Author: 0xBrooker

This week, the tightening of short-term liquidity in the U.S. and the uncertainty surrounding interest rate cuts in December have become the main trading themes in global financial markets.

Due to the government shutdown, the U.S. Treasury's TGA account has accumulated nearly a trillion dollars. Although the government has resumed operations, the release of funds has been slow, keeping short-term liquidity under pressure.

The absence of economic and employment data caused by the government shutdown has left the Federal Reserve lacking sufficient objective data for reference in the December meeting. Federal Reserve officials have been consistently "hawkish" for the past three weeks, continuously undermining market confidence, which ultimately led to a three-week decline in U.S. stocks.

On Friday, however, the Federal Reserve's "third-in-command," New York Fed President Williams, unexpectedly released a "dovish" statement to the market, significantly boosting the probability of interest rate cuts. Yet, whether there will be a rate cut in December remains uncertain, and predicting a rate cut in January next year is even more difficult.

This uncertainty has led to a significant decline in high-risk assets, with AI giants and the crypto market experiencing a crash-like drop. The Nasdaq fell nearly 10% in November, potentially impacting the 120-day moving average, while BTC has dropped over 35% from its peak. The impact of liquidity and uncertainty on the financial markets has been greater than anyone expected.

Compared to U.S. stocks, BTC and the crypto market face even greater uncertainty. In addition to the pressure from tight liquidity, the traditional four-year cycle of bull and bear market transitions in the crypto space has exacerbated market pressure, resulting in declines greater than three times that of the Nasdaq, which is usually correlated at two times.

Tight liquidity and uncertainty regarding interest rate cuts are expected to gradually ease in the coming weeks, but whether the crypto market's "cyclical law" will change—whether it will "turn bearish" or, after a sharp correction, follow the likely continuing bull market of U.S. stocks during the interest rate cut cycle—will require more time to prove.

Policy, Macro Finance, and Economic Data

Since Federal Reserve Chairman Powell stated on October 29 that "a rate cut in December is by no means a certainty" (at that time, the FedWatch probability of a rate cut was over 90%), throughout November, most Federal Reserve voting members and governors have continuously released "hawkish" statements in various public speeches, emphasizing that the job market is merely cooling, while the stickiness of inflation is the mission that needs to be focused on.

This sustained hawkish rhetoric over the past three weeks has reduced the probability of a rate cut from over 90% to below 40%. Coupled with the short-term liquidity pressure caused by the government shutdown, this has led to a continuous three-week decline in U.S. stocks at high valuations. Nasdaq 100 futures have dropped nearly 10%, approaching the 120-day moving average.

During this period, the highly anticipated earnings report from Nvidia, which exceeded expectations, also failed to boost market confidence. On the day of its release, it initially rose by 4% but ultimately recorded a 3% decline, with a fluctuation exceeding 7%.

Nvidia's earnings report did not alleviate market concerns, and high-valuation AI stocks responded to market liquidity tightening and uncertainty about December rate cuts by selling off. The continuous large outflows from Spot ETFs are seen as significant selling pressure on high-risk alpha-return BTC, which can only seek price rebalancing through a waterfall-like decline.

On Friday, the "dovish" remarks from Federal Reserve permanent voting member New York Fed President Williams were viewed as a "market rescue" signal during a critical moment for U.S. stocks. He emphasized that the downside risks to employment goals are rising (the labor market continues to cool), while the upside risks to price stability goals are diminishing (inflation is on a downward trajectory, only slowed by tariff disruptions), indicating that there is still room for further adjustments to bring policy closer to a neutral range. Given his special status as one of the "three horses" of the Federal Reserve, the market believes his remarks indicate a shift in the internal risk assessment focus of the Federal Reserve from "fighting inflation" to slightly leaning towards "protecting employment."

This judgment caused the FedWatch probability of a December rate cut to "dramatically reverse" before Friday's market open, soaring from below 40% to 70%, and the three major stock indices, which had been declining for several days, finally recorded gains that day.

Such a rapid adjustment in expectations still requires caution. For BTC's trend, it can at most be seen as a temporary breather from the decline. Whether a rate cut can be confirmed, and whether funds can flow back into high-risk assets afterward, remains to be seen.

