Original Link:

Written by: @yq_acc

Translated by: J1N, Techub News

In the first two weeks of November 2025, the old problems of DeFi were once again exposed. Stream Finance's xUSD first faced a crisis, followed by Elixir's deUSD and a host of synthetic stablecoins encountering issues. These projects were not simply the result of "bad luck" or "poor management" by the teams, but rather a concentrated outbreak of the underlying flaws in the industry's risk awareness, transparency, and trust mechanisms.

The collapse of Stream Finance was not the familiar narrative of "contracts being hacked" or "oracles being manipulated." What is truly chilling is that a project that could not even achieve basic financial transparency continued to don the guise of "decentralized finance." An external fund manager lost $93 million with almost no substantive oversight, ultimately triggering a cross-protocol chain reaction of $285 million; an entire "stablecoin sector," despite not losing its peg, saw its TVL evaporate by 40%-50% within a week. At this point, it is hard to continue believing what this industry has learned from its past painful experiences.

Ironically, the incentive structure of DeFi itself rewards those who "ignore risks" and punishes those who attempt to be prudent. When the time comes for a crisis, losses are socialized in various ways. There is an old saying in traditional finance that sounds particularly harsh today: if you don't know where the returns come from, then 80-90% of those returns likely come from you.

When mainstream lending markets offer 3%-5%, some can still promise a stable return of 18%, and the strategy details are not disclosed, then its profit logic has never been complicated. The user's principal is the source of the returns.

Stream Finance's Operational Logic and "Contagion Effect"

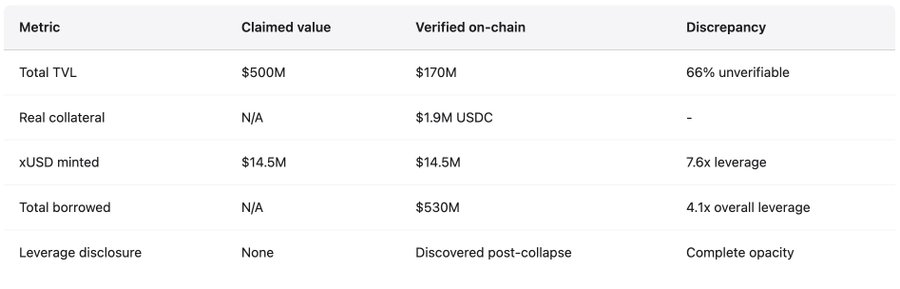

Stream Finance positions itself as a "yield optimization protocol," claiming to provide users with a stable annualized return of 18% USDC through its yield-bearing stablecoin xUSD. The publicly declared strategies of "Delta-neutral trading" and "hedged market making" sound impressive, but there are almost no verifiable details disclosed. Comparing the market environment at the time, the annualized return for USDC on Aave was 4.8%, and Compound was even just over 3%. By normal financial standards, a return three times the market level is already highly suspicious. However, users still poured hundreds of millions into it without any doubt. Before the collapse, the trading price of 1 xUSD in the secondary market once reached 1.23 USDC, explained as "the manifestation of compound returns." Stream officially claimed to manage assets as high as $382 million, but DeFiLlama's on-chain TVL peak was only around $200 million, with over 60% of the so-called "assets" unable to be found on-chain, meaning they likely existed in an off-chain black box.

After the collapse, Yearn Finance developer Schlagonia revealed the truth about Stream: it was a systematic fraud disguised as financial engineering. The core mechanism of Stream is a continuously self-circulating lending structure that recursively mints "shadow assets" without any real collateral. The process is roughly as follows:

Users deposit USDC.

Stream exchanges USDC for USDT via CowSwap.

Then uses this batch of USDT to mint deUSD at Elixir, where the incentives are high.

The minted deUSD is bridged to other chains (like Avalanche), then deposited into local lending markets to borrow more USDC.

