It can be argued that the validity of the current AI bubble narrative rested squarely on Nvidia’s shoulders yesterday, and after revealing stronger-than-expected quarterly performance, it appears the California-based chipmaker met the moment.

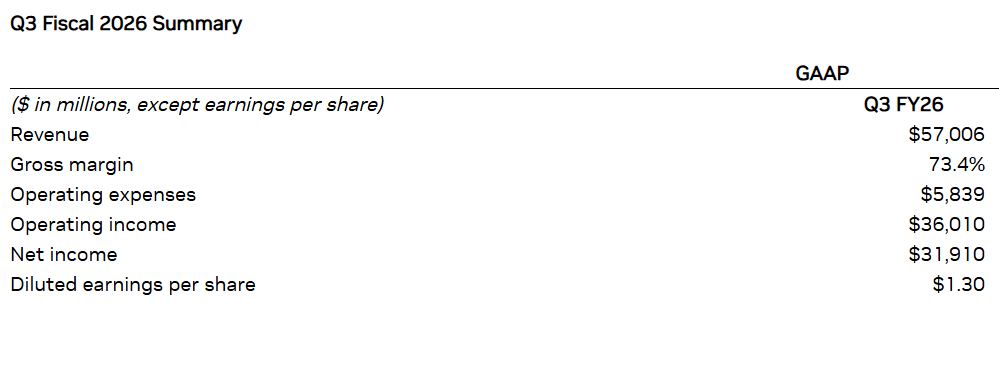

(A snapshot of Nvidia’s Q3 financial performance / Nvidia.com)

Nvidia’s third-quarter financials beat analysts’ predictions, with revenue climbing to $57 billion, a 22% increase from Q2 and a 67% jump from last year. Net income showed a similar trajectory, rising to nearly $32 billion, up 21% from last quarter and 65% from the previous fiscal year. Analysts had projected earnings per share of $1.26, but Nvidia blew past that with earnings of $1.30 per share.

Read more: Why Is Smart Money Dumping Nvidia?

The company’s fourth quarter predictions sound even better. Revenue is expected to reach $65 billion, and gross margin is projected to hit roughly 75%. In other words, Nvidia is not only headed towards higher revenues, it’s also predicting better profitability. Last month, CEO Jensen Huang reportedly said, “This is how much business is on the books. Half a trillion dollars worth so far,” and on yesterday’s investor call, CFO Colette Kress doubled down on that figure.

“There’s definitely an opportunity for us to have more on top of the $500 billion that we announced,” Kress said. “The number will grow.”

But exactly how long will the momentum last? There are many criticisms of the current hype around AI, but one interesting one is the phenomenon dubbed “round-tripping,” where firms like Nvidia make large equity investments in companies such as OpenAI that plan on building expansive data centers that will eventually be powered by, wait for it, Nvidia chips.

“Nvidia is the king of this kind of deal,” says Bryan McMahon, an independent AI researcher. “Like the mythical ouroboros, the snake that eats itself, the AI economy turns equity investments from Nvidia and other companies into purchases of their own products, effectively self-funding their own record revenues.”

Just two days ago, on Tuesday, AI startup Anthropic announced a deal that will see Nvidia dole out $10 billion to help Anthropic deploy its Claude models onto Microsoft’s Azure cloud platform. Microsoft, which also invested an additional $5 billion in Anthropic as part of the deal, uses Nvidia chips to power its Azure cloud system. It appears to be a recycling of capital. “What happens when this recirculation can’t cover for the lack of massive amounts of available cash for the planned AI buildout?” McMahon says.

But so far, that scenario hasn’t played out, and Nvidia has been able to beat expectations and temper the ever-growing concerns of an impending AI bust. The company’s shares climbed 5% following Wednesday’s Q3 results, opening at $194 on Thursday morning, and putting the company’s valuation at $4.7 trillion.

“There’s been a lot of talk about an AI bubble,” Huang said on yesterday’s call. “From our vantage point, we see something very different.”

- Why did Nvidia’s stock jump after earnings?

The company crushed Q3 expectations with $57B in revenue and strong profitability, easing immediate AI-bubble fears. - What is Nvidia forecasting next?

Executives reiterated expectations of more than $500 billion in future revenue, with Q4 sales projected at $65B. - Why are some analysts still cautious?

Critics warn of “round-tripping,” where Nvidia bankrolls AI firms that in turn buy massive amounts of Nvidia chips. - Is the AI bubble narrative dead?

Not yet, Nvidia’s results calmed markets for now, but concerns remain about whether the AI buildout is financially sustainable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。