The internal divisions within the Federal Reserve have become public, ignited by one of the "big three," John Williams, stating that "there is still room for rate cuts in the near term," which has sparked market enthusiasm.

“I still believe there is room for further adjustments to interest rates in the short term.” On November 21, John Williams, the president of the New York Fed and one of the "big three" at the Federal Reserve, sent a dovish signal during a speech. This statement immediately shook the market, with traders in the interest rate futures market adjusting their bets, raising the probability of a rate cut in December from less than 40% to over 70%.

As a close ally of Fed Chair Jerome Powell, Williams' remarks are seen as an important indicator of the intentions of the Fed leadership.

1. Key Signal: Williams Sets the Tone for Easing Expectations

● As the president of the New York Fed, Williams has permanent voting rights on the Federal Open Market Committee and, along with the Fed Chair and Vice Chair, forms the so-called "big three" decision-making core, giving his comments far more policy weight than those of ordinary committee members.

● In his speech in Santiago, Williams clearly stated, “Current monetary policy is still moderately restrictive,” and therefore he “still sees room for further adjustments to interest rates in the near term.” This statement was interpreted by the market as a clear signal for a rate cut in December.

He observed that U.S. economic growth has clearly slowed, and the labor market is gradually cooling, now comparable to the pre-pandemic period when the economy was not overheating. Williams specifically mentioned, “Labor demand is weakening, and the unemployment rate is beginning to rise,” which provides room for adjustments in monetary policy.

● On the inflation issue, Williams admitted that “inflation progress has stalled,” but he expects “inflation and wage growth to continue to decline,” with hopes of reaching the long-term target of 2% by 2027. He emphasized, “Achieving the inflation target is crucial without excessively risking the ‘maximum employment goal’.”

● Williams also discussed the impact of structural factors on monetary policy. He estimated that “fiscal policy may have pushed the neutral interest rate up by 25 to 50 basis points,” which is significant for setting the future path of monetary policy.

2. Market Probabilities

After Williams' speech, market bets on rate cuts surged.

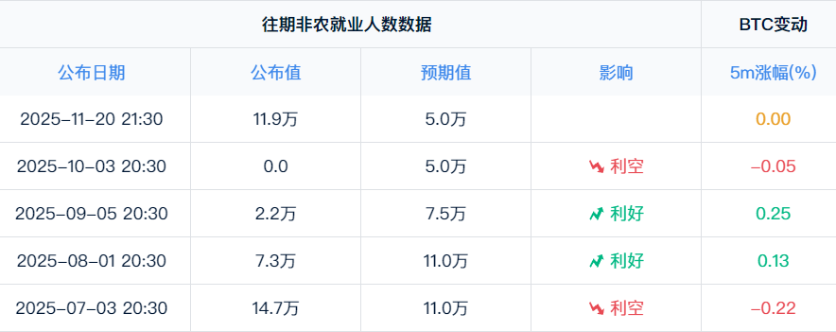

● According to the latest data from CME's "FedWatch," the probability of a 25 basis point rate cut by the Fed in December has reached 69.4%, while the probability of keeping rates unchanged is 30.6%. This change was rapid, nearly doubling from less than 40% after the non-farm payroll report.

● For longer-term policy expectations, the market anticipates a 56.9% probability of a cumulative 25 basis point rate cut by January next year, a 20.8% probability of keeping rates unchanged, and a 22.3% probability of a cumulative 50 basis point rate cut.

● In terms of market reaction, U.S. stocks staged a rollercoaster comeback, with the Dow Jones Industrial Average rising nearly 500 points overnight, and tech stocks began to recover. By the close, the three major indices halted their consecutive declines. The Dow closed up 1.08%, the S&P 500 rose 0.98%, and the Nasdaq increased by 0.88%.

3. Intense Clash Between Hawks and Doves

There are significant divisions within the Federal Reserve regarding whether to further cut rates in December, which have been clearly expressed in recent speeches by several officials, forming a stark hawk-dove dichotomy.

Dovish Camp

● The most dovish Fed governor, Michelle Bowman, explicitly expressed support for policy easing. She stated that yesterday's data “clearly leaned dovish”, and that labor market data was not as strong as expected.

● Bowman emphasized that “the Fed should be forecast-oriented rather than data-oriented”, and noted that if her vote were the deciding one, she would vote for a 25 basis point rate cut. She also specifically mentioned, “The most important financial condition is housing,” implying that the current interest rate levels are putting pressure on the real estate market.

