Highlights of This Issue

This week's newsletter covers the statistical period from November 7 to November 13, 2025. The RWA market shows a stabilizing growth trend, with the total on-chain market capitalization reaching $35.91 billion. The growth rate has slowed down, but the number of holders continues to grow strongly, surpassing 536,800. The stablecoin market maintains an "efficiency-driven" model, with transfer volumes approaching $5 trillion and a significant increase in monthly active addresses, indicating further strengthening of capital turnover and on-chain payment functions. There have been key developments in regulation: the U.S. SEC plans to introduce a "Token Classification Law" to clarify the attributes of crypto assets, and the CFTC is considering allowing stablecoins as collateral for derivatives; the Hong Kong Monetary Authority is advancing the Ensemble project to support tokenized asset trading; countries like Singapore, the UK, and the UAE are also synchronously improving policies on stablecoins and asset tokenization, accelerating the systematic construction of a global regulatory framework. On the project level, multiple initiatives are emerging: Standard Chartered Bank and DCS have launched a stablecoin-based credit card, DeCard, in Singapore; Circle is expanding the Arc chain ecosystem, launching an on-chain foreign exchange engine and multi-currency stablecoin collaboration plan, and is considering issuing a native token; South Korea's NH Nonghyup Bank is piloting a stablecoin-based tax refund service on the Avalanche platform, showing that the RWA ecosystem is extending from asset issuance and payment settlement to a full chain of services including credit cards, foreign exchange trading, and tax refunds, pushing the industry into a phase of scaled development.

Data Insights

RWA Track Overview

According to the latest data from RWA.xyz, as of November 14, 2025, the total on-chain market capitalization of RWA reached $35.91 billion, an increase of 5.35% compared to the same period last month, with a significant slowdown in growth rate; the total number of asset holders exceeded 536,800, up 10.96% from the same period last month, maintaining strong growth; the total number of asset issuers increased to 249.

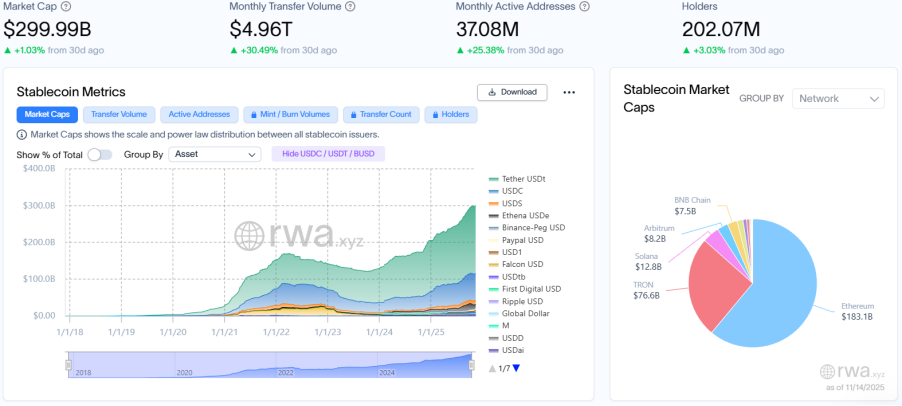

Stablecoin Market

The total market capitalization of stablecoins reached $299.99 billion, a slight increase of 1.03% compared to the same period last month; monthly transfer volume rose to $4.96 trillion, a significant increase of 30.49% compared to the same period last month; the total number of monthly active addresses increased significantly to 37.08 million, up 25.38% from the same period last month; the total number of holders steadily grew to 202 million, a slight increase of 3.03% compared to the same period last month. Both metrics validate the deepening of the market's efficiency-driven growth model, with the turnover efficiency of existing funds and user activity continuing to improve, further strengthening on-chain payment and settlement functions. Data indicates that the resonance between institutional large settlements and retail transactions continues, with transfer volume growth and active address growth far exceeding market capitalization growth, highlighting an improvement in market health. The leading stablecoins are USDT, USDC, and USDS, with USDT's market capitalization increasing by 1.63% compared to the same period last month; USDC's market capitalization slightly increased by 0.28% compared to the same period last month; USDS's circulation reached the $10 billion mark, climbing to third place in the stablecoin track, with a significant increase of 12.36% compared to the same period last month.

