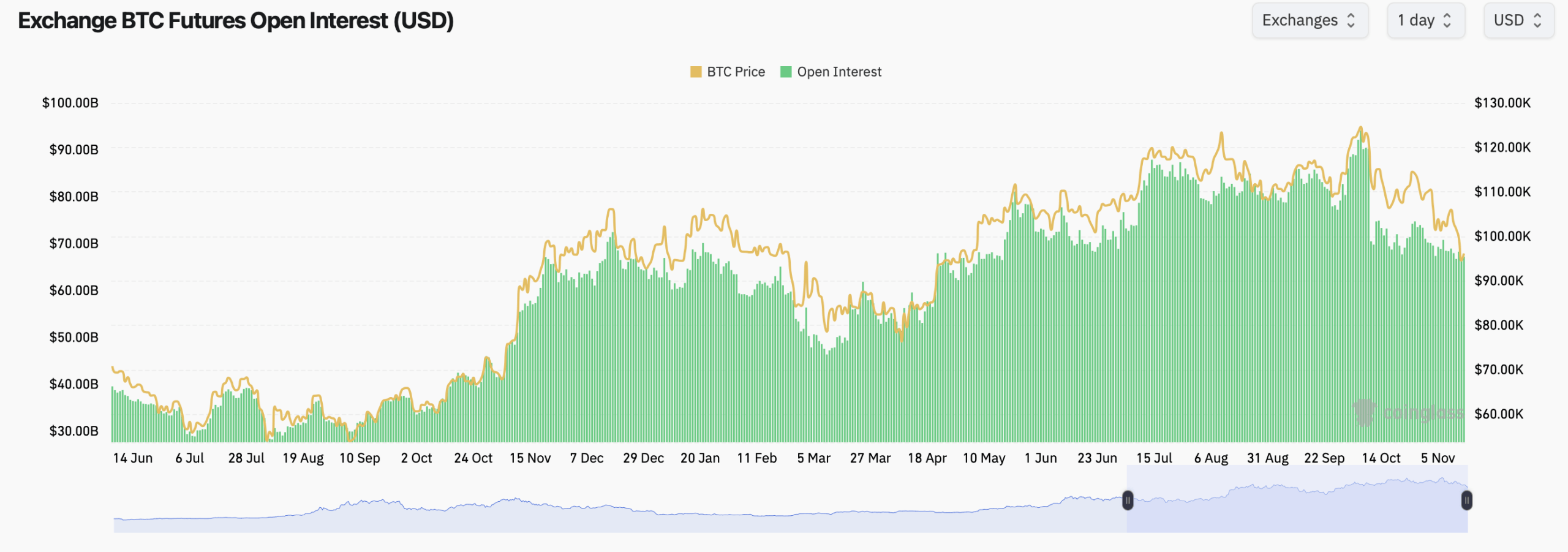

The pullback shaved 5.6% off bitcoin’s weekly performance, though a mild 1.4% intraday rise today has kept sentiment from fully slipping into doom mode. Across the futures landscape, coinglass.com stats show open interest (OI) totaled 699,010 BTC valued at $67.22 billion, a cool-down from recent highs that reflected a mix of forced deleveraging and voluntary risk-off retreats.

CME has maintained its iron grip on the institutional crowd with 143,170 BTC in total OI, translating to $13.76 billion and a dominant 20.47% share. Even with bitcoin’s dip, CME posted a modest 0.33% rise in the past hour and a 0.91% gain over 24 hours, signaling that the biggest players seem to be nibbling rather than panicking.

Bitcoin futures OI via coinglass.com on Nov. 15, 2025.

Binance follows closely with 134,130 BTC in OI worth $12.89 billion, and its 5.20% daily increase suggested traders were more interested in rotating positions than heading for the exit. OKX, Bybit, Kucoin, and MEXC all added fresh open interest in the daily window, while Gate and BingX saw noticeable drops.

BingX in particular logged a striking 10.67% decline in OI over one hour and a 15.36% reduction across 24 hours, pointing to how quickly leverage evaporates when the price backpedals. The broader yearly OI trend shows bitcoin futures still sitting at historically large levels despite the recent drawdown,

