Written by: ROSETTA Research Team

Translated by: Tia, Techub News

The risks of DeFi lending do not lie in volatility, but in the fact that returns, collateral, and governance depend on hidden human decisions and recursive leverage that users cannot see.

Beneath the user interface and on-chain automation mechanisms lies a layer of human decision-making that determines how capital actually flows. Curators, fund managers, and protocol designers choose markets, set parameters, and shape yield paths, which can enhance efficiency or increase risk based on incentive mechanisms and transparency. Many vaults, synthetic stablecoins, and lending loops hide subjective decisions that are often driven by incentive mechanisms that favor total value locked (TVL) and nominal annual percentage yield (APY) over genuine risk control.

Worse still, the interconnections within this ecosystem are far tighter than they appear. Seemingly independent protocols are actually closely linked through liquidity, collateral, and governance exposures. A single manager's mistake, poor asset allocation, or over-leveraging can ripple through multiple protocols, disrupting unrelated markets and even spreading to other chains. What appears to be a neutral, code-driven financial system is often a network composed of subjective decisions, opaque collateral flows, and recursive leverage cycles. This is not because DeFi itself is fragile, but because capital flows quickly, and the coordination of conflicts of interest is even faster.

Lending quietly accumulates; synthetic anchoring can mask under-collateralized positions; and temporary, self-referential liquidity loops can inflate annual yields. As decentralized finance (DeFi) scales, these effects will continue to compound. Therefore, transparency and risk assessment become crucial, especially when markets are rapidly volatile or established assumptions are broken.

The collapse of Stream exemplifies this, being one of the largest lending collapses in the DeFi space recently.

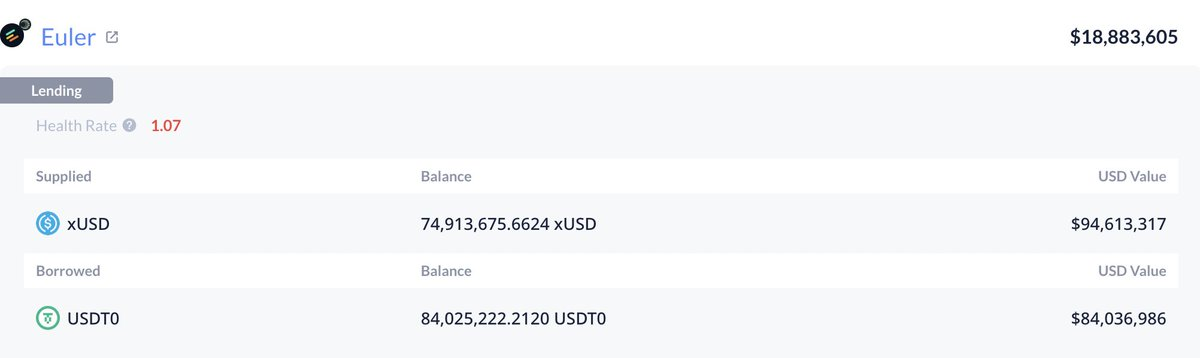

Users thought they were depositing USDC/ETH/BTC, but what they received was xUSD, a yield-bearing synthetic currency designed to operate like a 1:1 stablecoin.