Regulatory News

According to The Block, SEC Chairman Paul Atkins announced at the Philadelphia Federal Reserve's fintech conference that the SEC will launch a new regulatory framework called "Token Taxonomy," aimed at redefining when crypto assets are considered securities. Atkins stated that this framework will be based on the 1946 "Howey Test" to distinguish the legal attributes of tokens at different stages. He noted, "Cryptocurrencies may initially constitute investment contracts, but this will not always be the case—when the network matures, the code is complete, and the issuer exits, the tokens will no longer rely on the issuer's efforts."

Atkins pointed out that most crypto tokens are not securities and proposed two main principles: first, the asset's attributes do not change by being on-chain; second, economic substance outweighs labels—if a token represents profit expectations based on the efforts of others, it remains a security. Preliminary classifications include: network tokens, NFTs, and digital tool tokens are not securities, while tokenized stocks and bonds are securities. He stated that tokens could detach from securities attributes as the network matures, and non-security tokens could trade on CFTC or state regulatory platforms in the future. Atkins emphasized that the SEC will align with congressional legislation and continue to crack down on fraud, "not allowing fear of the future to trap us in the past."

According to CoinDesk, the U.S. Congress has been trying to give the Commodity Futures Trading Commission (CFTC) greater direct jurisdiction over the cryptocurrency spot market. According to informed sources, the CFTC is developing a tokenized collateral policy expected to be introduced early next year, which may allow stablecoins to be used as acceptable tokenized collateral in the derivatives market, potentially piloted first in U.S. clearinghouses with stricter regulations requiring more information disclosure, such as position sizes, large traders, and trading volumes, as well as more detailed reporting of operational events.

According to Interface News, the Hong Kong Monetary Authority announced the launch of Ensemble, marking the official trial phase of the project. This milestone signifies an important step for Hong Kong in conducting real transactions with tokenized deposits and digital assets in a controlled trial environment. Ensemble will continue to operate in 2026, laying a solid foundation for the next phase of innovation. Cross-bank settlement of tokenized deposit transactions will first be conducted through the Hong Kong dollar real-time gross settlement system (RTGS). The trial environment will gradually upgrade and optimize to support 24/7 settlement of tokenized central bank currencies, promoting the continuous development of a broader tokenized ecosystem in Hong Kong.

Monetary Authority of Singapore: Will Pilot Tokenized Notes and Introduce Stablecoin-Related Laws

According to Jin10, a senior official from the Monetary Authority of Singapore (MAS) stated on Thursday that the central bank plans to advance the construction of a scalable and secure tokenized financial ecosystem. To this end, it will launch a pilot for the issuance of tokenized MAS notes next year and introduce related laws to regulate stablecoins. MAS Director Chia Der Jiun pointed out at the Singapore FinTech Festival, "Tokenization has begun, but have asset-backed tokens reached 'escape velocity'? They have not yet." He stated that MAS has been refining the details of the stablecoin regulatory framework and will draft relevant legislative proposals, with a core focus on "robust reserve asset support and reliable redemption mechanisms." Chia Der Jiun also added that MAS is simultaneously supporting various pilot projects under the "Blue Initiative," which aims to explore the use of tokenized bank liabilities and regulated stablecoins for settlement.

Bank of England Proposes a £20,000 Cap on Individual Stablecoin Holdings

According to Jin10 data, the Bank of England has proposed a £20,000 cap on individual stablecoin holdings, with a limit of £10 million for corporate holdings. Stablecoins transitioning from the regulatory framework of the UK's Financial Conduct Authority (FCA) may have up to 95% of their reserve assets invested in short-term government bonds.

UAE Tests Digital Dirham in First Government Transaction

According to Cryptopolitan, the UAE government completed its first nationwide transaction using the country's central bank digital currency, the "Digital Dirham." The transaction was jointly completed by the Ministry of Finance and the Dubai Finance Department. The transaction was processed on the mBridge platform and took less than two minutes. Ahmed Ali Meftah, Executive Director of the Ministry of Finance's Central Accounts Department, noted that this pilot is to test operational readiness and ensure seamless technical integration with the UAE central bank system. In August 2025, the UAE central bank announced it was preparing to launch its central bank digital currency—the Digital Dirham—by the end of the year.

