Standing at the Crossroads of Real Innovation and Financial Illusion

Written by: Bruce

Introduction: The Hidden Shadows Beneath the AI Boom

We are in an exciting era where the AI revolution is permeating every corner of life at an astonishing speed, promising a more efficient and intelligent future. However, recently, a concerning signal has emerged: the world's most prominent AI company, OpenAI, has publicly requested federal loan guarantees from the U.S. government to support its massive infrastructure expansion, which could cost over a trillion dollars. This is not just an astronomical figure; it is a stark warning. If the financial blueprint supporting this AI boom bears a striking resemblance to the structure of the 2008 financial crisis that nearly destroyed the global economy, how should we perceive it?

Despite the promising prospects of the AI industry and the potential of technological revolution, recent market signals have surfaced indicating unsettling financial pressures. The underlying structure of its capital operations bears a remarkable similarity to several historical financial crises, particularly the 2008 subprime mortgage crisis. This article will delve into the capital cycles, leverage operations, and risk transfer issues behind these warning signs, penetrating the market narrative to stress-test the financial structure supporting current AI valuations. Ultimately, we will assess the nature of the risks, possible outcomes, and propose strategies for investors to respond.

Warning Signs Emerge: Early Warning Signals Centered on Oracle

In the current wave of prosperity driven by AI technology, market sentiment is generally optimistic, with tech giants' stock prices hitting new highs. However, just as experienced miners take canaries underground to warn of toxic gases, in this seemingly bright market, the abnormal financial indicators of certain companies can often serve as "canaries in the coal mine" revealing potential systemic risks in the entire industry.

