Author: J.A.E, PANews

With the frequent approval and large-scale implementation of spot ETFs, Ethereum seems to have completed a stunning transformation from a "geek experiment" to a "global asset." However, under the spotlight of the crypto market, the largest smart contract platform in the industry is currently standing at a historical crossroads.

Behind the prosperity, undercurrents are surging. Recently, Ethereum co-founder Vitalik Buterin warned at the Devconnect conference that Ethereum is currently facing three major risks: the threat of quantum computing, increased control by Wall Street, and governance fairness. These three pressures will test Ethereum's long-term sustainability and resilience as a trusted neutral infrastructure.

Technical Quantum Threat Looms, Quantum Resistance Upgrade Included in Roadmap

Beyond the impossible triangle of blockchain, another layer of more fundamental risk is approaching: cryptographic security.

The most destructive risk facing Ethereum comes from the disruption of modern cryptography by quantum computing. This technological threat has sudden and nonlinear characteristics; once it breaks through a critical point, all defenses will be shattered in an instant.

The account security of Ethereum and the vast majority of blockchain networks is based on the Elliptic Curve Digital Signature Algorithm (ECDSA). It relies on the computational difficulty of solving the Elliptic Curve Discrete Logarithm Problem (ECDLP) to achieve security. Under the classical model, deriving a private key from a public key requires exponential time, which is considered computationally infeasible.

However, this assumption is becoming precarious in the face of the rapid development of quantum computing. The Shor algorithm, developed by Peter Shor in 1994, poses a fatal threat to cryptographic systems based on ECDLP. The Shor algorithm utilizes the properties of quantum superposition and entanglement to reduce the computational complexity of ECDLP from exponential difficulty in the traditional model to polynomial time. This is seen as "efficient" or "manageable" computational time, as the time grows relatively controllable with increasing input size. Compared to exponential time, polynomial time algorithms can handle larger-scale problems in practice.

This means that if a fault-tolerant quantum computer (FTQC) with sufficient computing power emerges, it will be able to efficiently derive a user's private key from an exposed public key (which is typically exposed on-chain when a user initiates a transaction), thereby forging digital signatures and gaining unauthorized control and theft of user funds. This risk fundamentally undermines the ownership of crypto assets and forces the Ethereum ecosystem to complete a large-scale cryptographic migration before the arrival of quantum advantage.

Vitalik Buterin warned at Devconnect that quantum computers may have the ability to crack elliptic curve cryptography by 2028, and the community should prepare in advance.

Predictions about the arrival of quantum advantage are also accelerating. According to Metaculus, the emergence of quantum computers capable of RSA digital factorization has been moved up from 2052 to 2034. IBM plans to deliver its first FTQC by 2029.

In the face of quantum threats, Ethereum has included PQC (Post-Quantum Cryptography) as one of the key goals in the Splurge phase of its long-term roadmap.

Ethereum's preventive strategy is proactive and flexible.

Ethereum will treat L2 as a testing sandbox. Quantum-resistant cryptographic algorithms will first be trialed on L2 to assess their performance and security while avoiding disruption or risk to L1. This layered upgrade strategy will allow the network to prudently prevent continuously evolving technological threats.

In terms of candidate algorithms, Ethereum is also exploring various PQC solutions, mainly including:

- Lattice-based cryptography: This algorithm is considered to have strong mathematical resistance to quantum attacks.

- Hash-based cryptography: Such as SPHINCS and its component HORST, which can construct a scalable and post-quantum secure signature system through a Merkle tree structure.

This invocation of L2 solutions provides Ethereum with a flexibility advantage. Compared to Bitcoin, which has a rigid protocol design philosophy focused on immutability, Ethereum's structured design allows it to iterate and deploy PQC algorithms more rapidly and seamlessly integrate PQC into the user experience layer in the future through mechanisms like account abstraction.

Emphasizing Community Cohesion and Technical Route Correction to Prevent Community Fragmentation and Centralization Risks

The second dimension of risk for Ethereum comes from changes in market structure: the large-scale intervention of Wall Street institutional capital is reshaping Ethereum's economic and governance structure, which may erode the decentralized spirit of Ethereum, leading to dual risks of community fragmentation and infrastructure centralization.

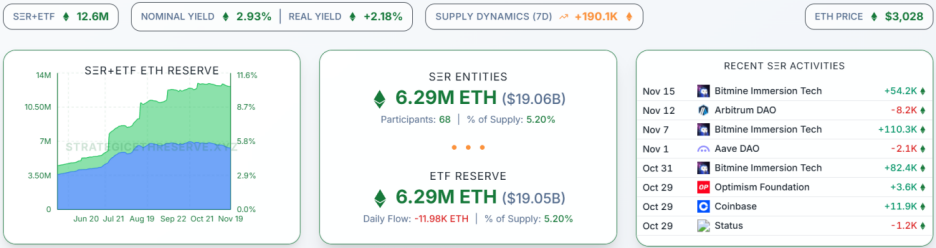

Institutional investors' interest in Ethereum is growing, locking a large amount of ETH in structured financial products. The latest data from SER shows that the total amount of ETH held by institutions (including spot ETFs and DAT treasury) has reached 12.58 million, accounting for 10.4% of the total supply.

This large-scale capital accumulation is bringing about two structural changes:

- Contraction of effective circulation: Research by glassnode reveals that the share of ETH on CEX (centralized exchanges) has sharply dropped from about 29% to around 11%. As institutions transfer ETH from high liquidity venues like CEX to low liquidity structures like ETFs or DAT, the market's effective circulation will continue to shrink.

- Change in asset qualification: This shift will also solidify ETH's positioning as productive collateral and a long-term savings asset. VanEck's CEO even referred to ETH as the "Wall Street token," reflecting the institutional financialization of ETH.