Kyrgyzstan Issues Approximately $50 Million Stablecoin USDKG and Nationwide Mining Suspension

According to Reuters, Kyrgyzstan has issued a national stablecoin, USDKG, with an initial scale of approximately 50.14 million units, nominally valued at $1 per unit, issued by a state-owned enterprise controlled by the Ministry of Finance and backed by gold reserves, intended for cross-border payments and trade. The official plan is to later increase this to approximately $500 million, eventually reaching about $2 billion. Meanwhile, due to power shortages, Energy Minister Talaybek Ibraev announced that all cryptocurrency mining operations in the country have been shut down, and measures such as limiting consumption and importing electricity from neighboring countries (including Russia) have been implemented.

Local Developments

According to Bloomberg, the Hong Kong government is marketing a new batch of "digitally native" green bonds, covering USD, HKD, EUR, and offshore RMB (CNH), intended to be recorded and settled through HSBC's distributed ledger platform, rated AA+ by S&P. The proposed issuance specifications include: USD two-year T3+3, EUR four-year MS+23, CNH five-year coupon 1.90%, HKD two-year coupon 2.50, all with a benchmark scale; if successful, this will be the third such issuance since 2023. Additionally, statistics show that several companies in Hong Kong have issued digital bonds this year, totaling approximately $1 billion.

Project Progress

According to official news, Mantle has announced a strategic partnership with Bybit and Backed to introduce tokenized US stocks to the Mantle blockchain through xStocks, partially enabling 24/7 access to globally leading assets. The xStocks tokens issued by Backed are backed 1:1 by underlying securities, redefining the interaction between traditional markets and blockchain technology.

Under the new mechanism, Mantle and Bybit users can access tokenized versions of leading stocks such as NVDAx, AAPLx, and MSTRx through xStocks. Bybit will fully support the access and withdrawal of xStocks via the Mantle network, achieving seamless connectivity between CEX and on-chain.

This collaboration marks an important milestone for Mantle as the largest ZK proof-driven L2 network on Ethereum, expanding within the RWA ecosystem.

Note: xStocks is not open to the U.S. region or U.S. residents.

Exodus Acquires Grateful, Focusing on Stablecoin Payments in Latin America

The self-custody cryptocurrency platform Exodus Movement, Inc. (NYSE American: EXOD) has announced the acquisition of Uruguayan payment orchestrator Grateful, planning to integrate its stablecoin payment technology into its self-custody wallet and merchant services. Grateful provides merchants and individuals with stablecoin collection and management, supporting wallet-to-wallet payments, QR cash registers, e-commerce settlements, off-site exchanges, and merchant dashboards, characterized by lower fees, instant fund availability, and interest on balances. Exodus stated that the integration will cover multi-chain products including Polygon, Optimism, Base, Arbitrum, and Solana.

Standard Chartered Bank and DCS Launch Stablecoin-Based Credit Card DeCard in Singapore

According to CoinDesk, Standard Chartered Bank has partnered with DCS Card Center to become the main banking partner for the new credit card, DeCard. This credit card allows users to make payments using stablecoins in everyday transactions. The two companies announced that DeCard will be launched first in Singapore, where local regulators encourage experimentation with digital payment systems, and will later expand to other major markets. Standard Chartered will provide virtual account services and API interfaces so that DCS can instantly identify and verify DeCard users' payments. This technological integration aims to make transactions faster and more transparent.

According to The Block, Singapore's DBS Bank is developing a cross-chain interoperability framework for tokenized deposits in collaboration with J.P. Morgan's Kinexys, aiming to support 24/7 transfers between public and permissioned chains. The solution will connect JPM's Deposit Tokens (based on Ethereum L2 Base) with DBS Token Services (permissioned chain), alleviating native interoperability issues and security risks. Both institutions have already provided real-time settlement and liquidity in their on-chain systems. Previously, BNY Mellon was reported to be exploring tokenized deposit services, and several UK banks (Barclays, Lloyds, HSBC) have initiated pilot programs for tokenized pound deposits; the BIS 2024 report indicated that nearly one-third of jurisdictions' commercial banks are conducting related pilots or research.

