Buy them, is it really for crypto exposure, or for that illusion of premium that no longer exists?

Written by: David, Deep Tide TechFlow

In the past month, BTC has dropped from its historical high of $126,000 to below $90,000, a 25% pullback that has sent the market into a panic, with the fear index now in single digits.

But that man is still buying.

On November 17, Michael Saylor tweeted as usual on X: "Big Week."

Subsequently, the announcement revealed that MSTR bought another 8,178 BTC, spending $835.6 million, bringing its total Bitcoin holdings to over 649,000 coins.

Don't panic, the biggest bull is still in the game. But is that really the case?

While Saylor's comment section is filled with excitement, someone has dug up a key piece of data:

MSTR's mNAV is about to drop below 1.

mNAV, or market net asset value, is a key indicator for measuring the premium of MSTR's stock price relative to its BTC assets.

Simply put, mNAV=2 means the market is willing to pay $2 for $1 worth of BTC assets; mNAV=1 means the premium has disappeared; mNAV<1 means it's trading at a discount.

This indicator is the lifeblood of Saylor's entire business model.

By comparison, when was the last time BTC dropped 25%? The answer is March of this year.

At that time, Trump announced tariffs on multiple countries, and the market was in despair, with the Nasdaq plummeting 3% in a single day, and the crypto market suffered as well.

BTC fell from $105k to $78k, a drop of over 25%. But at that time, MSTR was in a completely different state.

mNAV was still around 2, and Saylor had a full set of financing tools: convertible bonds, preferred stock, ATM issuance… he could conjure up money to buy the dip at any time.

What about this time? mNAV has dropped below 1.

This means that issuing stock to buy coins is gradually becoming unfeasible. For example, if they issue $1 worth of stock now, investors might only be able to buy $0.97 worth of BTC, which doesn't look like buying the dip; it looks like a loss.

According to MSTR's Q3 financial report, the company's cash on hand is only $54.3 million.

In other words, it's not that Saylor doesn't want to buy the dip big, but he might really not be able to.

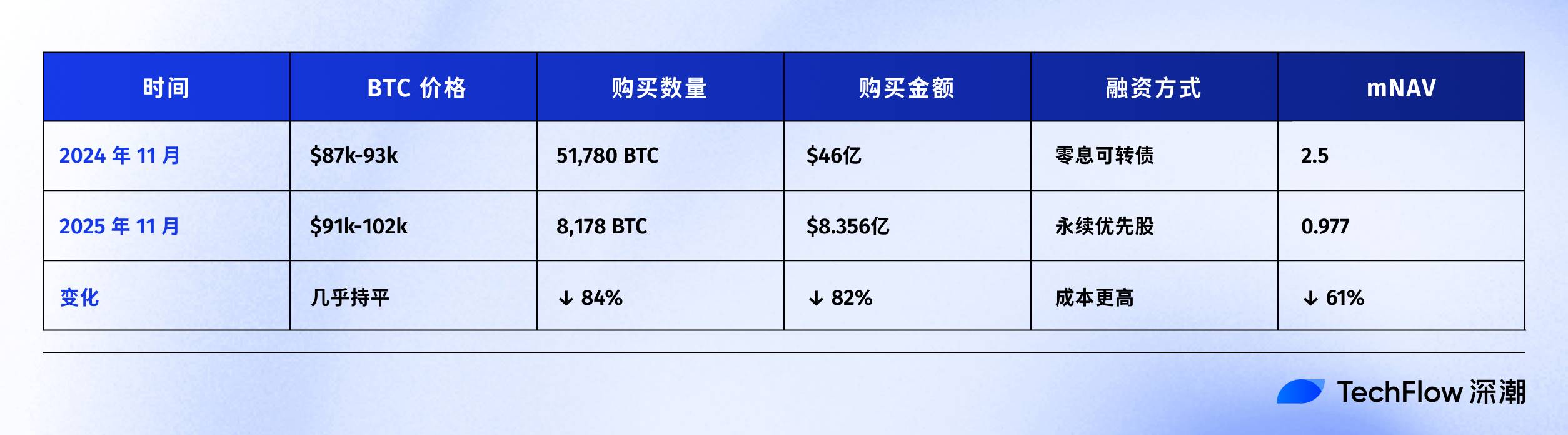

Last November vs. This November

Don't believe Saylor can't buy anymore? You might want to check the books from a year ago today.