Canaries in the Coal Mine

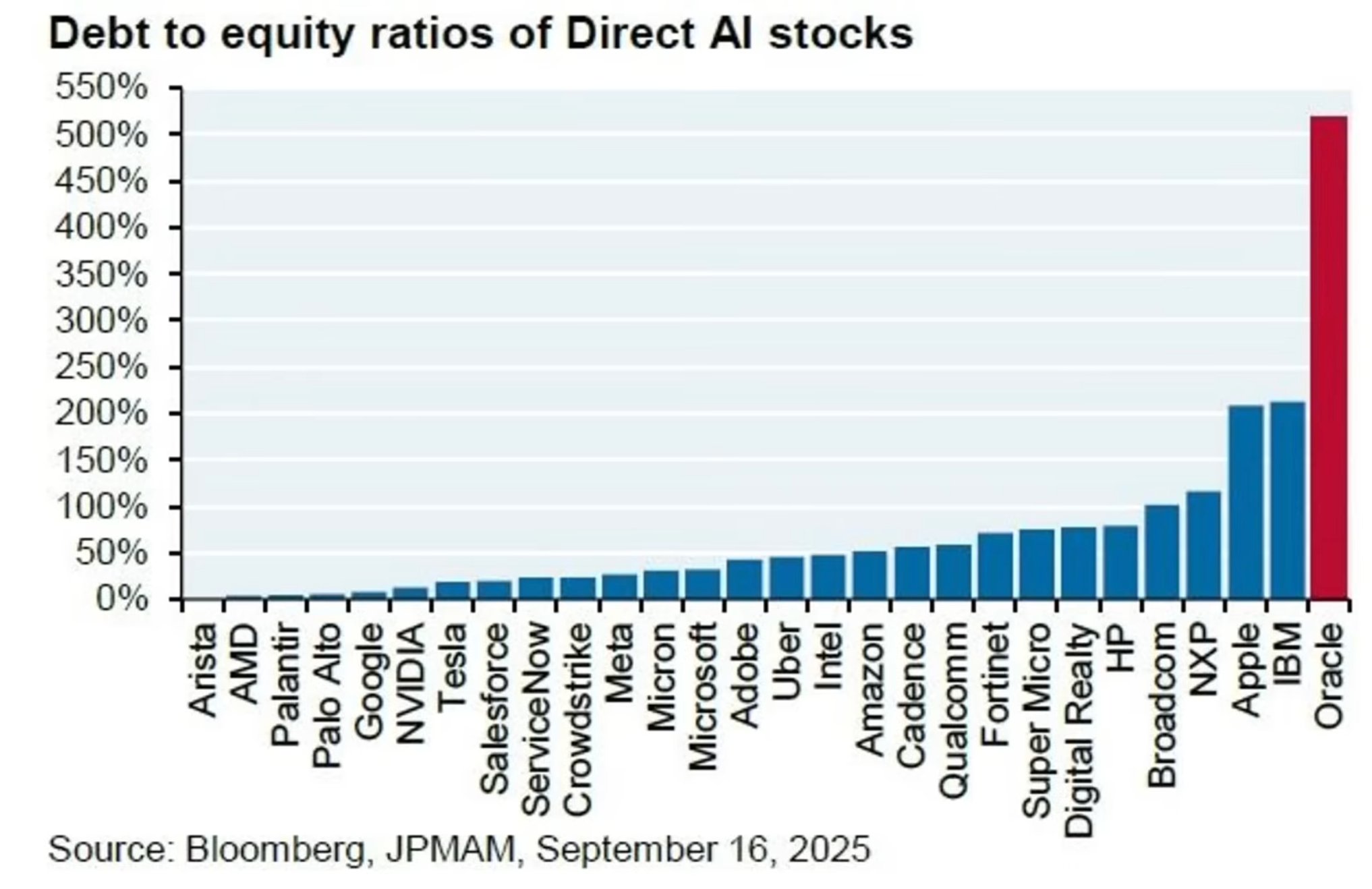

The established tech giant Oracle is making a high-stakes gamble. To challenge the dominance of Amazon, Microsoft, and Google in the AI data center space, it is investing hundreds of billions of dollars at the cost of extremely high debt, including the "Stargate" super data center project in collaboration with OpenAI. Its debt-to-equity ratio has reached an astonishing 500%, meaning its total debt is five times its net assets. In contrast, Amazon's debt-to-equity ratio is only 50%, and Microsoft's is even lower. In simple terms, Oracle has nearly wagered its entire fortune and future value in this AI race.

Debt Levels of U.S. Tech Giants

This alarm is known as Credit Default Swap, CDS. The most critical recent signal is the insurance cost set for Oracle's potential "debt default" fire: its CDS spread has soared to the highest point in years. We can understand CDS as a form of financial insurance: imagine your neighbor (Oracle) is stacking a large amount of flammable material (mountains of debt) in their basement every day. You are very concerned that their house might catch fire, potentially affecting you. So, you find an insurance company and pay out of your own pocket to buy fire insurance for your neighbor's house. This insurance contract in the financial world is the CDS, and the premium you pay is the price (spread) of the CDS. A soaring premium means that the insurance company believes the risk of fire has sharply increased.

This phenomenon conveys a clear message: the top and most astute financial institutions in the market generally believe that Oracle's default risk is rising sharply, rooted in the "mountains of explosive debt" on its balance sheet. Oracle's debt alarm is like a crack on the surface; although small, it suggests that the tectonic plates deep underground are undergoing violent movements. What kind of structural risks are hidden within this capital operation model driving the entire AI industry?

Deep Financial Structure: The "Infinite Money Loop" Game Among AI Giants

The financial pressure of a single company is just the tip of the iceberg. When we broaden our perspective from Oracle to the entire AI ecosystem, a deeper, structural risk emerges. The real risk is rooted in a unique capital operation model among AI industry giants, a financial game that seems to turn stone into gold but is, in fact, extremely fragile. This is the closed capital game known as the "infinite money loop," which inflates revenue bubbles out of thin air, constructing a seemingly prosperous yet fragile financial system.

