Hyperliquid targets professionals, Aster aims at retail and Asian markets, Lighter focuses on technology, and EdgeX caters to institutional users.

Author: Stacy Muur

Translation: Deep Tide TechFlow

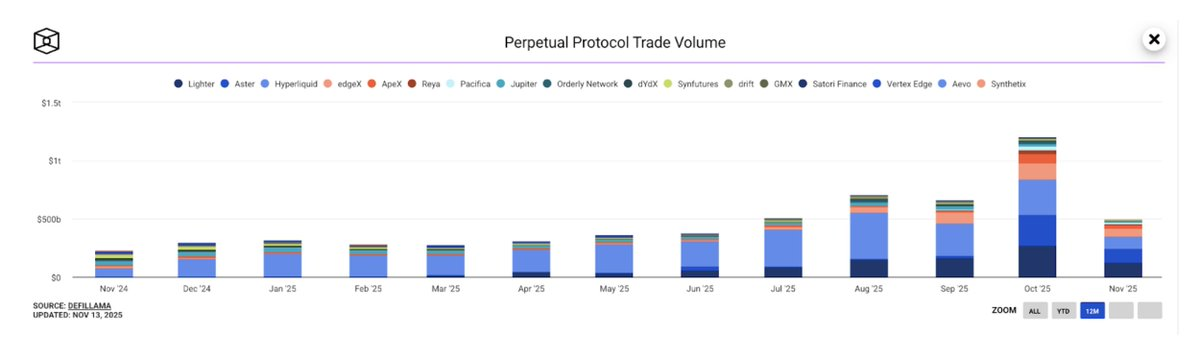

In 2025, the decentralized perpetual contract trading market (Perp DEX) experienced explosive growth. In October, the monthly trading volume of this market surpassed $1.2 trillion for the first time, attracting widespread attention from retail traders, institutional investors, and venture capital firms.

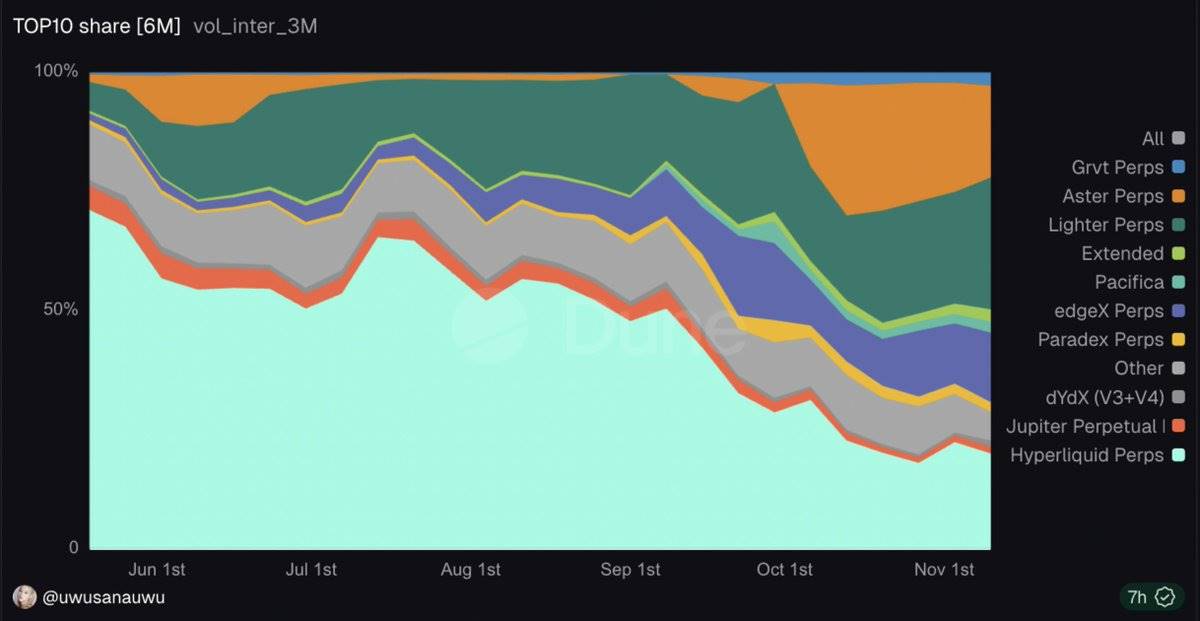

Over the past year, Hyperliquid has maintained dominance, with its market share peaking at 71% in May, accounting for the on-chain perpetual contract trading volume. However, by November, Hyperliquid's market share had plummeted to 20%, while new competitors rapidly emerged to capture market share:

