In the midst of strategizing, we decide victory from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

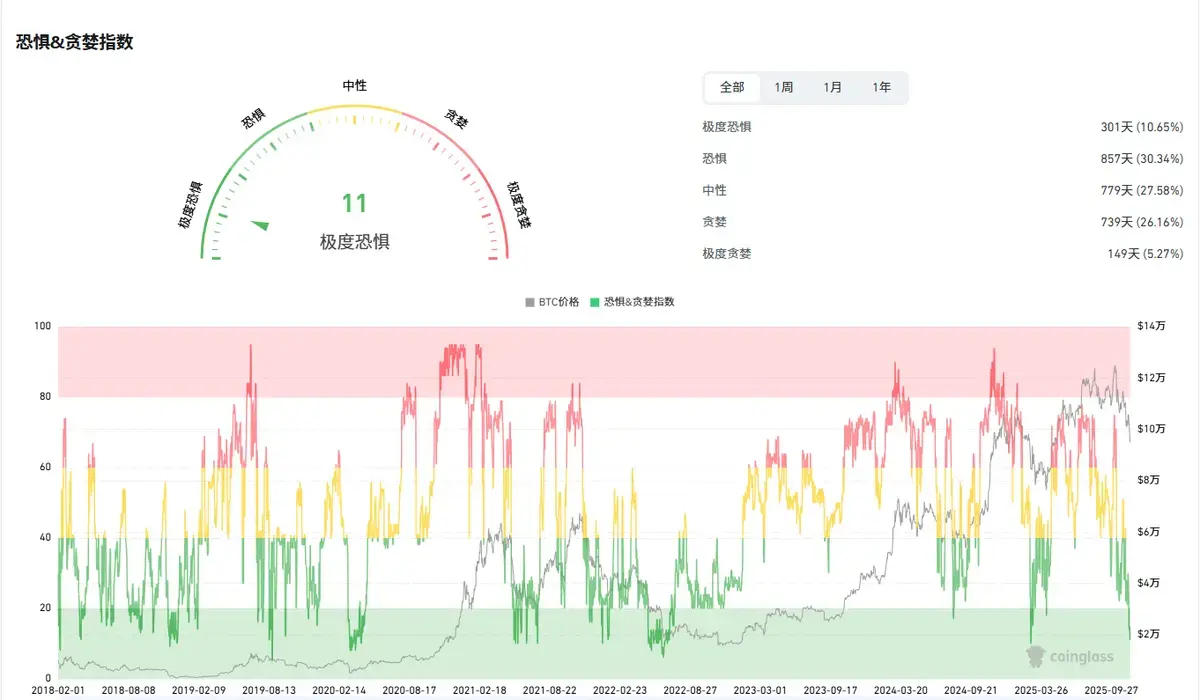

Friends who have been following Lin Chao for a long time will notice that this chart often appears in the text, reflecting market sentiment. Buffett once said, "Be fearful when others are greedy, and greedy when others are fearful." This chart is a barometer of the market and an important reference indicator in Lin Chao's trading, but it is definitely not the only indicator. The Fear and Greed Index is indeed helpful for building positions, but this data is not absolute.

The current fear index has dropped to 11, indicating that the market is very confused and fragmented right now. I see many bloggers saying to wait for a rebound. First of all, Lin Chao has always emphasized not to speculate on the market. When the market is in extreme fear, it is indeed possible to observe whether a bottom is being formed, but that does not mean a rebound will happen immediately, or that the bull market will be heralded. Moreover, given the current market liquidity, a skyrocketing market is impossible.

Many people are puzzled. There are still many positive news in the market, and the U.S. government has reopened, yet the market performance is still so sluggish?

Why do U.S. stocks react the fastest every time there is a tax increase or interest rate hike, while crypto assets show a lagging response?

But when liquidity worsens, especially during peak escape, crypto assets usually lead the decline compared to U.S. stocks?

This is actually related to trader behavior.

First, let’s answer why stock prices react so quickly to tax increases or interest rate hikes, while crypto assets may lag: You can understand that stocks have a set of best practices for market consensus valuation, the Discounted Cash Flow Model. This model consists of many "assumption factors," such as future income forecasts, gross margins, taxes, and interest rates, and ultimately this model can yield the "reasonable market value" of a stock.

Although these "assumption factors" are derived from research and intuition by various fund managers, everyone respects this methodology itself. Therefore, when a "tariff event" is announced, the change in the "tax" factor will immediately reflect in each fund manager's valuation model for every stock, and the change in the tariff factor will lead to a decline in the "model result," which is the market value. So when such events occur, the valuation changes caused by "tariffs" become market consensus, and "selling" also becomes consensus, making the process of reaching "price consensus" very quick, especially for more mature and blue-chip companies. This fair valuation system is missing for crypto assets; it is hard to say how a 50-point increase in tariffs affects the price of BTC, so the market's achievement of "price consensus" usually has a lag, and at this time, it mostly follows U.S. stocks.

So why do crypto assets usually decline first when liquidity worsens, especially during peak escape? Because when fund managers sense that liquidity is deteriorating and may be peaking, they start to shift to a defensive stance, and the first assets to be cleared are definitely the riskier ones, and cryptocurrencies are a riskier asset class than U.S. stocks. Lin Chao has also mentioned before that when the government reopens, although liquidity will be released, it will definitely not flow into the crypto market immediately. The reason is simple: there are too many places that need to be rescued, and the crypto market is indeed considered a marginal asset in the entire financial system. When a fire occurs, do you save your family first or look for that bird you have raised for a year?

