When tech giants invest over $300 billion this year in AI computing power, with total expected investment exceeding $30 trillion over the next three years, a question arises: Is this a replay of the 2000 internet bubble, or the largest productivity bet in human history?

This is not a simple binary debate of "bubble vs. non-bubble"; the answer may be more complex and nuanced than you think. I do not possess a crystal ball to predict the future. However, I attempt to delve into the underlying financial structure of this feast and construct an analytical framework.

The article is lengthy and detailed, so let’s start with the conclusion:

Directionally, I do not believe this is a major bubble. However, individual segments carry high risks.

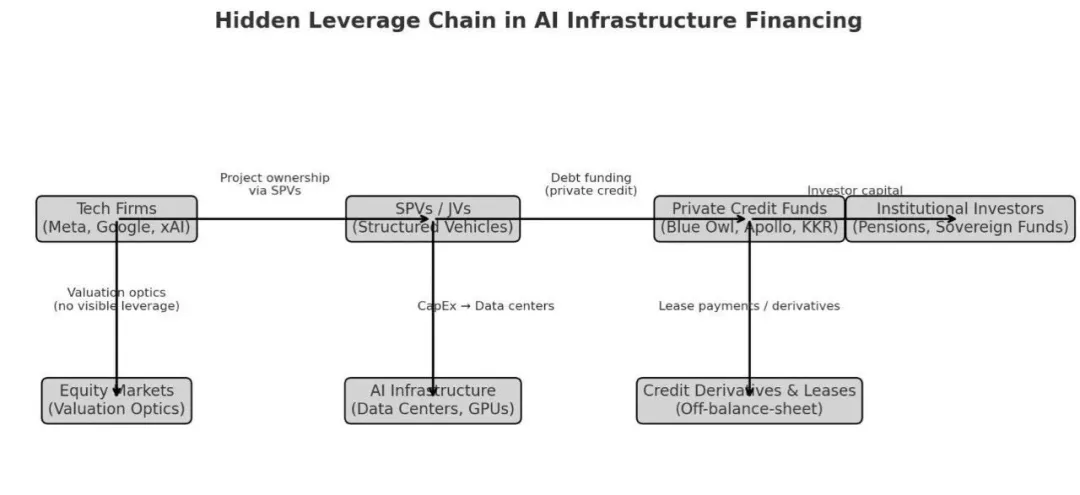

More precisely, the current AI infrastructure resembles a "cooperative + time-buying" long march. Major companies (Microsoft, Google, Meta, Nvidia, etc.) leverage financial engineering to create massive leverage, while outsourcing the main credit risk to special purpose vehicles (SPVs) and capital markets, tightly binding the interests of all participants.

The so-called "buying time" refers to their gamble on whether their cash flow and external resources can last until the day "AI truly enhances productivity" arrives.

If they win the bet, AI will deliver on its promises, and the major companies will be the biggest winners. If they lose (AI progress is slower than expected or costs are too high), the first to suffer will be the external resources providing financing.

This is not the kind of bubble seen in 2008, characterized by "excessive bank leverage and single-point detonations." This is a massive experiment in direct financing, led by the smartest and most cash-rich companies on Earth, using complex "off-balance-sheet financing" strategies to break down risks into many tradable fragments, distributing them for different investors to absorb.

Even if it is not a bubble, it does not mean that all AI infrastructure investments will yield good ROI.

