Aster is undergoing a reconstruction of its on-chain trading ecosystem, aiming for true stability and long-term success in the realm of on-chain finance.

Written by: Deep Tide TechFlow

Introduction

The market is shrouded in gloom, yet there are a few projects that are thriving, and Aster is one of them.

According to CoinGecko data from November 19, $ASTER has risen over 7.7% in the past 24 hours, 18.4% over the past week, and 32.1% over the past 14 days.

As one of the most successful TGE projects this year, the market has become increasingly focused on Aster's future direction after witnessing its remarkable achievement of over 2800% growth during the week of its TGE.

After all, it is not enough for a TGE to peak; there must be sustained users, trading, and revenue afterward to truly withstand the test of the market and community.

Moreover, with 2025 being a year of explosive growth for Perp DEXs, Aster's breakout battle will become even more compelling amidst the competition from other products in the same space, such as Hyperliquid, Lighter, and EdgeX.

So, what is Aster's core competitive strategy?

From launching Rocket Launch to provide users with early access to quality assets, to introducing a privacy-focused Layer 1, and empowering the $ASTER token through a series of designs such as staking, buybacks, burns, and fee discounts… On November 10, 2025, Aster founder Leonard provided a clear answer during a community-facing AMA event:

The market does not need another repetitive and boring Perp DEX; rather, it needs true trading freedom, which encompasses a series of demands such as security, trust, privacy, efficiency, cost, liquidity, and the discovery and capture of profit opportunities.

And Aster is achieving true stability and long-term success on the path of on-chain finance through a reconstruction of its on-chain trading ecosystem.

What did the founder say during the AMA aimed at clarifying Aster's future?

Summarizing this one-hour AMA, you can easily grasp the following key points:

Aster is building a privacy-focused Layer 1: The team is working hard and hopes to complete internal testing and be technically ready for the testnet before early 2026.

Continuous empowerment of the $ASTER token: Previously, Aster has launched specific use cases around $ASTER, such as fee discounts, airdrops, and VIP levels, and has continuously empowered the token's value through buyback and burn plans. In the future, as Layer 1 launches, the $ASTER token will unlock more utility in scenarios such as validation, staking, and governance.

Enriching trading targets: In addition to continuously expanding cryptocurrency support, Aster will extend support to assets such as gold, stocks, and commodities.

Optimizing liquidity incentives: Continuously attracting and rewarding market makers, while incentivizing professional large-cap market makers, Aster will also support those focused on providing liquidity for long-tail markets.

Exploring Degen directions: Launching and continuously operating Rocket Launch, empowering users with early value capture capabilities.

Building a global cooperation network: Perfecting the trading ecosystem landscape to bring richer experiences.

Each line may seem independent, but together they will form a synergy, further creating a truly attractive trading environment for all participants in the trading ecosystem, including traders, institutions, holders, and market makers.

Aster's Next Level After TGE

The tremendous success of the TGE was like a tsunami of traffic, bringing a surge of users, trading volume, and community discussions to Aster.

As the TGE comes to a successful conclusion, Aster has its own secret methods for effectively retaining users as a trading platform.

In Leonard's vision, this is a dual-track path of horizontally expanding revenue and vertically deepening experience.

To retain users, the first step is to make trading comfortable for them, which involves a series of experience optimizations. Aster is specifically built for traders, aiming to create a trading ecosystem that combines CEX-level smoothness with a trustworthy DEX environment. For traders, especially professional traders or institutional users, Aster has a series of advantages:

On one hand, under a decentralized architecture, Aster can list assets faster and more flexibly expand trading targets: Aster maintains an open permissionless approach, supporting not only cryptocurrencies but also trading in U.S. stocks, gold, and more. In the future, it will expand to include more types of U.S. stocks and commodities, providing a rich array of trading options on-chain for different traders.

On the other hand, Aster continues to promote refined liquidity management. The market maker program aims to incentivize LPs to fill the gaps in less liquid markets. While significantly optimizing the depth of mainstream cryptocurrencies, Aster will focus on long-tail assets in the future, planning to offer higher commission rewards to small-cap market makers to enhance depth and transaction quality, ensuring that users enjoy a smooth, low-slippage experience regardless of the asset they trade.

Privacy features are a significant differentiating advantage for Aster compared to other Perp DEX platforms. Many users, especially institutional-level traders, do not want all their strategies and positions to be publicly visible on-chain. Aster's Hidden Orders and hidden order system can effectively meet this need, helping to attract more institutional funds.

