Author: Louis, Trendverse Lab

Among the many industry dynamics in 2025, Tether's significant increase in gold reserves has undoubtedly sparked widespread discussion—by the end of the third quarter, Tether's gold reserves surged from $5.3 billion to $12.9 billion, a staggering increase of 143%, surpassing the official holdings of some countries. At the same time, it introduced a professional precious metals trading team from HSBC, incorporating gold into a more systematic asset management strategy.

This is not the main event in the stablecoin industry, but it provides a vivid entry point for understanding the overall changes in 2025. This year, the regulatory framework gradually took shape, Circle successfully went public, and the compliance requirements for stablecoins in Europe, the U.S., and Hong Kong became clearer, while the demand for corporate payments and cross-border settlements rose in tandem—a series of structural factors prompted stablecoins to transition from a phase of rapid growth to a role closer to financial infrastructure.

It is precisely under these changes that a seemingly contradictory phenomenon emerged: 2025 is the year of the most intensive restructuring of the stablecoin system, yet it is also the year with the most noticeable decline in market discussion. The heat on social media has faded, but the scale, usage, and institutional demand continue to grow. Thus, a truly worth-asking question arises: why does stablecoin seem "boring" after undergoing such drastic changes?

This question also serves as the starting point for reviewing the development trajectory of stablecoins in 2025.

I. 2025: From Expectation Frenzy to Institutional Implementation, and Then to a Year of Calm Testing

(1) Before May: Expectation-Driven Heat—The Market Immersed in the Excitement of "Regulatory Dividend Eve"

If we were to find a keyword for the stablecoin market at the beginning of 2025, it would undoubtedly be "expectation." During the period from January to April, although the regulatory framework had not yet officially landed, the imagination surrounding the formation of the system was enough to push market sentiment to a peak.

The EU entered a critical phase of the MiCA secondary rules; the U.S. frequently released draft signals; the Hong Kong Monetary Authority opened a stablecoin sandbox, revitalizing the Asia-Pacific market. For capital, enterprises, and crypto institutions, these signs collectively pointed to one judgment: 2025 will be the year when stablecoins are fully integrated into the mainstream regulatory system.

The accumulation of expectations caused the market to heat up even before real changes occurred. The total market capitalization of stablecoins steadily climbed in the first quarter, with USDC's corporate settlement volume significantly expanding in multiple regions, and the pilot speed for cross-border payments, trade financing, and wallet services accelerating. Tether's increase in gold reserves at the beginning of the year also drew attention—at that time, only $5.3 billion was seen as a routine adjustment of reserve structure, not deviating from a technical understanding.

The density of discussions at that time almost reached a peak: media, research institutions, and social platforms were all discussing "regulation is coming," "enterprise adoption is accelerating," and "stablecoins are entering the next phase." In an industry that has long relied on sentiment, expectations often arrive earlier and more intensely than facts.

However, what truly changed the trajectory of the industry was not the heat of this phase, but the subsequent actual implementation.

(2) May to September: Favorable Policies Intensively Land—Regulation, IPO, and Reserve Upgrades Push Stablecoins into the "Institutional Layer"

Starting in May, the stablecoin industry welcomed a true watershed moment this year. All expectations regarding regulation and institutional entry at the beginning of the year were densely fulfilled within just a few months. Hong Kong was the first to complete the legislation of the "Stablecoin Ordinance," incorporating capital, liquidity, and redemption requirements into the regional regulatory framework;

Shortly thereafter, Circle completed its IPO on the New York Stock Exchange in June, raising $1.1 billion, with a market capitalization briefly exceeding $20 billion, becoming the first stablecoin issuer to enter the global capital market; in July, the U.S. officially passed the GENIUS Act, incorporating core provisions such as 1:1 liquid reserves, monthly audits, and bankruptcy priority into federal law. This marked the first time in the history of stablecoins that the regulatory frameworks of the U.S., Europe, and Hong Kong nearly landed simultaneously, establishing a clear global institutional foundation for the industry.

