Author: Sandy Carter

Compiled by: Tim, PANews

PANews Editor's Note: This article was published on November 23, when the price of Bitcoin was below $85,000, and the market was in a state of extreme panic. The author reviews the occurrence of this crash and analyzes the possible reasons.

Bitcoin has dropped 30% from its peak, and gold has also retreated from above $4,200. According to the Financial Times, the Nasdaq has experienced its worst week since April 2025, especially among heavyweight tech stocks. When Bitcoin surged to $126,000, my friends were discussing its asset potential highlighted in a Forbes article, but now they are all asking me, "Will Bitcoin go to zero?"

As "digital gold" plummets alongside physical gold, and the highly sought-after AI concept stocks also crash collectively, are we witnessing a fundamental shift, or is it merely a significant correction? Does this mean that the great collapse of 2025, where everything falls, is unfolding?

It is rare for all assets (including those that usually exhibit negative correlations, such as gold and U.S. stocks) to decline simultaneously, so I have reflected on this to study market trends.

Ultimately, the crash of 2025 is not just an isolated event in Bitcoin or the AI sector; it is essentially a liquidity crisis.

And the liquidity crisis is reshaping the correlations between various assets.

What Happened to AI and Financial Markets?

Just a month ago, according to CME's FedWatch Tool, the probability of a federal rate cut in December was as high as 93.7%. Now, the probability has dropped to 44.9%, a significant decline in a short period. When investors realize they have collectively misjudged the direction of Federal Reserve policy, they will self-correct simultaneously.

Rate cuts typically boost the performance of stocks and alternative assets like gold and cryptocurrencies, as lower borrowing costs reduce the value of cash. However, when expectations are dashed, the opposite can occur, sometimes triggering even more severe reversals, as seen in 2015.

Meanwhile, discussions about an AI bubble have begun to emerge in the market.

CBS News analysts point out, "AI companies realize that investing massive amounts of money in data center construction will inevitably pressure profits." Data reveals this harsh reality: Microsoft and Google announced they would invest over $250 billion in AI infrastructure between 2024 and 2025, but during earnings calls, there has been no clear assessment of whether these investments will yield corresponding returns.

Even more concerning is the disconnect between expectations and performance for AI-related SaaS companies. Palantir's current trading price is 180 times its trackable earnings, while its customer acquisition costs have doubled year-on-year, reminiscent of the internet bubble era.

McKinsey's latest report shows that among companies using generative AI, only 23% have achieved significant benefits, yet these companies still need to increase their AI investments. Despite ongoing discussions in the industry about the value AI creates for businesses, actual results are often difficult to quantify, and very few companies publicly disclose their application outcomes.

Even tech giants like FANG are facing issues. Nvidia announced positive revenue growth, yet its stock price fell. This indeed indicates that even strong performance cannot withstand market downward inertia during turbulent times. Notably, recurring revenue is of little help. According to The Register, Nvidia plans to invest $100 billion in OpenAI, which will then purchase $100 billion worth of Nvidia chips, making this operation appear as if Nvidia is creating revenue from its own pocket.

Over the past three months, the dollar has finally surged to a high. This has effectively increased the cost for international buyers to purchase assets like gold and Bitcoin. A stronger dollar has broken gold's traditional safe-haven function, meaning investors have not flocked to precious metals like gold. As the dollar strengthens, gold has lost its safe-haven status and has failed to provide a refuge for investors.

Bitcoin Crash: Death Spiral or Bull Market Correction?

Currently, Bitcoin is fluctuating in sync with stocks rather than serving as a hedge. This reality undermines the claim that Bitcoin is "digital gold." According to The Block, institutional investors have withdrawn $900 million from Bitcoin ETFs. When the market needs Bitcoin to perform independently, it instead follows tech stocks closely. In fact, the current performance of gold, stocks, and long-term bonds is all better than that of Bitcoin.

However, Bitcoin has historically been resilient, having experienced both crashes and remarkable rebounds. Although this situation is different, with institutional investors, pension funds, publicly traded companies, and ETFs all positioning themselves in Bitcoin, these factors have collectively built a market foundation that did not exist before, providing unprecedented bottom support and value endorsement for Bitcoin.

Demand for downside protection in Bitcoin in the $80,000 to $85,000 range has surged, the question is no longer whether Bitcoin can survive, but how it can stabilize and rebound from the current sell-off frenzy.

Insights for Bitcoin Investors

The autumn crash of 2025 reveals a fundamental shift in the mechanisms of the crypto market. The important message conveyed by the market is that the era of easy money is over, and value investing is becoming the core focus. Investors are no longer looking at speculative trading but are concentrating on fundamental analysis. This investment principle applies to AI companies, Bitcoin traders, and the entire industry.

Some people are indifferent to the possibility that we may be in an AI bubble. Robert Metcalfe once pointed out, "Bubbles are catalysts for innovation; they can give rise to innovations that might not otherwise occur." Sarbjeet Johal also believes, "Bubbles are manifestations of the system's self-repair mechanism, indicating that the entire system is functioning as designed."