Up to this point, although the structure is complex and relies heavily on cross-chain interactions, it still barely qualifies as a "over-collateralized lending cycle" variant. However, the truly fatal part is that Stream did not use the newly borrowed USDC to continue the collateral cycle but instead directly used them to mint new xUSD through its own contract StreamVault. This means that the supply of xUSD was violently inflated, but there was almost no real asset backing it. At that time, the only verifiable USDC collateral on-chain was $1.9 million, while Stream minted $14.5 million of xUSD, equivalent to printing $7.6 of new "stablecoin" for every $1. This is a "shadow bank" without reserves, without regulation, and without a lender of last resort, even less than a shadow bank.

More dangerously, the structural interdependence between Stream and Elixir turned the entire system into a fragile two-way explosive device. During the cycle, Stream deposited $10 million USDT into Elixir, thereby increasing the issuance scale of deUSD. Elixir then exchanged these USDT for USDC and deposited them into Morpho, further lending them out. By early November, over $70 million USDC was supplied on Morpho, of which $65 million was borrowed, with the main actors in the lending being Stream and Elixir. Stream held 90% of the circulating deUSD (about $75 million), while the core asset supporting deUSD at Elixir was primarily the Morpho loans to Stream. The two projects served as collateral for each other. This typical self-reinforcing, interdependent "financial incest" was destined to collapse together as soon as one party encountered problems.

On October 28, industry analyst CBB publicly named the risks: "xUSD has only about $170 million in on-chain collateral, yet has borrowed about $530 million from various lending protocols, which is a 4.1x leverage, and all of it is backed by positions with extremely poor liquidity. This is not a yield strategy; it is outright gambling."

Schlagonia even warned the team 172 days before the incident: "Just five minutes looking at your positions, and you can tell this is going to blow up sooner or later."

All warnings were public, specific, and accurate. But what was ignored was the users' greed, the tacit approval of information platforms, and the various protocols' unspoken agreement of "as long as we can still earn fees, don't burst the bubble."

On November 4, when Stream announced that "an external fund manager lost about $93 million," the platform immediately suspended all withdrawals. A stablecoin without a redemption channel is like a theater on fire, with everyone rushing towards the only exit, the "secondary market." The liquidity-thin pool was instantly drained, and xUSD plummeted 77% within hours, collapsing directly from around $1 to $0.23. That stablecoin, once packaged as "stable and high-yield," evaporated three-quarters of its value in just one trading day.

Contagion Effect

According to statistics from the DeFi research institution Yields and More (YAM), the direct debt exposure related to Stream across the entire ecosystem reached $285 million. This includes: a loan of $123.64 million from TelosC to Stream, the largest single exposure among all Curators; Elixir Network's loans of $68 million through private Morpho vaults, accounting for 65% of deUSD collateral; MEV Capital's exposure of $25.42 million, of which about $650,000 became bad debt, as xUSD was locked at $1.26 in the oracle while the secondary market price had dropped to $0.23; Varlamore $19.17 million; Re7 Labs had $14.65 million and $12.75 million in two vaults; Enclabs, Mithras, TiD, Invariant Group, and others also had smaller positions. Euler alone bore about $137 million in bad debt, while over $160 million in assets were frozen across multiple protocols.

Researchers pointed out that this list is far from complete, "there may be more stablecoins and vaults affected," as the true scale of the interconnected exposure remained unclear weeks after the initial collapse. The data reflects the real picture of systemic risk in DeFi being amplified and intertwined on-chain.

Additionally, over $160 million in assets were forced to be frozen across multiple protocols, instantly paralyzing the entire on-chain credit system.

Researchers specifically noted: this list is not exhaustive, "the affected stablecoins and vaults may be far more than these," and weeks after the collapse, the complete chain of events remains difficult to clarify.

The second wave of the crisis came from Elixir. Since 65% of its deUSD reserves were concentrated in loans to Stream, deUSD plummeted from $1 to $0.015 within 48 hours, a drop of 98%, becoming the fastest large stablecoin death case since Terra UST in 2022. To protect its community, Elixir allowed about 80% of non-Stream holders to redeem USDC at a 1:1 ratio, but this "compensation" came at a huge cost: lending protocols like Euler, Morpho, and Compound bore most of the losses, effectively socializing the risk. Ultimately, Elixir announced the complete shutdown of all stablecoin products, admitting that its trust system had bled to the point of being irreparable.