FIS and Intain Launch Tokenized Loan Platform for Small Banks on Avalanche

According to CoinDesk, fintech provider FIS and structured finance platform Intain have launched the "Digital Liquidity Gateway" based on Avalanche, aimed at regional and community banks, supporting the tokenization of loans as NFTs and automatic settlement through stablecoins like USDC, integrated with FIS's core banking system (covering over 20,000 institutions). The platform has begun onboarding banks and institutional investors, expecting to complete hundreds of millions in loan transactions by the end of the year, with the first batch involving commercial real estate and aviation financing. Intain's AI verifies loan documents and data before minting NFTs, enhancing transparency and preventing double pledging.

Coinbase and Stablecoin Startup BVNK Cancel $2 Billion Acquisition Deal

According to Fortune magazine, a spokesperson for cryptocurrency exchange Coinbase confirmed that Coinbase and UK-based stablecoin startup BVNK have canceled acquisition negotiations. It is unclear why the two companies have shelved the deal, which had progressed to the due diligence stage, and in October, Coinbase and BVNK had reached an exclusivity agreement, meaning BVNK could not accept offers from other bidders. A Coinbase spokesperson stated in a statement, "We are always looking for opportunities to expand our mission and product offerings. After discussing the possibility of acquiring BVNK, both parties agreed to discontinue the matter."

BVNK helps clients use stablecoins for payments, cross-border transactions, and other applications, with an acquisition price of approximately $2 billion. If the deal had gone through, the amount would have been nearly double the $1.1 billion that fintech giant Stripe paid in February this year to acquire stablecoin startup Bridge.

ClearToken Receives UK Approval to Launch Cryptocurrency and Tokenized Asset Settlement System

According to The Block, the UK's Financial Conduct Authority (FCA) has approved London-based ClearToken to launch regulated settlement services for digital assets. Its upcoming CT Settle platform, using a "payment versus payment" model, will enable simultaneous settlement of cryptocurrency, stablecoin, and fiat currency transactions for both parties. The platform is designed similarly to the CLS system in the foreign exchange market, reducing settlement risk and freeing up capital. This approval grants ClearToken authorization as a payment institution and registered crypto asset company, laying the groundwork for its future tokenized and digital asset clearinghouse. Additionally, the company plans to apply for approval from the Bank of England to expand its clearing and margin services using the central bank's digital securities sandbox.

According to The Block, Nasdaq-listed Turbo Energy S.A. (TURB) has partnered with institutional blockchain company Taurus S.A. and the Stellar Development Foundation to initiate a hybrid renewable energy facility financing tokenization initiative, starting with a pilot in Spain. According to a Tuesday announcement, the pilot will tokenize the debt financing of power purchase agreements integrated with on-site batteries, deploying Turbo Energy's proprietary SUNBOX solar energy storage system. At the same time, Taurus's institutional-grade platform Taurus-CAPITAL will issue and manage these tokenized assets on the Stellar blockchain. The announcement stated that this approach demonstrates a decentralized, scalable model, with plans to expand to international markets through Turbo Energy Solutions and its new "Energy as a Service" subsidiary, facilitating project financing for business clients.

Visa Trials Stablecoin Payment Method for U.S. Businesses Using Fiat Currency

Payment giant Visa has announced the launch of a pilot project in the U.S. that allows businesses to pay dollar stablecoins (such as USDC) to crypto wallets through fiat currency accounts (such as USD). This service is enabled through the Visa Direct digital payment network, aiming to provide more convenient cash flow for industries that rely on fast payments, such as international business and freelancers.

Visa President Chris Newkirk stated that this move aims to achieve "minute-level" global circulation of funds, rather than "days." Currently, Visa is working with several partners and plans to further promote the service in 2026. According to Visa research, 57% of freelancers prefer digital payment methods for quick access to funds.