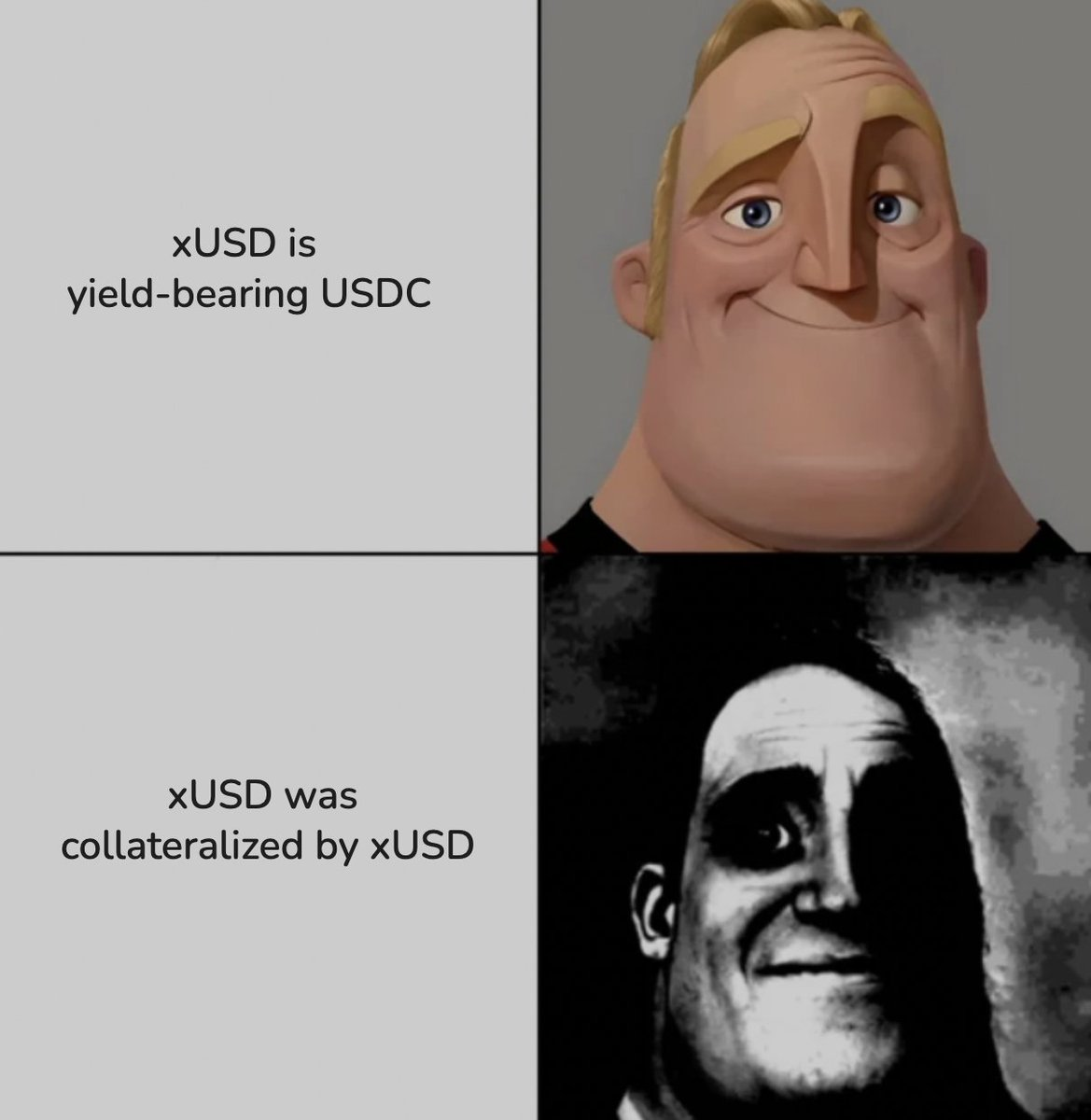

At its core, Stream dispersed deposits to external fund managers seeking higher yields and leveraged operations on other lending protocols like Euler, Morpho, and Silo. They borrowed, re-borrowed, and cycled funds into partner vaults, even using xUSD itself as collateral, thereby creating circular liquidity and inflating total value locked (TVL). In reality, Stream repeatedly collateralized its own synthetic tokens, building recursive leverage far beyond actual assets.