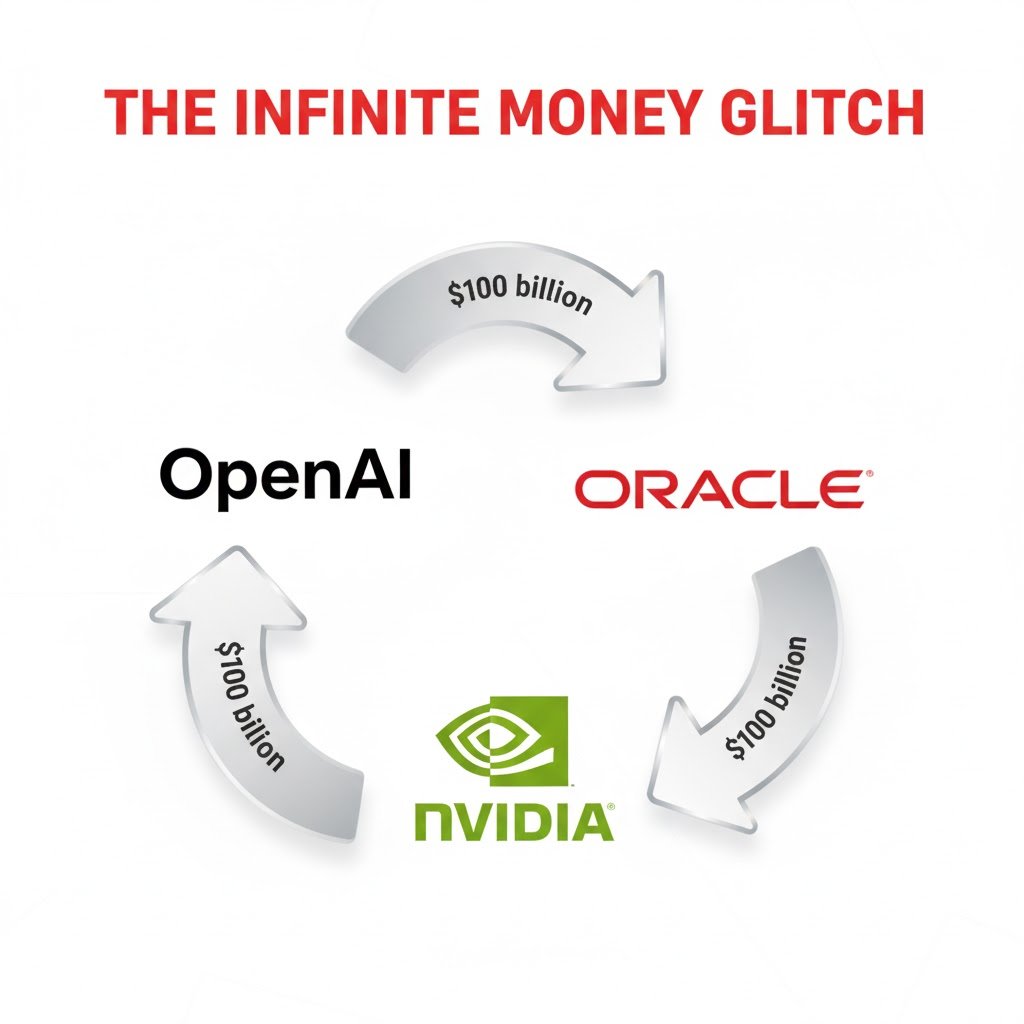

To better understand this model, we can simplify it into a "three friends starting a business" scenario:

Step One: Chip giant Nvidia (Mr. A) invests 100 yuan in the AI star company OpenAI (Mr. B).

Step Two: OpenAI (Mr. B) immediately pays all 100 yuan to Oracle (Mr. C), nominally to purchase its expensive cloud computing services.

Step Three: Oracle (Mr. C), upon receiving the 100 yuan, quickly uses it all to buy powerful superchips from the original investor, Nvidia (Mr. A).

The Game of Infinite Funds

After this round of circulation, the 100 yuan returns to Nvidia's hands. However, despite the funds merely circulating internally without any real purchases from external customers, all three companies' financial statements "magically" show that they each generated 100 yuan in revenue. This makes their financial reports exceptionally bright, strongly supporting their high stock prices and market valuations.

