Original | Odaily Planet Daily (@OdailyChina)

Although stablecoins have frequently faced crises recently, the market's enthusiasm for stablecoin protocols remains undiminished. On November 19, the stablecoin protocol Solomon Labs on Solana announced the conclusion of its 5-day public fundraising, ultimately raising over $102 million from 6,604 investors through MetaDao, making it the second-highest fundraising project for MetaDao, second only to UmbraPrivacy.

In a generally sluggish market, it is indeed commendable for a project to secure substantial financing in the public market, but the success of Solomon Labs left some players on Polymarket unable to celebrate.

This is because there was a prediction on Polymarket titled "Total commitments for the Solomon public sale on MetaDAO," where players could bet on the probability of "Solomon's final fundraising not exceeding a certain amount."

On the afternoon of November 18, less than 12 hours before the fundraising ended, Solomon had only raised $7.25 million, leading some players to confidently bet "no" on the possibility of raising over $40 million in the remaining time. Some conservative players even bet "no" on "Solomon raising over $100 million," with the probability of this outcome remaining around 97% just three hours before the fundraising ended.

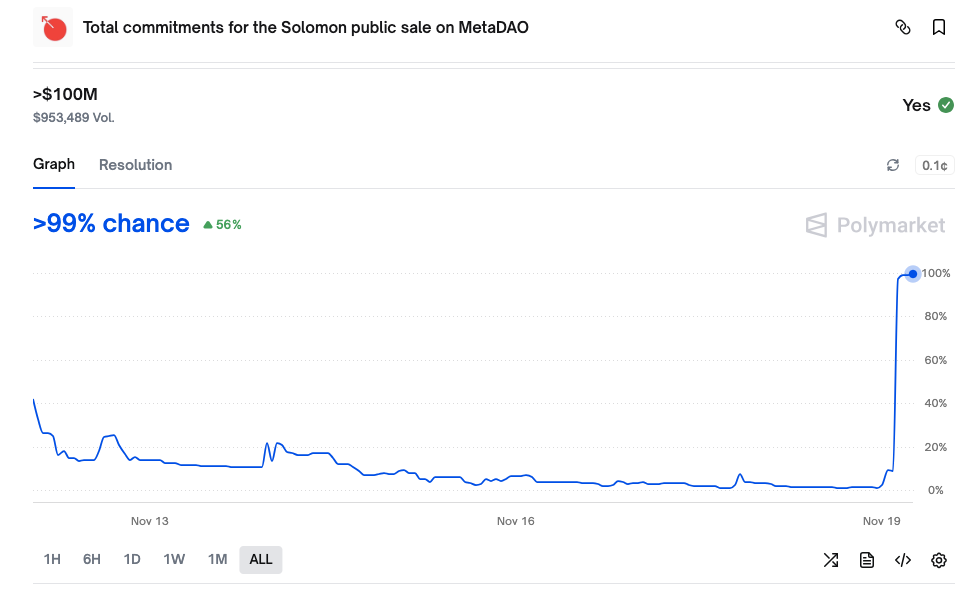

However, in the last hour or two before the fundraising closed, a sudden influx of funds was injected into Solomon's public offering, raising the total to $100 million. The probability of "Solomon raising over $100 million" on Polymarket instantly surged from 1.6% to 99%, catching many Polymarket players off guard, leading them to miss the opportunity to sell and ultimately losing 100% of their principal in pursuit of a 1% "investment return."

The probability of "Solomon raising over $100 million" skyrocketed at the last moment.

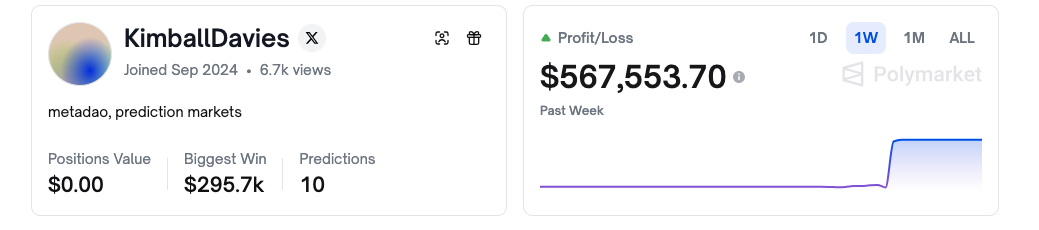

Afterward, Solomon's official account stated that there were no internal personnel or behind-the-scenes trading involved in this public offering. However, this explanation seems somewhat weak, as the community has already identified a Polymarket trader who had bet "yes" on the low probability outcome of Solomon's fundraising, earning over $560,000 in the process.