01 Understanding the Core: The Interest Binding Mechanism of "Cooperation"

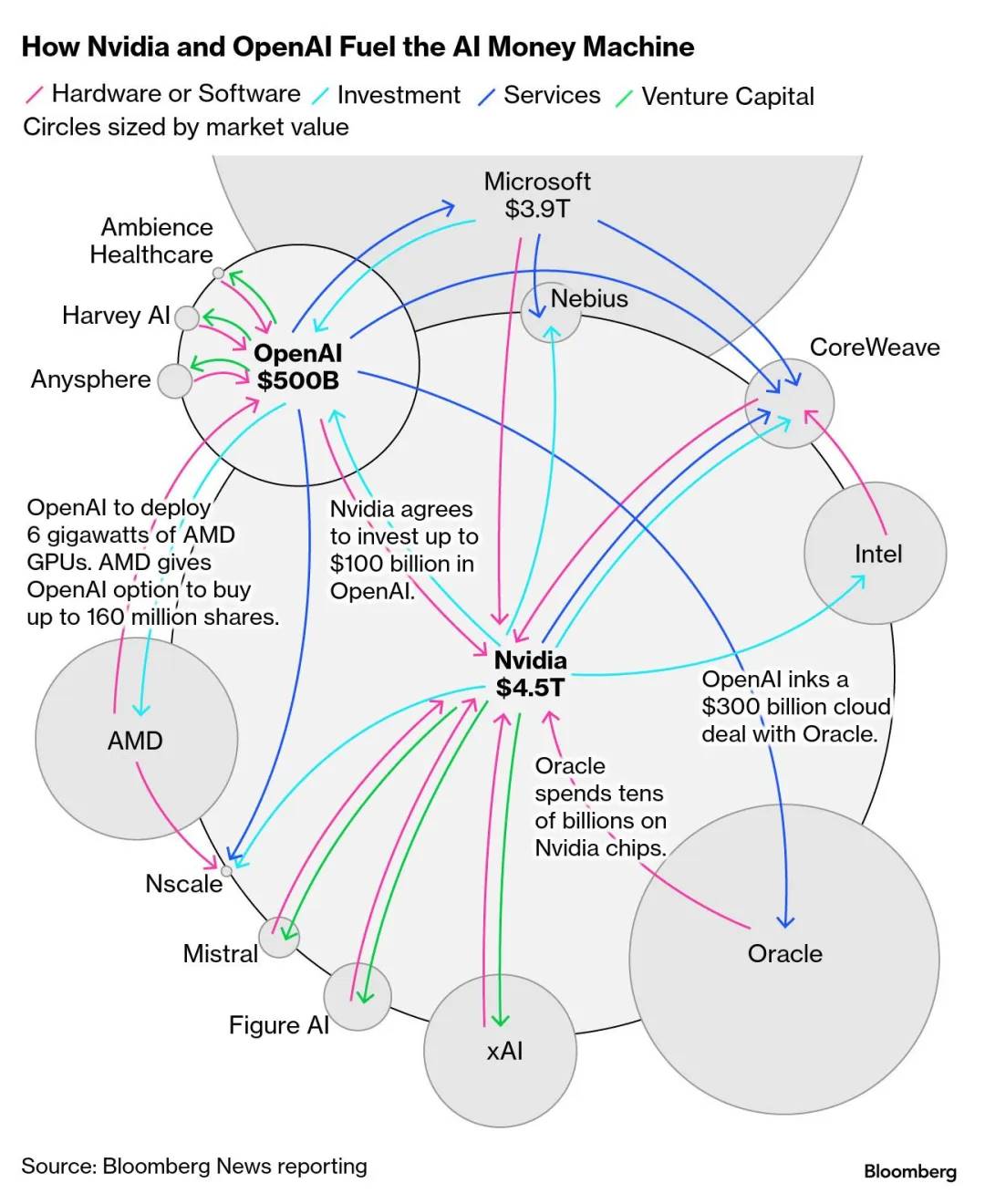

The so-called "cooperation" refers to the tight binding of interests among five parties in this AI infrastructure:

Tech giants (Meta, Microsoft, Google) and their large model partners (OpenAI, xAI): They need computing power but do not want to spend a large sum of money all at once.

Chip suppliers (Nvidia): They need continuous large orders to support their valuations.

Private equity funds (Blackstone, Blue Owl, Apollo): They need new asset classes to expand their asset management scale and collect more management fees.

Neocloud (CoreWeave, Nebius) and hybrid cloud service providers (Oracle Cloud Infrastructure): They provide infrastructure and computing power but also need long-term contracts from major companies to leverage financing.

Institutional investors (pension funds, sovereign wealth funds, traditional funds like BlackRock): They need stable returns higher than government bonds.

These five parties form an "interest community," for example:

Nvidia prioritizes supply to CoreWeave while also investing in its equity.

Microsoft provides CoreWeave with long-term contracts while assisting in its financing.

Blackstone provides debt financing while raising funds from pension funds.

Meta and Blue Owl jointly establish an SPV to share risks.

OpenAI and other large model manufacturers continuously raise the standards for model parameters, reasoning capabilities, and training scales, effectively increasing the overall industry's computing power demand threshold. Particularly under the deep binding with Microsoft, this "technology outsourcing, pressure internalization" cooperation structure allows OpenAI to become the igniter of the global capital expenditure race without spending money. It is not a funding party but the actual curator driving the leverage increase across the board.

No one can stand alone; this is the essence of "cooperation."

02 Capital Structure — Who is Funding? Where is the Money Flowing?

To understand the overall structure, we can start with the funding flow chart below.