At the same time, structural adjustments were also taking place within the industry. Tether's reserve strategy underwent significant changes during this phase: gold holdings rose to $12.9 billion in the third quarter, significantly increasing the proportion of professional management of non-bond assets; against the backdrop of strengthened regulation and growing institutional demand, its reserves evolved from a single dollar asset structure towards a more "basket of value reserves," reflecting a more stable and central bank-like risk management approach.

During these months, market sentiment was no longer driven by expectations as it had been at the beginning of the year, but rather by a sense of "certainty after implementation." Stablecoins made a crucial step from being a technical product of the crypto industry to having legal status and institutional constraints as financial infrastructure.

Even though the market generally believed that everything had returned to normal, subsequent market fluctuations still reminded people: the implementation of the system does not mean the industry will proceed smoothly.

(3) October to November: Stress Tests and Decoupling Events—Heat Disappears, but the Foundation Becomes More Solid

The decoupling event on October 11 briefly pulled the market away from the strong landing rhythm. USDe dipped to $0.60 under macro sentiment, and then in early November, several DeFi liquidity pools experienced a chain imbalance, with slight deviations in stablecoin prices and corrections in mainstream crypto assets forming a small shock. This was a severe yet typical "on-chain stress test," validating the system's ability to withstand pressure in a high-volatility environment.

Unlike the reactions of previous years, this time the volatility did not evolve into a systemic crisis. The core liquidity pools of USDT and USDC remained stable, institutional funds did not withdraw, and cross-border payments and corporate settlements were not materially affected. Even after the event, the total market capitalization of stablecoins remained stable above $300 billion, with the scale of value flow continuing to grow.

At this stage, the market realized: the "safety margin" provided by the regulatory framework, reserve quality, and institutional adoption has begun to truly dominate the operational logic of stablecoins, rather than market sentiment itself.

Thus, the decline in heat after October was not a recession, but a more mature appearance—stablecoins entered a phase that would not fluctuate with emotional ups and downs. Discussions became less frequent, but usage deepened; voices became quieter, but the foundation became more solid. This is a clear signal that stablecoins are moving towards infrastructure.

II. From Market Capitalization, Reserves to On-Chain Data: The Maturity of Stablecoins is an Established Fact

Data Source: DefiLama StableCoins

Even setting aside the narrative and regulation, the data alone is sufficient to show: stablecoins have entered a new cycle driven by actual usage and institutional demand. Data from DefiLama indicates that as of November 2025, the total market capitalization of stablecoins has consistently remained above $300 billion, with USDT accounting for over 60% and USDC around 24%. This concentration is not due to a lack of competition, but rather because after the regulatory implementation, the market automatically gravitated towards issuers with higher transparency and better reserve quality, which is a typical characteristic of the institutional phase.