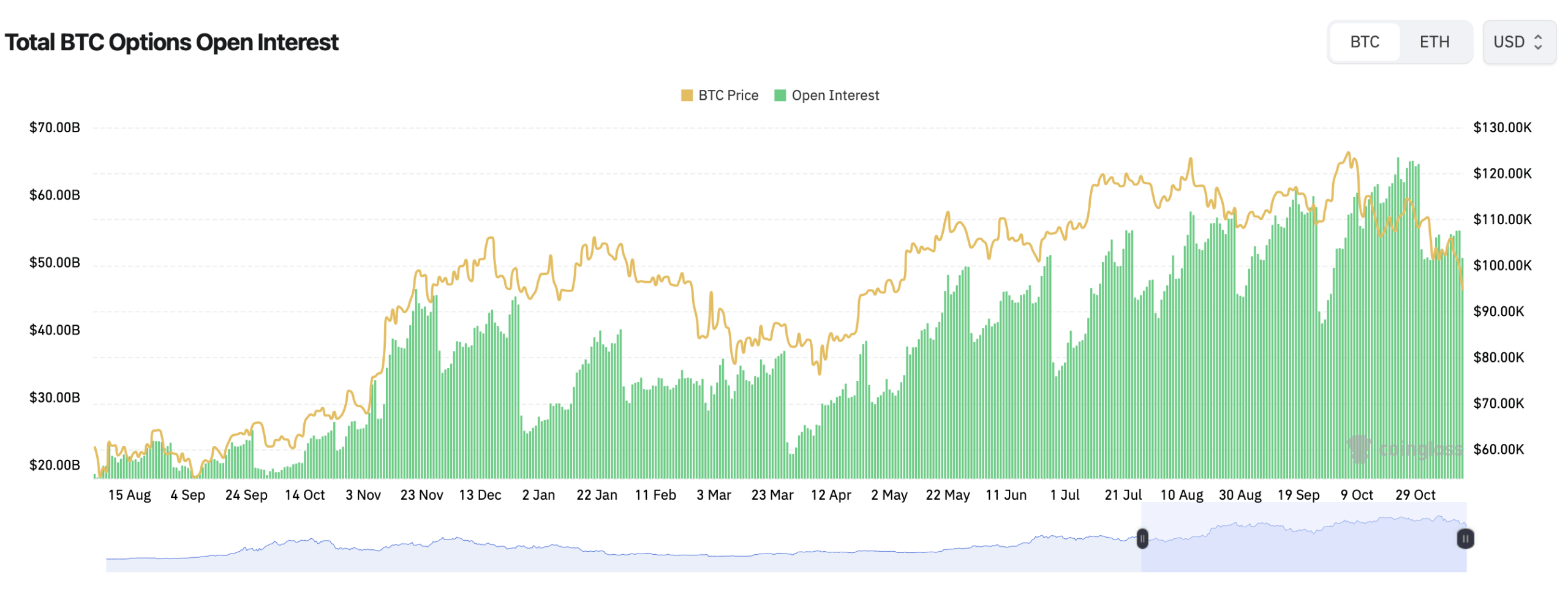

The market echoes past cleanup phases that often preceded sharp rebounds—or deeper corrections, depending on which camp you ask. The options market, this weekend, tells a different story entirely, one that looks considerably more upbeat. Calls dominated with 279,653 BTC in open interest, or 60.24% of the total, overshadowing 184,559 BTC in put OI.

Bitcoin options OI via coinglass.com on Nov. 15, 2025.

Over the last 24 hours, calls logged 23,214 BTC in volume versus 18,217 BTC in puts, reinforcing that traders continue to lean toward upside exposure even as price tests the mid-$90,000 region. Deribit’s leading contracts clustered around $85,000 puts and $140,000 to $200,000 calls, reflecting both protective hedging and long-dated bullish speculation. The Nov. 28, 2025, expiration has drawn meaningful action, especially at the $90,000 strike, where traders seem eager to guard against a deeper slide.

Also read: Bitcoin Price Watch: Bottoming or Just Breathing? The Charts Weigh In

Max pain levels across several major venues drew a neon underline under market indecision. On Deribit, the max pain zone sits between roughly $100,000 and $105,000, with monster notional volume surrounding the Dec. 26, 2025 expiry. Binance’s max pain curve runs hotter, nudging into the $110,000 to $150,000 range thanks to more aggressive upside speculation dominating its book.

OKX max pain stats center closer to spot, with max pain hovering in the $97,000 to $105,000 corridor. Together, they paint a picture of a market that wants bitcoin pinned in a tight band, a mildly irritating development for both breakout chasers and breakdown hunters. Despite the week’s turbulence, calls retaining the upper hand suggest traders aren’t ready to abandon the narrative of a massive Q4 rebound.

The futures market may be trimming risk, but the options market continues to broadcast a more confident tone, one where traders expect volatility but still lean toward strength this year over extended weakness. With max pain levels clustering around current prices, bitcoin may be stuck in this narrow range until an outside catalyst forces the next decisive move. For now, derivatives traders are bracing for impact while keeping one eye on the upside—just in case bitcoin decides to defy the mood once again.

- What is bitcoin’s total futures open interest today?

Bitcoin futures open interest is about $67.22 billion across major exchanges. - Are traders leaning toward calls or puts in the bitcoin options market?

Calls make up about 60% of open interest, showing a bullish tilt. - Where are max pain levels clustering for bitcoin options?

Max pain ranges roughly between $95,000 and $105,000, depending on the exchange. - • Which exchanges lead bitcoin derivatives activity?

CME, Binance, OKX, Bybit, and Deribit dominate today’s futures and options flows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。