Koreans have not stopped speculating; they have simply shifted the gambling table from the cryptocurrency market to the stock market.

Author: Uda

More than a month ago, I came across a video online.

With the familiar dark stage lights and the deafening cheers from the audience, one might think it was an offline esports competition for League of Legends.

But as the camera zoomed in, I realized: wait, this isn’t a game; isn’t that a candlestick chart!

Indeed, Koreans have turned cryptocurrency trading into an esports competition.

This video was from the official peripheral event held during Korea Blockchain Week this year—Perp-DEXDay2025.

Perp refers to perpetual contracts, which are the most thrilling leveraged plays in the crypto world, while Dex stands for decentralized exchanges, meaning exchanges that operate without a corporate entity, relying on smart contracts.

What Perp-DEXDay does is bring this high-leverage trading from the blockchain directly to the offline world, hosting a live contract trading competition with an audience.

While my first reaction to seeing such an event was shock, upon reflection, considering it happened in Korea, it didn’t seem so unexpected.

After all, the fact that young Koreans love trading cryptocurrencies seems to have never changed.

Korean media once summed it up with a very precise statement: “In Korea, trading cryptocurrencies is not a hobby; it’s a symptom of the times.”

However, what I didn’t expect was:

Just as I was habitually equating “Korea = crazy cryptocurrency trading” while reminiscing about the event from over a month ago.

A recent piece of news suddenly hit me with an unexpected blow.

The data from Korea's largest cryptocurrency exchange, Upbit, is experiencing a historic collapse—over the past few months, trading volume has plummeted significantly, with the trading volume of stablecoins dropping by as much as 80%.

Even more astonishing is that it’s not just Upbit’s trading volume that is declining; the search volume for cryptocurrencies among young Koreans, community discussion levels, and retail investor activity are all simultaneously diving.

All of this points to one conclusion: Koreans are exiting the market.

Has the country that treats cryptocurrency trading as a side quest in life finally begun to calm down?

From nationwide fervor to the current freezing point, what exactly has this generation of young Koreans experienced?

If we were to draw a heat map of global interest in cryptocurrencies, Korea would undoubtedly be the area with the highest intensity.

Those familiar with the crypto world know that Korea even has a phenomenon known as the “kimchi premium”—the same cryptocurrency can be priced 5% to 20% higher on Korean exchanges compared to the global average.

This means that Koreans are genuinely willing to invest real money to “get on board” in the cryptocurrency space.

There are countless articles online discussing the intense competition in Korea, such as “Seoul’s housing prices are suffocating,” “Koreans are not having children,” and “Seoul has one of the highest suicide rates in the world”…

While these issues are real, there are many countries and regions around the world facing similar social problems, and these reasons can explain why people everywhere want to make money.

However, they do not adequately explain why young Koreans would choose the path of “trading cryptocurrencies.”

In my view, the reason Korea has surged so aggressively in the crypto world is not because their lives are particularly “tragic,” but rather because the social rhythm, cultural habits, and psychological structure of young Koreans align perfectly with the mechanisms of the crypto world.

This creates a very strange, even dangerous, chemical reaction.

Since the massive influx of altcoins into the public eye in 2017, Korean society has been like dry tinder meeting its destined spark, igniting instantly and spiraling out of control.

Young Koreans possess several almost “innate” characteristics that make them more susceptible to getting hooked in the crypto market than people from other countries.

First, Korea is a society that highly values “immediate feedback.”

If you have been to Korea, you will understand this unique “sense of rhythm” that belongs to Korea.

For example, the ubiquitous iced American coffee on the streets of Seoul, the nightlife that only truly begins at 2 AM, and the average sleep time of just six hours.

This is not just about Koreans pursuing higher efficiency; it is embedded in Korean culture as a fast-paced lifestyle.

Even the well-known Korean entertainment culture seems to be perpetually on fast forward, with the rapid pacing of Korean dramas and the tightly edited format of Korean variety shows all showcasing this “constant stimulation, continuous rhythm, and immediate feedback” lifestyle of Koreans.

In such an environment, young Koreans are almost reflexively sensitive to “speed,” “stimulation,” and “immediate feedback.”

And what is the crypto world?

It is precisely the place in the world that excels at providing you with immediate feedback.

When the two collide, the result is only a fire meeting dry tinder.

The second reason young Koreans easily fall into the crypto world is that Korean society has a very unique “gamified” structure.

The lives of young Koreans are essentially like playing ranked games from start to finish.