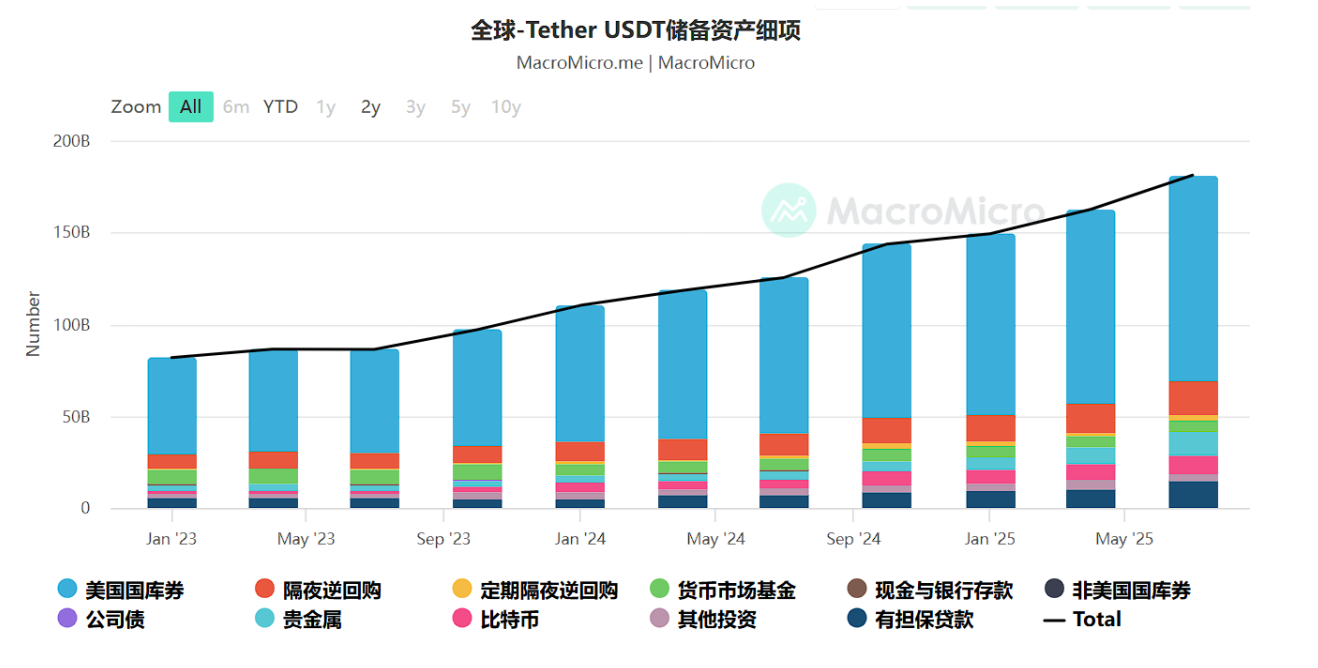

Data Source: MacroMicro USDT

To observe the industry status more representatively, we take Tether, which has the highest market share, as a reference. According to the latest reserve disclosure from MacroMicro, U.S. Treasury bonds account for over 70% of its asset structure, with a total scale exceeding $135 billion.

Reports from BraveNewCoin further point out that Tether has become the 17th largest holder of U.S. Treasury bonds globally, surpassing several countries, including South Korea. The remaining reserves consist of gold, overnight repos, cash, and a small amount of Bitcoin, making its reserve model increasingly resemble a "sovereign-level reserve portfolio," reflecting the trend of the entire industry towards a preference for high-quality assets during the institutionalization phase.

Data Source: Messari Stablecoins

On-chain data also showcases the mature appearance of the stablecoin market. Tracking by Messari shows that in the past year, the on-chain transfer volume of stablecoins exceeded $25 trillion, with the total number of transactions surpassing 3.2 billion and active addresses reaching 1.6 million, with growth rates in the range of 30%–60%. These increases are not driven by speculation, but rather stem from real scenarios such as cross-chain settlements, exchange settlements, corporate payments, on-chain custody, and cross-border remittances—each belonging to high-frequency, essential, and sustainable value transfer needs.

