The early capital formation methods are undergoing a profound structural transformation. The Internet Capital Markets (ICM) are redefining how funds are aggregated on the internet, shifting capital formation from traditional gatekeeping systems to a more open, transparent, and globalized model. It constructs a new pathway from the germination of ideas to becoming publicly listed companies through four consecutive and interconnected layers—Early Formation, Community Launch, Market Infrastructure, and Real-World Asset Bridges. Bloom Protocol, The Meteorite Collective, and Meteora jointly propose this research, aiming to systematically depict this rapidly maturing financial stack.

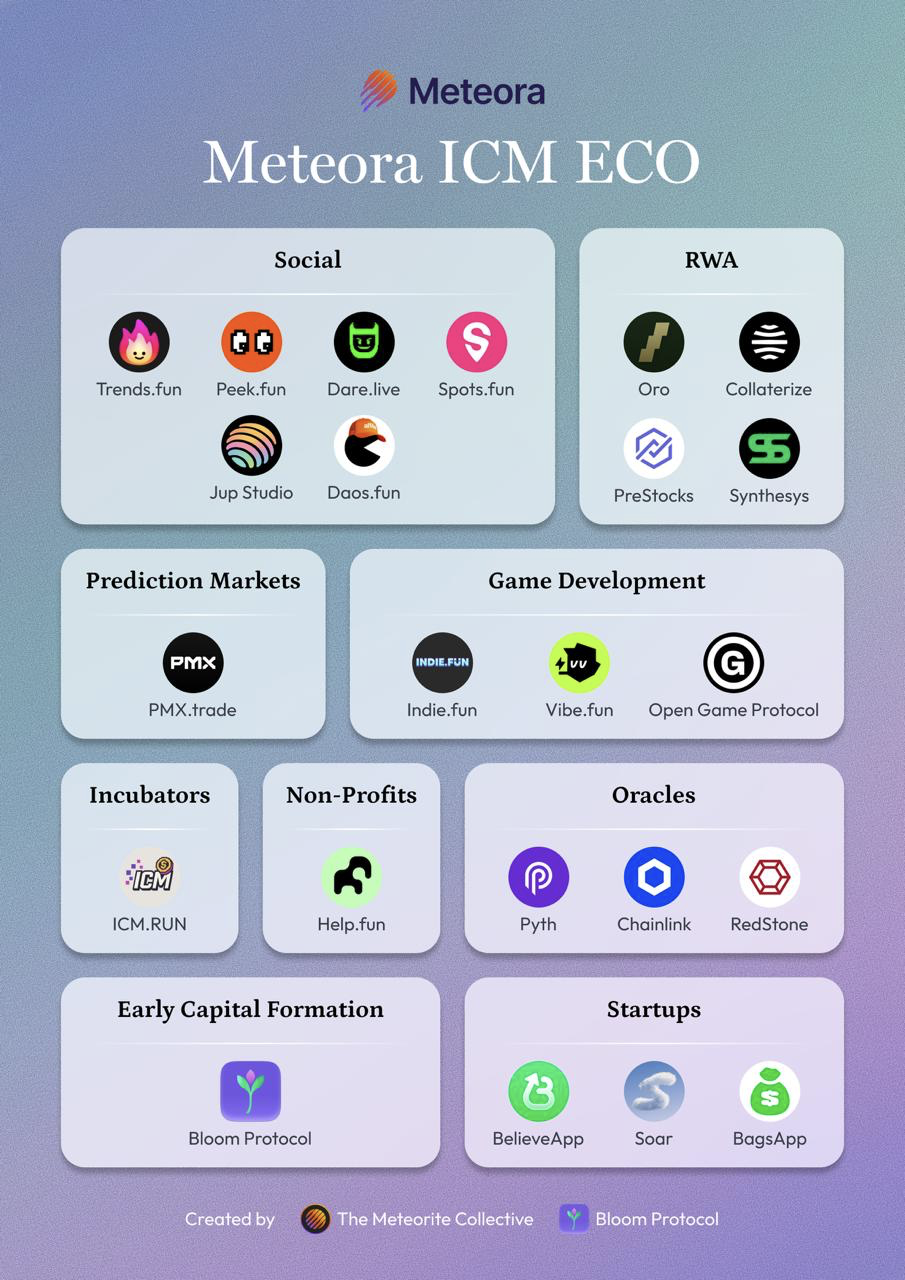

In this system, Bloom Protocol focuses on the topmost "Early Formation Layer," responsible for identifying and validating genuine community support; Meteora plays a key role in the "Community Launch Layer," allowing attention to be quickly converted into tradable capital; the infrastructure of Solana provides a system-level execution environment, ensuring fairness and consistency in transactions; while the Real-World Asset Bridges layer connects on-chain capital with the traditional financial system, enabling the growth of the Internet Capital Markets to extend into the trillions of dollars of the real economy.

The ICM Market Size is Rapidly Expanding

Between 2024 and 2025, the growth rate of the ICM-related ecosystem far exceeds industry expectations. Token Launch platforms and ICM-related infrastructure collectively handled hundreds of billions of dollars in transaction volume, with many platforms demonstrating stable and sustainable revenue capabilities.

Among these platforms, Meteora's DLMM (Dynamic Liquidity Market Maker) stands out particularly. It propelled Solana's liquidity infrastructure from less than $1 billion in TVL to over $20 billion in cumulative transaction volume within two years, gradually becoming one of the most efficient adaptive liquidity mechanisms in the crypto space. Meanwhile, a series of ICM-focused Launchpads such as BAGS, Believe App, and Help.fun have facilitated hundreds of Token issuances, contributing massive liquidity to both primary and secondary markets.