In November 2024, Trump was elected, and BTC skyrocketed from $75k to $96k.

What was Saylor doing? Buying coins in large amounts.

Where did the money come from? Issuing bonds. A $3 billion convertible bond, maturing in 2029, and the key is that there are no interest payments.

A year later, the situation has changed dramatically.

In addition to price changes, the change in financing methods is also noteworthy.

Last year, Saylor borrowed $3 billion to buy BTC, with no interest payments, and just had to pay it back in 2029. This is equivalent to borrowing money for free.

This year, Saylor can only sell a special type of stock (perpetual preferred stock), which requires him to take out 9-10% of MSTR's funds each year to distribute to those who buy these stocks.

The conditions have worsened, and the market may have lost confidence in MSTR, unwilling to lend him money for free anymore.

But with mNAV dropping below 1, the real trouble lies in the spiral chain reaction:

mNAV declines → financing ability weakens → must issue more stock → equity gets further diluted → stock price falls → mNAV continues to decline.

This spiral is happening.

Since the beginning of this year, BTC has only dropped 4.75%, but MSTR's stock price has already fallen by 32.53%.

On November 17, MSTR's stock price hit a 52-week low of $194.54, falling for six consecutive days. From the year's high, the stock price has dropped by 49.19%.

MSTR's stock has underperformed BTC by 27 percentage points. The market is voting with its feet; it's better to buy BTC directly than MSTR.

Moreover, in the 2025 market, more and more companies are adopting Bitcoin and other tokens as reserve strategies, and MSTR is no longer the only choice.

As competition increases and the crypto market becomes less favorable, why should investors pay a premium for MSTR?

The entire logic of MicroStrategy's model is quite clear: continuously financing to buy BTC, using the value growth of BTC to support the stock price, and using the stock price premium to continue financing.

But when BTC crashes and mNAV drops below 1, this cycle is no longer as smooth as before.

In November, Saylor is still buying, but the ammunition is clearly running low.

Other DAT companies are also struggling

MSTR's predicament is not an isolated case.

The entire Digital Asset Treasury (DAT) sector has been under heavy pressure in November.

First, let's look at companies holding BTC:

These companies are Bitcoin miners + treasury model. In the first two weeks of November, BTC dropped about 15%, but their stock prices fell by over 30%.

But worse off are those holding altcoins.

Companies holding ETH:

These companies use ETH as their main treasury asset. In the first two weeks of November, the price of ETH fell from $3,639 to $3,120 (-14.3%), but their stock prices fell by 17-20%.