Additionally, features like 1001x extreme leverage and fee advantages will further create a scale cost difference for large institutions or high-leverage traders.

Beyond the trading experience, traders care more about "earning," which aligns with Aster's core philosophy: Trade & Earn.

Stable returns are a key module for Aster, which aims to provide users, especially institutional users, with more efficient capital utilization through this module. By combining lending, perpetual contracts, and yield pool mechanisms, Aster seeks to improve capital returns while maintaining controllable risks. In the future, Aster will also expand to include more DeFi partners, bringing more yield scenarios.

USDF is the core of Aster's stable return module, serving as collateral for trading, a liquidity asset, and a source of passive income within the Aster trading system. As a delta-neutral yield stablecoin, USDF primarily generates returns by deploying underlying assets into low-risk DeFi protocols.

After the TGE, Aster has also introduced diverse incentive measures for users, continuously conducting Stage 3 and Stage 4 activities, and launching a Double Harvest trading competition with a total prize pool of $10 million, attracting users through rewards for real trading and promoting platform ecosystem growth.

Another noteworthy development for Aster post-TGE is the launch of Rocket Launch, which serves as the core vehicle for promoting Aster's value of "providing liquidity support." Rocket Launch offers high-potential projects a platform that combines trading depth with long-term value. Project teams can set up prize pools on the platform to reach a broader audience, while users gain an entry point to embrace Degen and capture early opportunities. Since its launch, it has already onboarded 5 projects, with a cumulative reward scale exceeding $3 million.

Since the TGE, Aster's growth logic has been validated through concrete data performance:

According to Aster's official data, the user base has exceeded 4.6 million; according to Dune data, Aster's 24-hour trading volume is $2.329 billion, with weekly trading volume exceeding $25.6 billion, capturing over 20% of the Perp DEX market share.

Although multiple data points have declined due to a bear market, they still strongly demonstrate that Aster has firmly established itself in the Perp DEX space, becoming a top-tier presence in the sector.

While continuing to pursue a dual-track path of horizontally expanding revenue and vertically deepening experience, Aster's trading ecosystem has more room for significant growth with the ongoing advancement of its Layer 1 strategy.

Aster Layer 1: A Narrative Upgrade from Perp DEX to Trading Infrastructure

In Leonard's AMA sharing, the most attention-grabbing topic was undoubtedly Aster Layer 1.

Building Layer 1 is akin to building infrastructure; Aster Layer 1 aims to create a chain specifically reconstructed for trading.

Why create a new chain? The core of the issue returns to Aster's original intention: to achieve a truly decentralized trading environment on-chain that still possesses CEX-like experiences.

On one hand, Aster believes that the trading ecosystem must be built on a decentralized foundation, as the verifiability and self-custody capabilities brought by blockchain can lay a strong trust foundation for the entire ecosystem.

On the other hand, for the trading ecosystem, the core of trading lies in order book matching. Aster needs a set of infrastructure that can provide performance close to centralized matching. However, existing public chain solutions for trading matching mostly operate on contracts or off-chain systems, merely treating the blockchain as a place to record data, which presents many limitations.

At the same time, if we purely consider matching performance, Leonard believes that no chain can currently outperform centralized matching engines and databases. Therefore, while pursuing a CEX-like experience, Aster Layer 1 must further find the key to differentiated competition, and privacy is Aster's answer.

In many cases, traders do not wish for their trading strategies to be completely transparent and exposed on-chain, as this could lead to many additional troubles for them. The privacy of strategies becomes increasingly important. The well-known trader James Wynn's experience with targeted attacks on Hyperliquid illustrates this point well, and the rising popularity of Zcash further validates market demand. Providing on-chain privacy options is not only a gap in the current market but also the key to enabling more users and strategies to operate on-chain.

Based on the above, Aster Layer 1 has already begun to take shape:

Designed specifically for trading: Aster Layer 1 aims to directly embed order book logic into the blockchain kernel, writing the entire trading matching process into the consensus and execution layers, including order placement, matching, cancellation, and more. This ensures that the resource scheduling and performance optimization of the entire Aster Layer 1 chain primarily revolve around trading, delivering a trading experience comparable to CEX.

Deep reinforcement of privacy and security mechanisms: Privacy has always been Aster's core differentiating advantage, and the design of Aster Layer 1 continues this privacy feature, protecting trading strategies and user privacy.

Verifiable and self-custodial: Breaking the black box dilemma of centralized trading, trading participants can set trading rules and verify transactions.