According to Stablewatch data, in just one week after the Stream incident, the TVL of yield-bearing stablecoins collectively dropped by 40%-50%. Even though the vast majority still maintained their dollar peg, over $1 billion flowed out from protocols that had not encountered issues. Users could not distinguish which structures were compliant, transparent, and robust, and which were shadow banks using complexity to mask fraud, so they chose to "cut and run." The entire DeFi TVL evaporated by $20 billion in early November. The market was not reacting to the failure of a single protocol but was pricing in the "structural collapse of trust" across the entire industry.

October 2025: A $60 million chain liquidation triggered by a single event

Less than a month after the collapse of Stream Finance, the crypto market experienced what seemed like a "market crash," but on-chain evidence shows that this was actually a precision strike. Utilizing known vulnerabilities, the attack was meticulously planned at an institutional scale. On October 10-11, 2025, a $60 million USDe sell-off triggered oracle failures, leading to a large-scale chain liquidation in the DeFi ecosystem. This was not caused by high leverage but rather by design flaws in institutional-grade oracles amplifying risks, employing tactics that have repeatedly appeared since 2020.

The attack began on October 10 at 5:43 UTC, with $60 million of USDe dumped into the spot market of a single exchange. If the oracle design had been sound, this transaction would have had little impact on the market, as the system would offset manipulation through multiple independent price sources and time-weighted mechanisms. However, the reality was entirely different; the oracle applied the manipulated price from the exchange to the collateral valuation (including wBETH, BNSOL, and USDe) in real-time, instantly triggering large-scale liquidations. Millions of liquidation requests flooded in simultaneously, overwhelming the system, causing market makers to be unable to place orders in time, API failures, withdrawal queues, and an instantaneous disappearance of liquidity, leading to a self-reinforcing collapse cycle in the entire market.

Attack Methods and Cases

The method of this attack was actually quite simple and precise. The oracle completely copied the manipulated price from a single exchange, while prices in other markets remained almost stable. Major exchanges showed USDe at $0.6567 and wBETH at $430, while the price deviation on other exchanges was less than 30 basis points. The on-chain liquidity pools were hardly affected. As pointed out by Ethena founder Guy Young, "the on-chain redeemable stablecoin collateral exceeded $9 billion" throughout the event, proving that there was nothing wrong with the underlying assets themselves. However, the oracle reported the manipulated price, triggering liquidations, and positions were forcibly closed based on valuations that did not exist in other markets, ultimately causing significant losses.

As early as November 2020, Compound suffered $89 million in liquidation losses when DAI surged to $1.30 on Coinbase Pro within an hour while remaining at $1 in other markets. The attack method was identical to that of bZx in February 2020 (manipulating the Uniswap oracle to steal $980,000), Harvest Finance in October 2020 (manipulating Curve to steal $24 million and triggering a $570 million run), and Mango Markets in October 2022 (manipulating multiple exchanges to withdraw $117 million). Between 2020 and 2022, there were 41 oracle manipulation attacks, with cumulative losses reaching $403.2 million. The industry's response has been slow and fragmented, with most platforms still relying on spot-based, insufficiently redundant oracles. As the market scale expands, the amplification effect of such vulnerabilities becomes more pronounced: a $5 million manipulation in Mango Markets led to a $117 million loss, with a magnification factor of up to 23 times.