Lighter: 27.7%

Aster: 19.3%

EdgeX: 14.6%

As this rapidly changing ecosystem evolves, four major players have emerged, fiercely competing for industry dominance:

@HyperliquidX – The seasoned leader in on-chain perpetual contracts

@Aster_DEX – A rocket with massive trading volume but ongoing controversies

@Lighter_xyz – The disruptor with zero fees and native zk (zero-knowledge proof) technology

@edgeX_exchange – The low-profile, institution-friendly dark horse

This in-depth investigation will analyze these platforms from multiple dimensions, including technology, data, controversies, and long-term viability, helping readers distinguish hype from reality.

Part One: Hyperliquid – The Undisputed King

Why Can Hyperliquid Dominate?

Hyperliquid has established itself as the leading decentralized perpetual contract exchange, with a market share peak of 71%. Although competitors have temporarily captured media headlines with explosive trading volume growth, Hyperliquid remains a core pillar of the perpetual contract decentralized exchange (Perp DEX) ecosystem.

Technical Foundation

Hyperliquid's dominance stems from its revolutionary architectural decision – building a custom Layer 1 blockchain specifically designed for derivatives trading. The platform employs the HyperBFT consensus mechanism, supporting sub-second order confirmations and a performance of 200,000 transactions per second, even surpassing many centralized exchanges.