Tech giants need astronomical amounts of computing power, and there are two paths:

Building their own data centers: This is the traditional model. The advantage is complete control, but the downside is slow construction, and all capital expenditures and risks are placed on their balance sheets.

Seeking external suppliers: The giants are not simply renting servers; they have spawned two core "external supplier" models. This is the current trend and the focus of our analysis.

The first is SPV (Special Purpose Vehicle), a purely financial instrument. You can think of it as a special entity established for "a single project, a single client."

Business model: For example, if Meta wants to build a data center but does not want to spend a large sum at once, it forms an SPV with an asset management company. The SPV's sole task is to construct and operate this center exclusively for Meta. Investors receive high-quality debt (a mix of corporate bonds and project financing) backed by rental cash flow.

Client type: Extremely singular, usually only one (e.g., Meta).

Risk level: Survival completely depends on the credit of a single client.

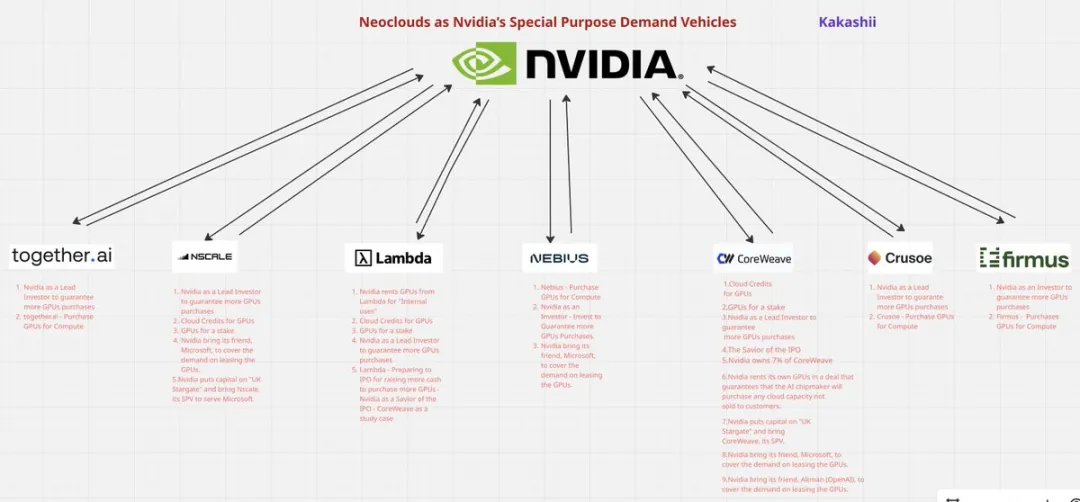

The second is Neocloud (such as CoreWeave, Lambda, Nebius), which is an independent operating company (OpCo) with its own operational strategy and complete decision-making authority.

Business model: For instance, CoreWeave raises funds (equity and debt) to purchase a large number of GPUs and leases them to multiple clients, signing "minimum/reserved" contracts. It is flexible but has high volatility in equity value.

Client type: Theoretically diverse, but in practice, it is highly dependent on major companies (e.g., Microsoft's early support for CoreWeave). Due to its smaller scale, unlike SPVs backed by a single wealthy parent, Neoclouds are more reliant on upstream suppliers (Nvidia).

Risk level: Risks are spread across multiple clients, but operational capability, technology, and equity value all affect survival.

Despite being legally and operationally distinct, both share the same commercial essence: they are the "external suppliers of computing power" for the giants, moving massive GPU purchases and data center construction off the giants' balance sheets.

So where does the money for these SPVs and Neoclouds come from?

The answer is not traditional banks but private credit funds. Why?

This is because after 2008, the Basel III Accord imposed strict capital adequacy requirements on banks. Banks face high reserve requirements for taking on such high-risk, high-concentration, long-term massive loans, making it unfeasible.

The businesses that banks "cannot do" or "dare not do" have created a significant vacuum. Private equity giants like Apollo, Blue Owl, and Blackstone have filled this gap—they are not subject to bank regulations and can provide more flexible, faster financing, albeit at higher interest rates, secured by project rents or GPUs/equipment with long-term contracts.

For them, this is an attractive opportunity—many have traditional infrastructure financing experience, and this theme is sufficient to grow their asset management scale several times, significantly increasing management fees and carried interest.

So where does the money from these private credit funds ultimately come from?

The answer is institutional investors (LPs), such as pension funds, sovereign wealth funds, insurance companies, and even general investors (for example, through private credit ETFs issued by BlackRock, which include Meta's project under the 144A private bond Beignet Investor LLC 144A 6.581% 05/30/2049).