According to data from Blockworks Research and Token Terminal, the revenue of the Launchpad category is expected to grow more than tenfold year-on-year by 2025; leading platforms have annual fee revenues ranging from $5 million to $15 million. Although most of the current ICM traffic comes from meme and cultural tokens, its underlying structure is reminiscent of the early days of DeFi: first experiments, then scaling, and finally solidifying into infrastructure. The difference this time is that the driving force behind liquidity is not mining incentives, but attention itself—narratives, communities, and culture have become the new asset pricing foundation in on-chain markets.

Overall, between January and November 2025 alone, the ICM-driven transaction volume in Solana and other ecosystems has exceeded hundreds of billions of dollars, marking a scale where attention is moving towards a mature financial vernacular, while the Internet Capital Markets are in the early stages of rapid formation.

The Four Stages of Internet Capital Markets

As AI drives product development costs to extremely low levels and the number of "individual entrepreneurs" skyrockets, competition among founders intensifies. In an era where products are easy to manufacture, the real bottleneck shifts from "creating a product" to "how to raise early capital and gather genuine community belief." Traditional fundraising methods—whether VC or public offerings—cannot meet this speed and scale. Founders need a faster, fairer, and more market-demand-driven way of early capital formation.

In this context, a new financial architecture begins to emerge: Internet Capital Markets (ICM). It is built on a simple yet powerful premise: anyone, anywhere, can convert genuine community support into tradable capital.