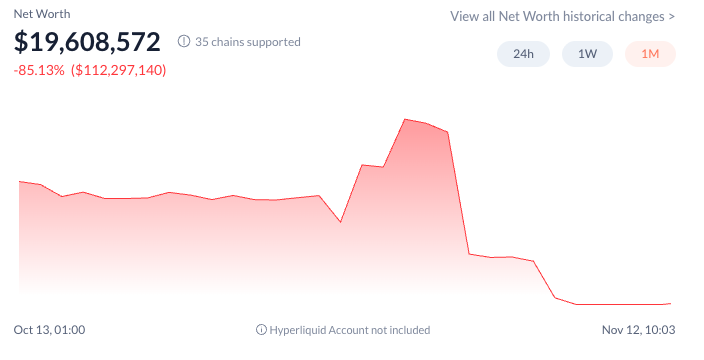

While the actual supporting assets were about $170 million, total liabilities ballooned to over $530 million, with a leverage ratio exceeding 3x. As long as the market remained calm, this illusion could be maintained. Once one component encountered issues, the entire structure would collapse.

The cracks appeared when an external fund management company—one of the institutions Stream entrusted to manage its funds—lost about $93 million, likely due to trading losses on centralized exchanges. This simple operational error completely destroyed the collateral foundation supporting xUSD. Suddenly, every xUSD in circulation was no longer backed by $1 in collateral. Panic spread, and the exchange rate of xUSD plummeted from $1 to nearly $0.30, prompting Stream to freeze withdrawals and redemptions.

The shock did not end there. Other protocols, such as… Elixir, which issued its own stablecoin deUSD, had 65% of its collateral exposure linked to Stream, amounting to about $68 million.

After Stream froze, Elixir's reserves evaporated instantly. Custodians like Re7, Telos, and MEV Capital, which had deposited user funds into Stream's vault, also had their accounts frozen, preventing end users from accessing their assets, while these custodians themselves were still able to operate.

Ultimately, the sequence of events was extremely simple:

A fund manager lost $93 million → Stream's collateral foundation collapsed.

Dollar decoupling → Confidence waned.

Withdrawals halted → Liquidity across the chain froze.

In the end, it was not any aspect of "code governance" that failed: it was human capital allocation, opaque re-collateralization, and governance mechanisms. This is the true hidden risk engine of DeFi.

For more related content, click here:

https://x.com/schlagonia/status/1983276845069152607?s=46&t=Hv6NP_Lw2ENr-Dv4Tfn-EA

and

https://x.com/yieldsandmore/status/1985571764441579649?s=20

The Myth of "Code Governance" Risks

The DeFi market is promoted as being governed by code, but in reality, the true risk engine is human. Curators choose assets, parameters, and leverage paths; smart contracts merely execute these choices.

Morpho Blue changed the trading landscape: independent, trading pair-segmented markets and curator-set parameters can effectively control default risk and make dependencies easier to understand. However, whether in centralized vault models or independent trading pair markets, discretion cannot be eliminated. Incentive mechanisms still favor total collateral value (TVL) and annual percentage yield (APY), and when the same collateral is reused across multiple asset pools, the problem of excessive recursion arises.

The issue is that dashboards display asset allocation, not asset dependencies. You can see which assets you have deposited, but you cannot see what risks you are actually taking on (or what institutions or individuals you are exposed to).

Due to a lack of standardized limits, independent oversight, or real-time disclosures, custodians often over-expand the system in pursuit of efficiency. The result is excessive recursion: the same economic collateral is collateralized across multiple protocols, leading to risk exposure multiplying rather than diversifying. Once an issue arises at one layer, all mirrored positions will collapse.

Dashboards obscure this fact. They will tell you where your funds are, but they will not tell you how many layers of re-collateralization separate you from the underlying collateral.

Risk Elements (Failure Points)

1) The Trap of Excessive Leverage

Leverage is the invisible addiction of DeFi. Initially just a simple optimization—using collateral to borrow and earn more yield—it eventually evolved into a vicious cycle of protocols continuously borrowing and re-collateralizing each other's assets. On-chain, this seems efficient. But in reality, it is layered leverage.

