原创 | Odaily星球日报(@OdailyChina)

作者 | 叮当(@XiaMiPP)

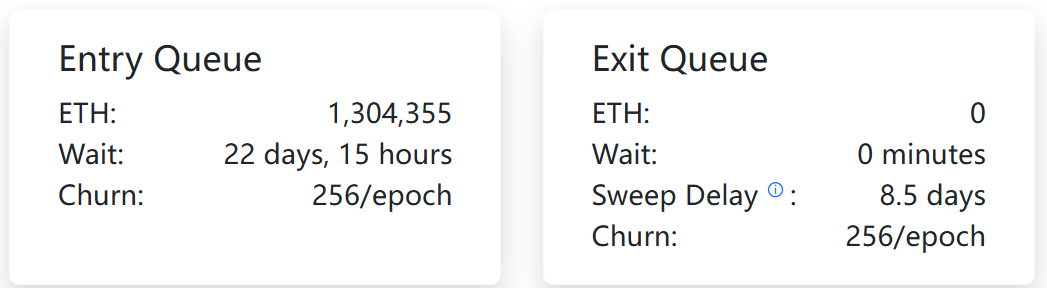

1 月 7 日,以太坊 PoS 机制下的质押退出队列正式清零。至少从链上数据来看,持续数月的退出压力终于被完全消化,当前尚未观察到新的大规模赎回请求出现。

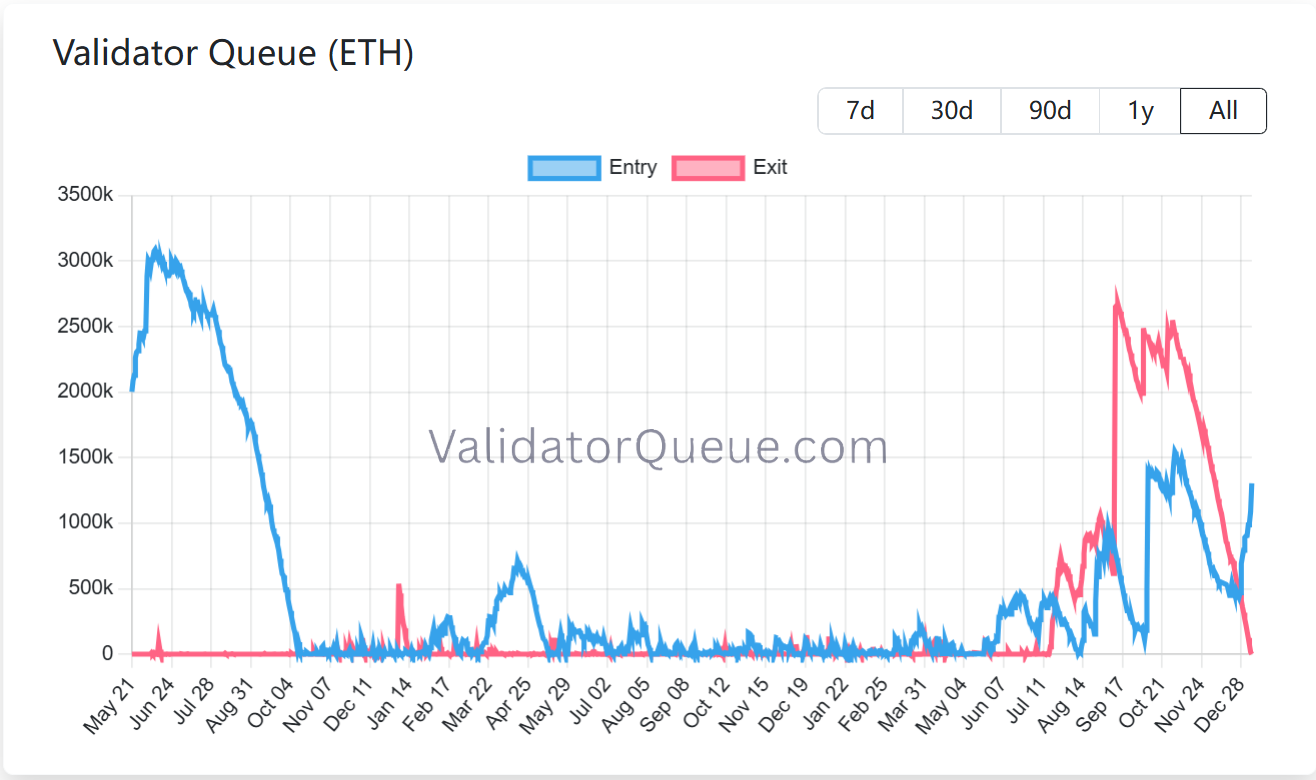

与此同时,进入质押队列的规模却出现显著上升,当前排队规模已增至约 130.44 万枚 ETH,等待时间约 22 天 15 小时,这一状态几乎与去年 9 月中旬形成了完全的反转。

当时 ETH 价格处于约 4700 美元的阶段性高点,市场情绪高涨,但是质押端却呈现出不同的态度:266 万枚 ETH 选择退出质押,退出队列等待时间一度超过 40 天。而在随后的三个半月中,ETH 价格下跌约 34%,从 4700 美元回落至 3100 美元。

如今,在价格完成一轮深度回调之后,退出队列终于被完全消化。

质押队列是“情绪指标”,但并非价格信号?

通常而言,验证者队列的变化被视为观察市场情绪的重要风向标。背后的逻辑在于,以太坊 PoS 为了保障共识稳定性,并不允许节点随意进出,而是通过流量控制机制,对质押与退出行为进行节奏调节。

因此,当 ETH 价格处于高位阶段时,退出需求往往容易累积,部分质押者可能会选择兑现收益,不过潜在卖压并不会瞬间释放,而是通过退出队列在链上被“拉长”;而当退出需求逐步枯竭,甚至被完全消化时,可能意味着一轮结构性的抛售压力正在告一段落。

