Market risk aversion is rising, with U.S. stocks, gold, and cryptocurrencies rarely declining in sync. Disagreements within the Federal Reserve regarding the path of interest rate cuts are intensifying. Federal Reserve Governor Waller delivered a speech in London supporting another rate cut in December, citing a weak labor market and the adverse effects of monetary policy on low- and middle-income consumers.

Despite some officials supporting continued rate cuts, market expectations for a December rate cut by the Federal Reserve have dropped from nearly 100% before the October meeting to about 40%. This shift in expectations has triggered significant fluctuations in global asset prices, with U.S. stocks, gold, and cryptocurrencies experiencing rare simultaneous declines, liquidity alarms have been suddenly raised.

1. Probability of Rate Cuts Plummets

Recent hawkish statements from Federal Reserve officials have led to a decline in market expectations for a December rate cut from nearly 100% before the October meeting to about 40%.

● According to CME's "FedWatch Tool," the probability of a 25 basis point rate cut in December is 42.9%, while the probability of maintaining the current rate is 57.1%.

● The probability of a cumulative 25 basis point rate cut by January next year is 48.2%, with a 35.6% chance of maintaining the current rate, and a 16.1% chance of a cumulative 50 basis point cut. This data reveals a significant shift in market expectations regarding the Federal Reserve's monetary policy path, from nearly certain cuts over a month ago to now being uncertain.

2. Asset Markets Suffer Across the Board

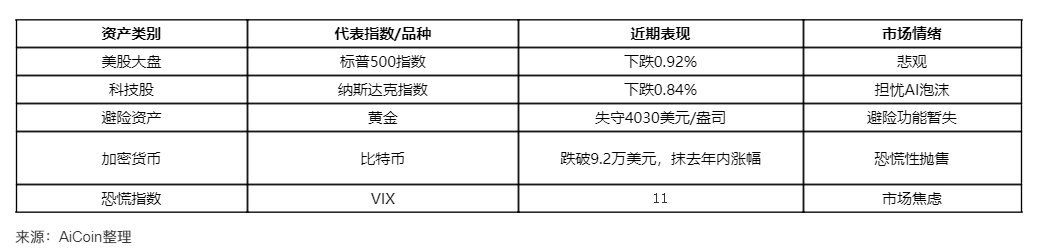

The cooling of rate cut expectations has led to a significant adjustment in global asset prices, resulting in an unusual phenomenon where both risk and safe-haven assets decline simultaneously. All three major U.S. stock indices fell, with the Dow Jones down 1.18%, the S&P 500 down 0.92%, and the Nasdaq down 0.84% at the close.

● Traditional safe-haven asset gold was also not spared, with international gold and silver prices plummeting after opening. London spot gold fell below $4030 per ounce during trading, and London spot silver dropped below the important threshold of $50 per ounce.

● The cryptocurrency market was hit hard, with Bitcoin falling below $92,000, erasing all gains made this year.

The table below shows the recent performance of major assets:

3. Clear Divisions Within the Federal Reserve

Disagreements within the Federal Reserve regarding the interest rate path are deepening, with two camps holding sharply opposing views.

● Federal Reserve Vice Chair Jefferson is cautious about whether to cut rates in December, believing that the Fed should "proceed cautiously" with further easing. Jefferson stated, "The constantly changing risk balance highlights the need for caution as we approach neutral interest rates."

In contrast, Federal Reserve Governor Waller reiterated his support for another rate cut in December.

● Waller clearly stated: "Given that core inflation is close to the Federal Open Market Committee's target and there is evidence of a weak labor market, I support lowering the policy rate by 25 basis points at the December meeting."

This division creates uncertainty for the Federal Reserve's December policy meeting. Nick Timiraos, known as the "Fed's mouthpiece," stated that Fed officials are facing a significant challenge in bridging internal disagreements in the absence of new economic data.

4. Signs of a Looming Liquidity Crisis

The simultaneous decline of risk and safe-haven assets suggests that financial markets may face more severe liquidity challenges. The drop in both gold and U.S. stocks indicates that the market may be facing a more serious situation—investors have no safe harbor to seek.

● Michael Ambruster, co-founder of the futures brokerage Altavest, stated: "In the short term, as investors seek liquidity, gold may fluctuate in sync with other risk assets." This phenomenon is particularly typical during crises, as BullionVault's research director Adrian Ash pointed out:

● "In a 'real crisis,' the correlation of all assets tends to approach 1.0, as 'traders losing on one type of asset need to liquidate profitable positions to raise cash.'"

This situation is reminiscent of the 2008 financial crisis and the early days of the pandemic in 2020, when investors would sell profitable assets to cover losses.

5. AI Boom Faces Tests

Tech stocks have significantly corrected, and concerns about an artificial intelligence bubble are rising.

● Goldman Sachs warned in its latest report that the current U.S. stock market may have priced in most of the potential gains from AI. Goldman analysts stated: "Some individual companies may achieve astonishing profit growth for a period. But such increases may be correct for a specific company, but not necessarily for the market as a whole."

● Since the launch of ChatGPT, the combined market value of AI-related companies in the U.S. stock market has increased by over $19 trillion, and Goldman believes this indicates that "the U.S. stock market may have priced in most of the potential upside from AI."

● JPMorgan also warned that the biggest concern regarding the current hot AI trades is that it may replicate the boom and bust of the internet bubble in the late 1990s.

6. Economic Data as a Key Variable

Following the end of the government shutdown, the market will face a series of key economic data releases this week, which will provide important clues for investors to assess the Federal Reserve's policy trajectory.

● The Federal Reserve will also release the minutes from the October 28-29 meeting, revealing rare disagreements among decision-makers. The non-farm payroll report for September, to be released this Thursday, will be of significant importance to the Federal Reserve.

The current positions of key Federal Reserve officials show clear divisions, reflecting diverse policy inclinations:

● Federal Reserve Vice Chair Jefferson holds a cautiously hawkish stance. In recent statements, he emphasized that the Federal Reserve should maintain a "gradual approach" to monetary policy adjustments, primarily because current interest rates are close to the neutral rate range. This position holds significant influence within the Federal Reserve, as Jefferson's views are often considered highly aligned with those of Fed Chair Powell, often signaling important policy directions.

● In contrast, Federal Reserve Governor Waller exhibits a clear dovish stance. He has repeatedly expressed support for another 25 basis point rate cut at the December meeting. Waller's decisions are based on concerns about signs of weakness in the labor market and the potential pressure current monetary policy may place on low- and middle-income groups. His views have garnered support from some Fed officials, forming a significant push for easing policies within the Federal Open Market Committee.

● Notably, Fed Chair Powell himself has not yet indicated a clear stance on recent policy directions. This deliberate withholding of position has led the market to pay closer attention to the statements of other officials, attempting to interpret the Federal Reserve's policy signals. Currently, the cautious stance of Jefferson and the easing advocacy of Waller create a clear policy tension, which will significantly influence the final decision at the December meeting.

The market is closely watching the non-farm payroll report for September, set to be released this Thursday, as it will be one of the most critical employment data points before the Federal Reserve's December meeting. This report will not only affect market expectations for the Fed's December policy but will also serve as a litmus test for assessing the health of the U.S. economy.

As expectations for a Federal Reserve rate cut continue to cool, global markets are undergoing a comprehensive liquidity test from risk assets to safe-haven assets.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。