This cycle often hides under the guise of "diversification." Vaults are spread across various platforms, but they reuse the same underlying collateral through synthetic assets and re-collateralization. Total collateral (TVL) appears very large, but much of it is duplicated. A single stress event can destroy the entire structure, as the same $1 has been collateralized, re-collateralized, and re-leveraged across multiple protocols.

When everyone chases yield, the system generates a counterforce: yield → drives deposits → inflates total collateral ratio → enables more borrowing → forms tighter loops → until a cascade of liquidations occurs.

2) The Illusion of Stablecoins

Stability is the biggest lie that DeFi loves to tell.

Some "decentralized finance protocols" eventually issue their own "stable" currency units, not to reshape the monetary system, but to simplify lending, accounting, and liquidity flows. These tokens are anchored, not inherently stable, and their peg depends on the quality of collateral, liquidity depth, and the functioning of arbitrage paths.

When any of these factors weaken, the pegged value drifts. Stablecoins maintain their peg through:

Collateral redeemable at face value

Clear arbitrage paths

Market confidence that the redemption mechanism will always work

Why This Happens

Reserve Shock: Supporting assets depreciate or become inaccessible.

Liquidity Run: Too many holders attempt to redeem through shallow liquidity pools.

Arbitrage Friction: High gas fees, bridge congestion, or insufficient market liquidity hinder market stability.

Cross-Token Contagion: Collateral exposure to other unstable assets.

These dynamics are not unique to DeFi; they are strikingly similar to the pressures faced in traditional credit markets. This is somewhat akin to the infamous CDO structures that led to the 2008 subprime mortgage crisis. At that time, CDOs were constructed by layering poor assets with good ones to create a bond that appeared healthy on the surface. Today, it is built on complex and sometimes fragile over-collateralization paths, creating seemingly attractive annual percentage yields (APY).

The difference is that on-chain information is transmitted instantaneously, but without standardized real-time collateral dashboards, users still cannot fully understand the cumulative situation of underlying risk exposures. This again highlights the necessity of establishing independent infrastructure that can continuously coordinate collateral, liquidity, and market health signals.

3) The Liquidity Trap

The most common trap is also the mathematically most inevitable trap: high utilization rates.

Utilization Rate (U) = Total Borrowed / Total Supplied Available Liquidity = Total Supplied × (1 - U)

When lending demand surges, available liquidity can quickly vanish. At a 95% utilization rate, a vault with $100 million in deposits has only $5 million available for withdrawal. If you hold $10 million, you can withdraw a maximum of $5 million: the remaining funds will be frozen until the borrower repays. During market stress, when you need liquidity the most, borrowers often cannot repay. They may be insolvent, facing margin calls from other markets, or hoping for a market recovery. Utilization rates remain above 95%, and the withdrawal queue extends indefinitely.

4) Bankruptcy Protocols: Socializing Losses through Vaults

When lending protocols accumulate bad debts due to liquidation failures, oracle vulnerabilities, or operational losses, ways must be found to cover these losses. In direct lending, this situation becomes immediately apparent: the protocol token price plummets, governance proposes emergency measures, and you can choose to exit based on transparent information (or not).

In the Vaults structure, losses are quietly socialized.

Vault allocation across 3 protocols: Protocol A: $40M (healthy) Protocol B: $30M (suffers $20M bad debt) Protocol C: $30M (healthy) Total Assets: $40M + $10M + $30M = $80M Total Liabilities (depositor claims): $100M Shortfall: $20M (20% haircut)

All depositors immediately lose 20% — not due to their own asset allocation decisions, but because the custodian chose Protocol B. You are unaware of this risk exposure, have no control over the risk parameters, and cannot exit before the losses are finalized. A system that can verify asset allocator behavior, track underlying markets, and display changes piece by piece can significantly reduce this opacity.