The risk transmission path is thus established:

(Final risk bearers) Pension funds/ETF investors/Sovereign funds → (Intermediary) Private credit funds → (Financing entities) SPVs or Neoclouds (like CoreWeave) → (Final users) Tech giants (like Meta).

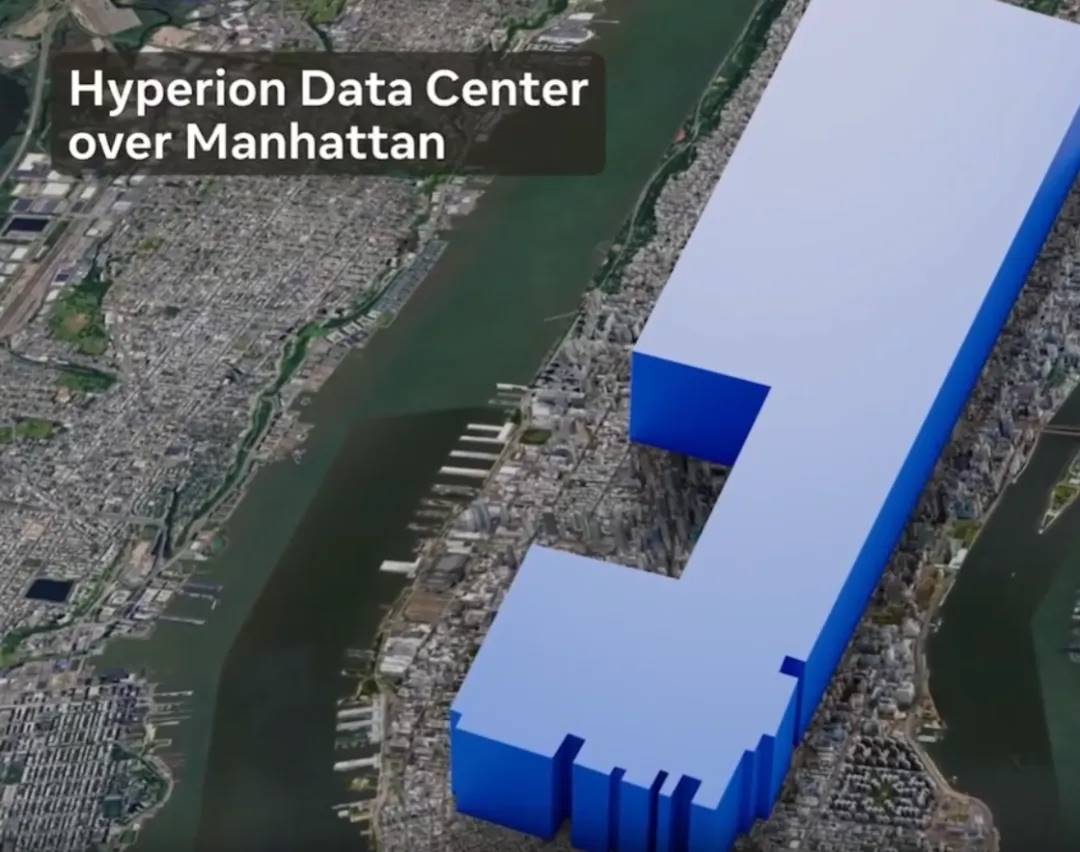

03 SPV Case Study — Meta's Hyperion

To understand the SPV model, Meta's "Hyperion" project is an excellent case study (with sufficient public information):