The infrastructure improvements brought by Aster Layer 1 will effectively connect various modules of the ecosystem, leading to a series of chain reactions for the Aster trading ecosystem:

On one hand, there is the underlying optimization of the trading experience;

On the other hand, achieving true "verifiable + self-custodial + privacy" will open the door for institutional adoption and propel Aster towards the evolution of "trading infrastructure." Whether it is DeFi projects or traditional financial institutions such as brokerages, exchanges, banks, and payment companies, they can directly build on Aster while replicating Aster's successful model of "combining CEX-level smoothness with DEX trustworthiness":

Aster provides a matching engine + liquidity + risk control, while partner projects provide branding + products + localized operations.

In the future, Aster will start from Asia and further expand into English-speaking markets, continuously broadening its global partner network to achieve rapid expansion of the Aster trading ecosystem.

At the same time, with the launch of Layer 1 and the introduction of staking features, the value cycle of the Aster trading ecosystem will further achieve a closed loop through the $ASTER token.

All Value Concentrated in $ASTER

As the core value carrier of the ecosystem, Aster continuously introduces specific application scenarios for $ASTER, empowering token holders. Currently, the following have been launched:

Governance: Token holders can vote on the development of the protocol, including which liquidity sources to integrate, fee structures, fund management, etc.;

Fee discounts: Users can enjoy discounts when paying trading fees with $ASTER;