There are rankings in school, rankings in job hunting, and another set of rankings for company performance. Even fitness and vocabulary apps have national leaderboards for competition.

In other words, young Koreans are living a “real-life monster-hunting and leveling-up” experience every day.

So when they trade cryptocurrencies, they naturally interpret it as a game narrative;

Making money is leveling up; losing money means dropping ranks.

Using leverage is akin to hitting the big move at a critical moment; if unfortunate enough to get liquidated, it’s a “team wipe.”

In a society that operates within a gamified mechanism for a long time, people will naturally be attracted to “immediate stimulation + visualized achievements.”

The crypto world is precisely such a “real-life Squid Game” with a higher density of stimulation than the real world.

This also explains why scenes like Perp-DEXDay, which turns cryptocurrency trading into an esports competition, seem completely fitting in Korea.

Because for young Koreans, this is not a “financial event” at all; it resembles a large-scale event like MrBeast’s “real-life Squid Game.”

When the rhythm of a society, its entertainment methods, and even its narrative habits all simultaneously create a chemical reaction towards something, the only word left to describe the result is—madness.

Korea's crypto frenzy is a product that has accelerated fermentation under such conditions.

But frenzy does not last forever; as soon as one link in this narrative breaks, the entire emotional system can collapse in an instant.

The crypto frenzy among young Koreans once reached a point where the entire society was crazy about it.

However, if we draw a timeline of this frenzy, we find that it was not a case of “continuously soaring until suddenly crashing.”

Instead, it resembles a journey that experienced: volcanic eruption → earthquake → smoldering revival → PTSD → collective braking; a winding path akin to a candlestick chart.

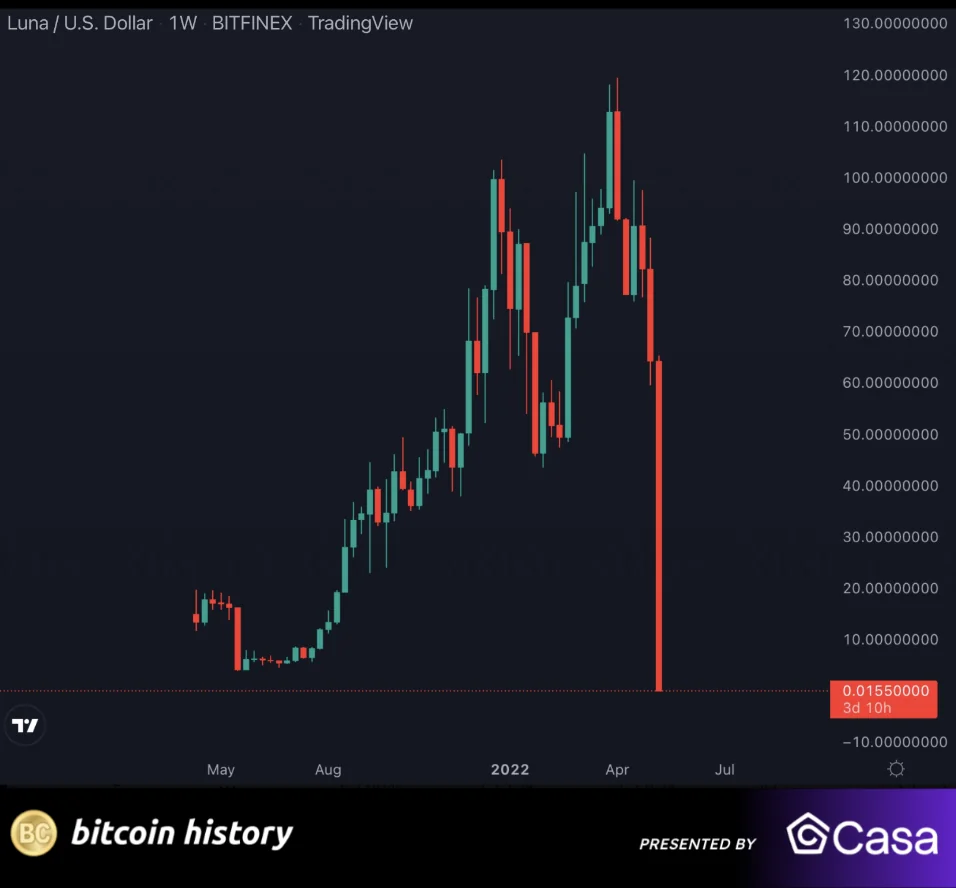

And all of this cannot be separated from a key event: the collapse of LUNA in 2022.