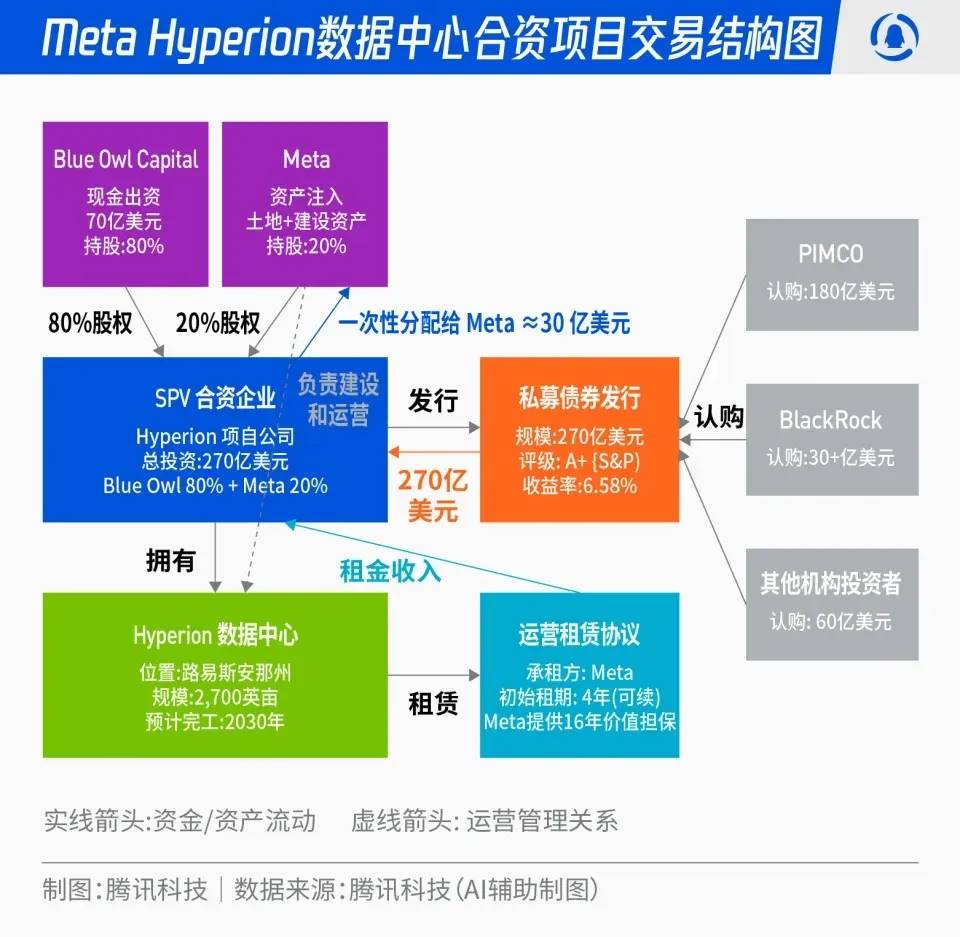

Structure/Equity: Meta and Blue Owl manage a fund to form a JV (Beignet Investor LLC). Meta holds 20% equity, and Blue Owl holds 80%. They issue bonds under the SPV 144A structure. The JV builds the asset, and Meta leases it under a long-term contract. Capital expenditures during the construction phase are in the JV, and as financing leases begin, assets gradually transfer to Meta's balance sheet.

Scale: Approximately $27.3 billion in debt (144A private bonds) + about $2.5 billion in equity, making it one of the largest single corporate bond/private credit project financings in U.S. history. The maturity date is 2049, and this long-term amortization structure essentially "locks in the most challenging time risk" first.

Interest rate/Ratings: The debt has an S&P A+ rating (high ratings allow insurance companies to allocate), with a coupon rate of about 6.58%.

Investor structure: PIMCO subscribed $18 billion; BlackRock's ETFs collectively over $3 billion. For this group of investors, this represents an attractive high-quality stable return.

Cash flow and lease: Blue Owl is not focused on potentially depreciating GPUs (I believe some in the market are misplacing concerns about the depreciation assumptions of GPUs, as GPUs are just hardware, while the overall value of AI lies in hardware + models; the price of older hardware may drop due to iteration, but that does not mean the value of the final AI model application also declines), but rather on the SPV cash flow supported by Meta's long-term lease (starting from 2029). Construction phase funds are also pre-allocated to U.S. government bonds to reduce risk. This structure combines the liquidity of corporate bonds with project financing protection clauses, while also being 144A-for-life (limited investor circle).

So why is the short-term risk of this structure extremely low?

This is because, under this structure, the Hyperion task is straightforward: on the left hand, it collects rent from Meta, and on the right hand, it pays interest to Blue Owl. As long as Meta does not collapse (the probability of this in the foreseeable future is extremely low), the cash flow remains rock solid. There is no need to worry about fluctuations in AI demand or GPU price drops.

This 25-year ultra-long-term, rental amortization debt structure locks in all recent refinancing risks as long as rental income is stable and interest payments are made normally. This is the essence of "buying time" (allowing the value created by AI applications to gradually catch up with the financial structure).

At the same time, Meta uses its own credit and strong cash flow to obtain massive long-term financing that bypasses traditional capital expenditures. Although under modern accounting standards (IFRS 16), long-term leases ultimately still appear as "lease liabilities" on the balance sheet, the advantage is that the pressure of tens of billions of dollars in capital expenditures during the initial construction phase, along with related construction risks and financing operations, are first transferred to the SPV.