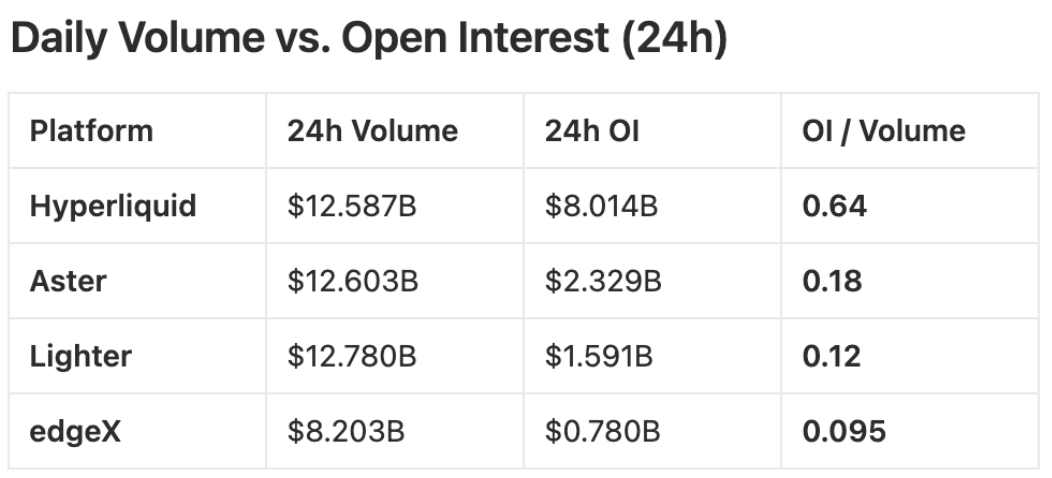

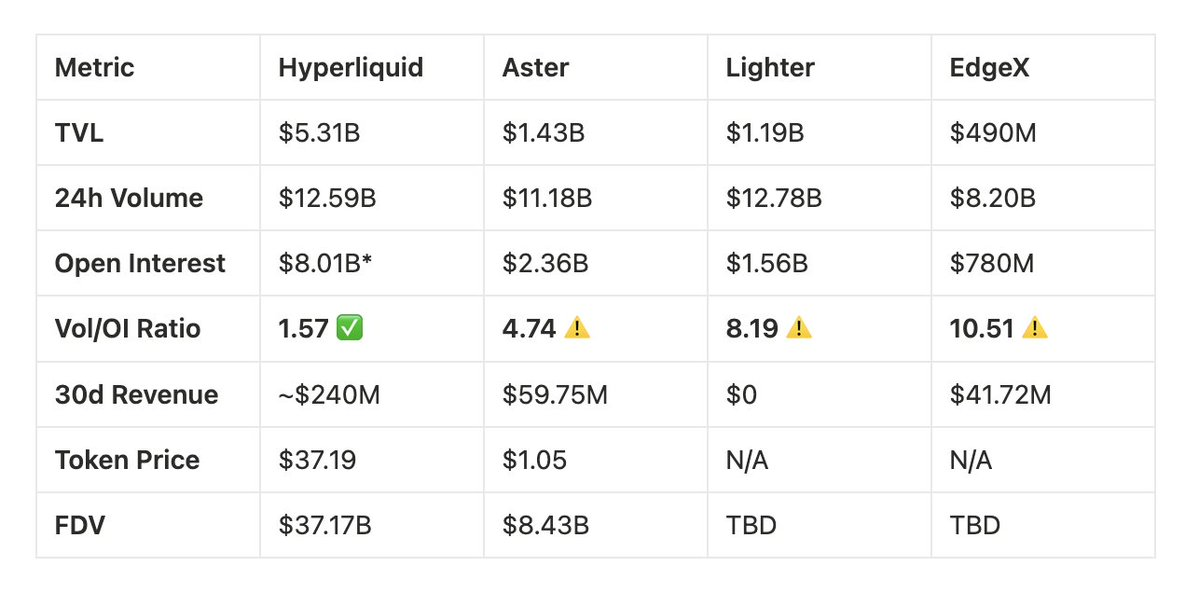

The True Picture of Open Interest

While competitors often grab headlines with eye-catching 24-hour trading volume data, the metric that truly reveals capital deployment is open interest (OI), which is the total value of outstanding perpetual contracts.

Trading volume represents activity

Open interest reflects long-term capital commitment

According to data from 21Shares, as of September 2025:

Aster's trading volume accounted for about 70%

Hyperliquid's trading volume temporarily dropped to about 10%

However, this advantage is limited to trading volume, which is the easiest metric to distort through incentives, rebates, frequent trading by market makers, or wash trading activities.

The latest 24-hour open interest data shows:

Hyperliquid: $8.014 billion

Aster: $2.329 billion

Lighter: $1.591 billion

EdgeX: $780.41 million

Total open interest (top four): $12.714 billion

Hyperliquid market share: approximately 63%

This means that Hyperliquid holds nearly two-thirds of the open positions among major perpetual contract platforms, exceeding the combined total of Aster, Lighter, and EdgeX.

Open Interest Market Share (24-hour data)

Hyperliquid: 63.0%

Aster: 18.3%

Lighter: 12.5%

EdgeX: 6.1%

This metric reflects the capital that traders are willing to hold overnight, rather than just trading frequently for incentives.

Hyperliquid: High open interest/trading volume ratio (approximately 0.64) indicates a significant amount of trading flow converting into active and sustained positions.

Aster & Lighter: Low open interest/trading volume ratios (approximately 0.18 and 0.12) indicate high turnover rates but less capital held, which is often a sign of incentive-driven activity rather than stable liquidity.

Comprehensive Analysis:

Trading volume (24 hours): Reflects short-term activity

Open interest (24 hours): Reflects capital at risk

Open interest/trading volume ratio (24 hours): Indicates the authenticity of activity and whether it is incentive-driven

Based on all open interest-based metrics, Hyperliquid is the structural leader:

Highest open interest

Largest proportion of committed capital

Strongest open interest/trading volume ratio

Open interest exceeds the total of the other three platforms combined

Trading volume rankings may fluctuate, but open interest reveals the true market leader, which is Hyperliquid.

Proven in Practice

October 2025 Liquidation Event

During the liquidation event in October 2025, the market liquidation scale reached $19 billion, while Hyperliquid maintained perfect operational stability in response to the surge in trading volume.

Institutional Recognition

21Shares has submitted product applications related to Hyperliquid (token code: HYPE) to the U.S. Securities and Exchange Commission (SEC) and has listed a regulated HYPE ETP (exchange-traded product) on the SIX Swiss Exchange. These developments have been reported by CoinMarketCap and other market data tracking platforms, indicating increasing institutional access to HYPE. Meanwhile, the HyperEVM ecosystem is also expanding, but public data has yet to confirm the specific authenticity of its claimed "180+ projects" or "$4.1 billion total locked value (TVL)."

Conclusion: Based on current application records, exchange listings, and ecosystem growth reported by platforms like CoinMarketCap, Hyperliquid demonstrates strong momentum and increasing institutional recognition, further solidifying its position as a leading decentralized derivatives platform.