5) Oracle Failures and Collateral Pricing Errors

Lending protocols rely on price oracles to assess collateral value and trigger liquidations. When oracles fail due to human manipulation, delays, or technical issues, the entire market can be thrown into turmoil.

Normal state: ETH price: $2,000 (per oracle) User borrows $1,600 against 1 ETH (80% LTV) Health Factor: ($2,000 × 0.80) / $1,600 = 1.0 Oracle reports incorrect price: $1,500 New Health Factor: ($1,500 × 0.80) / $1,600 = 0.75 Liquidation triggered But actual ETH price is still $2,000: Position is liquidated unnecessarily User loses liquidation penalty (5-10%) No recourse, no appeal

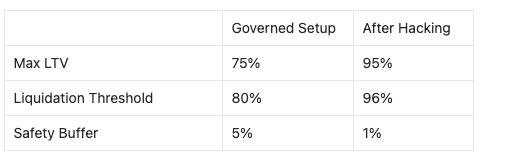

6) Governance Attacks and Parameter Manipulation

DeFi governance grants token holders control over parameters, but it also opens the door for malicious changes to parameters, potentially trapping lenders' funds. We have seen this in governance attacks like the governance tensions of Beanstalk and MakerDAO.

Most mainstream protocols have adopted multi-layer protection mechanisms: guardian roles, time locks, circuit breakers, and community oversight. So far, these mechanisms have prevented any complete governance takeover or malicious parameter tampering. But the risk is real, as the rules of the game are simple:

Risk Parameter Games

When parameters are pushed to such extremes, the system becomes fragile. With only a 1% safety buffer, even slight price fluctuations can trigger forced liquidations. During periods of extreme volatility, forced liquidations often fail for the following reasons:

Network congestion

Insufficient funds for liquidators

Slippage

The result is: bad debts continue to accumulate, ultimately borne by all lending institutions. Finally, and perhaps most annoyingly:

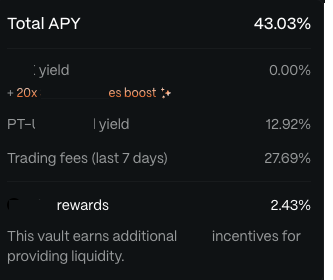

The Illusion of Interest

In DeFi, yields only match the rates claimed on the interface in very few cases.

Some project managers deliberately exaggerate data—such as annualizing a week of anomalous returns, compounding unclaimed rewards, or displaying total returns before deducting protocol fees. Other project managers may not be intentionally deceiving but simply cannot accurately measure returns. Their dashboards update every cycle, while the markets they rely on generate interest with every block. This leads to significant data gaps that can obscure risks.

Even those platforms that seem honest only show you snapshots, not the real situation.

Annual percentage yield (APY) is calculated based on outdated averages, ignoring idle funds, delays between deposits and loans, and losses from assets awaiting liquidation. Therefore, you typically end up receiving only half of the promised yield. In fact, no one can promise a fixed annual yield, as yields fluctuate with each block.

For those lenders who are still surviving, they might wonder, "Well, okay… there are indeed many risks, but how can I avoid these risks?"

Lending markets can never be completely risk-free. They are dynamic systems influenced by liquidity, incentive mechanisms, market structures, and human decisions. The distinction between sustainable yields and fragile yields lies not in luck, but in how risks are constructed—specifically, how the accumulation of interest is clearly defined.