The fatal flaw of this model lies in the fact that the entire game is not built on solid customer demand but entirely relies on the commitments of the participants to each other and the ever-expanding credit. Once any link in the cycle breaks—such as Oracle being unable to repay loans due to excessive debt—the entire seemingly prosperous system could collapse in an instant. This closed capital loop that inflates revenue bubbles through internal transactions is not financial innovation; its structure bears a striking resemblance to the operational methods before certain historical financial crises, evoking memories of the storm that nearly destroyed the global economy.

Echoes of History: Five Striking Similarities Between the Current AI Financial Structure and the 2008 Subprime Crisis

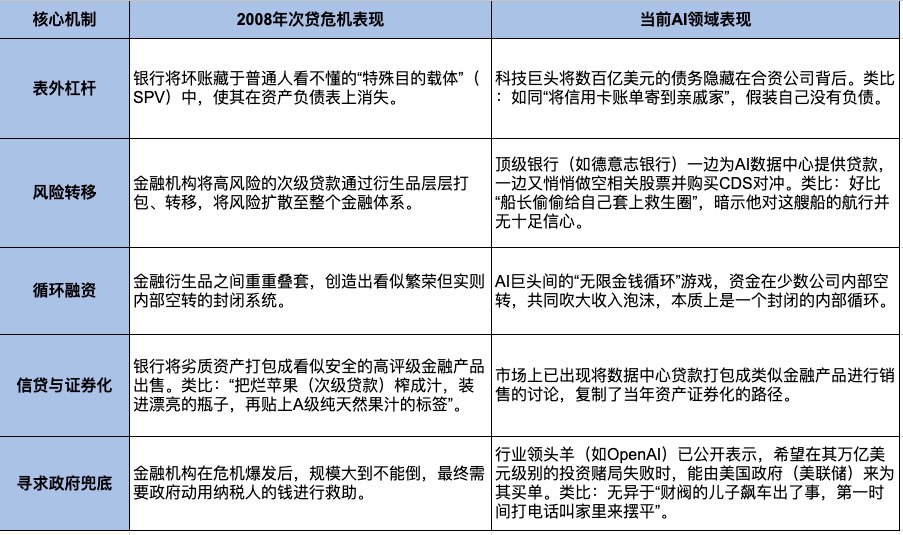

The current financial phenomenon is not isolated. When we piece together Oracle's debt alarm with the capital cycle among AI giants, market observers who experienced the 2008 financial tsunami may feel a sense of "déjà vu." Below, we systematically analyze the five key commonalities between the current financial operations in the AI field and the core elements that led to the 2008 global financial crisis, revealing that history may be repeating itself in a new form.

Comparison of the 2008 Subprime Crisis and the Current AI Bubble

These five striking similarities paint a disturbing picture. However, history never simply repeats itself. Before we hastily equate the AI bubble with the subprime crisis, we must answer a core question: at the center of this storm, is the nature of the "assets" used as collateral fundamentally different?

