Bitcoin, once hailed as "digital gold," is now rapidly losing its luster. In the early hours of Monday, Bitcoin's price plummeted, briefly falling below the $93,700 mark, completely erasing over 30% of its gains this year and dropping below last year's closing level. The once-shining fire of this digital currency is gradually extinguishing amid panic selling.

Just over a month ago, Bitcoin stood proudly at a historic peak of $126,251, but it has now dropped over 24%, with a market value evaporating by more than $1.1 trillion.

This crash has triggered a chain reaction of liquidations that is hard to bear—within the past 24 hours, nearly 160,000 investors worldwide have been crushed in the crypto market, with total liquidations reaching $580 million, among which bullish positions suffered the most, with $410 million in liquidations.

I. Digital Collapse: The Instantaneous Shattering of the Bull Market Myth

This round of Bitcoin's crash is not only rapid but also thorough. Market data shows that Bitcoin has fallen to a low of $93,000, not only giving back all its gains for the year but also dropping below last year's closing level. Mainstream cryptocurrencies have all suffered, with ETH down 1.93% and SOL down 1.62%, leaving the market in a state of despair.

This collective plunge is not coincidental. Since reaching a historic high on October 6, Bitcoin has entered a downward channel. Especially after Trump's unexpected tariff remarks triggered global market turmoil, digital currencies were the first assets to be sold off.

II. Who is Abandoning Bitcoin?

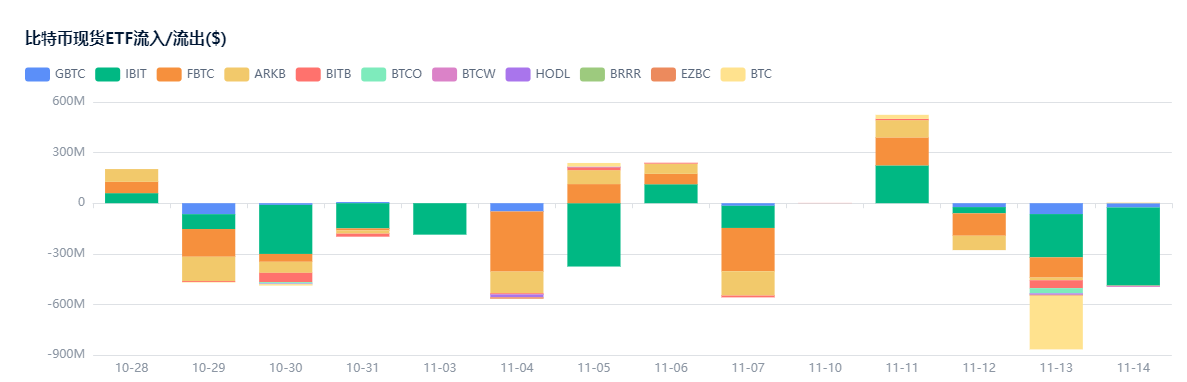

- Institutional withdrawal is the main driver of this decline. Patrick Munnelly of Tickmill Group pointed out in a report that major investment funds, ETF investors, and corporate finance departments have all retreated from Bitcoin. The exit of these institutional investors has taken away the "key pillars supporting this year's rebound," thus "opening a new era of market vulnerability."

- The concentrated selling by long-term holders has further exacerbated the situation. AiCoin data shows that in the past 30 days, long-term Bitcoin holders have sold approximately 815,000 Bitcoins, marking the highest selling activity since early 2024.

- Even more concerning is that "whale" wallets holding Bitcoin for over seven years are continuing to sell at a rate of over 1,000 Bitcoins per hour. The specific addresses of these whales are 1GcCK347TMbzHrRpDoVvJ6eyECyqHCiU; bc1qmnjn0l0kdf3m3d8khc6cukj8deakg8m588z24g; bc1qczar85zjppfjr8df8qnc4l3h5r957v6p2udryz.