Circle Expands Arc Chain Ecosystem, Launches On-Chain Foreign Exchange Engine and Multi-Currency Stablecoin Collaboration Plan,Considering Issuing Native Token on ARC Network

According to The Block, Circle has announced the launch of the StableFX on-chain foreign exchange engine and multi-currency stablecoin collaboration plan on its Arc blockchain. This service supports compliant institutions to use stablecoins for multi-currency trading and atomic settlement 24/7, simplifying the counterparty and clearing processes of traditional foreign exchange markets. The first batch of partners includes regional stablecoin issuers from Brazil, Australia, Japan, and South Korea. The Arc mainnet is expected to launch in 2026.

According to Solid Intel, Circle Internet Group is exploring the launch of a native token on the ARC Network.

Sui Launches Stablecoin USDsui, Set to Go Live This Year

According to the Sui blog, Sui will collaborate with Bridge (a subsidiary of Stripe) to launch the native stablecoin USDsui, aimed at wallets, DeFi, and application scenarios, compatible with the Bridge ecosystem and interoperable with stablecoins on platforms like Phantom, Hyperliquid, and MetaMask. USDsui is deployed based on Open Issuance, positioned for compliance readiness, cross-border payments, and P2P transfers, intending to adhere to the requirements following the enactment of the GENIUS Act; related revenues will be used for ecosystem growth and investment. The official report states that the on-chain transfer volume of Sui stablecoins totaled approximately $412 billion from August to September, reflecting demand and capacity.

South Korea's NH Nonghyup Bank Pilots Stablecoin-Based Tax Refund Service on Avalanche

According to The Block, NH Nonghyup Bank, one of South Korea's five major banks, has launched a proof-of-concept project to digitize VAT (Value Added Tax) refunds for inbound tourists and utilize stablecoins to validate real-time settlement models. The project collaborates with Avalanche, Fireblocks, Mastercard, and Worldpay, leveraging the Avalanche blockchain to test smart contract-driven tax refund automation and stablecoin settlement processes. As it aims to confirm technical and operational feasibility, it does not involve real funds or customer data. The project seeks to improve the VAT refund process in response to the growing number of tourists visiting South Korea, allowing foreign visitors to apply for a 10% VAT refund upon departure. NH Nonghyup Bank plans to transform the traditional paper-based refund process in two ways and has stated it will further develop stablecoin-based payment and refund services according to upcoming guidelines from financial regulators.

Global Fund Network Calastone Partners with Polygon for Tokenized Asset Distribution

According to The Block, global fund network Calastone has once again selected Polygon as its tokenization technology partner. Starting Wednesday, asset management companies can distribute Calastone's tokenized fund share classes on the Polygon network. Simon Keefe, Calastone's Head of Digital Solutions, stated that the market is eager for more efficient and transparent infrastructure, and blockchain is now ready for large-scale applications; with Polygon, its tokenized issuance platform can seamlessly integrate into the on-chain ecosystem, combining global networks with blockchain efficiency to simplify the fund issuance process. The tokenized fund share classes are digital forms of traditional mutual fund or ETF shares, supported by 1:1 ratios of real regulated custodial fund units.

According to Businesswire, Telcoin has announced that it has received a final charter from the Nebraska Department of Banking and Finance to launch the first digital asset custody institution in the U.S.—Telcoin Digital Asset Bank. This charter allows Telcoin to directly connect U.S. bank accounts with regulated "digital cash" stablecoins. Its flagship product, eUSD, will become the first bank-issued, on-chain dollar stablecoin. This also marks the first explicitly authorized bank license connecting U.S. consumers with DeFi.

Hedera Integrates ERC-3643 Standard to Enhance Asset Tokenization Compliance

Hedera has announced the integration of ERC-3643 (the T-REX standard proposed by Tokeny) into its Asset Tokenization Studio, supporting cross-border asset issuance within a global compliance framework. This standard introduces on-chain identity verification and a modular architecture, enhancing flexibility and compliance. The new features will assist financial institutions and enterprises in conveniently issuing compliant assets that meet KYC/KYB requirements, while also supporting ERC-1400 in parallel for global compatibility.