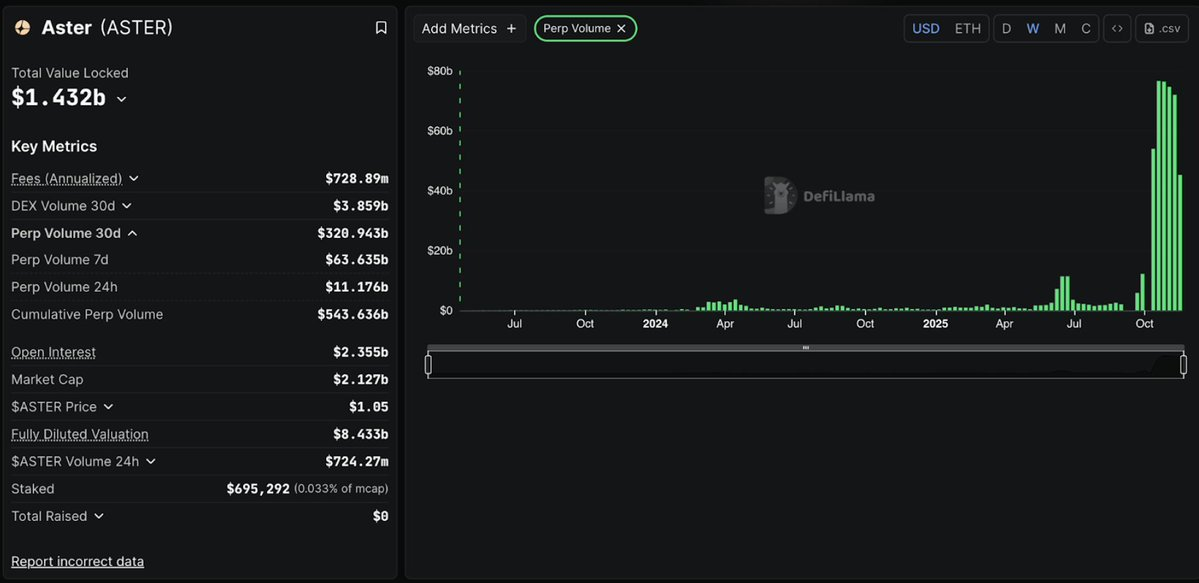

Part Two: Aster – Explosive Growth Amid Scandals

Aster is a multi-chain perpetual futures exchange that launched in early 2025, with a clear goal: to provide users with high-speed, high-leverage derivatives trading across BNB Chain, Arbitrum, Ethereum, and Solana without the need for asset cross-chain bridging.

The project did not start from scratch but originated from the merger of Asterus and APX Finance at the end of 2024, combining APX's perpetual contract engine with Asterus's liquidity technology.

Explosive Growth

Aster launched on September 17, 2025, at a price of $0.08 and skyrocketed to $2.42 within a week, an increase of 2800%. Daily trading volume peaked over $70 billion, briefly dominating the entire decentralized perpetual contract market.

The "rocket fuel" driving this growth came from Binance founder Changpeng Zhao (CZ). CZ supported Aster through YZi Labs and endorsed it on social media, causing the token price to soar. In the first 30 days post-launch, Aster's trading volume exceeded $320 billion, briefly capturing over 50% of the perpetual contract market.

DefiLlama Delisting Incident

On October 5, 2025, DefiLlama (the most trusted data source in the crypto industry) removed Aster's data due to its trading volume being almost perfectly aligned with Binance's – a 1:1 match.

Real exchange data typically shows natural fluctuations, while perfect correlation indicates one issue: artificially generated trading data.

Evidence:

Trading volume patterns completely replicate Binance (including all trading pairs like XRP, ETH, etc.)

Aster refused to provide trading data to verify the authenticity of trades

96% of ASTER tokens are controlled by just six wallets

Trading volume/open interest ratio exceeds 58+ (healthy values should be below 3)

After that, the price of the ASTER token immediately plummeted by 10%, dropping from $2.42 to the current approximately $1.05.

Defense of Aster

CEO Leonard claims that the correlation in trading volume is merely the result of "airdrop farmers" hedging on Binance. But if this is true, why refuse to provide data to prove it?

Although Aster was re-listed on DefiLlama a few weeks later, DefiLlama warned that it "remains a black box, and we cannot verify the authenticity of the data."

