For a long time, liquidity fragmentation and idle capital have been two major challenges that the DeFi sector has been trying to overcome. The market has thousands of liquidity pools, but hundreds of billions in funds often lie dormant in protocols, making it difficult to gather them into a vibrant flow.

On November 17, DEX aggregator leader 1inch announced the launch of the liquidity protocol Aqua, aiming to play the role of a "waker" and drive DeFi towards more refined liquidity management.

Transitioning from Aggregator to Infrastructure Provider, Aqua is Now Open to Developers

The release of Aqua marks a turning point in 1inch's recent strategic transformation. Initially, 1inch was known in the market for its DEX aggregation capabilities, focusing on integrating optimal trading routes and prices across DEXs for users. However, in recent years, 1inch's strategic focus has shifted from purely retail aggregation services to becoming a B2B infrastructure provider.

The initial release of Aqua is not directly aimed at ordinary retail users but primarily opens developer tools, including SDKs, libraries, and technical documentation. This developer-first strategy indicates that 1inch positions Aqua as a foundational protocol.

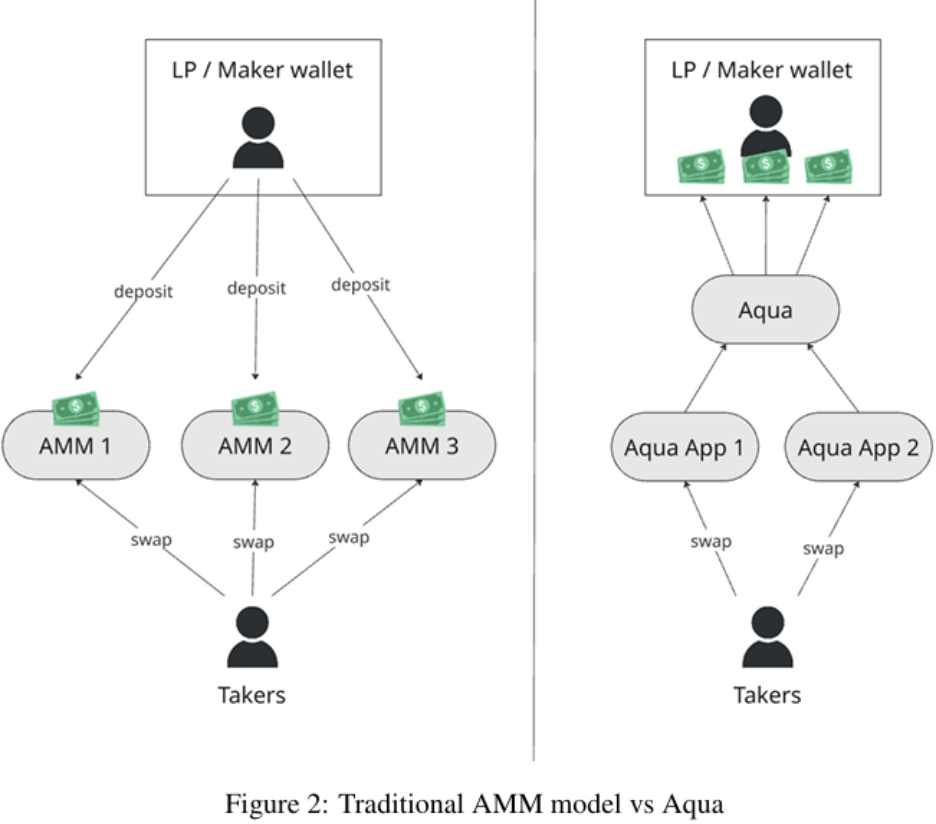

Aqua adopts a brand new shared liquidity model, allowing assets to achieve concurrent and dynamic access and invocation across multiple DeFi protocols, rather than being locked in isolated liquidity pools as in traditional models.

1inch co-founder Anton Bukov emphasized Aqua's core value for market makers at the protocol's launch: "Aqua addresses the liquidity fragmentation issue for market makers by stimulating the multiplier effect of effective capital. From now on, the only limitation on capital efficiency will be the strategy itself."

Another co-founder, Sergej Kunz, positioned Aqua as "the underlying architecture for scalable and capital-efficient DeFi." Traditional DeFi capital efficiency is usually defined by the ability to concentrate capital within an independent liquidity pool, but Aqua is attempting to elevate efficiency to a higher dimension: the ability for concurrent calls across protocols and strategies.