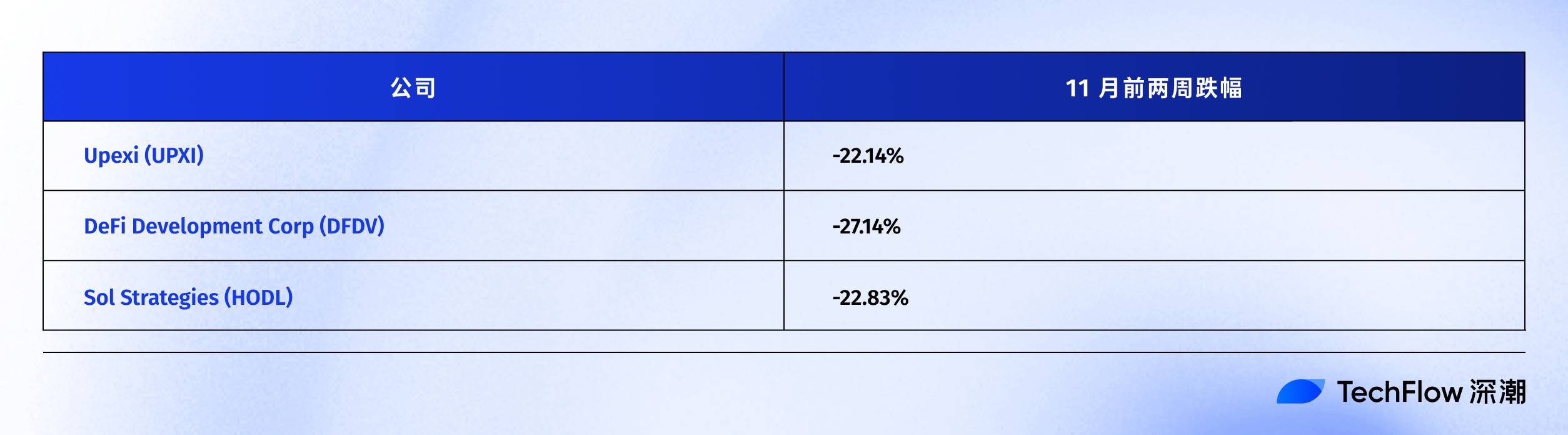

Companies holding SOL:

The most surreal among them is DFDV, which saw its stock price soar by 24,506% due to its SOL treasury strategy at the beginning of 2025. But by November 17, it had fallen from a high of $187.99 to around $6.74.

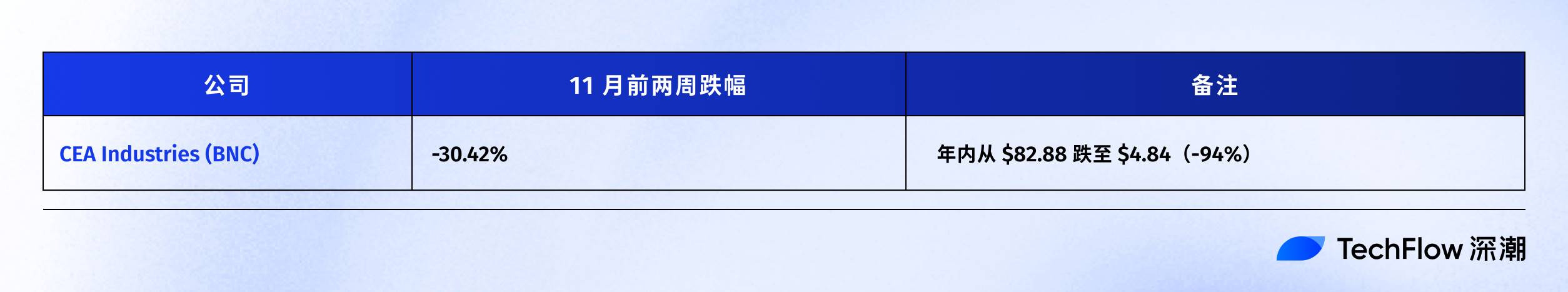

Companies holding BNB:

Why do altcoin treasury companies fall even harder?

The logic is simple:

In this round of market correction, BTC fell by 25%, but altcoins like ETH, SOL, and BNB fell much more than BTC.

When the treasury assets themselves are more volatile, the stock prices will be further magnified. Moreover, altcoin treasury companies face a bigger problem: liquidity risk.

BTC is the most liquid crypto asset; even holding hundreds of thousands of BTC, MSTR can slowly sell them through the OTC market or exchanges.

But the liquidity of ETH, SOL, and BNB is far less than that of BTC. When the market is fearful, the selling pressure of millions of ETH can further crush prices, creating a vicious cycle.

The big drop in November was a comprehensive stress test.