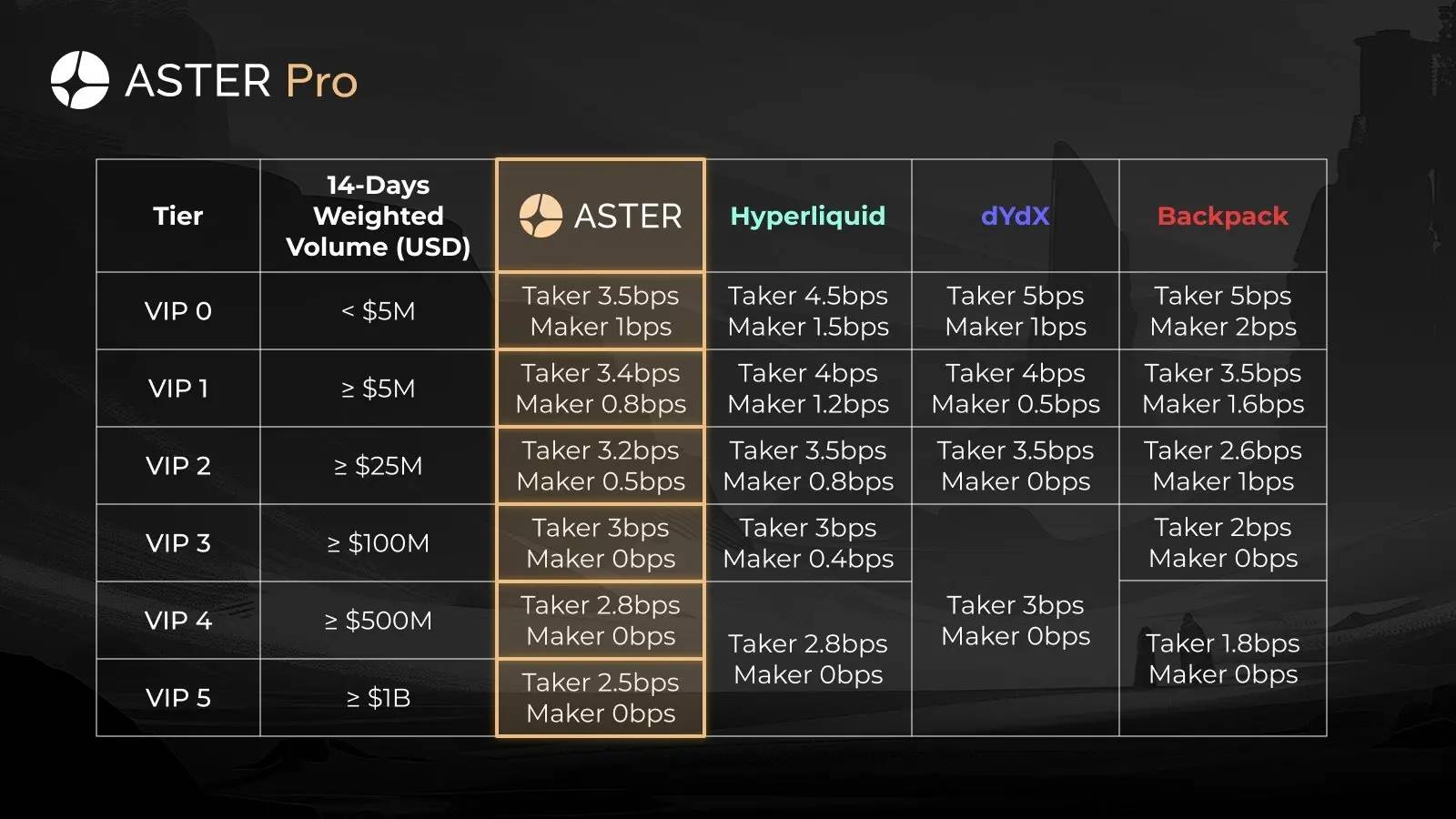

VIP levels: A multi-tier VIP ladder system is established based on trading volume and $ASTER holdings, allowing higher-level users to unlock deeper fee discounts, priority access to liquidity, higher leverage limits, and other benefits;

Token airdrops: Holding or staking $ASTER can enhance the multiplier in Aster Spectra, thus prioritizing access to future airdrops;

Event participation: For example, holding a certain amount of $ASTER is required to participate in Rocket Launch, etc.

In addition, Aster is also negotiating partnerships with some lending protocols to further provide more use cases for the $ASTER token.

At the same time, Aster has also launched a buyback and burn mechanism to further maintain token value:

Previously, Aster announced that 70% - 80% of the trading fees generated during S3 would be used to buy back $ASTER, while stating that 50% of all buyback funds from S2 and S3 would be burned, and 50% would be returned to locked airdrop addresses to reduce token supply and enhance its long-term value.

Currently, all operations are being executed in an orderly manner and are publicly transparent, enhancing community trust.

These series of measures significantly weaken the speculative nature of $ASTER, further transforming holders into long-term co-builders of the ecosystem. Under the virtuous cycle of "more active trading → higher platform revenue → higher buybacks and burns → further empowering holders," a more sustainable positive flywheel is formed.

After the official launch of Layer 1, the value binding between $ASTER and the entire Aster trading ecosystem will become even closer:

On one hand, validator nodes and staking features are expected to launch alongside the Aster Layer 1 mainnet. Due to the near-zero gas design of Layer 1, validator node incentives will be driven by two funding sources: one is the ecological incentive distribution at the protocol layer, and the other is the sharing of trading fees. Thanks to Aster's continuous positive cash flow, it can well support the formation of a stable and sustainable incentive mechanism for the ecosystem, while the trading behavior within the ecosystem is further endowed with the special significance of maintaining network security.

On the other hand, the buyback logic can be directly written into smart contracts for automatic execution, allowing the quantity, price, and address of each buyback to be publicly verifiable, avoiding front-running and information asymmetry, while retaining sufficient algorithmic flexibility to allow different buyback parameters to be used at different stages.

Additionally, with the launch of Aster Layer 1, the governance scenarios for the $ASTER token will be further unlocked. Stakers will participate in on-chain governance voting and ecological parameter decision-making, allowing the token to play a more central governance role within the ecosystem.

Conclusion

From developing Perp DEX products to reconstructing trading infrastructure, Aster is undergoing a narrative evolution of the on-chain trading operating system. This leap from the application layer to the infrastructure layer signifies that Aster is committed to building an ecological soil where countless trading scenarios can thrive.

When global DeFi, brokerages, exchanges, and financial institutions can quickly build their derivative trading platforms based on Aster's infrastructure, the $ASTER token, as the value carrier of this vast ecosystem, will see its potential grow alongside the expansion of the ecological landscape.

It is also worth mentioning that behind this narrative evolution, Aster carries a distinct "Binance system" label: YZi Labs is a supporter behind Aster, and notably, on the evening of November 2, CZ announced that he purchased 2.09 million Aster tokens with his own money, marking a strong endorsement of Aster and indicating that true industry influencers are voting for Aster's future with their actions.

From enhancing trading performance to achieving trading privacy, Aster chose a differentiated competitive path for Perp DEX from the very beginning and quickly captured market share in the Perp DEX space with its actual performance. As a new round of competition in the Perp DEX space unfolds, will Aster once again experience "explosive growth during the TGE phase"?

With Aster Layer 1 expected to meet everyone by the end of 2025, let us always keep our expectations for the future of on-chain trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。