Some days in the crypto market feel like turning pages; others feel like re-reading the same chapter. Monday, Nov. 17, belonged to the latter. Investors once again leaned toward defensive positioning, pulling hundreds of millions of dollars from bitcoin and ether ETFs, even as solana quietly held its ground. The momentum patterns of the past week not only continued, they sharpened.

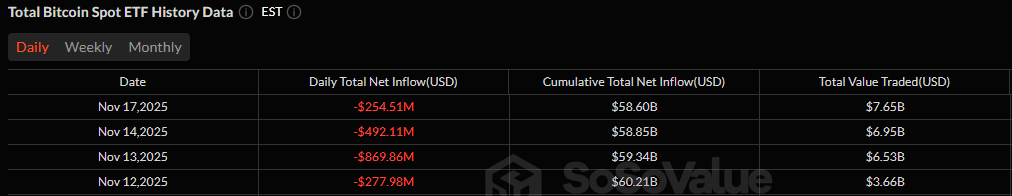

Bitcoin ETFs registered their fourth straight day of exits, closing the session with $254.51 million in outflows. Blackrock’s IBIT remained the largest pressure point, losing $145.57 million as its institutional flows swung decisively negative. Grayscale’s GBTC followed with a $34.52 million decline, while ARK & 21Shares’ ARKB shed $29.67 million.

Vaneck’s HODL also struggled, recording $23.32 million in redemptions. Fidelity’s FBTC retreated by $11.97 million, and Bitwise’s BITB saw $9.46 million leave its books. Despite the selling, trading activity remained strong, with $7.66 billion in value exchanged, although net assets declined again to $121.01 billion.

Four days of consecutive outflows for bitcoin ETFs totaling $1.9 billion

Ether funds endured a similar fate. Ether ETFs posted their fifth consecutive day of outflows, led by Blackrock’s ETHA with a substantial $193.04 million withdrawal. Fidelity’s FETH added another $2.98 million to the red side of the ledger. Grayscale’s Ether Mini Trust and ETHE did manage inflows of $10.75 million and $2.47 million, respectively, but the buying wasn’t enough to counterbalance the broader exodus. Total trading volume hit $2.91 billion, while net assets slipped to $18.76 billion.

Read more: Bitcoin, Ether ETFs Bleed $1.8 Billion as Solana Stays Green

Yet again, solana ETFs broke away from the gloom. Bitwise’s BSOL attracted a healthy $7.31 million inflow, and Grayscale’s GSOL added $947,800, extending the category’s multi-week winning streak. Activity remained modest at $34.67 million traded, but net assets held firm at $513.48 million.

It was another day where bitcoin and ether stumbled, but solana refused to follow. Markets may be cooling, but investor conviction, at least for one asset, appears to be warming.

FAQ🌍

- Why did Bitcoin and Ether ETFs see fresh outflows?

Investors continued defensive positioning, pulling over $430 million combined from BTC and ETH ETFs amid ongoing risk-off sentiment. - Which funds were hit the hardest?

Blackrock’s IBIT and ETHA led the outflows again, driving most of the day’s losses for both asset classes. - Did any crypto ETF category remain positive?

Yes, solana ETFs posted another day of steady inflows, extending their multi-week streak. - What does trading activity indicate?

High trading volumes across BTC, ETH, and SOL ETFs show strong participation despite persistent outflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。