Crypto Market

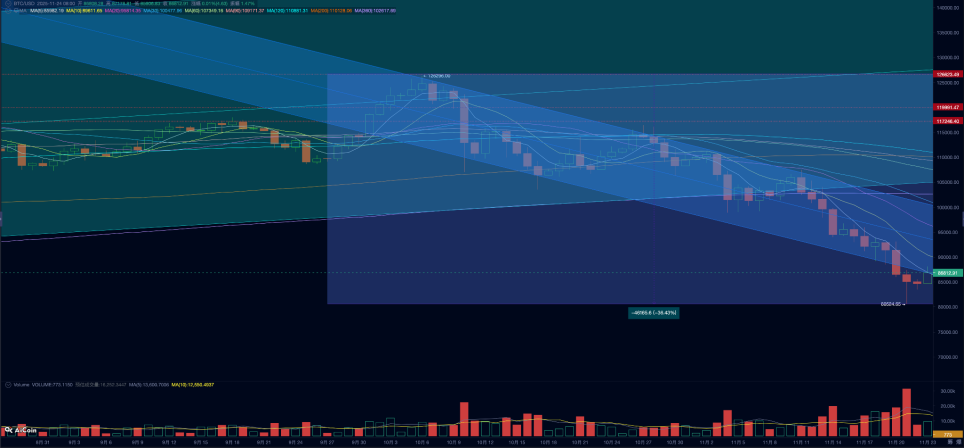

Compared to the Nasdaq, BTC's performance has been more severe under the dual pressures of macro liquidity and "cyclical law" selling. Following a 5.25% drop last week, it continued to fall by 7.83% this week, operating below the 5-day moving average for the entire week, with trading volume nearly doubling compared to last week.

BTC Daily Chart

Recently, we have repeatedly emphasized that the "cyclical law" selling has become the biggest source of pressure on BTC's upward movement. Continuous selling from long-term holders has loosened the market's chip structure, making it exceptionally fragile. This week, during the market's waterfall-like decline, long-term holders further increased their selling pressure compared to last week, with a scale exceeding 42,000 coins, while total selling from both long and short holders exceeded 260,000 coins.

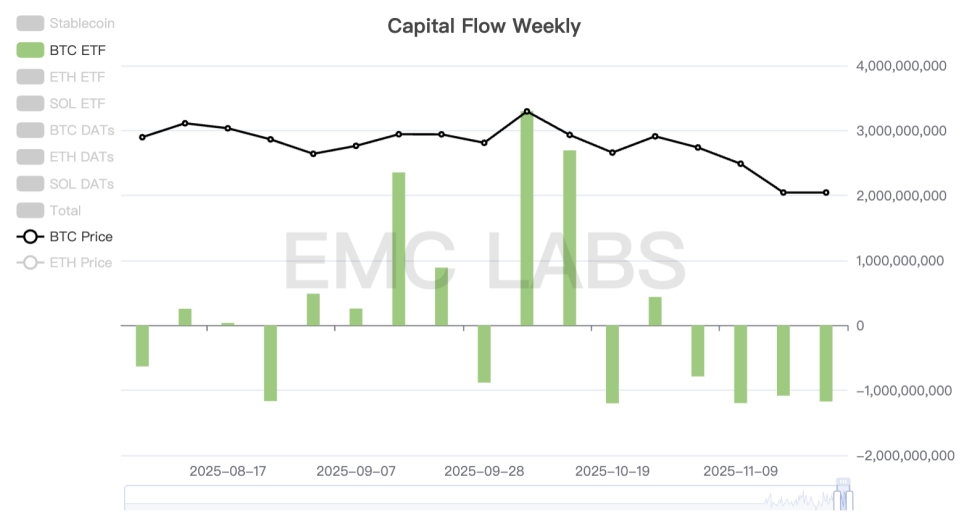

BTC ETFs have contributed funding momentum to two upward phases of this bull market. However, in the context of recent liquidity tightening and continuous declines, this funding channel has turned into a selling force, with over $1.171 billion flowing out over the week, marking a significant decline for four consecutive weeks.

Another important source of buying power—DAT Company—purchased $800 million in BTC last week, and BMNR continued to buy ETH during this week's crash. However, in the face of relentless selling pressure, their buying power has not been able to slow down the decline.

The indistinct whale shark group has become the largest buyer this week, with their on-chain address clusters experiencing net inflows for seven consecutive days, totaling nearly 110,000 coins.

Technically, BTC has completely broken down, remaining below the rising channel and the 360-day moving average for two consecutive weeks. On the pessimistic side, we see that long and short holders are still continuously selling on a large scale; on the optimistic side, we observe that the whale shark group and DAT Company are still buying, which keeps the exchange's chips slightly flowing out rather than accumulating. Additionally, the most pessimistic time for macro liquidity may be passing, as the Treasury's TGA account begins to decline slowly, and the Federal Reserve starts to "dovish" slightly, turning towards a potential rate cut in December.

We have yet to complete the final confirmation of the bull-bear transition—this will require more time. The transformation of the new and old cycle's forms remains uncertain—this will also require more time. During this challenging time, controlling positions and maintaining rationality in the face of price declines while holding long-term optimism for industry development may be the best choice.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, entering a "downward phase" (bear market).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。