The results are clear: whether holding BTC or altcoins, DAT companies' stock prices have fallen far more than their treasury assets.

And companies holding altcoins face even more severe impacts.

When the money printer malfunctions

Returning to the question at the beginning of the article: if even Saylor can't buy anymore, how are your DAT stocks doing?

The answer is already clear.

The November market has stripped away the last layer of cover from DAT stocks. According to the latest data from SaylorTracker, MSTR's Bitcoin holdings have fallen below $60 billion, and its 649,870 BTC holdings are about to see their unrealized gains drop below $10 billion.

When mNAV drops below 1, MSTR's "BTC money printer" model is gradually failing. The path of issuing stock to buy coins is no longer smooth; rising financing costs and insufficient ammunition are problems Saylor must face.

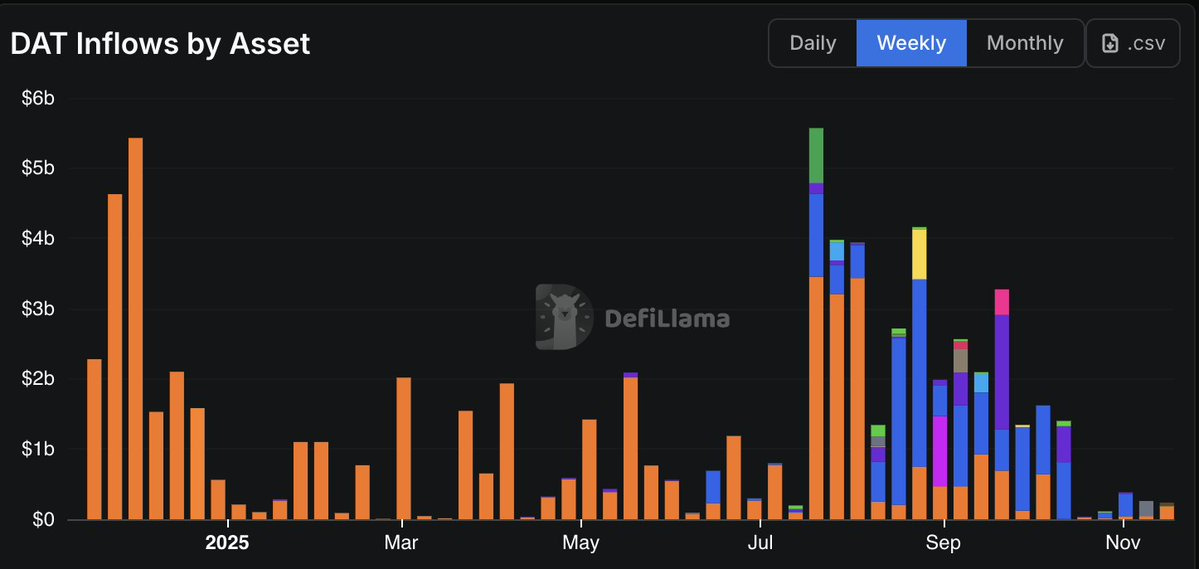

Data also confirms this, as the inflow of funds into DAT companies has shown a downward trend, with October's inflow hitting the lowest record since the 2024 election.

BTC miner stocks have generally fallen by 30%, ETH treasury companies by 20%, and SOL and BNB treasury companies' stock prices have plummeted to the point of questioning life. Regardless of which company you favor, the stock price declines far exceed the treasury assets themselves.

While there is certainly an impact from the current environment of U.S. stock market investors selling off to seek safety, the structural issues inherent in the DAT model are becoming increasingly tricky in a headwind:

When the crypto market corrects, the leverage property of DAT stocks amplifies the decline. You think you are buying "BTC exposure with a premium," but in reality, it is a leveraged downturn accelerator.

If you still hold these stocks, perhaps you should ask yourself:

Are you buying them for crypto exposure, or for that illusion of premium that no longer exists?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。