But we are indeed facing issues of asset correlation. The influx of institutional investors has triggered a new correlation between the crypto market and traditional tech stocks. When the Nasdaq index experienced its worst single-week drop since April 2025, Bitcoin not only failed to act as a hedge but also amplified the decline.

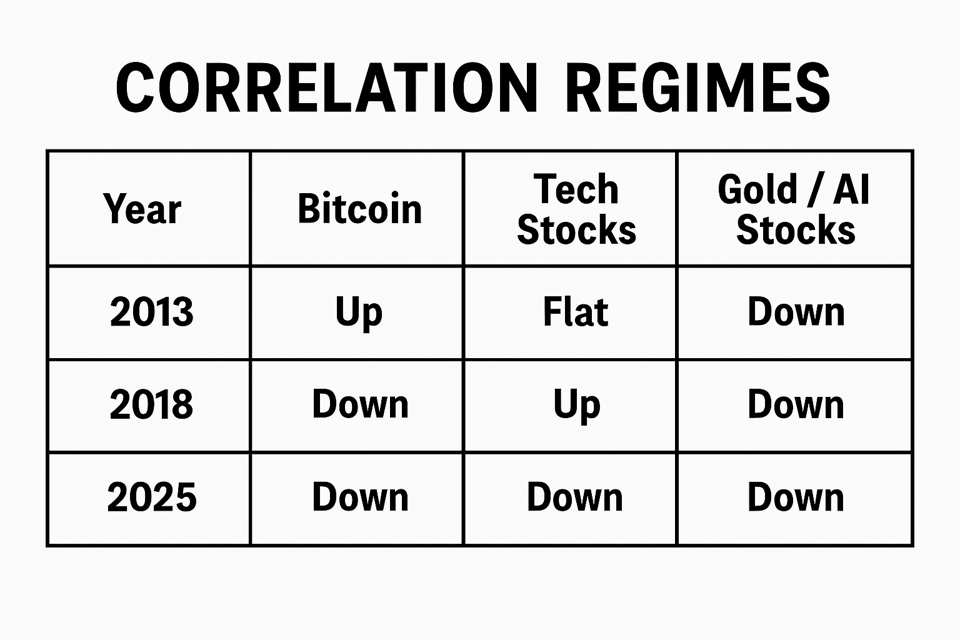

In 2013, Bitcoin surged while tech stocks remained flat and gold plummeted; in 2018, the crypto market faced a sell-off while tech stocks rose; by 2025, for the first time, gold, Bitcoin, and AI stocks collectively corrected on the same day, which is a typical characteristic of a liquidity-driven market.

Data Source: CoinMarketCap Bitcoin Price Historical Data, Nasdaq Historical Index Data, Macrotrends Gold Price Chart

The result is a situation where traditional diversification strategies have failed.

Market Outlook: The Next 90 Days Will Determine Bitcoin's Trend

In the next 90 days, the most immediate catalyst will be the Federal Reserve's interest rate meeting on December 18. If the Fed decides to cut rates, risk assets may experience a relief rally by the end of the year. However, it is crucial to pay attention to the Fed's policy guidance for 2026; any signals suggesting that interest rates will remain high for longer could trigger a new round of sell-offs.

For Bitcoin, three key price levels should be monitored: $85,000 represents institutional support, as significant ETF funds previously flowed in at this level; a drop below $75,000 may indicate new problems; while a breakout above $95,000 would confirm that the bull market structure remains intact. These price levels will be tested by the market in the next 4-6 weeks.

Watch Nvidia's fourth-quarter earnings report (image provided by Justin Sullivan/Getty)

AI stocks follow different cyclical patterns. The fourth-quarter earnings season will be a critical litmus test; AI companies must demonstrate strong returns from their AI investments. Pay close attention to Nvidia's forecasts for data center demand and the AI revenue data from the four major tech giants of FANG. If any party fails to meet expectations, it could trigger a new round of sector-wide declines.

Will Bitcoin Go to Zero?

It is nearly impossible for Bitcoin to go to zero, but this crash reveals a deeper transformation: Bitcoin has evolved from a revolutionary outsider to a mature participant.

The real key question is no longer about survival, but about its identity.

What will happen to a digital asset designed to be macro-uncorrelated that now fluctuates in sync with the Nasdaq?

This identity anxiety is not a temporary phenomenon. The direction of Bitcoin over the next decade boils down to a simple choice: will it continue as a macro-sensitive institutional asset, or will it reclaim its independent attributes?

Choosing the institutional path means Bitcoin will trade like high-beta tech stocks, driven by Federal Reserve policy and fund positions. Choosing the decentralized path will require different catalytic factors: including a higher degree of self-custody, stronger L2 adoption rates, an increasing number of on-chain stablecoin transfers, and a sustainable mining economic model.

The current generation holding Bitcoin believes in its narrative as "digital gold." The future generation will determine whether Bitcoin will reclaim its decentralized original intent or resign itself to being an ordinary asset within a diversified investment portfolio.

The "all boats rise" market after 2020 has come to an end. Now, we are returning to an era of fundamental investing.

The market, like life, often undergoes the most intriguing transformations at the moment of total collapse. Bitcoin, reborn from chaos, may deviate from its original intent, but that may not necessarily be a bad thing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。