Historical Review: Failures from 2020 to 2025

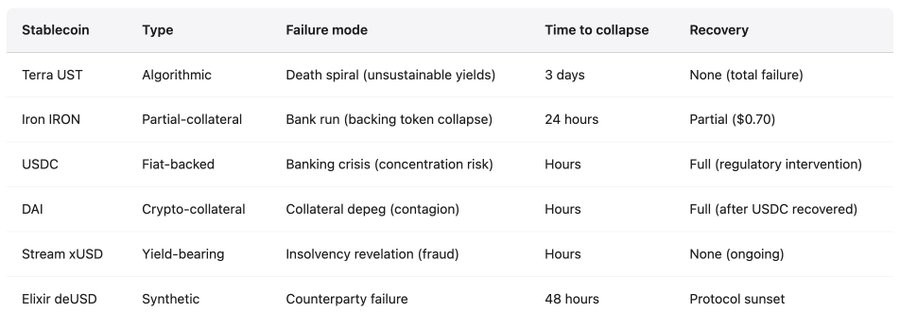

The collapse of Stream Finance was neither new nor unexpected. The DeFi ecosystem has repeatedly experienced stablecoin failures over the past few years, each time exposing similar structural vulnerabilities. Yet the industry has repeatedly fallen into the same traps on a larger scale. This pattern has remained consistent in cases over the past five years. Algorithmic stablecoins or partially collateralized stablecoins offer unsustainable high yields to attract deposits, with these yields not stemming from real income but relying on token issuance or new capital subsidies. The protocols themselves are over-leveraged, lack transparency regarding real collateral ratios, and exhibit circular dependencies. Protocol A supports Protocol B, which in turn supports Protocol A. When any shock reveals the underlying insolvency or subsidies can no longer be maintained, withdrawal runs ensue. Users rush to withdraw, collateral values plummet, liquidation chains erupt, and the entire structure collapses within days or even hours. The contagion effect further spreads to protocols that accept failed stablecoins as collateral or hold related positions, plunging the entire ecosystem into a chain of risks.

May 2022: Terra (UST/LUNA)

In just three days, $45 billion in market value evaporated. UST was an algorithmic stablecoin that maintained its peg through a mint-and-burn mechanism with LUNA. The Anchor Protocol offered a high yield of 19.5% for UST deposits, with about 75% of UST deposited in the protocol for rewards. The entire system relied on continuous capital inflows to maintain the peg. Trigger point: On May 7, a large withdrawal of $375 million from Anchor led to massive UST sell-offs, causing it to lose its peg. Users exchanged UST for LUNA to exit, causing LUNA's supply to surge from 346 million to 6.5 trillion in three days, creating a death spiral, with both tokens' prices nearly collapsing to zero. This collapse not only destroyed retail investors but also directly led to the bankruptcy of several large crypto lending platforms, including Celsius, Three Arrows Capital, and Voyager Digital. Terra founder Do Kwon was arrested in March 2023 and faced multiple fraud charges.

March 2023: USDC

TVL of $2 billion nearly went to zero within 24 hours. IRON was partially collateralized, with 75% in USDC and 25% in TITAN. To attract deposits, it offered an unsustainable yield of up to 1700% APR. When large holders began redeeming IRON for USDC, the sell-off pressure on TITAN created a self-reinforcing effect, causing TITAN's price to plummet from $64 to $0.00000006, completely destroying IRON's collateral base. Lesson: Partial collateralization is insufficient to support the system under stress tests, and when the supporting token itself falls into a death spiral, the arbitrage mechanism fails.

November 2025: Stream Finance (xUSD)

The peg dropped to $0.87 (a 13% drop) due to $3.3 billion in reserves being trapped in the near-bankrupt Silicon Valley Bank. For a "fully collateralized" fiat stablecoin, this should not have been possible, especially with periodic audits proving it. The restoration of the peg relied on the FDIC initiating a systemic risk exception, safeguarding SVB deposits. Chain reaction: triggered DAI's de-pegging (over 50% collateralized by USDC), leading to over 3,400 automatic liquidations on Aave, totaling about $24 million. This illustrates that even regulated, reputable stablecoins face concentration risks and are highly dependent on the stability of the traditional banking system.

Across these cases, a common failure pattern emerges. Unsustainable high yields: Terra offered 19.5%, Iron offered up to 1,700% APR, and Stream offered 18%, all of which were disconnected from actual income.