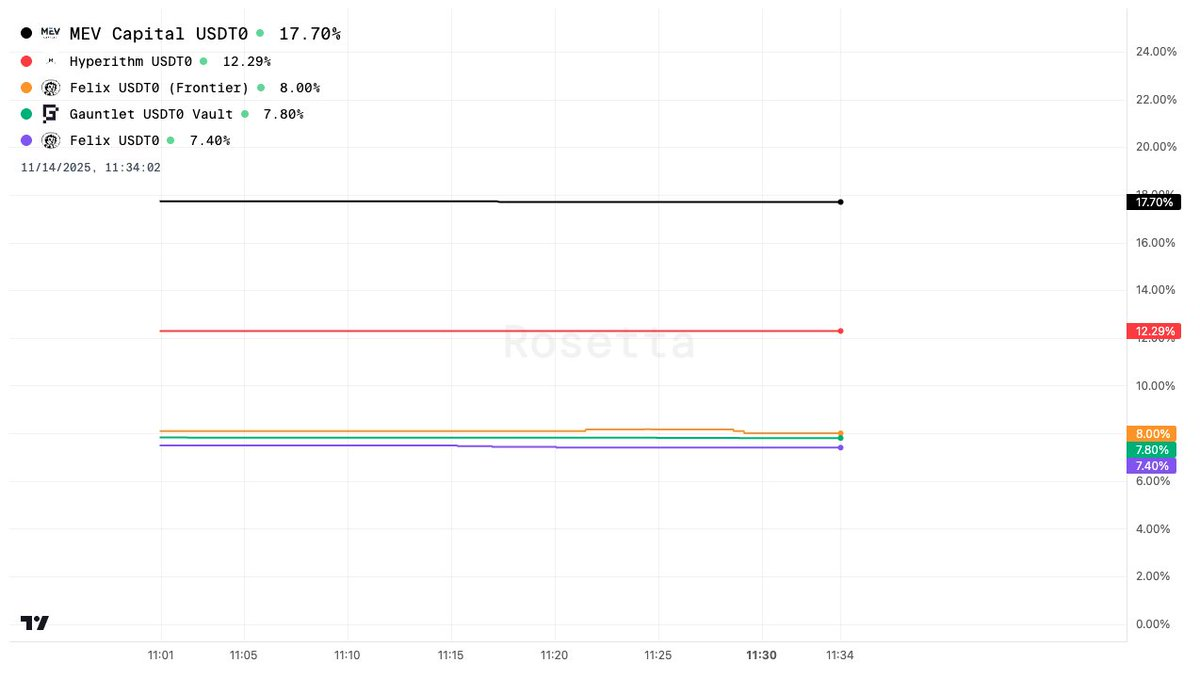

Rosetta's approach is to eliminate the hidden discretion of curators and achieve transparency through engineering:

On the surface, routers are applications. At the foundational level, Rosetta is the infrastructure layer related to yields.

Block-by-block yield tracking: Each vault's yield directly derives from on-chain accumulation. Even without user transactions updating vault status, interest continues to accumulate in each block. Rosetta captures this real-time dynamic, eliminating noise, outdated annual yields, and human-smoothed returns.

Interest Rate Model-based Validation: Rosetta follows the Interest Rate Model (IRM) curve (previously discussed here) and validates whether the results align with the protocol, ensuring that the returns users see are the actual returns generated by the protocol.

Cross-Market Reconciliation: Matching the reported yields of vaults with the weighted performance of their underlying asset allocations. Factors such as idle assets, changes in utilization, and unused liquidity are all considered, allowing users to understand the reasons behind yield fluctuations, not just the yield changes themselves.

Unified Transparency Layer: Users can view the sources of yields and how they evolve block by block. Only vaults with verifiable consistency will be listed, but even so, fund allocation remains entirely under user control. Rosetta conducts whitelist audits; however, the final decision-making power remains in your hands, allowing you to choose the set of vaults for fund rotation.

Rosetta focuses on sustainable yields rather than noise: it strives for the highest annual percentage yield (APY) under stability constraints. Subsidized yields, temporary yields, or structurally fragile yields will be excluded, as durability is always more important than visual appeal.

In short, Rosetta does not provide specific values in advance; the infrastructure measures and calculates. The router only allocates based on your strategy.

Interest is not predicted, subsidized, or guessed; it is measured, verified, and updated in real-time on-chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。