Transforming a one-time massive capital expenditure into rental payments amortized over the next 25 years greatly optimizes cash flow. Then, it bets on whether these AI investments can generate sufficient economic benefits to pay back principal and interest in 10-20 years (based on the bond's 6.58% coupon rate, considering operating expenses, the ROI calculated using EBITDA must be at least 9-10% to provide equity holders with a decent return).

04 Neocloud's Buffer — Equity Risk of OpCo

If the SPV model is "credit transfer," then Neocloud models like CoreWeave and Nebius represent "further layering of risk."

Taking CoreWeave as an example, its capital structure is far more complex than that of an SPV. Multiple rounds of equity and debt financing involve investors including Nvidia, VCs, growth funds, and private debt funds, forming a clear risk buffer sequence.

Assuming AI demand is lower than expected, or new competitors emerge, and CoreWeave's revenue plummets, making it unable to pay high interest, what happens:

The first step is the evaporation of equity value: CoreWeave's stock price crashes. This is the "equity buffer" — the first to absorb the shock. The company may be forced to finance at a discount, significantly diluting the original shareholders' equity, or even losing everything. In contrast, the SPV's equity buffer is thinner, as it cannot directly finance in the public market.

The second step is creditor losses: Only after the equity is completely "burned" and CoreWeave still cannot repay its debts do private creditors like Blackstone bear the losses. However, these funds typically require excellent collateral (latest GPUs) and strict repayment priority when lending.

Both CoreWeave and Nebius adopt the strategy of "first securing long-term contracts, then financing against those contracts," rapidly expanding in the capital market. The brilliance of this structure lies in the fact that major clients can achieve better capital utilization efficiency, leveraging future procurement contracts to drive more capital expenditures without investing upfront, limiting the risk contagion to the entire financial system.

Conversely, Neocloud shareholders need to be aware that they occupy the most turbulent yet exciting position in this gamble. They are betting on high-speed growth while also praying for the management's financial maneuvers (debt extensions, equity issuances) to be nearly flawless. Additionally, they must pay attention to the debt maturity structure, pledge scope, contract renewal windows, and customer concentration to better assess the equity risk-reward ratio.

We can also speculate on who would be the marginal capacity most easily abandoned if AI demand grows slowly. Would it be SPVs or Neoclouds? Why?

05 Oracle Cloud: The Upsurge of a Non-Typical Cloud Player

While everyone is focused on CoreWeave and the three major cloud giants, an unexpected "dark horse" in the cloud space is quietly rising: Oracle Cloud.

It does not belong to Neocloud, nor is it part of the frontline of the three major tech giants, but it has secured contracts for computing loads from Cohere, xAI, and even part of OpenAI through highly flexible architectural design and deep cooperation with Nvidia.

Especially as Neocloud's leverage tightens and traditional cloud space becomes insufficient, Oracle, with its "neutral" and "replaceable" positioning, has become an important buffer layer in the second wave of the AI computing power supply chain.

Its existence also shows us that this battle for computing power is not just a showdown among three giants; there are also non-typical but strategically significant suppliers like Oracle quietly vying for position.

But let’s not forget that this game’s table extends beyond Silicon Valley to the entire global financial market.

The Government's "Implicit Guarantee" Everyone Covets

Finally, in this game dominated by tech giants and private finance, there is a potential "trump card" — the government. Although OpenAI recently publicly stated that it "does not have and does not wish" for the government to provide loan guarantees for data centers, and that discussions with the government are about potential guarantees for chip manufacturers rather than data centers, I believe that their (or similar participants') original plans must include the option of "bringing the government in for cooperation."

How so? If the scale of AI infrastructure is so large that even private debt cannot bear it, the only way out is to upgrade it to a national power struggle. Once AI leadership is defined as "national security" or "the 21st-century moon race," government intervention becomes a natural progression.

The most effective way for this intervention is not to provide direct funding but to offer "guarantees." This approach brings a decisive benefit: significantly lowering financing costs.

Investors of my age should still remember Freddie Mac and Fannie Mae. These two "government-sponsored enterprises" (GSEs) are not formal departments of the U.S. government, but the market generally believes they have "implicit government guarantees."

They purchase mortgages from banks, package them into MBS, and guarantee them, then sell them in the public market to redirect capital back into the mortgage market, increasing the funds available for lending. Their existence also amplified the impact of the 2008 financial tsunami.

Imagine if a "national AI computing power company" emerges in the future, backed by implicit government guarantees. The bonds it issues would be regarded as quasi-sovereign debt, with interest rates approaching those of U.S. Treasury bonds.