从这个角度来看,本轮退出队列清零,与进入队列同步上升,的确构成了一种值得关注的变化。但是我认为,这种变化虽然在表面上形成了积极共振,但其对市场价格的影响力,注意是“影响力”,与 9 月份“高退出、低进入”的阶段并不对等。因为进入质押队列的 ETH,并不等同于“当下新增资金正在积极买入 ETH”。相当一部分进入质押的筹码,很可能已在更早阶段完成建仓,只是选择在当前时间点进行再配置。因此,质押队列的上升,更多反映的是资金对长期收益、网络安全性以及质押回报稳定性的偏好变化,而非即时价格需求的显著增强。这也意味着,当前队列结构的改善,更偏向于预期修复,而非对短期价格形成同等强度的推动。

尽管如此,当前质押进入队列的显著增长,仍然值得关注。其背后最主要的推动力来自以太坊最大的 DAT 财库公司 BitMine。CryptoQuant 数据显示,BitMine 在近两周内累计质押了约 77.1 万枚 ETH,占其约 414 万枚 ETH 持仓的 18.6%。

这也就意味着此次质押趋势的转向,是由单一大型机构主导的资产配置行为,而非市场整体风险偏好同步回暖的结果。因此,它并不能被简单解读为“全面看多情绪的回归”。不过,在加密行业这种新兴、流动性分布并不均衡的市场中,大型机构的行动往往更容易、也更可能在短期内对市场形成一定程度的情绪托底与预期修复。

至于这种趋势能否持续、是否会扩散至更广泛的参与者,仍有待时间验证。但从链上基本面数据来看,以太坊的多项核心指标,正在同步显现出边际改善的迹象。

从“质押变化”走向“基本面协同改善”

