The Ecological Rift of Hyperliquid

Written by: Zuo Ye

When the time comes, the world works together; when the opportunity goes, heroes are not free.

Binance has raised the Aster to attack Hyperliquid's OI and trading volume, while $JELLYJELLY and $POPCAT have successively attacked HLP, merely a skin disease;

Amid the booming HIP-3 growth mode, the rumored BLP (lending protocol), and the active pledge of 1 million $HYPE to become aligned quote assets, Hyperliquid has revealed its own cracks—HyperEVM ecology and $HYPE are not yet aligned.

Alignment is not complicated; under normal circumstances, the HyperEVM ecology consumes $HYPE, and $HYPE will also support the development of the HyperEVM ecology.

Currently, the situation is abnormal. The Hyperliquid Foundation's focus remains on the utilization of $HYPE in the HyperCore spot, contract, and HIP-3 markets, while the development of the HyperEVM ecology remains a second-class citizen.

Earlier, a third party proposed the HIP-5 proposal, hoping to allocate some funds from the $HYPE repurchase fund to support ecological project tokens, but it faced overall denial and skepticism from the community. This points to a harsh reality: the current price of $HYPE is entirely supported by the HyperCore market repurchase, with no surplus to support the HyperEVM ecology.

A Stone from Another Mountain: The Successes and Failures of Ethereum's Expansion

The shift to L2 Rollup has not satisfied ETH, and third-party sorters are almost absurd.

The development of a chain involves three main entities: the main token (BTC/ETH/HYPE), the foundation (DAO, spiritual leaders, companies), and ecological project parties.

Among them, the interaction model between the main token and ecological project parties determines the chain's future:

Main Token ⇔ Ecology: Bidirectional interaction is the healthiest; ecological development requires the main token, and the main token empowers ecological projects, as SOL currently does best;

Main Token -> Ecology: The main token unidirectionally empowers the ecology; after the main token's TGE, it disperses, typical examples being Monad or Story;

Ecology -> Main Token: The main token drains the ecological projects, with the ecology in a competitive state with the main token.

The historical changes in the relationship between Ethereum and its DeFi projects, as well as L2, are the most direct and can reflect the current true state of HyperEVM and the potential for future breakthroughs.

According to 1kx research, the top 20 DeFi protocols account for about 70% of on-chain revenue, but their valuations are far inferior to those of underlying public chains. The theory of fat protocols still holds sway; people trust Uniswap and stablecoins on Ethereum more than standalone Hyperliquid and USDe.

Not to mention Vitalik's long-standing "hatred" for DeFi yet inability to part with it, ultimately awkwardly creating a low-risk DeFi theory. Many DeFi protocols have attempted to build their own portals, from dYdX V4 to MakerDAO's 2023 EndGame plan, with technology choices spanning Cosmos and Solana and other AltVM systems.

Then came Vitalik's public sell-off of $MKR. Beyond the interaction between the main token and ecology, people have long underestimated the "official" legitimacy of public chains, especially the role of spiritual leaders.

Vitalik, representing the Ethereum Foundation (EF), has long allowed DeFi to run its course while focusing on metaphysical philosophical concepts. The clam and the heron fight, and the fisherman benefits; the rise of the Solana DeFi ecology is not unrelated to this. Ultimately, Hyperliquid, in the form of an exchange + public chain, has brought public chain competition into a new phase.

The impact of Solana on Ethereum has led to widespread criticism of Vitalik and the EF. However, beyond DeFi, the gains and losses of L2 Scaling are even more thought-provoking. The L2/Rollup route has not technically failed, but the diversion of L1 revenue has led ETH into a downward cycle.

Image Caption: ETH Dream: L2 Scaling -> L1 Scaling

Image Source: @zuoyeweb3

When Ethereum L1 faced the expansion demand after the DeFi explosion, Vitalik designated a Rollup-centered expansion route and gambled on the long-term application value of ZK, guiding the industry, capital, and talent into a FOMO frenzy around ZK Rollup. From 2020 to 2024, this has created countless wealth effects or tragedies.

However, one point remains: DeFi is a real product aimed at the C-end. The continuously launched L2 essentially consumes Ethereum L1's infrastructure resources, thereby splitting ETH's value capture ability. The end of L2/Rollup will arrive in 2024, and 2025 will see a return to the L1 Scaling route.

After four years away, it returns to L1 as the main focus.