In the PoS (Proof of Stake) consensus mechanism, the amount of ETH held is directly related to staking rights and governance rights. Although ETH held through ETFs does not directly participate in on-chain staking, the large-scale economic concentration will grant major stakeholders significant potential governance influence. This economic concentration may gradually translate into governance control over the protocol decision-making process.

Ethereum's core competitiveness stems from its vibrant open-source community and idealistic developer group. However, the will of institutional capital often runs counter to the spirit of crypto punk.

The first risk of institutional capital intervention is the potential for community fragmentation. When governance power is concentrated in a few institutional stakeholders, the fairness and neutrality of the governance process will be challenged.

When Wall Street giants become the main holders, the community governance discourse will subtly tilt towards capital interests. Even if Ethereum superficially maintains decentralization, actual power will concentrate in a "small circle" composed of institutions like BlackRock, Fidelity, and Bitmine.

The development of the Ethereum ecosystem will no longer rely solely on technical advantages but will depend more on proximity to capital, which will lead to a decoupling of economic value from community spirit. Ethereum will shift from idealism to capitalism, thereby undermining the decentralized development foundation of the protocol.

Moreover, institutions tend to favor compliance, stability, and auditability, while developers often pursue privacy, innovation, and censorship resistance. If governance power is overly concentrated in institutions holding large amounts of capital, even without obvious corruption, community decisions may unconsciously lean towards maximizing the commercial value of stakeholders rather than maintaining the inherent fairness and decentralization principles of the protocol. This could alienate a large number of developers, lead to talent loss, and weaken Ethereum's credibility and neutrality as a world computer.

Another profound risk is that the pursuit of returns and operational efficiency by institutional capital may subtly alter Ethereum's technical roadmap, transforming decentralization at the consensus mechanism level into centralization at the physical layer.

First, to meet the extreme demands of institutions for transaction processing speed and compliance, the underlying technology is likely to lean towards high-performance nodes, significantly raising the threshold for ordinary users to run nodes.

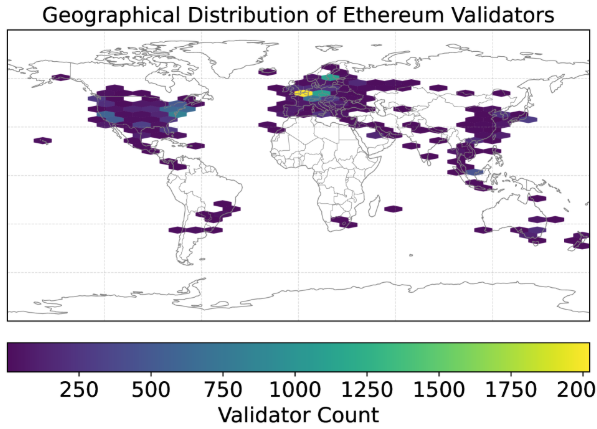

Second, existing research has shown that although Ethereum has a large validator pool, there is a serious geographical centralization phenomenon among its validators, mainly concentrated in areas with the lowest network latency, particularly North America (East Coast) and Europe. North America is often the "focal center" of the network, providing geographical advantages to validators in that region. If staking ETFs from issuers like BlackRock and Fidelity are approved, this trend is expected to be further exacerbated.

Due to low latency (i.e., faster reception and proposal of blocks), which directly translates into higher staking returns and MEV (Maximum Extractable Value) capture efficiency, institutional-level validators will also accelerate their influx into these "minimum latency" areas. This profit-driven behavior may solidify and exacerbate the current geographical centralization trend.

In fact, this physical layer centralization also introduces single-point risks. ETH held by institutions is often staked through custodians, leading to a concentration of numerous validation nodes in data centers subject to U.S. law. This not only causes geographical centralization but also exposes the Ethereum network to regulatory scrutiny (e.g., OFAC compliance requirements). Once the underlying layer no longer possesses censorship resistance, Ethereum will degrade into merely a "financial database" running on distributed servers. Therefore, the coupling of economic incentives and geography is transforming decentralization at the protocol consensus mechanism level into centralization at the physical layer, which contradicts the fundamental security goals of blockchain.

To prevent institutional capital from indirectly dominating governance, Ethereum can promote improvements from multiple levels.

In terms of community cohesion, Ethereum can grant developers higher governance weight to balance the capital advantages of institutional giants. Community funding support will become an important supplement; the Ethereum Foundation should significantly expand its Grant program and collaborate with platforms like Gitcoin to subsidize open-source contributions, preventing talent loss due to capital bias.

In terms of technical route correction, Ethereum should advance solutions that balance technology and incentives. Ethereum can encourage institutions to adopt multi-signature + DVT (Distributed Validator Technology) or re-staking combinations through certain incentive measures, allowing institutions to distribute staked ETH across more independent nodes, meeting both custodial and compliance needs while enhancing decentralization. To address geographical concentration issues, Ethereum should introduce delay balancing algorithms at the protocol level and initiate node distribution subsidy programs, focusing on reducing the proportion of North American validators to a reasonable range. At the same time, the hardware threshold needs to be lowered, along with client optimization solutions, to bring the cost of running full nodes for independent validators down to an affordable range.

Throughout Ethereum's evolutionary history, it is essentially a history of racing against potential crises.

In the face of the "pressing threat" of quantum computing and the "sugar-coated shell" of Wall Street capital, Ethereum can indeed build a new moat through quantum upgrades and balancing community governance weights in conjunction with software and hardware solutions. This game of technology and humanity will determine whether Ethereum ultimately becomes the financial technology backend of Wall Street or a public infrastructure of digital civilization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。