If you are not involved in the crypto world, you might not know how popular the LUNA project was in Korea at that time.

It can be said that LUNA, standing at the peak of the bull market, was not just a crypto project; it was more like a “national hope.”

Its founder, Do Kwon, was portrayed by Korean media as a genius akin to Elon Musk, and countless young Koreans regarded him as an entrepreneurial idol.

△ Do Kwon’s captivating pose pays homage to Musk.

However, in May 2022, the narrative switched from an inspirational film to a disaster film.

At that time, due to massive sell-offs of the algorithmic stablecoin UST (TerraUSD) within the LUNA ecosystem, the supply of LUNA surged, causing its price to plummet.

In just a few days, the price of LUNA dropped from nearly $90 to less than $0.015, nearly reaching zero, and the once $40 billion market cap of the LUNA ecosystem vanished in an instant, leaving countless people with nothing.

As the local market for LUNA, Korean retail investors were undoubtedly the group that suffered the most during this asset catastrophe.

Angry Korean investors surrounded Do Kwon's residence, and there were even several extreme social incidents in Seoul as a result.

It can be said that the collapse of LUNA was not just an investment failure for young Koreans, but a nationwide psychological trauma.

△ In 2023, Do Kwon was arrested in Montenegro and extradited to the United States.

As time passed, the global cryptocurrency market gradually warmed up from 2023 to 2025, with Bitcoin repeatedly hitting new highs.

Koreans have returned, but this time, their mindset is completely different from before.

If the frenzy of 2020-2021 saw young Koreans diving in with dreams of “overthrowing the chaebols”;

Then in the market recovery of 2023-2025, they seem more like gamblers returning to the table with freshly healed scars.

After the collapse of LUNA, cryptocurrencies underwent a role change in the eyes of Koreans, transforming from a “stepping stone in life” to a true “high-risk competitive game.”

If we both know this is a “high-risk game,” then it’s just a matter of who runs faster.

This has led to an unprecedented sensitivity in the reaction speed of Korean retail investors.

Whenever market sentiment wavers slightly, Korean retail investors are the first to withdraw. As soon as regulatory hints are dropped, Korean users quickly start to reduce their positions and wait.

Thus, by 2025, when the cryptocurrency market experienced a cooling period that should have been “normal fluctuations,” the reaction from Korean retail investors was far more intense than that of other countries.

The result was a shocking phenomenon to the outside world: the trading volume of Korea's largest exchange, Upbit, plummeted by 80% in a short time.

From an external perspective, this seems difficult to explain, but within the social context of Korea, it makes perfect sense.

A group that has experienced a “massive zeroing out” naturally has a lower threshold for risk; even a slight headwind in the market is enough to trigger a collective exit mechanism.

However, if you think that Korean retail investors suddenly withdrawing from the crypto market in the second half of 2025 is a story of collective rationality pulling back from the cliff, you are gravely mistaken.

The hardest thing in the world is to stop a gambler from gambling.

Koreans' risk appetite has never diminished; they have simply switched to a more vibrant battlefield, turning their attention to the Korean stock market.

The most direct signal comes from the data.

In 2025, the KOSPI index surged as if ignited, rising over 70% within the year, repeatedly hitting historical highs in single months, and brokerage apps experienced outages due to overwhelming trading activity. Samsung Electronics and LG Energy both saw their stock prices double, while SK Hynix skyrocketed over 240% since the beginning of the year, becoming the new “national faith” for retail investors.

At this stage, the Korean stock market has completely taken over the social sentiment that once belonged to the crypto market.

With the global surge in demand for AI and semiconductors this year, Korea has once again positioned itself at the forefront of the industrial chain, coupled with a series of government measures, making the entire Korean stock market unstoppable.

The fervent capital that once flowed into the crypto market has now all surged into the tech sector of the Korean stock market.

Meanwhile, the crypto market has quietly lost its last batch of players willing to take over. The trading volumes of Upbit and Bithumb have halved, and the altcoin sector has completely cooled into a gray wasteland.

In short: Koreans have not stopped speculating; they have simply shifted the gambling table from the crypto world to the stock market.

They continue to chase high returns and are still willing to use leverage; it’s just that this time, they are betting not on some new air coin, but on more substantial and grander targets like Samsung and SK Hynix.

However, I would not be surprised if one day, when the AI craze passes, the semiconductor boom slows down, or when the crypto world concocts a sufficiently grand narrative again.

Those dormant gamblers will still be awakened.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。