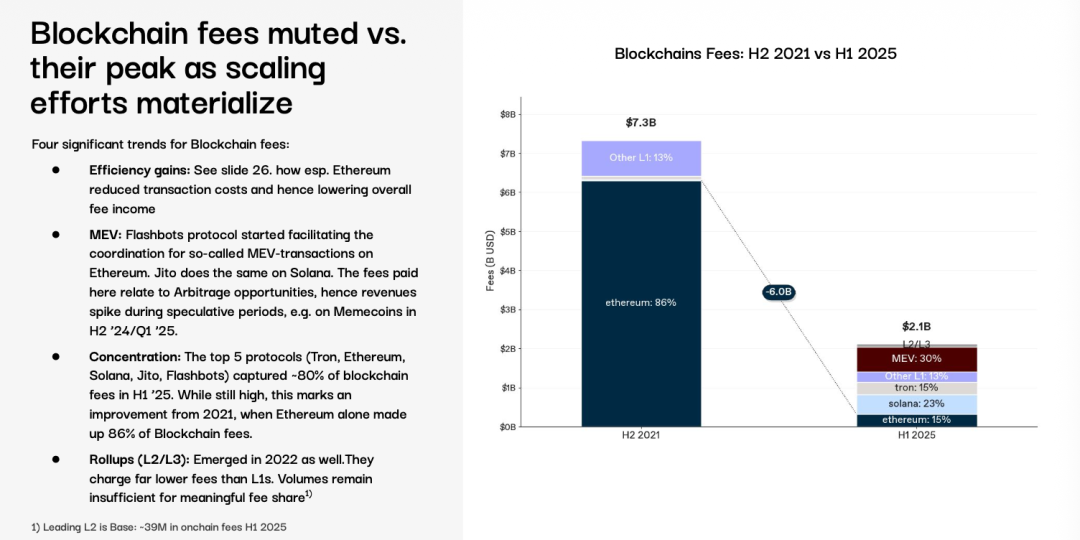

Image Caption: Speeding Up and Reducing Costs Hurts Its Own Revenue

Image Source: @1kxnetwork

On a technical level, ZK and L2/Rollup have indeed significantly alleviated L1's burden, and speeding up and reducing costs has benefited participants, including ordinary users. However, outside the competitive relationship of public chain > DeFi (applications), on an economic level, a complex triangular relationship of public chain > L2 > applications has been added out of thin air, ultimately resulting in a three-way loss.

Ethereum's revenue has decreased due to L2 siphoning, L2's excessive wealth effects are dispersed, and applications are constantly expanding, leading to a diversion of L2's energy.

Ultimately, Hyperliquid ends the dispute with the unified stance of "public chain is application, application is transaction," and Vitalik lowers his proud head to reorganize the EF (Ethereum Foundation) and re-embrace user experience.

In the process of shifting from L2 to L1, at a certain point in time, technical choices, such as Scroll's emphasis on four types of ZK EVMs and Espresso's bet on decentralized sorting for L2, have ultimately been falsified. Recently, Brevis has gained attention as Vitalik re-emphasizes the importance of ZK for privacy, which has little to do with Rollup.

The fate of a project must consider not only its own efforts but also the historical process.

Amidst the chaotic beauty, from one victory to another, Hyperliquid has once again encountered Ethereum's dilemma. How should it handle the relationship between the main token and the ecology?

Throwing a Brick to Attract Jade: The Alignment Choices of HyperEVM

BSC is an appendage of Binance; what exactly is HyperEVM to Hyperliquid? The team has not figured it out.

In the article "Creating Waves in HyperEVM," the unique development path of Hyperliquid was introduced: first creating a controllable HyperCore, then an open HyperEVM, while linking the two with $HYPE.

From recent developments, the Hyperliquid Foundation insists on empowering $HYPE as the center, maintaining HyperCore as the main body, and developing a multi-ecological token economics for HyperEVM.

This leads to the core concern of this article: how should HyperEVM carve out its unique development path?

The BSC ecology is an appendage of Binance's main site and $BNB, with its PancakeSwap and ListaDAO swaying with Binance's will, so there is no competitive relationship between BNB and BNB Chain.

Even Ethereum, strong as it is, cannot maintain a long-term balance between ETH and ecological freedom and prosperity. In comparison, the existing problems of Hyperliquid are detailed as follows:

There is no established collaborative relationship between HyperEVM and HyperCore, making HyperEVM's position awkward.

$HYPE itself is the only concern of the Hyperliquid Foundation, leaving ecological project parties somewhat at a loss.

Before answering the question, let's take a look at the current state of HyperEVM. It is very clear that the HyperEVM ecological projects cannot keep up with the Hyperliquid team's thinking.