Actual Highlights of Aster

To be fair, Aster does offer some practical features, including:

1001x Leverage: Extremely high leverage that attracts high-risk traders.

Hidden Orders: Supports discreet trading, enhancing trading privacy.

Multi-chain Support: Covers BNB Chain, Ethereum, and Solana, facilitating cross-chain operations for users.

Yield-bearing Collateral: Allows users to earn yields by staking assets. Additionally, Aster is building a privacy-preserving chain based on Zero-Knowledge Proofs—Aster Chain. However, no amount of good technology can cover up the issue of false data.

Conclusion: Evidence is Conclusive

The following facts cannot be ignored:

✅ Perfect correlation with Binance = Wash Trading

✅ Refusal of transparency = Concealment of issues

✅ 96% of tokens controlled by 6 wallets = Highly centralized

✅ DefiLlama delisting = Trust completely collapsed

Aster has drawn significant value through CZ's promotion and artificially generated trading volume but has failed to establish a true infrastructure. It may survive due to Binance's support, but its credibility has been permanently damaged.

For Traders: High risk. You are betting on CZ's story rather than real growth. It is advisable to set strict stop-loss points.

For Investors: Avoid. Too many risk signals, and there are better options in the market (like Hyperliquid).

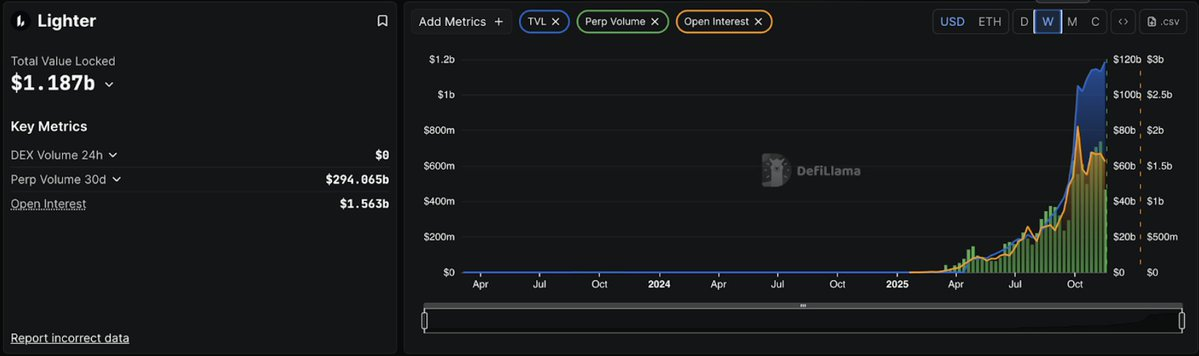

Part Three: Lighter—Potential in Technology, Doubts in Data

Technical Advantages

Lighter's technical background is impressive: founded by former Citadel engineers, it has received support from Peter Thiel, a16z, and Lightspeed, raising $68 million with a valuation of $1.5 billion. It uses Zero-Knowledge Proofs to cryptographically verify each transaction, ensuring transparency and security.

As a Layer 2 (L2) on Ethereum, Lighter inherits Ethereum's security and provides users with fund protection through an "Escape Hatch" mechanism—allowing users to retrieve funds via smart contracts even if the platform fails. In contrast, Layer 1 (L1) on app chains typically lacks this security guarantee.

Lighter launched on October 2, 2025, and within just a few weeks, its total locked value (TVL) reached $1.1 billion, with daily trading volume stabilizing at $700-800 million and over 56,000 users.

Zero Fees = Aggressive Strategy

Lighter charges 0% fees for traders (both Makers and Takers), making it completely free. This strategy makes it irresistible for all fee-sensitive traders while instantly diminishing the appeal of competing platforms.

Its strategy is straightforward: capture market share through an unsustainable economic model, cultivate user loyalty, and then turn a profit.

The Test on October 11

Just ten days after the mainnet launch, the largest liquidation event in cryptocurrency history occurred, resulting in $19 billion in liquidations.

Positive Aspects:

The system operated normally during 5 hours of market chaos.

The LLP (Liquidity Pool) provided liquidity support as competitors exited.

Negative Aspects:

- The database crashed after 5 hours, causing the platform to be down for 4 hours.

Concerning:

- The LLP incurred losses, while Hyperliquid's HLP and EdgeX's eLP achieved profits.