This would fundamentally change the previously mentioned "buying time while waiting for productivity to rise":

Extremely low financing costs: The lower the borrowing costs, the less demand there is for the "speed of AI productivity enhancement."

Time extended indefinitely: More importantly, it allows for continuous rollovers at extremely low costs, effectively buying nearly unlimited time.

In other words, this approach significantly reduces the probability of the gamble "blowing up." However, if it does blow up, the impact could expand by several multiples.

06 The Trillion-Dollar Bet — The Real Key to "Productivity"

All the financial structures mentioned above — SPVs, Neoclouds, private debt — no matter how sophisticated, only answer the question of "how to pay."

The fundamental question of whether AI infrastructure will become a bubble is: "Can AI truly increase productivity?" and "How fast?"

All financing arrangements lasting 10 to 15 years essentially aim to "buy time." Financial engineering gives the giants a breathing space, allowing them not to see immediate results. But buying time comes at a cost: investors in Blue Owl and Blackstone (pension funds, sovereign funds, ETF holders) need stable interest returns, while equity investors in Neoclouds need multiple valuation growth.

The "expected return rates" of these financing parties are the thresholds that AI productivity must cross. If the productivity gains from AI cannot cover the high financing costs, this intricate structure will begin to collapse from its most vulnerable points (the "equity buffer").

Therefore, in the coming years, special attention should be paid to the following two aspects:

The speed of launching "application solutions" across various fields: Having powerful models (LLMs) is not enough. We need to see real "software" and "services" that can make enterprises spend money. These types of applications need to be widely adopted, generating cash flows large enough to repay the principal and interest of the massive infrastructure costs.

Constraints from external limitations: AI data centers are energy-hungry monsters. Do we have enough electricity to support the exponentially growing demand for computing power? Is the speed of upgrading the power grid keeping pace? Will the supply of Nvidia's GPUs and other hardware encounter bottlenecks, causing them to "lag behind" the timelines required by financial contracts? Supply-side risks could drain all the "bought time."

In short, this is a race between finance (financing costs), physics (electricity, hardware), and business (application implementation).

We can also estimate quantitatively how much productivity improvement AI needs to bring to avoid a bubble:

According to Morgan Stanley's estimates, this round of AI investment should accumulate to $30 trillion by 2028.

The aforementioned cost of Meta's SPV bond issuance is around 6-7%, while according to Fortune's report, CoreWeave's current average debt interest rate is about 9%. Assuming that most private debt in the industry requires returns of 7-8% and a debt-equity ratio of 3:7, the ROI for these AI infrastructures (calculated using EBITDA and total capital expenditures) needs to be at 12-13% to allow equity returns to exceed 20%.

Therefore, the required EBITDA = $30 trillion × 12% = $3.6 trillion; if calculated with an EBITDA profit margin of 65%, the corresponding revenue would be about $5.5 trillion;

With the nominal GDP of the U.S. estimated at about $29 trillion, this equates to approximately 1.9% of GDP in new output that needs to be long-term supported by AI.

This threshold is not low, but it is not a fantasy (the total revenue of the global cloud industry in 2025 is expected to be about $400 billion; in other words, we need to see AI empower the reconstruction of one to two cloud industries). The key lies in the speed of application monetization and whether physical bottlenecks can be synchronized.

Risk Scenario Stress Test: What Happens When "Time" Runs Out?

All the financial structures mentioned above are betting that productivity can outpace financing costs. Let me simulate two stress tests to illustrate the chain reaction when AI productivity realization speed is slower than expected:

In the first scenario, we assume that AI productivity is realized "slowly" (for example, it takes 15 years to scale, while many financings may be for 10 years):

Neocloud is the first to collapse: Independent operators like CoreWeave, with high leverage, cannot cover high interest with their income, leading to their "equity buffer" being burned out, triggering debt defaults or discounted restructurings.

SPVs face extension risks: When the debt of SPVs like Hyperion matures, Meta must decide whether to refinance at a higher interest rate (the market has already witnessed the failure of Neocloud), eroding core business profits.

Private credit fund LPs suffer massive losses, and tech stock valuations are significantly revised downwards. This is an "expensive failure," but it will not trigger a systemic collapse.

In the second scenario, we assume that AI productivity is "falsified" (technological progress stagnates or costs cannot be reduced and scaled):

Tech giants may choose "strategic default": This is the worst-case scenario. Giants like Meta may determine that "continuing to pay rent" is a bottomless pit, and choose to forcibly terminate leases, forcing SPV debt restructuring.

