easily attracted by aggressive, misleading promotional activities, leading to a surge in speculative trading in the crypto market. Some investors have even lost their life savings due to using volatile assets like contracts for difference or investing in unregistered cryptocurrencies. In several incidents, including the Hong Kong JPEX case, investors reported losses influenced by online promotions and social media investment opinions.

The Hong Kong JPEX virtual asset platform fraud case is the largest cryptocurrency fraud case in Hong Kong in recent years, involving over 1.6 billion HKD and affecting more than 2,700 victims. JPEX personnel attracted a large number of investors by advertising, social media, over-the-counter exchanges, and influencer/KOL promotions, claiming "legal compliance, celebrity endorsement, low risk, and high returns," ultimately transferring customer funds into cryptocurrency wallets for money laundering. In this case, the police also cited the provisions of the "Anti-Money Laundering and Counter-Terrorist Financing Ordinance," which took effect in 2023, regarding "fraudulently or recklessly inducing others to invest in virtual assets," to prosecute several involved influencers. This case reflects how easily investors can be influenced by online promotions and social media opinion leaders, leading to blind investments; on the other hand, it also reflects the government's emphasis on regulating the harmful promotion of virtual assets.

On the other hand, Hong Kong is steadily advancing the improvement of its virtual asset regulatory framework, emphasizing compliance for tokenized assets and continuously establishing a licensing system to regulate virtual asset-related services. In the future, Hong Kong may adopt the regulatory standards for stock analysts in the traditional financial industry, requiring virtual asset KOLs to adhere to higher professional and disclosure requirements when providing investment advice, to prevent disorderly promotion and misleading information in the virtual asset market, maintain market order, and protect investor interests.

Given the current regulatory trends, financial influencers and content creators in the virtual asset field need to pay special attention to potential KOL legal compliance risks. As the Hong Kong SFC plans to require brokers to conduct due diligence on KOL influencers and continuously monitor their content, the operational costs and compliance thresholds for the entire KOL industry may significantly increase.

In this context, market participants may face two main choices:

First, participants can adjust their expression methods to cautiously avoid having their discussed content classified as investment advice. For example, participants can shift towards educational content such as blockchain technology analysis, macro trend interpretation, and risk management, avoiding mentions of specific tokens' buying and selling points and target prices, more prudently navigating the boundaries of content creation, and clearly disclosing risks and interests to evade the regulatory red line of "investment advice."

Second, participants can actively seek compliance pathways and establish cooperative relationships with licensed institutions. For instance, participants can collaborate with licensed virtual asset trading platforms like HashKey and OSL or traditional licensed institutions to incorporate content creation into a compliance framework.

These industry adjustments may enhance overall compliance levels while also bringing about some structural changes. For example, the channels through which investors obtain investment advice may become restricted, the costs of professional consulting services may increase accordingly, and some market participants may have to scale back their operations or shift to regions with relatively lenient regulatory environments due to an inability to bear compliance costs. However, in the long run, establishing a clear regulatory framework will help promote the orderly development of the virtual asset market. On one hand, it can enhance market transparency in the crypto asset field, reducing the likelihood of retail investors falling victim to "pump and dump" schemes and boosting the confidence of compliant institutional investors; on the other hand, it may encourage the industry’s content creation to shift towards professionalism and value, thus achieving a more balanced development path between protecting investor interests and promoting industry growth.

Conclusion

The Zhou Baixian case serves as a mirror, reflecting Hong Kong's efforts to protect financial security and ordinary investors. For KOLs in the crypto field, this is also a clear warning signal—Web3 KOLs also need to fulfill compliance obligations.

"Decentralization" does not mean "no regulation"; technological innovation must be balanced with investor protection. As Hong Kong's virtual asset regulatory framework continues to improve, only those participants who can grasp market trends while adhering to compliance boundaries will stand out in the new era.

Whether Hong Kong can find a balance between promoting Web3 innovation and maintaining market integrity will depend on the joint efforts of regulatory wisdom and industry self-discipline, and this ruling is undoubtedly an important milestone in that process.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。