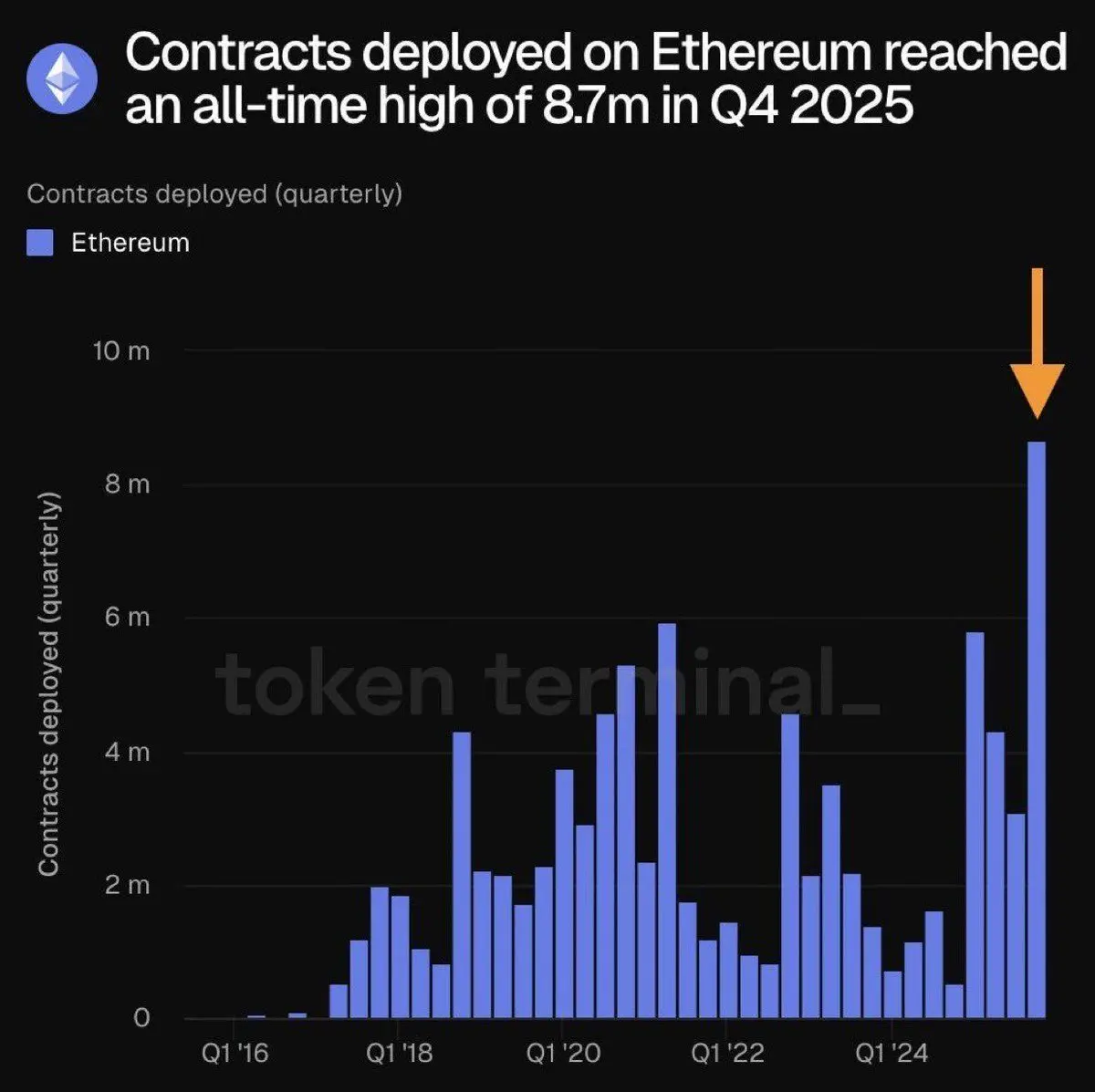

首先,在开发者维度,以太坊的开发活动正在创下历史新高。数据显示,2025 年第四季度,以太坊共部署约 870 万个智能合约,刷新历史单季度纪录。这一变化更接近于持续性的产品与基础设施建设,而非短期投机行为。更多合约的部署,意味着更多 DApp、RWA、稳定币与基础设施正在落地,以太坊作为核心执行层与结算层的角色仍在持续强化。