Founder Vlad Novakovski's Explanation: A database upgrade was originally planned for Sunday, but market volatility on Friday caused the old system to crash prematurely.

Trading Volume Issues:

Data indicates clear signs of point farming behavior:

24-hour Trading Volume: $12.78 billion

Open Interest: $1.591 billion

Trading Volume/OI Ratio: 8.03

Healthy Ratio: Typically below 3; above 5 is concerning; 8.03 is at an extreme level.

Comparative Data:

Hyperliquid: 1.57 (organic trading)

EdgeX: 2.7 (moderate level)

Aster: 5.4 (concerning)

Lighter: 8.03 (clear signs of point farming behavior)

Traders generate $8 in trading volume for every $1 deployed—frequent rapid flipping to earn points rather than holding real positions.

30-day Data Confirmation: Cumulative trading volume $294 billion vs. cumulative open interest $47 billion = 6.25 ratio, still far above reasonable levels.

Airdrop Questions

Lighter's point program is highly aggressive. User points will convert to LITER tokens during the token generation event (TGE, expected in Q4 2025 or Q1 2026). Currently, the over-the-counter market prices points at $5 to over $100. Considering the potential airdrop value could reach tens of thousands of dollars, the explosive trading volume seems reasonable.

Key question: What will happen after the TGE? Will users continue to stay, or will trading volume collapse rapidly?

Conclusion

Advantages:

✅ Top-notch technology (Zero-Knowledge Proofs effective)

✅ Zero fees = True competitive advantage

✅ Inherits Ethereum's security

✅ Top-tier team and supporters

Concerns:

⚠️ 8.03 trading volume/open interest ratio = High farming behavior

⚠️ LLP incurred losses under stress testing

⚠️ 4-hour downtime raises doubts

⚠️ User retention post-airdrop remains unverified

The key difference from Aster: no wash trading accusations, not delisted by DefiLlama. The high trading volume ratio reflects aggressive but temporary incentives rather than systemic fraud.

Bottom Line: Lighter has world-class technology, but its data metrics are concerning. Can it convert "farmers" into real users? Technically, the answer is yes, but historical experience suggests a lower likelihood.

For Farmers: A good opportunity before the TGE.

For Investors: It is advisable to wait 2-3 months after the TGE to see if trading volume can be maintained.

Probability Forecast:

40% chance of becoming one of the top three platforms

60% chance of being just a point farm with excellent technology

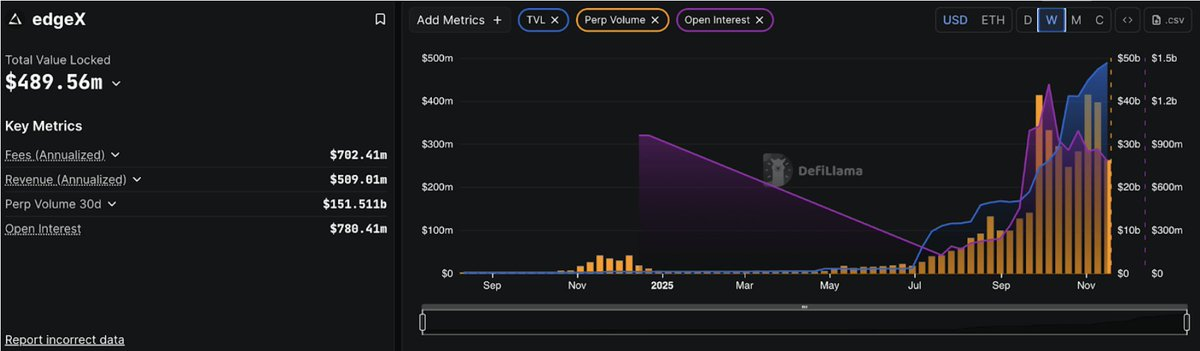

Part Four: EdgeX—Institutional-Level Professional Platform

Advantages of Amber Group

EdgeX's operational model is unique. As a project incubated by Amber Group (managing assets worth $5 billion), it brings together professionals from Morgan Stanley, Barclays, Goldman Sachs, and Bybit. This is not about native users in the crypto space learning financial knowledge, but rather traditional finance (TradFi) experts bringing institutional-level experience into decentralized finance (DeFi).