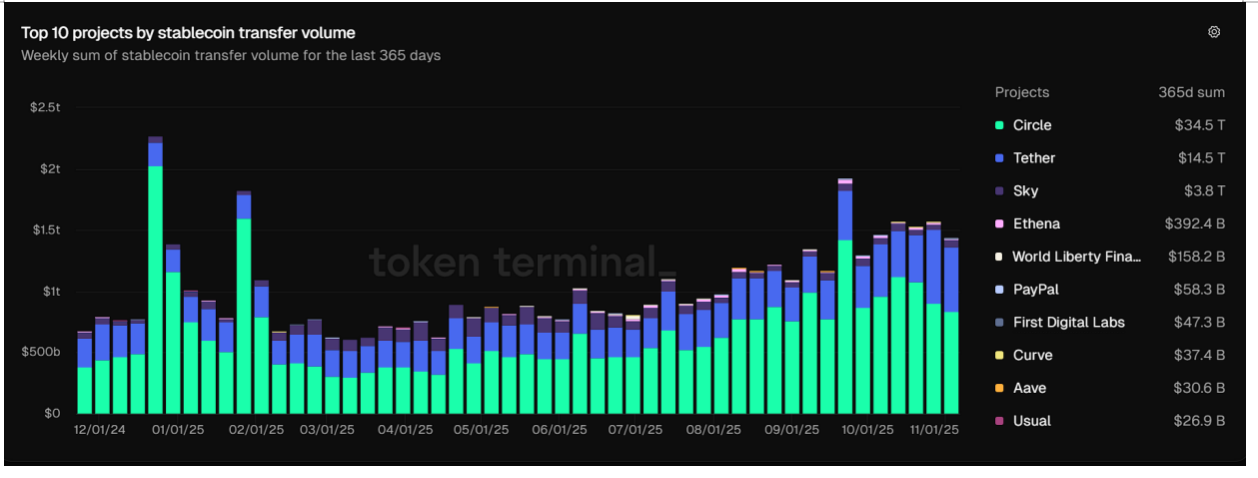

Data Source: TokenTerminal

Data from TokenTerminal further reveals structural changes: in the past year, Circle's stablecoin transfer volume reached $34.5 trillion, far exceeding other competitors, with Tether following closely at $14.5 trillion. From a weekly trend perspective, on-chain activity significantly increased after September, corresponding precisely to the phase of regulatory implementation and accelerated corporate adoption.

At the same time, stablecoins are continuously penetrating broader commercial networks. Visa, PayPal, and several cross-border payment institutions are constantly expanding stablecoin settlement channels, while enterprise-level APIs and wallet infrastructure are being standardized. A study cited by CoinDesk predicts that by 2030, 5%–10% of global commercial transactions may be completed on stablecoin rails, corresponding to a scale of $2.1–4.2 trillion. This judgment is no longer based on speculative models but on long-term trends of payment network integration, corporate adoption curves, reserve transparency, and cross-chain interoperability.

Overall, a clearer industry profile is taking shape: stablecoins are evolving from the underlying modules of the crypto ecosystem to the underlying settlement rails of the global financial system. Their growth increasingly relies less on price volatility and narrative heat, and more on institutions, reserves, safety margins, and cross-scenario value flows. This structural change is the most explicit signal that stablecoins are entering a mature phase in 2025.

III. How "Low Presence" Became Stablecoins' Biggest Moat

After a whole year of regulatory formation and accelerated institutional adoption, stablecoins present a distinctly different appearance in 2025: they no longer dominate social media, nor do they become the focal point of industry narratives. Discussions have decreased, emotions have cooled, and attention has receded—but the more this is the case, the clearer a fact emerges: stablecoins have reached today’s status precisely because they have successfully "become boring."

This is not irony, but an accurate description of their developmental stage. The reason stablecoins can enter the global financial system is that they have shed the identity of "new technology products" and become a financial tool that does not require repeated explanation or promotion. True infrastructure has never relied on hype but on stability, predictability, and institutionalized operational models. What stablecoins achieved in 2025 is precisely this value accumulation.

When an asset retreats from the public stage to the background, its functions become more stable and deeper. Stablecoins are no longer the focus like a new product because their role has shifted from "a tool of choice" to "a system that exists by default." Users no longer need to learn how to use them, and enterprises no longer hesitate during integration; it occurs as naturally as electricity or bank settlements. The less users are aware that they are using stablecoins, the more it indicates that they have entered the truly mature financial realm—settlements, clearances, payments, and custody are the most fundamental, critical, and least debatable aspects.

This "boring" nature also precisely delineates the boundary between stablecoins and other crypto tracks. In the hotspots of AI agents, re-staking, memes, and even traditional DeFi, the heat often comes fiercely and recedes quickly; their existence heavily relies on emotions, narratives, and imagination. Once user interest wanes, the track may even stall instantly. The path of stablecoins, however, is entirely different: by reducing volatility, increasing transparency, and establishing auditing standards, they have honed themselves into an almost irreplaceable underlying tool—becoming a foundational tool that others cannot bypass.