Insider Trading by the Project Team or Manipulation by Big Players?

The trader, named KimballDavies, joined Polymarket in September 2024, and his slogan is "metadao, prediction markets," possibly indicating that he specializes in prediction events related to metadao.

However, since joining, this trader has only placed bets on two events: one was a $10 bet on "The Federal Reserve will lower interest rates by 50 basis points after November 20204," and the other was a cumulative investment of $65,703.58 on the Solomon public offering event.

Insider Trading by the Project Team?

Starting from November 17, KimballDavies began to buy "yes" bets in batches on "Solomon raising over $40 million," and over the next two days, he also placed "yes" bets on raising over $60 million, $80 million, and $100 million.

This indicates that the trader had been planning his actions for November 19 since November 17, ultimately earning $567,554, with returns nearly 10 times his investment… Therefore, we reasonably suspect that KimballDavies had insider information.

What is even more worth pondering is who owns this account. The general speculation in the community is that this account belongs to the project team, which may have injected tens of millions of dollars at the last moment to earn over $500,000 on Polymarket.

While this possibility exists, the logic seems questionable. First, is $500,000 too "small" for a project that is about to issue tokens? Injecting tens of millions for just over $500,000 seems too petty; second, if such an event occurs, the first party to be suspected is the project team, as they would be damaging their project's reputation for a mere $500,000, which could affect community trust and potentially have adverse effects on future exchange listings. It doesn't seem worth it.

Of course, there is also the possibility that internal team members placed bets privately. The project team may have had a Plan B, where, in the case of low public fundraising, they injected a large amount of their own funds, allowing them to further control token distribution while also conducting a marketing push. Thus, an "intern" who knew about this plan secretly placed bets on Polymarket for all the low-probability events.

Manipulation by Big Players is More Likely

If we rule out the possibility of insider trading by the project team, then the last-minute influx of funds into Solomon's public offering can only be attributed to manipulation by big players, or at least by "assistants" who had prior knowledge of the information.

Perhaps these big players had already considered participating in Solomon's public offering but noticed the predictions regarding the fundraising on Polymarket. Driven by the desire to make money or for "fun," they decided to teach Polymarket players a lesson, showing them that money can manipulate the outcomes of prediction markets.

This is not the first time big players have manipulated event outcomes on Polymarket. In July 2025, during a prediction about whether Ukrainian President Zelensky would wear a suit before July, even though mainstream media reported that Zelensky wore a suit at an event, some UMA whales chose "did not wear" in the final result determination vote, leading to the traders who bet on "did not wear" winning. _([Related reading: _Polymarket once again embroiled in truth controversy: Zelensky's attire will determine the allocation of $140 million])

Polymarket Does Not Predict Crypto Truth

Although there have been cases of manipulation by big players in past prediction markets, the Solomon public offering amount prediction is the first event in the crypto market to raise significant insider suspicion. This incident serves as a signal that as more crypto players join Polymarket and the capital capacity increases, it becomes a prime ground for information asymmetry in the crypto market.

For example, betting on when a project will have its TGE or what the FDV will be at TGE inherently carries an asymmetrical advantage, as the project team and VCs already know the outcome and can even easily alter the event. The more funds in the prediction pool, the stronger the motivation for them to engage in wrongdoing.

In these events, Polymarket does not predict the truth; it merely reflects human greed. For ordinary users, this incident once again highlights the risks of late-stage strategies, as what seems like a 99% probability safe investment may actually be a carefully woven trap waiting for you to fall into. _([Related reading: _95% win rate, yet still losing money: I've experienced the late-stage "investment" trap in prediction markets for you])

In traditional financial markets, insider trading is subject to strict legal penalties once discovered; in the crypto market, money laundering, insider trading, and market manipulation are gradually receiving regulatory scrutiny; however, in the increasingly expanding prediction market sector, there are still few laws and regulations governing these malicious behaviors. Even if someone were to come forward and claim they manipulated the Solomon public offering results, aside from scorn for their antics, what could we do about it?

However, I believe that in the future, countries will regulate behaviors in prediction markets more strictly, and by then, Polymarket may finally be able to predict the truth beyond public events.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。