Amber Group's market-making gene directly translates into EdgeX's core advantages: deep liquidity, tight spreads, and execution quality comparable to centralized exchanges (CEX). The platform launched in September 2024 with a clear goal: to provide CEX-level performance while retaining users' self-custody rights.

EdgeX is built on StarkEx (StarkWare's mature zero-knowledge engine), processing 200,000 orders per second with latency under 10 milliseconds, comparable to Binance's speed.

Lower Fees than Hyperliquid

EdgeX comprehensively outperforms Hyperliquid in terms of fees:

Fee Comparison:

EdgeX Maker: 0.012% vs Hyperliquid: 0.015%

EdgeX Taker: 0.038% vs Hyperliquid: 0.045%

For traders with a monthly trading volume of $10 million, this means savings of $7,000 to $10,000 annually compared to Hyperliquid.

Additionally, EdgeX performs better in liquidity for retail orders (less than $6 million)—with tighter spreads and less slippage, outperforming competitors.

Sustainable Revenue and Healthy Metrics

Unlike Lighter's zero-fee model or Aster's questionable data, EdgeX has achieved real and sustainable revenue:

Current Data:

Total Locked Value (TVL): $489.7 million

24-hour Trading Volume: $8.2 billion

Open Interest (OI): $780 million

30-day Revenue: $41.72 million (up 147% from Q2)

Annualized Revenue: $509 million (second only to Hyperliquid)

Trading Volume/Open Interest Ratio (Volume/OI): 10.51 (though concerning, requires in-depth analysis)

At first glance, a 10.51 trading volume/OI ratio seems suboptimal. However, considering that EdgeX launched liquidity through aggressive point programs, this ratio is steadily improving as the platform matures. More importantly, EdgeX has maintained healthy revenue throughout this process—proving that it attracts real traders rather than mere speculators.

October Stress Test

During the market crash on October 11 (with $19 billion liquidated), EdgeX performed excellently:

✅ Zero Downtime (in contrast, Lighter was down for 4 hours)

✅ eLP (EdgeX Liquidity Pool) remained profitable (Lighter's LLP incurred losses during stress testing)

✅ Provided 57% annualized yield for liquidity providers (the highest in the industry)

eLP demonstrated exceptional risk management capabilities during extreme market volatility, achieving profitability while competitors struggled.

Unique Advantages of EdgeX

- Multi-chain Flexibility:

Supports Ethereum mainnet (Ethereum L1), Arbitrum, and BNB Chain;

Allows USDT and USDC as collateral;

Supports cross-chain deposits and withdrawals (in contrast, Hyperliquid only supports Arbitrum).

- Best Mobile Experience:

Offers official iOS and Android apps (Hyperliquid does not);

Clean user interface, allowing users to manage positions anytime, anywhere.

- Focus on the Asian Market:

Strategically entering the Korean and Asian markets through localized support and participation in Korean Blockchain Week;

Capturing users in regions overlooked by Western competitors, avoiding excessive competition.

Transparent Point Program:

60% from trading volume

20% from referrals

10% from TVL/liquidity pool

10% from liquidations/open interest (OI) Clearly states: "We do not reward wash trading." Data also verifies this—trading volume/OI ratio is improving rather than deteriorating like pure farming models.

Challenges Faced

Market Share: EdgeX currently holds only 5.5% of the open interest market for perpetual contracts. Further growth requires aggressive incentives (which may lead to farming behavior) or significant partnerships.

Lack of Killer Features: EdgeX performs well across the board but lacks standout features. It is more like a "business class" option—solid but not disruptive.

Insufficient Fee Competitiveness: Lighter's zero fees make EdgeX's "lower than Hyperliquid" fee advantage less appealing.

Late TGE Timing: EdgeX is expected to conduct its TGE in Q4 2025, missing the early airdrop frenzy of competitors.

Final Judgment

Advantages:

✅ Institutional Support: Amber Group provides liquidity assurance

✅ Real Revenue: Annualized revenue reaches $509 million

✅ Best Liquidity Pool Returns: 57% annualized yield, maintaining profitability during market crashes

✅ Fee Advantage: Lower than Hyperliquid

✅ Clear Data: No wash trading scandals

✅ Multi-chain Flexibility + Excellent Mobile App: Provides the best user experience

Risks:

⚠️ Small Market Share: Only 5.5% of the open interest (OI) market

⚠️ Trading Volume/OI Ratio: 10.51 (though improving, still high)

⚠️ Lack of Unique Differentiated Features: No killer highlights

⚠️ Insufficient Fee Competitiveness: Unable to compete with zero-fee platforms

Suitable Audience:

Asian Traders: Users seeking localized support

Institutional Users: Professionals relying on Amber's liquidity

Conservative Traders: Users focused on risk management

Mobile-First Users: Traders needing to manage positions anytime, anywhere

Liquidity Provider (LP) Investors: Investors seeking stable returns

Summary:

EdgeX's goal is not to challenge Hyperliquid's market dominance but to focus on serving the Asian market, institutional users, and conservative traders, expecting to capture 10-15% of the market share. It is building a sustainable and profitable niche.

