Original Title: "Santa Claus Rally": Bitcoin vs. Gold

Original Author: Ashrith Rao, Blockhead

Original Translation: Chopper, Foresight News

The so-called "Santa Claus Rally" refers to the phenomenon where the cryptocurrency market typically experiences a price surge in the last few weeks of December and into early January of the following year. This trend is driven by multiple factors, including annual fund reallocation triggered by institutions and traders adjusting their portfolios, as well as a seasonal boost in investor confidence.

During the holiday season, decreased market liquidity may amplify price volatility, further propelling the rebound momentum. There are significant differences in market behavior for crypto assets throughout the year compared to the Christmas period. Although this trend originated in traditional stock markets, it has begun to reflect in the gold market and has recently been seen in the Bitcoin market.

Whenever global markets slow down due to the holidays, market participants reassess the possibility of a Santa Claus Rally. In times of low liquidity or shifts in market sentiment, the reactions of gold and Bitcoin can differ significantly.

Now, investors are starting to debate: which asset, gold or Bitcoin, will benefit more from the anticipated seasonal rise in December?

For generations, people have been buying gold to protect their wealth from inflation. Central banks around the world have also accumulated large amounts of gold in their reserves as an important component of foreign exchange reserve management and monetary policy.

At the end of each year, the seasonal demand for gold tends to rise, usually driven by various factors:

- Jewelry purchases typically increase during the festival and wedding seasons in India and China;

- Central banks continue to adjust their reserve structures, leaning towards increasing their gold holdings;

- Institutions engage in year-end risk management and portfolio adjustments.

Gold's Holiday Performance

December is usually not a month for soaring gold prices but rather shows a gradual upward trend. In times of economic downturn or geopolitical turmoil, gold often exhibits more safe-haven properties than other assets.

Although gold prices fluctuate with the overall economy, they rarely deliver the astonishing returns seen in cryptocurrencies.

Nevertheless, this year, gold prices have surged, repeatedly hitting historical highs, peaking at $4,380 per ounce, with subsequent corrections being unprecedented.

In recent weeks, gold has rebounded from a significant drop, currently trading above $4,100 per ounce, showing strong performance. In this highly active trading market, long positions have seen substantial profits.

With the end of the U.S. government shutdown and the national debt expected to reach a historic high of $40 trillion, this precious metal has rebounded from a deep decline.

Currently, gold prices are just 7% away from their historical highs, and investors are well aware that after the government shutdown ends, deficit spending will only increase further.

Bitcoin: A New Choice for Value Storage

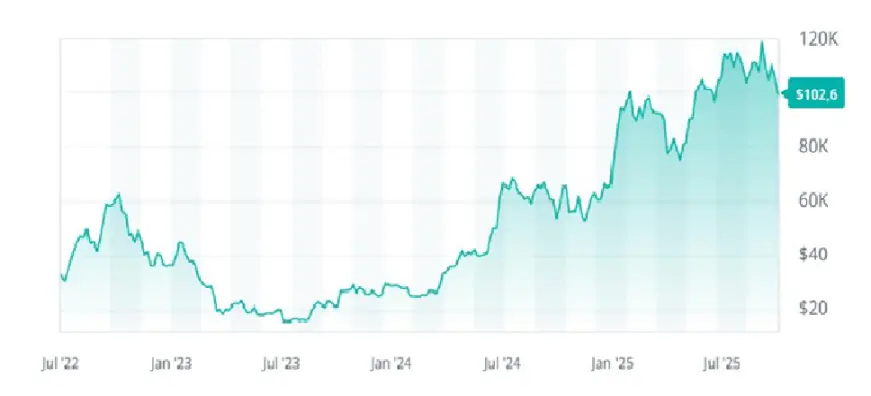

Since Bitcoin's price reached about $16,000 in November 2022, the view that "Bitcoin is digital gold" has gained widespread acceptance, and its price has continued to rise.

On December 5, 2024, Bitcoin first broke the $100,000 mark, subsequently reaching this level multiple times. In October of this year, during peak periods, Bitcoin's price surpassed $125,000, but similar to gold, it later experienced a significant correction.

Even so, Bitcoin has largely maintained the critical psychological level of $100,000, with only a few brief dips below it.

Bitcoin's decentralized structure and fixed supply of 21 million coins make it a potential choice for resisting currency inflation.

However, overall, Bitcoin is viewed as a riskier investment compared to gold: when investor confidence is high, its price can skyrocket; when confidence wanes, it can plummet.

Historically, Bitcoin's performance in the fourth quarter of each year tends to be noteworthy.

Data Source: TradingView

Macroeconomic Factors as This Year's Core Driver

This year, the economic situation has become the most critical factor determining whether the Christmas rebound will occur as expected.

Market liquidity, price stability indicators, and central bank policies (especially those of the Federal Reserve) are all core influencing factors.

At the Federal Reserve's meeting in October 2025, the central bank lowered the federal funds rate by 25 basis points, setting a new target range of 3.75%-4.00%. This rate cut was in line with market expectations and followed another cut in September, bringing borrowing costs to their lowest level since the end of 2022.

A decrease in interest rates typically leads to a depreciation of the dollar, which may increase investor interest in alternative assets like Bitcoin.

Reports indicate that the official inflation rate in the U.S. was 3.0% in September 2025, up from 2.9% in August; however, the core inflation rate slightly decreased from 3.1% to 3.0%. During periods of high inflation, market attention towards alternative assets like Bitcoin and safe-haven assets like gold tends to rise significantly.

Unlike traditional assets, Bitcoin's liquidity exhibits higher volatility.

Institutional buying of Bitcoin exchange-traded funds (ETFs) and small fund inflows can significantly impact short-term price fluctuations.

The core difference between the two asset classes lies in their buyer demographics: gold's main purchasers are jewelers, sovereign wealth funds, and central banks; while Bitcoin's core supporters are young cryptocurrency enthusiasts, tech pioneers, and retail investors.

Comparison of Past Performance of Gold and Bitcoin

In recent years, both asset classes have risen in tandem during multiple rebounds, with this trend being particularly evident in 2025. However, there have also been many instances where "one asset rebounds before the other begins its upward cycle."

In 2020, in response to the economic recession triggered by the pandemic, governments around the world launched large-scale stimulus plans. As fiat currencies depreciated, investors seeking asset preservation flocked to assets with stability promises.

At the beginning of that year, gold prices soared; in the second half, Bitcoin's momentum surged. In December 2020, gold closed at $1,900, slightly up; while Bitcoin approached its peak, closing around $29,000.

This case illustrates that during periods of ample market liquidity and low interest rates, Bitcoin's performance typically outshines traditional assets like gold.

From 2021 to 2022, inflation soared, and central banks raised interest rates significantly in response.

During this market crash, speculative risk assets like Bitcoin were severely impacted. Market participants turned to gold, a traditional safe-haven asset, which experienced multiple rounds of price increases, demonstrating strong resilience.

This indicates that during periods of monetary tightening and market pressure, gold's preservation ability typically surpasses that of Bitcoin.

With the government shutdown causing data freezes, the Washington fiscal deadlock has now ended, and the release of inflation data will largely determine which of the two asset classes can win the Christmas rally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。