Focusing on Self-Custody AMM, Making Liquidity No Longer Locked

Before Aqua's emergence, mainstream AMM (Automated Market Maker) models widely adopted a "pooled custody" design, requiring LPs (liquidity providers) to deposit and lock their assets in the protocol. However, this design has led to two structural inefficiencies:

- Idle Capital: Locked user funds can only execute a single strategy. According to data disclosed in Aqua's white paper, up to 85% of LP capital remains idle, passively waiting for trades to occur or for price fluctuations.

- Utility Loss: Once assets are locked, they cannot be simultaneously used for other DeFi activities, resulting in high opportunity costs. LPs must make trade-offs between different DeFi activities, leading to capital utility erosion.

Aqua introduces a new metric: TVU (Total Value Unlocked), representing that user funds will no longer be physically locked in DeFi protocols but will achieve dynamic strategy parallelism through an authorization mechanism.

Unlike traditional pooled custody systems, user funds always remain in their own wallets. They are only transferred or used based on pre-set permissions during actual transactions or strategy executions.

Aqua aims to leverage the multiplier effect of capital through a self-custody model. User funds, while maintaining self-custody, can be authorized to participate in multiple DeFi activities. For example, the same asset can simultaneously provide liquidity for an AMM, participate in DAO governance voting of the protocol, and serve as collateral in lending protocols. This design significantly enhances capital efficiency and application scenarios, creating a multiplier effect when used in combination.

Aqua's core technological innovation is the registry authorization system, which decouples asset ownership from usage rights. Aqua itself does not directly hold assets but allocates virtual balances for LPs in different DeFi strategies within an internal registry. These virtual balances will determine the share of underlying assets that each strategy can access. This design allows different DeFi applications (such as AMMs, lending, or stablecoin liquidity pools) to simultaneously call the same underlying capital, achieving shared liquidity without requiring LPs to split or transfer funds across pools.

For LPs, this mechanism also provides granular permissions and risk control mechanisms. They can set clear authorizations and capital limits for each strategy, thereby restricting the usage requirements of funds. Once the parameters of a strategy are set, they become immutable, which helps improve code security and integration reliability, keeping risks within specific, authorized strategy ranges.

Unlike leading DEX protocol Uniswap V3, Aqua primarily focuses on solving the liquidity fragmentation issue across strategies. Uniswap V3's concentrated liquidity model allows LPs to concentrate liquidity deployment within specific price ranges to enhance capital efficiency within the pool, resulting in lower slippage for trades near specific price intervals. However, V3 still requires funds to be locked in a position represented by an NFT (non-fungible token) certificate, leading to continued fragmentation and locking of liquidity.

If V3 addresses the question of "how to use capital more efficiently within a single pool," Aqua addresses "how to allow the same capital to provide liquidity for multiple pools simultaneously," representing fundamentally different technological approaches.

Multiple Limitations Behind Innovation, Token Yet to Benefit

Despite Aqua's numerous technological innovations, its architectural design also introduces new risks and variables.

First is the complexity and latency of transactions. Unlike the complexity of traditional AMM single strategies, Aqua's shared liquidity model involves interactions with multiple strategies, leading to increased transaction complexity, which may cause delays, especially in large or high-frequency trades, affecting user experience.

Second is path dependency loss. When multiple strategies simultaneously call the same underlying asset, but the actual wallet balance is lower than the sum of all strategies' promised virtual balances, the transaction will roll back. However, Aqua will not automatically pause strategy quotes, potentially locking in unfavorable exposures during price fluctuations, similar to amplified impermanent loss, requiring LPs to monitor in real-time and manually withdraw strategies.

Third is security vector risk. 1) Due to the registry's reliance on ERC-20 authorization, which is immutable, strategy parameters cannot be modified once deployed. Initial configuration errors cannot be reversed, meaning that a 100% audit must be conducted before launch; otherwise, it will run with permanent flaws. 2) Although self-custody reduces the single-point risk of smart contract vulnerabilities, malicious or buggy strategies may still withdraw funds within the user's authorization range.

Finally, there is a lack of token value capture. The white paper emphasizes that Aqua will feed back into 1inch products, deepening ecological liquidity. As a turning point in 1inch's infrastructure transformation, Aqua may indirectly enhance 1inch's usage by increasing aggregator call volumes, thereby supporting the demand for the 1INCH token. However, the white paper does not mention the direct role of 1INCH, such as fee burning or direct sharing, which may limit the token's appreciation potential.

Aqua points to a direction for DeFi liquidity management: shifting from "how much to lock" to "how much to use," but an unknown direction also means challenges in implementation. After the front-end launch in Q1 2026, the market will validate the real data—will it be a feast of capital efficiency or another narrative overwhelmed by complexity? Until the answer is revealed, a rational approach and bold experimentation are currently the most prudent paths.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。