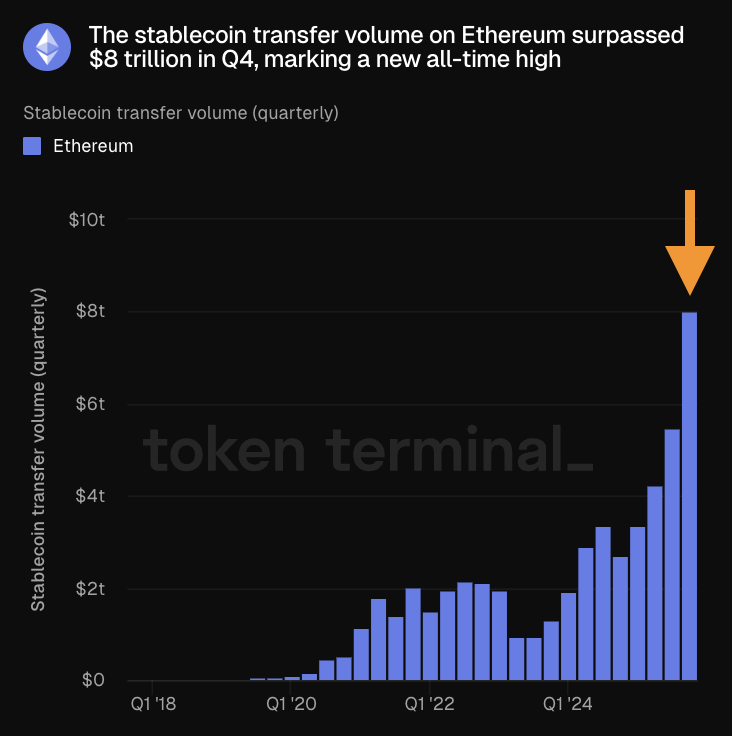

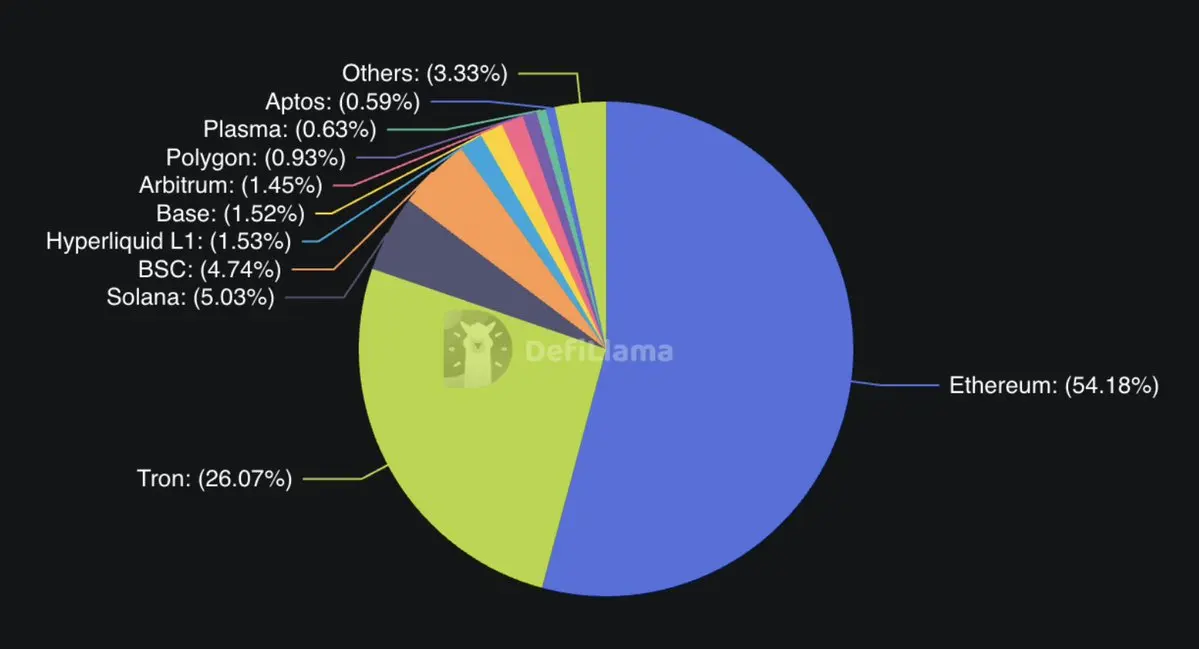

在稳定币领域,第四季度以太坊稳定币链上转账量已超过 8 万亿美元,同样刷新历史纪录。从发行结构来看,以太坊在稳定币生态中的优势依然显著。数据显示,以太坊链上稳定币发行量占比高达 54.18%,远超 TRON(26.07%)、Solana(5.03%)、BSC(4.74%)等其他主流区块链网络。

与此同时,以太坊 Gas 费用创下了主网上线以来的最低纪录,且正在持续打破纪录。某些时段 Gas 费用甚至低于 0.03 Gwei。