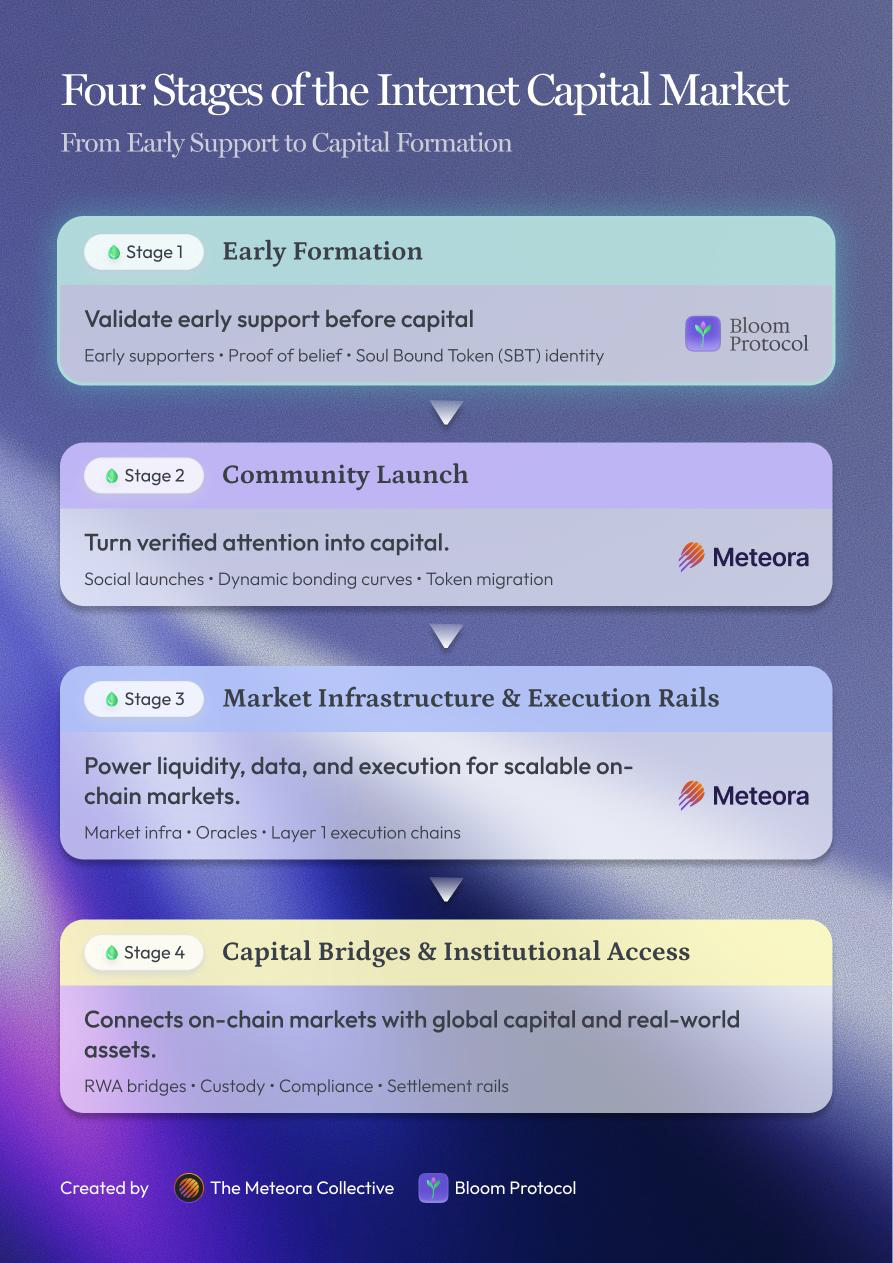

The architecture of ICM consists of four interconnected layers:

- Early Formation—making genuine support visible and verifiable;

- Community Launch—allowing attention to be instantly converted into capital;

- Market Infrastructure—ensuring sustainable market depth for capital formation;

- Real-World Asset Bridges—connecting on-chain capital with the trillion-dollar traditional financial system.

These four stages reinforce each other, ultimately forming a complete and sustainable capital formation system.

Stage One: Early Formation—The Missing Foundation of the Past

Although hackathons, developer communities, and educational platforms have made the birth of product prototypes easier, very few mechanisms can convert initial community belief into sustainable momentum. This is precisely the stage where Bloom Protocol intervenes.

Bloom is designed specifically for the new generation of "product-oriented founders"—in an era where AI drives product development costs close to zero, and the integration of Web2 and Web3 becomes increasingly natural in the hands of builders. Bloom provides a complete mechanism for teams to gather early belief, validate market demand, and ultimately convert this early support into capital.