BNY Mellon Launches Money Market Fund Designed for Stablecoin Issuers

According to U.S. media reports, BNY Mellon is launching a money market fund specifically tailored for stablecoin issuers, who need to comply with the recently signed U.S. stablecoin legislation. The bank's BSRXX is one of the first funds designed specifically for stablecoin providers, aiming to provide them with an investment venue to deposit funds received when issuing new tokens, while adhering to the GENIUS Act signed into law earlier this year by Trump. This law requires U.S. dollar-backed digital token issuers to invest their reserves in ultra-safe investments with shorter durations than traditional money market funds. Stephanie Pierce, Deputy Head of BNY Mellon Investment, stated that the new fund is designed to meet the law's requirements by holding only securities with maturities of 93 days or less.

Aave Labs' subsidiary Push Virtual Assets Ireland Limited has received authorization from the Central Bank of Ireland under the EU MiCAR framework to launch regulated zero-fee stablecoin deposit and withdrawal services in the EEA, supporting GHO and other stablecoins. This service allows users to conveniently convert between euros and digital assets, emphasizing consumer protection and transparency. Aave Labs has chosen Ireland as its EEA operational hub; the authorization only applies to Push's compliant deposits and withdrawals, while the decentralized Aave Protocol remains unaffected.

Tokenized Stock Trading Platform MSX Launches Spot and Contract Targets for Three Data Tracks

According to official news, MSX has completed spot and contract trading for data storage product manufacturer $STX.M and storage solution provider $WDC.M; the spot trading for comprehensive retail electricity and power generation company $VST.M has also been newly launched.

Insights Highlights

BNY Mellon: By 2030, the Scale of Stablecoins and Tokenized Cash Could Reach $3.6 Trillion

According to CoinDesk, BNY Mellon's latest report states that by 2030, the scale of stablecoins and tokenized cash could reach $3.6 trillion, with the stablecoin market cap expected to be $1.5 trillion, and the remainder composed of tokenized deposits and money market funds. These digital cash equivalents can accelerate settlement, reduce risk, and enhance collateral liquidity. The report points out that tokenized assets such as U.S. Treasuries and bank deposits can help institutions optimize collateral management and simplify processes. In the future, pension funds may be able to use tokenized money market funds to margin derivative contracts instantly, making such scenarios more common. The report believes that regulation is a key driving force, with the EU's Crypto Asset Market Regulation and ongoing policy work in the U.S. and Asia-Pacific indicating that the regulatory environment is maturing, likely to support both innovation and market stability. The report suggests that blockchain will not replace traditional systems but will work in conjunction with them, combining traditional and digital to bring significant value to customers and the global economy.

RWA 2025 Report: Asset Tokenization and Future Outlook

PANews Overview: The tokenization of real-world assets has moved beyond the early experimental stage by 2025, officially entering a "mainstreaming" turning point driven by large-scale adoption by global mainstream financial institutions (such as UBS and Apollo) and clear regulatory frameworks; it is no longer merely about simply "moving" traditional assets (from bonds to stocks) onto the blockchain to provide access opportunities, but rather about leveraging unique advantages such as round-the-clock trading and programmability to create entirely new financial applications like stock-collateralized lending, thereby constructing a new financial infrastructure that connects traditional finance with Web3, safeguarded by clear regulations, and poised to enter the next phase of large-scale expansion, led by Asia.

Banking "On-Chain Wave": Tokenized Deposits Become a New Battlefield in Global Finance

PANews Overview: The global financial landscape is undergoing a profound transformation from "de-banking" to "banking on-chain," where traditional banking systems no longer resist blockchain but actively initiate a systematic change aimed at reclaiming the dominance of currency digitization while balancing efficiency and sovereignty, using "tokenized deposits" (i.e., on-chain certificates of bank deposits) as a weapon; from cross-chain interoperability in Singapore, multi-layer currency frameworks in Hong Kong, to institutional pilots in the UK, banks in various countries are attempting to integrate and reshape the on-chain payment and settlement ecosystem by moving their liabilities on-chain, while retaining existing legal validity and regulatory control, thereby constructing a future financial infrastructure composed of central bank digital currencies, tokenized deposits, and regulated stablecoins that are mutually complementary across multiple layers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。