SPV bonds collapse: Bonds like Hyperion, which are considered A+ rated, will instantly decouple from Meta, causing prices to plummet.

This could completely destroy the private credit "infrastructure financing" market and is highly likely to trigger a confidence crisis in the financial markets through the aforementioned interconnectedness.

The purpose of these tests is to transform the vague question of "is it a bubble" into specific scenario analyses.

07 Risk Thermometer: A Practical Observation Checklist for Investors

For changes in market confidence, I will continue to monitor five things as a risk thermometer:

The speed of AI project productivity realization: This includes the acceleration or deceleration of expected revenues from large model vendors (linear growth or exponential growth) and the application status of different AI products and projects.

Neocloud company stock prices, bond yields, announcements: This includes large orders, defaults/restructurings, debt refinancing (some private debts will mature around 2030 and need special attention), and capital increase pace.

Secondary prices/spreads of SPV debt: Whether private bonds like Hyperion maintain prices above par, whether trading is active, and whether ETF holdings are increasing.

Changes in the quality of long-term contract terms: take-or-pay ratios, minimum retention periods, customer concentration, price adjustment mechanisms (electricity prices/interest rates/inflation adjustments).

Progress in electricity supply and potential technological innovations: As the most likely external factor to become a bottleneck, attention should be paid to policy signals regarding substations, transmission and distribution, and electricity pricing mechanisms. Additionally, whether new technologies can significantly reduce electricity consumption.

Why is this not a repeat of 2008?

Some may draw parallels to the bubble of 2008. I believe this approach may lead to misjudgments:

The first point is the fundamental difference in core assets: AI vs. housing.

The core asset of the 2008 subprime mortgage crisis was "housing." Houses themselves do not contribute to productivity (rental income growth is very slow). When housing prices detach from the fundamentals of residents' incomes and are packaged into complex financial derivatives, the bursting of the bubble is just a matter of time.

In contrast, the core asset of AI is "computing power." Computing power is the "tool of production" in the digital age. As long as you believe that AI has a high probability of significantly increasing overall societal productivity (software development, drug research, customer service, content creation) at some point in the future, there is no need to worry too much. This is a "prepayment" for future productivity. It has real fundamentals as an anchor point, just not fully realized yet.

The second point is the different key nodes in financial structures: direct financing vs. banks.

The 2008 bubble spread significantly through key nodes (banks). Risks were transmitted through "indirect financing" by banks. The failure of one bank (like Lehman) triggered a crisis of trust in all banks, leading to a freeze in the interbank market and ultimately igniting a systemic financial crisis (including a liquidity crisis) that affected everyone.

Currently, the financing structure for AI infrastructure is primarily based on "direct financing." If AI productivity is falsified, CoreWeave collapses, and Blackstone defaults on $7.5 billion in debt, this will result in massive losses for Blackstone investors (pension funds).

The banking system has indeed become more robust after 2008, but we cannot oversimplify and assume that risks can be completely "contained" within the private market. For example, private credit funds may also use bank leverage to amplify returns. If AI investments generally fail, these funds could still suffer massive losses that may spill over through two paths:

Leverage defaults: Defaults on leveraged financing from funds to banks will transmit risks back to the banking system.

LP impacts: Pension funds and insurance companies may face deteriorating balance sheets due to investment losses, leading them to sell other assets in the public market, triggering a chain reaction.

Therefore, a more accurate statement would be: "This is not a 2008-style single-point explosion leading to a comprehensive freeze of interbank liquidity crisis." The worst-case scenario will be an "expensive failure," with lower contagion and slower speed. However, given the opacity of the private market, we must remain highly vigilant about this new type of slow contagion risk.

Insights for Investors: At Which Layer of This System Are You?

Let’s return to the initial question: Is AI infrastructure a bubble?

The formation and bursting of a bubble stem from a significant gap between expected benefits and actual results. I believe that, in general, it is not a bubble but rather a sophisticated high-leverage financial layout. However, from a risk perspective, aside from certain aspects that require special attention, we should not underestimate the potential "negative wealth effect" that small-scale bubbles may bring.

For investors, in this multi-trillion-dollar AI infrastructure race, you must understand what you are betting on when holding different assets:

Tech giant stocks: You are betting that AI productivity can outpace financing costs.

Private credit: You earn stable interest but bear the risk that "time may not be enough."

Neocloud equity: You are the first buffer with the highest risk and highest reward.

In this game, position determines everything. Understanding this series of financial structures is the first step to finding your own position. Recognizing who is "curating" this show is key to judging when this game will end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。