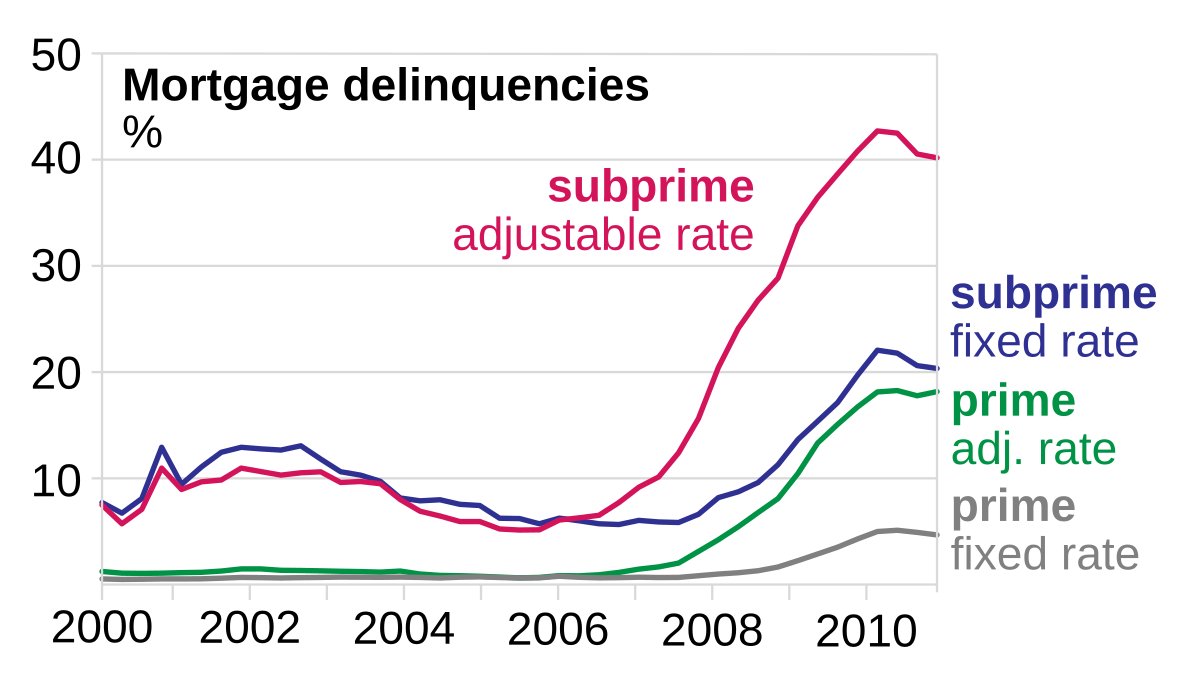

2008 Subprime Crisis

Key Difference Analysis: Why This Time May Not Be a Simple Replay of 2008

Despite the aforementioned similarities being alarming, equating the current AI wave with the 2008 subprime crisis is one-sided. History has rhythm but does not simply repeat itself. Beneath the astonishing similarities lie three fundamental differences that may determine the ultimate trajectory and impact of this potential crisis.

The Nature of Core Assets is Different: The core asset in 2008 was non-productive residential real estate. For the vast majority of homeowners, the property itself did not generate cash flow to repay loans. The entire game relied entirely on a fragile belief: "home prices will always rise." Once this belief was shattered, the entire credit chain would snap.

The current core assets in AI are productive data centers and GPUs. Data centers and GPUs are typical productive assets, akin to "cash cows." They are built solely to generate cash flow by providing computing power services. Therefore, the key question shifts from "Will asset prices fall?" to "Will the speed of cash flow generation from assets outpace their financing and operating costs?" This fundamental shift is the key distinction that downgrades this potential crisis from "systemic risk threatening the global banking system" to "a significant reshuffle within the tech industry."

The Creditworthiness of Borrowers is Different: In 2008, the borrowers were subprime credit individuals. The powder keg that ignited the crisis was those individuals with unstable incomes and poor credit histories, who lacked the genuine ability to repay from the start.

Current AI borrowers are top tech companies. The ones engaging in reckless borrowing in the AI field today are primarily the wealthiest and most profitable top companies like Amazon, Microsoft, and Google. Their ability to repay debts is far beyond what subprime borrowers could compare to.

Regulatory Environment Differences: We live in a "post-2008" world. After that global crisis, the global financial regulatory system has been patched with a series of important "fixes." Banks are required to hold more capital to cope with potential risks, and regulatory bodies like central banks are now more inclined to "intervene proactively" rather than being reactive as they were back then.

Considering these three key differences, we can draw an important conclusion: even if the AI bubble eventually bursts, the outcome is unlikely to be a systemic financial crisis that destroys the global banking system like in 2008. Instead, it is more likely to evolve into another historically notable crisis pattern: a "2000 Internet Bubble 2.0" in the tech industry.

Risk Assessment and Outlook: A "2000 Internet Bubble 2.0" in the Tech Industry?