Circular dependencies: UST-LUNA, IRON-TITAN, xUSD-deUSD, tokens mutually support each other in a "left foot stepping on right foot" manner;

Opaque operations: Terra concealed the subsidy costs for Anchor, Stream conducted 70% of its operations off-chain, and Tether has faced repeated scrutiny over its reserve composition;

Partial collateralization or spontaneous backing: relying on volatility or self-issued tokens as collateral, when market pressure arrives, the collateral value collapses just when it is most needed, triggering a death spiral;

Oracle manipulation: frozen or manipulated price feedback hinders correct liquidations, turning price discovery into trust discovery, with bad debts accumulating until the system becomes insolvent. The conclusion is clear: stablecoins are not truly stable; they appear stable before destabilization, and this turning point often occurs within just a few hours.

When Oracles Fail, the Entire Infrastructure Collapses

When the collapse of Stream began, the oracle issues immediately became apparent. The real market price of xUSD had already dropped to $0.23, but many lending protocols still "pegged" the oracle price at $1 or even higher, attempting to avoid a chain reaction of liquidations. This decision, intended to provide stability, resulted in a fundamental disconnect between market reality and protocol behavior. This "artificial stability" was not a technical failure but a deliberate strategy. Many protocols adopted manual updates for oracles to avoid triggering liquidations during short-term volatility, but when the price drop reflects real insolvency rather than temporary fluctuations, this strategy becomes completely ineffective.

Protocols face an impossible choice. Using real-time prices: easily manipulated during volatile periods, triggering chain liquidations, as shown in October 2025, resulting in massive losses. Using delayed prices or time-weighted average prices (TWAP): unable to respond to real bankruptcies, with bad debts continuously accumulating, as in the Stream Finance incident, where the oracle showed $1.26 while the actual market price was only $0.23, resulting in approximately $650,000 in bad debts for MEV Capital alone. Using manual updates: introduces centralization and discretionary intervention, and can also hide bankruptcy risks through frozen oracles. All three methods have led to the loss of hundreds of millions or even billions of dollars.

Collapse of Infrastructure Under Pressure

As early as October 2020, Harvest Finance faced a $24 million attack that led to a run, with TVL dropping from $1 billion to $599 million. The industry should have recognized a simple yet brutal fact at that time: systems must not only handle transactions during normal periods but also provide sufficient buffers for stress scenarios. Oracles need to account for delays and congestion under extreme loads, liquidation mechanisms should have rate limits and circuit breakers, and trading platforms should reserve system redundancies far exceeding normal levels.

However, the events of October 2025 proved that these lessons had hardly been implemented at the institutional level. When millions of accounts simultaneously hit the liquidation line, when billions of dollars in positions were systematically closed within an hour, and when order books were depleted in minutes with no new orders due to system congestion, the infrastructure failed alongside the oracles at a critical moment. It was not a matter of "slower response," but rather the entire market lost its ability to function normally at that moment. Technical solutions had never been absent: rate limits, asynchronous liquidations, off-chain matching caches, load isolation, transaction priority queues… The industry has discussed these for years but has remained at the "talking stage." The reasons are not complex: these solutions sacrifice efficiency during normal times, increase operational costs, and reduce profits. Thus, the system chooses to "tune everything to the fastest" during stable periods, neglecting that extreme market conditions are the true test. The shock of 2025 merely unveiled long-hidden issues, allowing everyone to see that the infrastructure was not much more robust than the oracles in the face of pressure.

If you can't even clearly explain where the returns come from, what you have is not a return but the source of someone else's profit. The essence is simple, yet billions of dollars still flow into so-called "black box strategies," because people would rather believe they are "lucky" than face the truth. The next Stream Finance incident may be brewing; it just hasn't been exposed yet.

Stablecoins are not stable. Decentralized finance is neither decentralized nor secure. Returns without a clear source are not profits but predation with a countdown. This is not an opinion but an empirical fact validated at a great cost. The only question is whether we can truly act based on existing experiences or if we will once again pay a $20 billion price for the same lessons. History shows that the latter is more likely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。