This article is from: Jeff Park, Bitwise Consultant

Compiled by: Moni, Odaily Planet Daily

In just six weeks, Bitcoin's market value has evaporated by $500 billion, with ETF fund outflows, Coinbase discounts, structural sell-offs, and poorly positioned long positions being liquidated, all without any obvious catalysts to stimulate a market rebound. Moreover, concerns about whale sell-offs, heavily loss-making market makers, a lack of defensive liquidity supply, and survival threats from quantum crises continue to hinder Bitcoin's potential for a rapid recovery. However, throughout this decline, one question has persistently troubled the community: What has happened to Bitcoin's volatility?

In fact, the volatility mechanism of Bitcoin has quietly undergone a transformation.

Over the past two years, it has been widely believed that ETFs have "tamed" Bitcoin, suppressing its volatility and transforming this asset, which was once highly sensitive to macroeconomic factors, into a trading tool constrained by institutional oversight and volatility suppression mechanisms. However, if we focus on the past 60 days, we find that this is not the case; the market seems to have returned to its previous state of volatility.

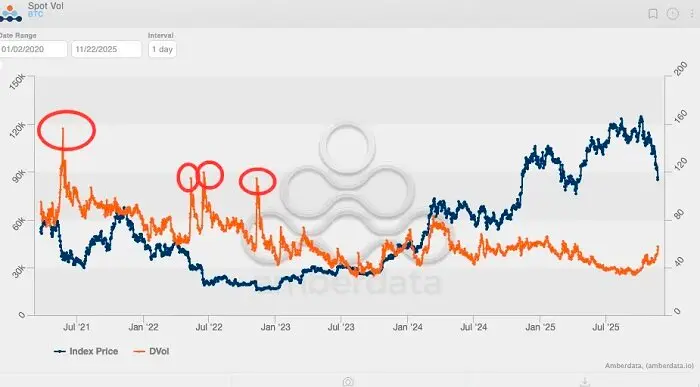

Looking back at the implied volatility of Bitcoin over the past five years, we can trace the peaks of this indicator:

The first peak (and the highest) occurred in May 2021, when Bitcoin mining faced setbacks, causing implied volatility to soar to 156%.

The second peak appeared in May 2022, triggered by the collapse of Luna/UST, reaching a peak of 114%.

The third peak occurred from June to July 2022, when 3AC was liquidated.

The fourth peak was in November 2022, during the FTX collapse.

Since then, Bitcoin's volatility has never exceeded 80%. The closest it came to 80% was in March 2024, when the spot Bitcoin ETF experienced three months of continuous fund inflows.

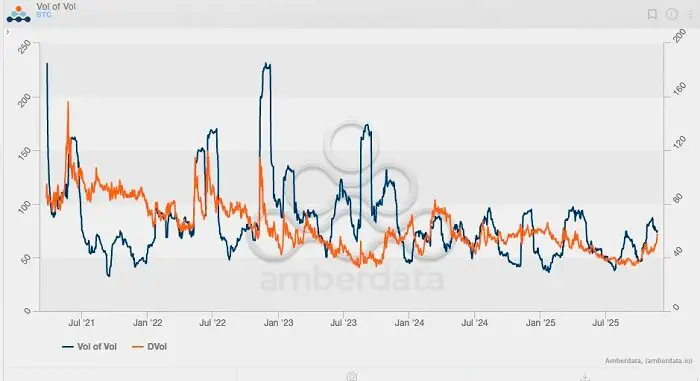

If we observe the Bitcoin volatility index (vol-of-vol index), a clearer pattern emerges (this index is essentially the second derivative of volatility, reflecting the rate of change of volatility itself). Historical data shows that the highest value of the Bitcoin volatility index occurred during the FTX collapse, when the index surged to about 230. However, since the ETF received regulatory approval for listing at the beginning of 2024, the Bitcoin volatility index has never breached 100, and implied volatility has continued to decline, unrelated to the spot price trend. In other words, Bitcoin seems to no longer exhibit the characteristic high volatility behavior seen in the market structure before the ETF launch.

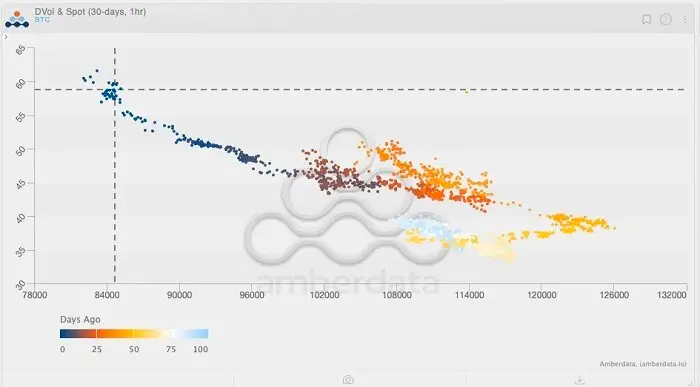

However, the situation has changed in the past 60 days, with Bitcoin's volatility experiencing its first increase since 2025.