考虑到今年以太坊仍将持续推进区块扩容,这一趋势在中期内仍具备延续空间。更低的交易成本,会直接降低了链上活动门槛,也为应用层的持续扩展提供了现实基础。

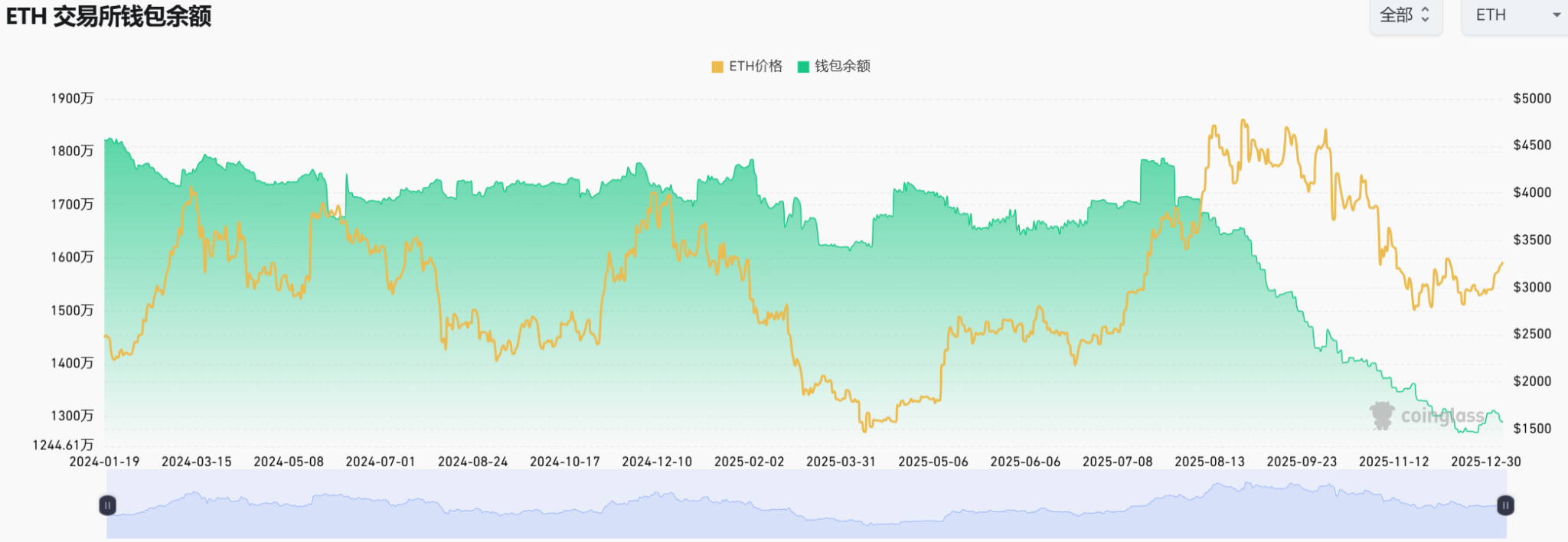

从交易所余额这一指标来看,以太坊的潜在抛压同样处于低位。12 月中旬,以太坊交易所供应量降至 1270 万枚,为 2016 年以来最低水平。尤其是自 2025 年 8 月以来,该指标出现了超过 25% 的显著下滑。尽管近期交易所余额略有回升,但增量仅约 20 万枚,整体仍处于历史低位区间,显示出交易员的抛售意愿并不强。