EdgeX can be seen as the "Kraken" of decentralized exchanges for perpetual contracts—not the largest or flashiest, but solid, professional, and trusted by mature users who value execution quality.

For Farmers: EdgeX offers moderate opportunities, with less competitive pressure than other platforms.

For Investors: Suitable for small allocations to achieve diversified investments, with lower risk and relatively stable returns.

Market Comparison Analysis of Decentralized Exchanges for Perpetual Contracts

Figure: Predictions based on existing public data

Trading Volume/OI Ratio Analysis

Industry Standard: Healthy ratio ≤ 3

Hyperliquid: 1.57 ✅ Indicates strong organic trading model

Aster: 4.74 ⚠️ High ratio reflects significant incentive activities

Lighter: 8.19 ⚠️ High ratio indicates point-driven trading behavior

EdgeX: 10.51 ⚠️ Clear impact of point program, but improving

Market Share: Open Interest Distribution

Total Market Size: ~ $13 billion in open interest

Hyperliquid: 62% - Market leader

Aster: 18% - Strong second position

Lighter: 12% - Growing presence

EdgeX: 6% - Focused on niche market

Platform Overview

Hyperliquid - Leader

Market Share: 62%, stable metrics

Annual Revenue: $2.9 billion, active buyback program

Community Ownership Model: Has a reliable track record

Advantages: Market dominance, sustainable economic model

Rating: A+

Aster - High Growth, High Risk

Ecosystem Support: Deep integration with the BNB ecosystem, supported by CZ

Data Controversy: Faced transparency issues with DefiLlama in October 2025

Multi-chain Strategy: Promotes user adoption

Advantages: Ecosystem support, retail market coverage

Concerns: Data transparency issues need ongoing monitoring

Rating: C+

Lighter - Technological Pioneer

Zero Fee Model: Attracts high-frequency traders

Technological Innovation: Advanced ZK verification technology

Top-tier Support: Investors like Thiel, a16z, Lightspeed

Launch Timing: TGE expected in Q1 2026, currently limited performance data

Advantages: Technological innovation, Ethereum L2 security

Concerns: Sustainability of business model, user retention post-airdrop

Rating: Pending (awaiting TGE performance)

EdgeX - Institutionally Focused

Institutional Support: Amber Group provides liquidity

Annual Revenue: $509 million, stable liquidity pool performance

Market Strategy: Focused on the Asian market, mobile-first

Advantages: Institutional credibility, steady growth

Concerns: Small market share, competitive positioning

Rating: B

Investment Recommendations

Trading Platform Selection:

Hyperliquid: Deepest liquidity, reliable performance

Lighter: Zero fee model benefits high-frequency traders

EdgeX: Fees lower than Hyperliquid, excellent mobile experience

Aster: Multi-chain flexibility, BNB ecosystem support

Token Investment Timeline:

HYPE: Already listed, current price $37.19

ASTER: Current trading price $1.05, need to monitor future developments

LITER: TGE expected in Q1 2026, need to assess post-listing performance

EGX: TGE expected in Q4 2025, need to observe initial performance

Key Conclusions

Market Maturity: The decentralized exchange for perpetual contracts has shown clear differentiation, with Hyperliquid establishing leadership through sustainable metrics and community collaboration.

Growth Strategies: Each platform targets different user groups—Hyperliquid focuses on professionals, Aster targets retail and Asian markets, Lighter emphasizes technology, and EdgeX concentrates on institutional users.

Key Metrics: The trading volume/OI ratio and revenue generation reflect platform performance more clearly than pure trading volume.

Future Outlook: The post-TGE performance of Lighter and EdgeX will determine their long-term competitive positioning; Aster's future depends on resolving transparency issues and maintaining ecosystem support.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。