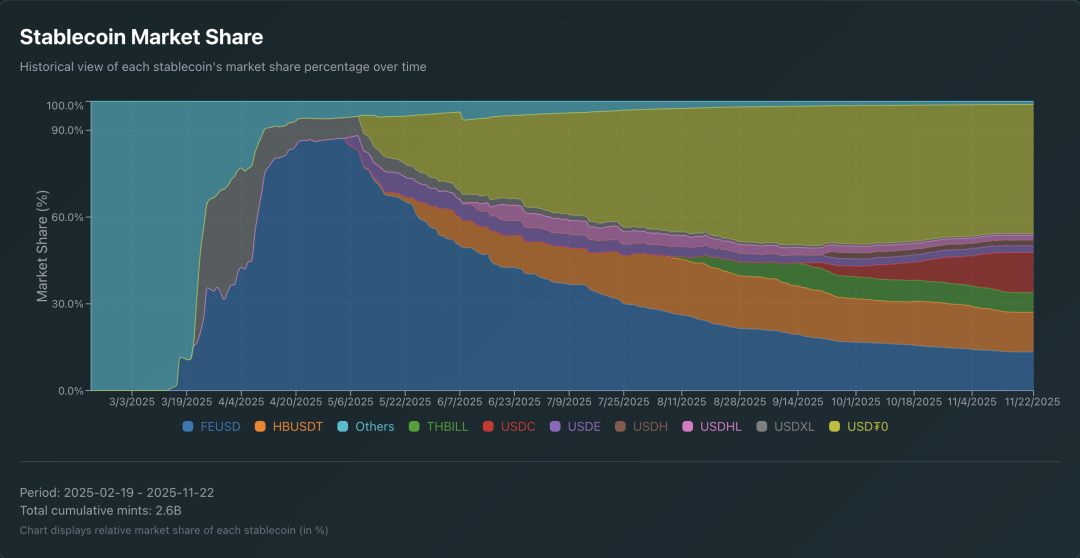

Image Caption: HyperEVM Stablecoin Market Share

Image Source: @AIC_Hugo

The USDH team's election has triggered FOMO among many stablecoin teams, but the existing stablecoin project parties in HyperEVM have no significant advantages. BLP may also have potential conflicts of interest with existing lending protocols, and the most obvious is the HIP-5 proposal event, where basically no one supports HYPE token empowerment for ecological projects.

$ATOM is the heartache of the Cosmos team, while $HYPE is the mirror flower and water moon for ecological project parties; no matter how much is done, it is still consumable.

A classic question arises for HyperEVM ecological project parties: What if Hyperliquid takes action?