III. Deteriorating Sentiment: The Market is Deeply Trapped in a Negative Vortex

- A report from market sentiment analysis platform Santiment shows that negative discussions around Bitcoin, Ethereum, and XRP have surged, with the positive/negative sentiment ratio significantly declining, and sentiment levels far below normal. This widespread pessimism indicates that investor confidence in cryptocurrencies continues to wane.

- Since the large-scale liquidation event on October 11, key sentiment indicators have shown that market sentiment has failed to recover and has instead further deteriorated.

- Market analysis firm 10x Research bluntly stated that the crypto market has entered a "confirmed bear market phase." Weak ETF inflows, continued selling by long-term holders, and low willingness of retail investors to enter all indicate that market sentiment is secretly worsening.

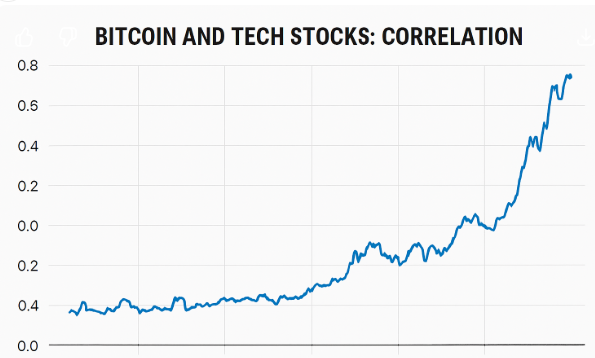

IV. Increasing Correlation Between Bitcoin and Tech Stocks

- A new feature of this bear market for Bitcoin is its increasingly close correlation with traditional financial markets. The correlation between Bitcoin and U.S. tech stocks has rarely risen to high levels.

- The 30-day correlation between Bitcoin and the Nasdaq 100 index has reached about 0.80, the highest level since 2022 and the second highest in the past decade. This data indicates that Bitcoin's market performance is increasingly resembling that of leveraged tech stocks.

- Bitwise Chief Investment Officer Matthew Hougan admitted, "Overall market sentiment is leaning towards risk aversion. Cryptocurrencies are the canary in the coal mine; they are the first assets to retreat."

V. Has the Bottom Not Yet Arrived or Is It a Good Buying Opportunity?

- Analysts have differing views on the market outlook. 10x Research pointed out that the two rounds of bear markets in the summer of 2024 and early 2025 brought declines of 30% to 40%. Currently, Bitcoin has only retraced over 20% from its 2025 peak, which is not enough to form a true bottom signal.

- Data from the derivatives market also supports this cautious view. Demand for put options with strike prices below $100,000 has significantly increased. Among them, protective contracts around $90,000 and $95,000 are the most actively traded, indicating that the market expects prices to potentially drop further.

- However, Bitwise CEO Hunter Horsley offered a different perspective, arguing that the traditional four-year cycle model is based on the old era of cryptocurrencies. "Since the launch of the Bitcoin ETF and the new management team taking office, we have entered a completely new market structure: new participants, new dynamics, and new reasons for people to buy and sell."

VI. The Growing Pains and Future of Cryptocurrencies

This crash reveals the still fragile nature of the cryptocurrency market.

- Cory Klippsten, CEO of Swan Bitcoin and a veteran in the Bitcoin industry, revealed that many early holders have been talking about the $100,000 figure since 2017. "For some reason, this is the level people have always said they would sell some."

- Nic Carter, co-founder of Castle Island Ventures, advises investors to "emotionally decouple from cryptocurrencies" and not to put too much pressure on themselves to "succeed" in 'this cycle.' He reminds investors, "Real life is not like that. The price trends of cryptocurrencies over the past decade have blinded you. This will not happen again."

The plunge in Bitcoin once again confirms its inherent high volatility. As long-term holders cash out at the $100,000 mark and institutional funds quietly withdraw, the pillars supporting Bitcoin's glorious rise have already shaken.

The matrix inflection point has arrived, and future trends will heavily depend on the Federal Reserve's policy decisions and the return of risk appetite in traditional financial markets. At present, Bitcoin's title as the "canary in the coal mine" seems particularly apt—it is not only a warning signal for risk sentiment but also a barometer for the shift in investment world mentality.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。