Hawkish Stance

● Dallas Fed President Lorie Logan expressed a completely different viewpoint. She stressed, “We should be cautious about further rate cuts.”

● Logan believes that keeping rates unchanged at the December meeting may be appropriate to avoid a situation where policymakers overly ease and then have to reverse course and raise rates.

● Boston Fed President Susan Collins also leans towards maintaining policy stability, stating that keeping rates unchanged is “appropriate.”

4. Data Dilemma: The Fed Decides in a Fog

The Federal Reserve's decision-making is facing an unprecedented data dilemma, described by outsiders as a “blind flight” state, which further exacerbates the uncertainty of policy decisions.

● U.S. economic data releases have become chaotic, and the Fed, which has been guided by inflation data, has been in a blind flight for a long time. Complicating matters, the U.S. Bureau of Labor Statistics decided to cancel the release of the October CPI report and postpone the November CPI data release to December 18.

This means that the Fed will once again lack a key inflation data point as a reference for its December rate decision, forcing policymakers to make judgments in the absence of complete information.

● Meanwhile, the previously released “late” September non-farm payroll data was significantly better than expected, with an increase of 203,000 jobs, far exceeding the market expectation of 150,000, complicating the Fed's decision-making landscape.

“We are in an extremely complex decision-making environment,” said former Fed economist Julia Coronado, “On one hand, there are signs that the economy is slowing, while on the other hand, the labor market remains resilient, and inflation data is unreliable, making any policy decision fraught with risk.”

5. Jefferson Assesses Financial Stability Risks

Fed Vice Chair Philip Jefferson specifically discussed the impact of artificial intelligence on the economy and financial stability in a speech on November 21, a topic that has garnered widespread attention on Wall Street.

● Jefferson believes that the current AI boom is fundamentally different from the internet bubble of the late 1990s. He pointed out that unlike many internet companies at that time, which had only speculative income prospects, today's AI-related companies have mature profit models and real cash flows.

● “Price-to-earnings ratios are far below the peak of the internet bubble,” Jefferson emphasized, “Today's AI-related companies are more mature and have real profitability.” He observed that AI companies have not heavily relied on debt financing so far, and the use of leverage is more limited, which may reduce the extent to which any shift in AI sentiment transmits to the broader economy.

● In terms of financial stability assessment, Jefferson concluded that the current financial system is overall “robust and resilient.” However, he also warned that the Fed is closely monitoring potential risks from non-bank financial institutions, particularly the leverage levels in hedge funds and private credit markets.

● Nevertheless, Jefferson emphasized that “it is still too early to judge how AI will affect the labor market, inflation, and monetary policy.” He suggested that policymakers should maintain a “humble” attitude in the face of potential economic structural changes brought about by AI, avoiding premature conclusions.

6. Policy Outlook

Regarding the future policy path of the Federal Reserve, analysts point out that Powell is facing unprecedented internal resistance and decision-making complexity.

● “Fed mouthpiece” Nick Timiraos stated that it is highly likely that there will be three or more dissenting votes at the December meeting, breaking the tradition of the Fed seeking policy consensus for decades. Regardless of whether the final decision is to cut rates or hold steady, it may face strong opposition from either hawkish or dovish committee members.

● Evercore ISI economist Krishna Guha noted, “We are witnessing a breakdown in the decision-making process, and we may see a severely divided committee next year.” This division may continue into next year, meaning that even a change in chair does not guarantee more rate cuts.

● Political factors are also influencing the outlook for monetary policy. Trump stated this week that he expects rates to drop significantly after appointing a new Fed chair in May next year. However, the complex divisions within the Fed mean that his wishes may be difficult to realize.

● Michael Feroli, chief U.S. economist at JPMorgan, believes that “the Fed is walking a very narrow path. If it cuts rates too quickly, it may reignite inflation; if it waits too long, it may stifle the economic recovery.”

Regarding balance sheet policy, Logan mentioned in her speech that “the Fed's balance sheet will soon resume growth,” suggesting that the Fed may adjust the pace of balance sheet reduction in the near term to provide more liquidity support to the financial system.

As the FOMC meeting on December 9-10 approaches, the divisions among Fed officials continue. Nick Timiraos, known as the “new Fed correspondent,” mentioned that there may be at least three dissenting votes on whether to cut rates in December.

This near-split situation poses the most severe leadership challenge for Powell in his eight years as Fed chair. Regardless of how he ultimately decides, it will be made amid unprecedented internal dissent, setting the stage for a potentially more divided committee landscape in 2026.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。