It is precisely because there is no drama that stablecoins can transcend cycles; it is because they do not require hype that they can be accepted by enterprise systems, payment networks, cross-border supply chains, and regulatory frameworks. For a financial infrastructure, the greatest success has never been to "spark discussions," but to "become un-discussed."

Thus, when the outside world feels that stablecoins have become boring, they have actually completed the most critical leap: from crypto products to global financial infrastructure. Their boredom signifies their success.

IV. Hidden Risks and Future Outlook: What Crossroads Do Stablecoins Stand At After Maturity?

Although stablecoins have entered an institutionalized track in 2025, beneath the surface of stable operation, several invisible risks cannot be ignored. The most critical point is that the larger the scale of stablecoins, the higher their correlation with the global macro environment. Under conditions of a declining interest rate cycle and ongoing U.S. fiscal pressures, stablecoin issuers holding large amounts of short-term government bonds will see their sensitivity to yields, bond prices, and sovereign credit increase. This means that the risks of stablecoins no longer stem from on-chain factors but partially shift to the traditional financial system—this "risk structure transformation" is an inevitable cost of the institutionalization phase.

Secondly, although the regulatory framework has been established, there is still a lack of unified standards for cross-border use, reserve disclosure, and multi-collateral models globally. While the systems in the U.S., Europe, and Hong Kong have taken shape, they are not entirely consistent, which means that stablecoins still face different compliance requirements when flowing across jurisdictions, leaving uncertainties for future regulatory coordination. Additionally, the pace of CBDC advancement may also pose medium- to long-term competitive pressure on stablecoins, especially in scenarios like cross-border payments and corporate settlements, where the relationship between central bank digital currencies and stablecoins remains in a dynamic balance of "cooperation, substitution, and coexistence."

Even so, from a longer-term perspective, the challenge facing stablecoins is not growth constraints but the issue of role upgrading. With clearer regulations, deeper corporate adoption, and standardized payment networks, stablecoins are gradually evolving from internal tools of the crypto world to the underlying interfaces of the global financial system. In the coming years, they may take on more significant functions than today: as a dollar alternative path for cross-border trade, as a real-time settlement layer for financial markets, as an efficient channel for corporate cash flow, and even as a new type of "digital dollar" network for global capital flows.

In other words, the future risk of stablecoins does not lie in "whether they can continue to exist," but in "what kind of global infrastructure they will evolve into." With the joint promotion of regulation, technology, and macro environments, what they face will not be the possibility of disappearance but the responsibilities and constraints that come with expansion. Stablecoins have entered a mature phase, and their next journey will concern how the global financial system redefines the speed, manner, and boundaries of value flow.

If the trend continues, stablecoins may ultimately become not just a digital shell of the dollar but the 'master agreement' for global capital flows, becoming a new unit that is the most universal, profound, and even implicitly accepted in the financial context of the internet era.

V. Conclusion

Stablecoins crossed a critical threshold in 2025: moving from the narrative focus to the underlying operations quietly functioning within the financial system. The establishment of regulatory frameworks, the expansion of enterprise-level adoption, and the maturation of reserve structures have collectively pushed them from "products that need to be understood" to "infrastructure that exists by default."

Their perceived boredom stems from the fact that their operations no longer rely on emotions but are supported by institutions, transparency, and real demand. This low profile signifies that they are detaching from the emotional cycles of the crypto market and entering a phase of alignment with the global financial system.

In an industry constantly tugged by new concepts, short-lived trends, and emotional fluctuations, the ability to achieve "not needing to be discussed" is itself a rare capability. The value of stablecoins lies not in being stunning but in being stable; not in noise but in continuity.

When they cease to be a topic, they begin to truly function—this is the hallmark of maturity and their greatest success.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。