Lin Chao understands that friends holding spot assets will have hope, thinking that the market is already so devastated, it should give a little hope. Many people trade based on their feelings, with a short-sighted perspective. If we extend the cycle, there have been many times of extreme panic; currently, it is not an absolute low point, and it may even be a historical high for crypto assets. Extreme panic in the market, could it not be the beginning of a bear market? Could it not be the start of a continuous decline? Could it not be six months of fear? If you still hold onto fantasies and hopes, it indicates that the market has not yet fully declined.

The reality may make everyone more painful, more fearful, and even continuously fearful. Still, the same saying applies: do not think about easily bottoming out, and do not think about being able to sell at the peak. We are all ordinary people; what we can do is to make good use of the tools in our hands, follow the market rhythm, engage in trend trading, and earn the easy money. Do not be afraid; after all, it is still possible to make money in a bear market.

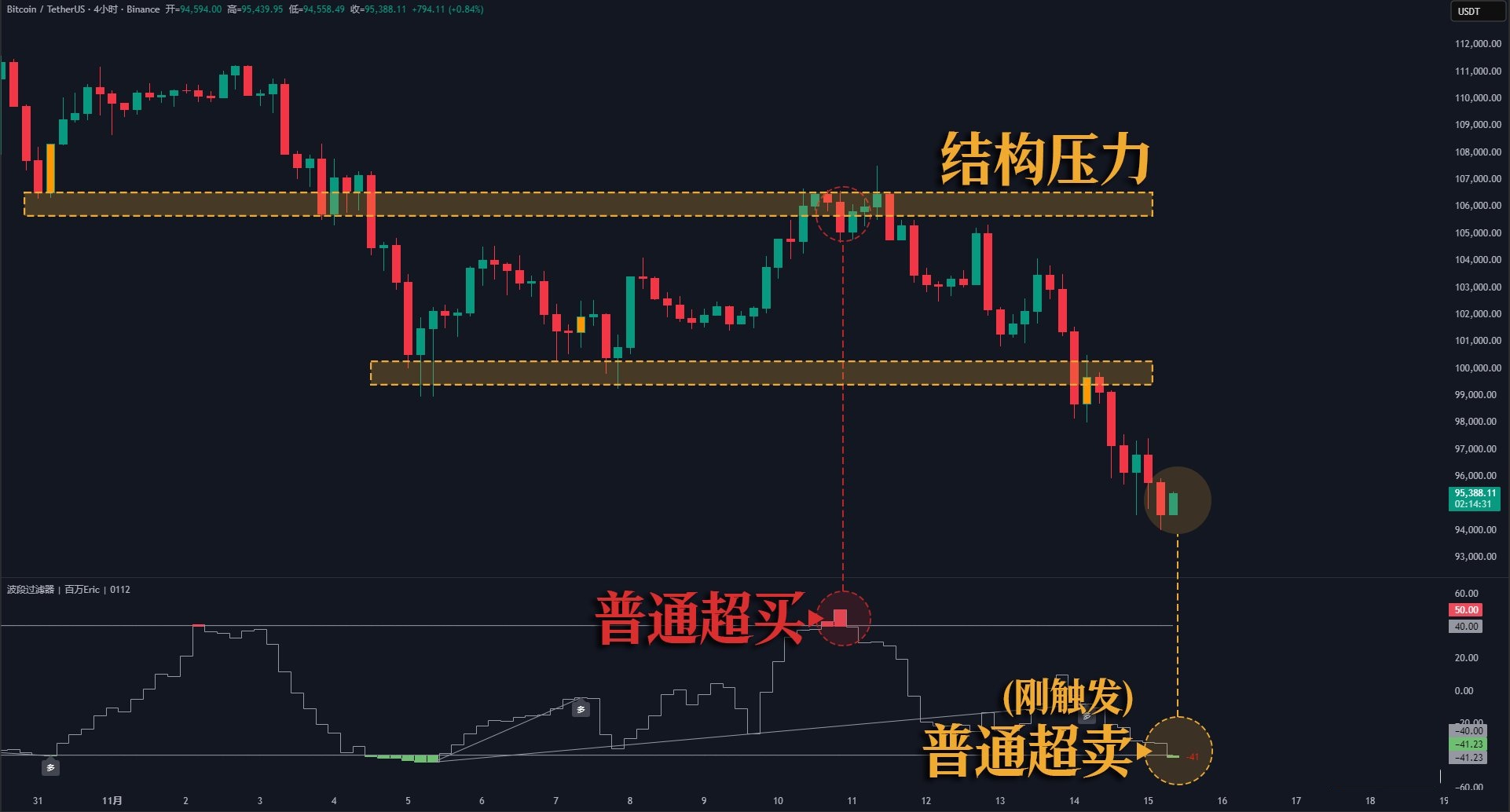

Let’s look at the current index situation. From a technical perspective, Bitcoin has triggered a four-hour oversold signal. If a rebound occurs, wait for the price to rebound back to the structural resistance area or the moving average resistance area, observe the momentum decay, and Lin Chao will re-enter to short, rather than waiting for a rebound following the emotions. Learn to hedge, learn to hedge, learn to hedge; Lin Chao needs to emphasize this repeatedly because it is very important.

The success of investment depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocation is essential for steady progress in the ocean of investment. Life in the world is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or a moment, but rather planning before action and knowing when to stop to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The crypto space has risks; invest cautiously!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。