Based on the previous analysis of the similarities and differences between the AI financial structure and the 2008 crisis, we can make a more precise qualitative assessment and outlook for the potential risks in the current AI field. The conclusion is that if a crisis does erupt, its pattern will be closer to the burst of the 2000 internet bubble rather than the global financial tsunami of 2008.

Based on this judgment, the ultimate outcome of this potential crisis is more likely to be a crisis primarily confined within the tech industry. Once the bubble bursts, we may see a large number of AI companies that rely on "stories" and debt collapse; tech stocks will experience painful declines; and countless investors' wealth will evaporate. The "pain will be severe," but it is highly probable that it "will not drag the entire world down." The reason for the relatively limited impact is that the risks are mainly concentrated among equity investors and the tech supply chain, rather than permeating the global banking system's balance sheets through complex financial derivatives as in 2008, thus avoiding systemic credit freezes.

With a clear understanding of the nature of the risks and possible outcomes, the most critical question for investors involved is no longer "Will there be a collapse?" but rather "How should we respond?"

Investor Response Strategies: Finding Opportunities Amid Caution

In the face of a potential internal industry crisis, the core task for investors is not to panic and liquidate their positions, but to engage in rational risk management and portfolio optimization. Now is not the time to flee, but rather to carefully prune the investment portfolio like a shrewd gardener. The following three specific, actionable strategies aim to help investors remain vigilant while protecting existing gains and positioning for the future.

Strategy One: Review and Categorize AI Stocks Held:

First, it is essential to clearly categorize the AI-related stocks you hold to assess their respective risk levels:

Core Players: Such as Nvidia and Google. These companies have strong financial foundations, and their AI investments primarily stem from robust profits and cash flow, making them the most resilient participants.

High-Risk Challengers: Such as Oracle. These companies attempt to achieve "curve jumping" through massive borrowing, which may yield high returns but is also extremely fragile, making them the most vulnerable group in a potential crisis.

Investment Warning: For stocks like Oracle that have already experienced a round of "pump and dump," do not attempt to "catch the bottom" until a new narrative emerges that can support a higher valuation. The selling pressure from those previously trapped is immense, and the risk of entering at this time is very high.

Strategy Two: Think Like a Bank and "Insure" the Portfolio:

- Learn from the hedging mindset of smart financial institutions and "insure" your investment portfolio. For ordinary investors, the simplest and most effective hedging method is not complex options trading but rather taking partial profits. It is advisable to sell some of the stocks that have risen the most, especially those high-risk stocks driven by "narratives," turning "paper wealth" into cash in hand. This move does not indicate a lack of confidence in the long-term future of AI but reflects a mature investor's effort to protect existing gains.

Strategy Three: Diversify Investments to Avoid Putting All Eggs in One Basket:

- It is recommended to transfer some of the profits from AI stocks into more robust asset classes to diversify risk. Viable directions include higher dividend-paying defensive assets or traditional safe-haven assets like gold and government bonds. For those wishing to maintain exposure to the tech sector while seeking to diversify risk, broader index tools like the Nasdaq 100 Index ETF (QQQ) should be used to replace excessive concentration in a single high-risk stock.

Conclusion: Standing at the Crossroads of Real Innovation and Financial Illusion

AI is undoubtedly a technological revolution that will profoundly change all of our lives, and this is beyond doubt. However, its current trajectory is supported by some fragile financial structures. This places us at a critical crossroads. The real question is whether we will build this bright future on the foundation of genuine innovation and sound finance, or on a fragile sandcastle constructed from cyclical credit and financial illusions. The answer to this question will not only determine the ultimate direction of this AI feast but will also profoundly impact the wealth fate of each one of us in the coming years.

In summary, the AI industry is showing signs of debt-driven financial fragility, and its capital operation model bears unsettling similarities to historical financial bubbles. This requires us to immediately shift the focus of our investment strategies from "opportunity-oriented" to "risk management priority." Stay vigilant, but do not panic. The primary task now is to optimize the portfolio structure, lock in realized substantial profits, and comprehensively enhance the quality and risk resilience of holdings.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。