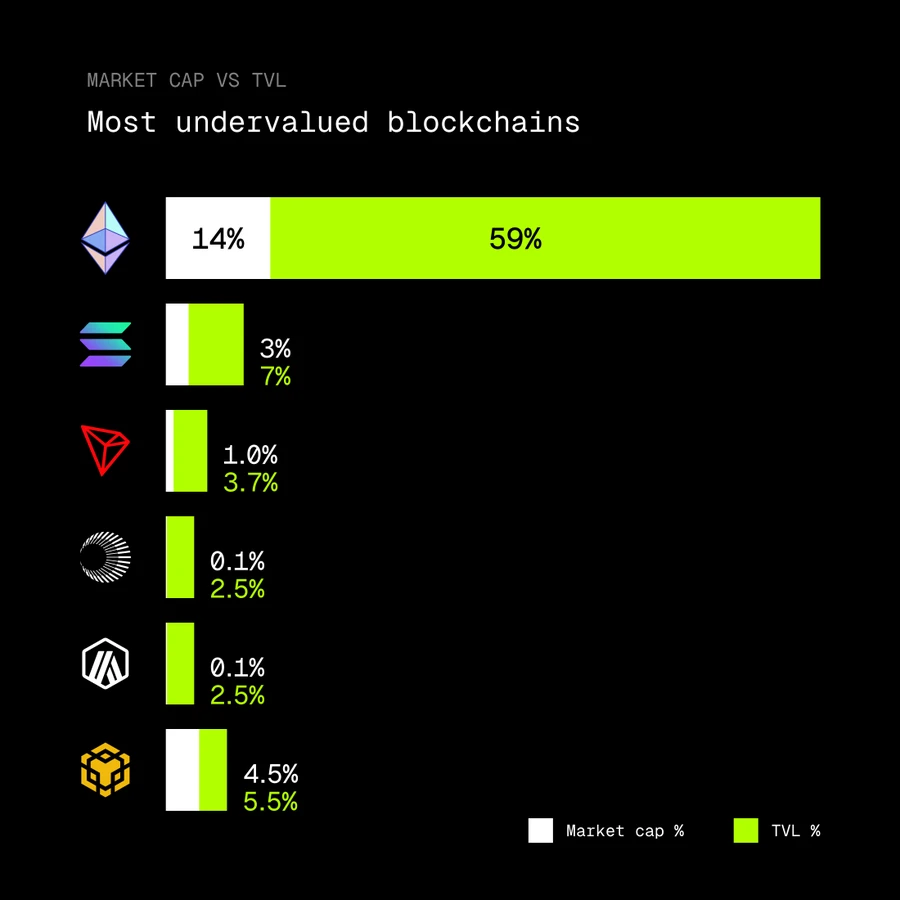

此外,加密 KOL rip.eth 近日在 X 平台发文指出,从总锁定价值(TVL)与市值之间的差距来看,以太坊可能是当前被低估程度最高的区块链网络。数据显示,以太坊承载了加密市场 59% 的 TVL,但其代币 ETH 的市值占比仅约 14%。作为对比,Solana 的代币市值 / TVL 比率为 3% / 7%,Tron 为 1% / 3.7%,BNB Chain 为 4.5% / 5.5%。这在一定程度上反映出,ETH 的估值与其所承载的经济活动规模之间,仍然存在明显错位。

结语

综合来看,质押队列的变化或许并非决定价格走势的“单一变量”,但当它与开发者活跃度、稳定币使用规模、交易成本、交易所余额等多项指标同步改善时,所呈现出的就不再是孤立信号,而是一幅更为立体的基本面图景。

对于以太坊而言,这或许并不是一轮情绪驱动的快速反转,而是在其完成一轮深度调整之后,系统正在逐步恢复结构稳定性的过程。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。