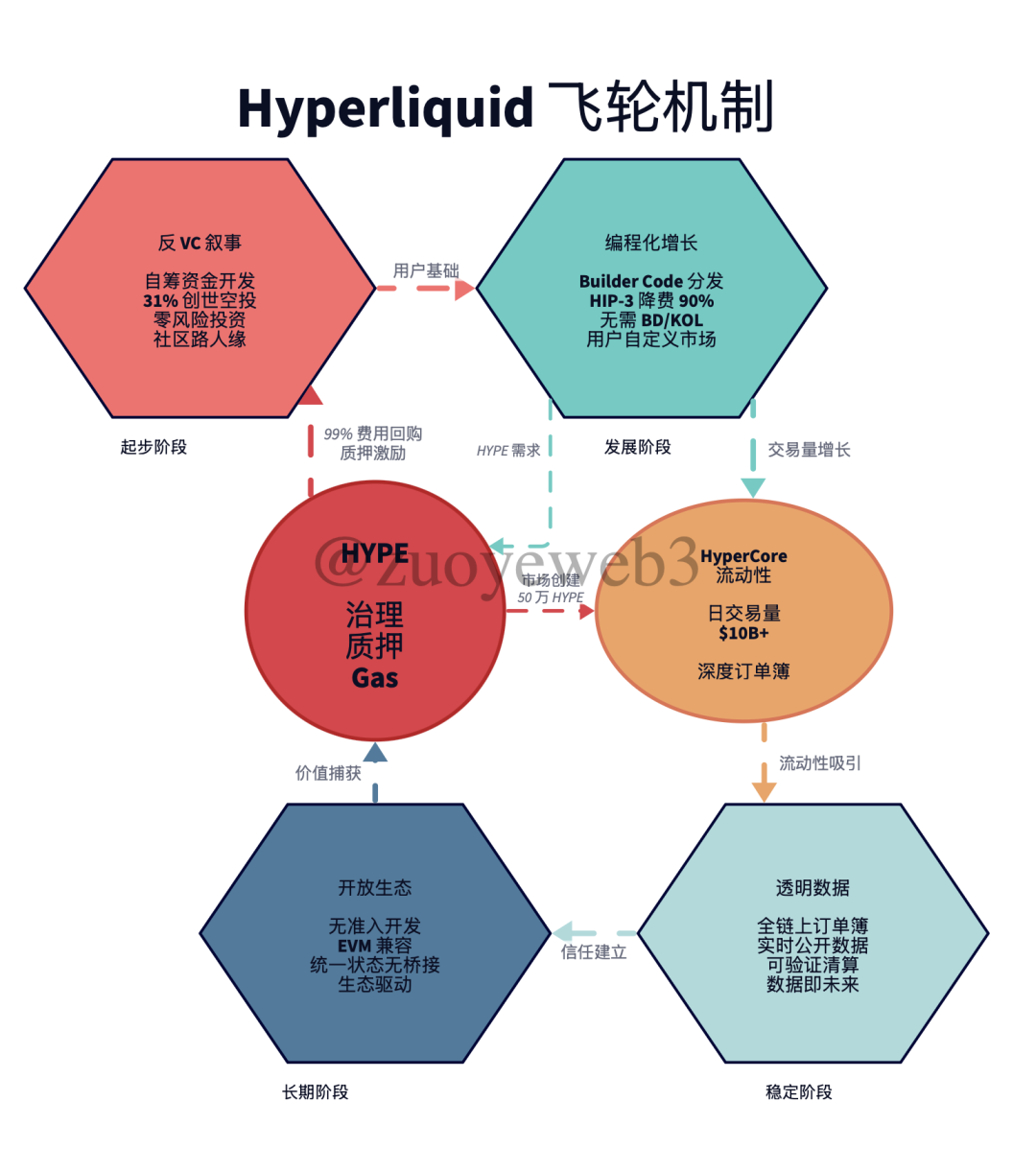

Image Caption: Hyperliquid Flywheel

Image Source: @zuoyeweb3

Looking at the Hyperliquid team's consistent approach, they are very adept at making moves during industry crises to build their own anti-fragility. During industry downturns, not only are the costs of recruiting new members low, but they also reverse market their robustness, gradually凝聚出 Hyperliquid's tight community consensus.

The anti-VC narrative in the initial stage emphasizes self-funding for market-making and entrepreneurship. Although it will still ally with market makers and VCs for token purchases, it has a strong appeal to the public, attracting early seed users;

The marketing strategy in the development stage is not about recruiting business development (BD) to attract key opinion leaders (KOLs) for commissions, but rather programming it (Builder Code/HIP-3 Growth Mode), allowing users to fully customize;

The maximization of transparent data in the stabilization stage is also Hyperliquid's latest contribution to blockchain beyond decentralization (with few and centralized nodes and governance by company will), allowing transparent data to represent the future on-chain;

The openness of HyperEVM in the long-term phase should not be based on human trust to build the on-chain ecology, but rather drive ecological development without entry barriers.

The issue lies in the long-term vision. The interests of the Hyperliquid Foundation and $HYPE are completely aligned, but to some extent, HyperEVM has a cautious inclination to prioritize the development of its own tokens and ecology. This is understandable, as the on-chain ecology is inherently a game of liquidity for growth.

The governance mechanism has not kept pace with the real demands of technological innovation. From Satoshi's departure to Vitalik's admiration and abandonment of DAOs, and then to the foundation model, public chain governance is still undergoing constant experimentation.

In a sense, the Vault Curator also embodies the contradiction between technology and mechanism, continuously absorbing the real governance system to move on-chain. Lawyers + executives + BD, the issues faced by large on-chain companies are even more abstract than those in Silicon Valley and Zhongguancun.

The Hyperliquid team is at least closer to the technical characteristics of blockchain in terms of "everything being programmable." On-chain is inherently trustless, and there is no need to laboriously establish trust models. However, this still requires additional impetus on HyperCore, such as the management of HLP, which may very well require manual intervention in times of crisis.

At least at this stage, HyperEVM has not truly achieved "no entry barriers" in governance mechanisms and liquidity. This does not mean that Hyperliquid is still imposing technical restrictions, but rather that legitimacy has not yet been fully opened to the entire community.

We will witness the co-evolution of HyperEVM and $HYPE in the impending bear market or see Hyperliquid devolve into a Perp DEX.

Conclusion

Our ETH, the problem of Hyperliquid.

Ethereum's resilience is indeed strong, having undergone the transition from PoW to PoS and from L2 Scaling to L1 Scaling, as well as the impacts of Solana in the DeFi space and Hyperliquid in the DEX space, yet it still maintains an unassailable market position.

Moreover, $ETH has already moved beyond the bull-bear cycle, but $HYPE has not yet faced the true test of a bear market. Sentiment is a precious consensus, and there is little time left for the alignment of $HYPE and HyperEVM.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。