Bloom's mission system (Bloom Missions) and soulbound tokens (SBT) form the key foundation. Through Bloom AI Co-Pilot, teams can quickly design tasks to test PMF and attract supporters who genuinely understand the product's value. Supporters receive SBTs with "future utility," which can both prove their early belief and later convert into assets, achieving a flexible transition from "community participation" to "capital formation."

Bloom's role in ICM is to provide downstream ecosystems (like Meteora) with "validated products with early traction." When these projects enter the Community Launch stage, they can immediately access on-chain liquidity, allowing attention to be directly converted into capital. The entire structure is cross-ecosystem compatible, integrating with any network and issuance system that values product-driven teams.

Stage Two: Community Launch—Turning Attention into Capital

Once the early support layer ensures that projects possess quality and genuine participation in the initial stages, the Community Launch stage takes on another critical task: transforming these validated beliefs into capital that everyone can participate in. It is at this stage that the revolution of Internet Capital Markets first presents itself in a truly visible form to the public.

In the Solana ecosystem, this breakthrough comes from the new liquidity architecture pioneered by Meteora—centered around dynamic bonding curves and open liquidity modules. Meteora significantly lowers the technical and financial barriers to token creation, allowing any project to launch in a fairer and more efficient manner, thus laying an important foundation for the current wave of community-driven on-chain issuance.

Trends (trends.fun) showcases the core logic of attention capitalization. Popular trends or memes are no longer just fleeting signals on social media but can be instantly minted into tokens. The explosion of Suolala is a typical case: a meme created by the Chinese community that spread into a cross-cultural internet character economy within days; holders collaborate to produce fan content, extend across chains, and even create charitable versions. Once attention is priced, the community can collectively own and spread narratives, achieving a scale effect that traditional internet could hardly reach. This community-driven attention assetization lays the groundwork for the next stage: not only can culture and memes be priced, but more serious products and companies can also be guided to the on-chain capital market following the same logic.

More Companies Getting Involved

As the Meteora-based issuance model matures, more teams are beginning to explore bringing genuinely revenue-generating startups into the on-chain capital market. Platforms like ICM.RUN, Help.Fun, Soar, and Crafts are actively promoting project screening, optimizing issuance processes, and standardizing capital pipelines, allowing "company-level" projects to enter ICM more smoothly.

Help.Fun applies Meteora's curve issuance mechanism in a permissioned, mission-driven Launchpad. While ensuring project quality, it centers on charity, directing issuance proceeds towards charitable purposes, forming a "controlled, sustainable" issuance model. ICM.RUN further expands the ecosystem through a DAO incubation model, providing projects with community guidance, ecological collaboration opportunities, and early market exposure, allowing teams to establish a solid foundation before entering the public market.

As the Internet Capital Markets gradually mature, the next stage is no longer limited to "issuing tokens," but rather moving the entire company structure on-chain. MetaDAO represents this shift, redefining how new teams launch, govern, and finance within the ICM framework.

Through a governance system based on futarchy (prediction market governance), MetaDAO shifts decision-making from centralized committees to prediction markets that assess whether proposals can enhance protocol value. For startups and early teams, this mechanism provides a highly transparent path, allowing decisions on ownership distribution, treasury capital allocation, and funding for new projects to be based on measurable performance rather than hierarchy and political considerations.

In practice, MetaDAO serves as both an on-chain accelerator and governance shell, containing modules such as automated market making (AMM) and treasury management, making its operation a self-contained economic system. Any team can leverage these modules to quickly build their own "internet-native company" driven by programmable incentives, without relying on cumbersome traditional oversight systems.

Thus, MetaDAO marks a critical turning point for Internet Capital Markets, transitioning from "project issuance" to "programmable company formation," making it a self-operating ecosystem with institutional potential.

These cases collectively illustrate that Meteora's liquidity architecture opens the door for creators to convert validated beliefs into tradable capital, laying the foundation for the next stage of ICM—cross-ecosystem, sustainable market infrastructure.