Looking at the above chart, note the color gradient (light blue to dark blue represents "days ago"). Tracking recent trends, you will notice a brief window where the spot Bitcoin volatility index climbed to around 125, while implied volatility was also rising. At that time, Bitcoin's volatility indicators seemed to suggest a potential market breakout, as previously, volatility was positively correlated with spot prices. However, contrary to expectations, everyone now knows that the market did not rise as anticipated but instead reversed and fell.

Interestingly, even as the spot price declined, implied volatility (IV) continued to rise. Since the advent of the ETF era, it has been rare for Bitcoin's price to decline while implied volatility continues to rise. It can be said that we may be at another significant "turning point" in Bitcoin's volatility patterns, where implied volatility returns to the state it was in before the ETF appeared.

To better understand this trend, we use a skew chart for further analysis. During significant market declines, the skew of put options typically spikes rapidly—this can be seen in the three major events mentioned earlier, where the skew reached -25%.

However, the most noteworthy data point is not the skew during market declines but rather in January 2021, when the skew of call options peaked above +50%. At that time, Bitcoin experienced the last true mega-gamma squeeze in recent years: Bitcoin's price soared from $20,000 to $40,000, breaking the historical high of 2017 and triggering an influx of trend followers, CTAs, and momentum funds. Actual volatility exploded, forcing traders to buy spot/futures to hedge the gamma risk of their short positions, which in turn pushed prices higher—this was also when Deribit saw record retail fund inflows as traders discovered the power of out-of-the-money call options.

Analysis shows that monitoring changes in options positions is crucial. Ultimately, it is the options positions—not just spot trading—that create the decisive moves that push Bitcoin prices to new highs.

As the trend of Bitcoin volatility reaches another "turning point," it suggests that prices may once again be driven by options. If this shift continues, the next wave of Bitcoin's upward movement will not only come from ETF fund inflows but also from a volatile market (with more investors entering to seek profits from volatility), as the market finally recognizes Bitcoin's true potential.

As of November 22, 2025, the top five nominal amounts of open contracts on the Deribit platform are as follows:

A $85,000 put option expiring on December 26, 2025, with an open contract size of $1 billion;

A $140,000 call option expiring on December 26, 2025, with an open contract size of $950 million;

A $200,000 call option expiring on December 26, 2025, with an open contract size of $720 million;

An $80,000 put option expiring on November 28, 2025, with an open contract size of $660 million;

A $125,000 call option expiring on December 26, 2025, with an open contract size of $620 million.

Additionally, as of November 26, BlackRock's IBIT top ten options positions are as follows:

This indicates that the demand for options configuration before the end of the year (measured by nominal value) is greater than the demand for options configuration (also measured by nominal value), and the strike price range of options is more skewed towards out-of-the-money options.

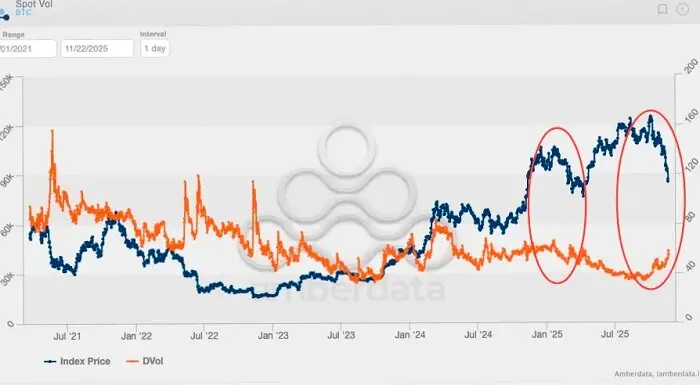

If we further observe the two-year implied volatility chart of Bitcoin, we find that the sustained demand for volatility over the past two months closely resembles the trend seen on the chart during February to March 2024. Many should remember that this was the period of explosive growth driven by Bitcoin ETF fund flows. In other words, Wall Street needs Bitcoin to maintain high volatility to attract more investors, as Wall Street is a trend-driven industry that likes to maximize profits before year-end bonuses are distributed.

Volatility is like a self-propelling profit-driven machine.

Of course, it is still too early to assert whether volatility has formed a breakthrough trend and whether ETF fund flows will follow, meaning that spot prices may continue to decline. However, if spot prices continue to drop from their current position while implied volatility (IV) rises during this period, it would strongly indicate that prices may experience a significant rebound, especially in an environment where traders still prefer to buy "sticky options." But if the sell-off continues and volatility stagnates or even declines, the path out of the downward range will be greatly narrowed, especially in light of the recent structural sell-off triggering a series of negative external effects. In this case, the market is less about finding a rebound point and more about gradually forming a potential bear market trend.

The next few weeks will be very interesting.

Recommended reading:

Rewriting the 2018 script, the end of the US government shutdown = Bitcoin price will soar?

$1 billion stablecoin evaporation, the truth behind the DeFi chain explosion?

MMT short squeeze event review: a carefully designed money-making game

Click to learn about ChainCatcher's job openings

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。