As more ecosystems adopt similar foundational modules, the paradigm provided by Meteora also becomes an important blueprint for the evolution of Internet Capital Markets, enabling a complete closed loop from "belief formation" to "capital formation" in a continuous and interoperable process.

Stage Three: Market Infrastructure—From Liquidity to Durability

Community issuance proves that "capital can form at the speed of social media," but for the market to exist long-term, deeper microstructural issues must be addressed: order matching, fairness, latency, liquidity distribution, and more. These issues are NASDAQ-level challenges, and Solana views them as core components of its roadmap, not just an enhancement of TPS.

Building on Solana's foundational execution, Metaplex, Meteora, and MetaDAO are creating tools that can truly be utilized by builders and users.

Metaplex, as the most mature asset issuance framework on Solana, has created over 920 million digital assets and processed over $10 billion in cumulative transactions. The Genesis Protocol, launched in 2025, ushered in the era of structured issuance, with its auction mechanism effectively reducing MEV and bot interference, making the issuance process fairer and more transparent. The successful issuance of DeFiTuna's $TUNA and the Portals project demonstrates the positive effects of structured ICM launches: more reasonable price discovery and more equitable participation.

Meteora addresses the most critical issue after token release—liquidity decay. DLMM maintains continuous liquidity for tokens throughout their growth cycle through an adaptive mechanism, allowing many community tokens that would otherwise quickly die to maintain market depth over the long term.

MetaDAO completes this structure by utilizing prediction market-based governance, allowing all capital to enter a cyclical system, creating a closed and self-reinforcing system of fundraising, liquidity, and governance.

Together, these three components form a closed-loop ICM infrastructure that encompasses asset issuance, market liquidity, and governance coordination, guiding the on-chain market towards an "institutional-level" evolution.

Stage Four: Real-World Assets and Traditional Bridges—Connecting Trillions of Dollars

The final layer involves whether ICM can truly connect to the real-world economy.

In 2025, Wall Street began to substantively enter the on-chain space: BlackRock announced the launch of RWA funds based on on-chain tokens; CME completed the first batch of Sol and XRP options trading; Western Union released the Solana-based stablecoin USDPT, bringing its network of millions of users' remittances on-chain.

On-chain RWA platforms are also rapidly maturing: Backed's xStocks has tokenized over sixty U.S. stocks and ETFs, enabling 24/7 trading; Collaterize and Synthesys provide institutional-level asset tokenization and on-chain fund management; PreStocks brings Pre-IPO equity into ICM, providing liquidity for private equity.

Meanwhile, financial institutions in East Asia and Japan are also beginning to build on-chain treasury infrastructure (cash layer), such as tokenized money market funds issued by Chinese fund companies, billions of dollars in assets managed by Securitize, and on-chain treasury mechanisms from DFDV JP, all allowing on-chain projects to manage treasury storage and liquidity safely and compliantly.

Visa and Mastercard have also integrated USDC settlement into their systems; Worldcoin provides over ten million verified human identities; licensed brokers like Futu are bringing tokenized assets into traditional channels. The infrastructure of the bridge layer has already taken shape, enabling ICM to directly interconnect with traditional capital systems.

Conclusion: A New Capital Order is Taking Shape

The Internet Capital Markets are rapidly becoming a parallel structure to traditional capital formation methods.

Bloom Protocol is responsible for making upstream supporters' beliefs clean, genuine, and verifiable; the Meteora ecosystem instantly converts this "validated attention" into open liquidity; Solana's infrastructure ensures these markets possess institutional-level execution quality; and the RWA bridges extend all of this into the real-world financial system.

For founders, this means no longer needing to wait for VC approval or go through a lengthy IPO process;

For supporters, early participation is no longer just emotional investment, but a contribution that can be recorded, respected, and valued;

For institutions, this represents a transparent, programmable, and global market system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。