When BTC matures first, ETH follows behind, and SOL still needs time, where are we in the cycle?

Written by: Ignas

Translated by: AididiaoJP, Foresight News

Why the classic rotation model of cryptocurrencies has failed in this cycle

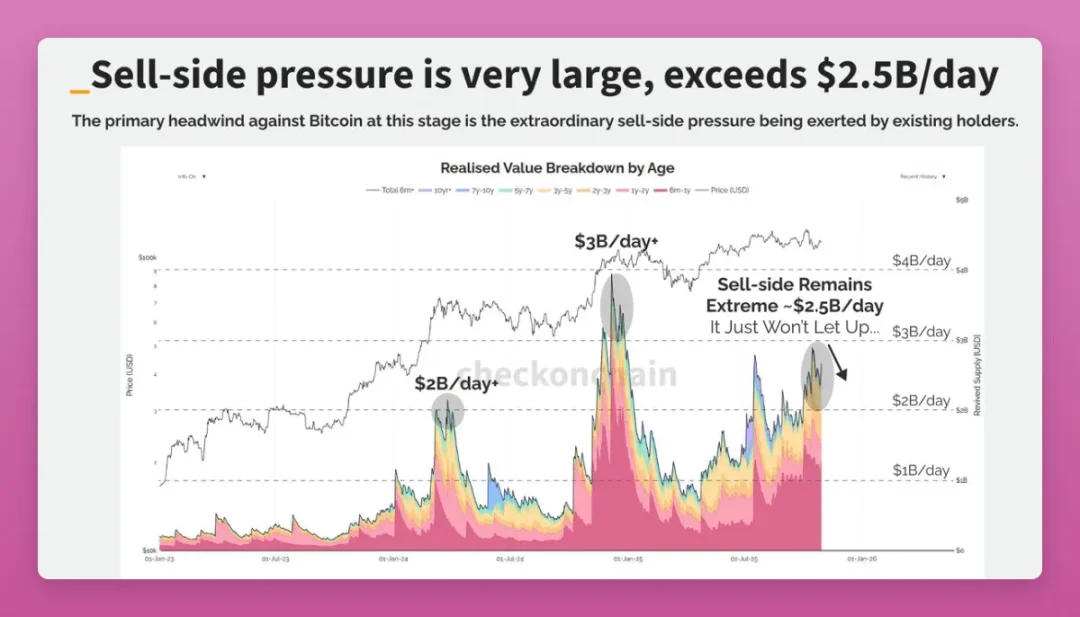

BTC holders have already gained excess returns, and early believers are taking profits. This is not a panic sell-off, but a natural process of shifting from concentrated holdings to decentralized holdings.

Among many on-chain indicators, the most critical signal is the selling behavior of the whales.

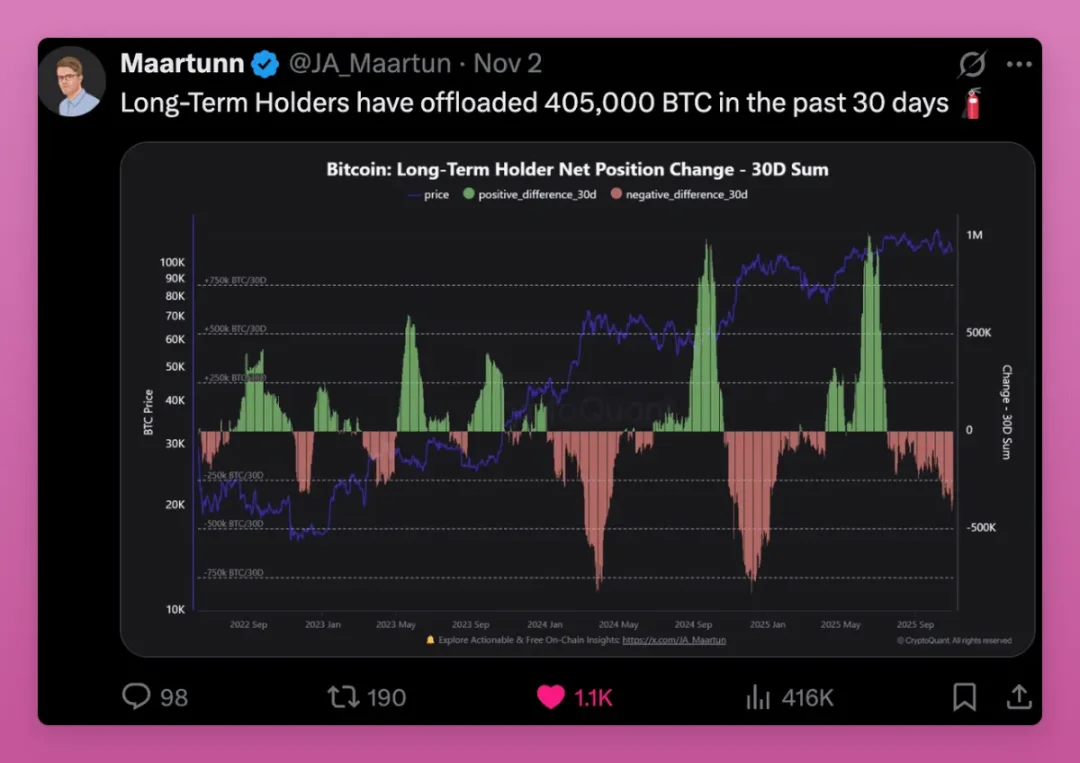

Long-term holders have sold 405,000 BTC in just 30 days, accounting for 1.9% of the total BTC supply.

Take Owen Gunden as an example:

This Bitcoin veteran whale once made large transactions on Mt. Gox, accumulating a massive position, and has served on the board of LedgerX. His associated wallet holds over 11,000 BTC, making him one of the largest individual holders on-chain.

Recently, his wallet has begun transferring large amounts of BTC to Kraken, with the behavior of transferring thousands of tokens in batches typically signaling a sell-off. On-chain analysts believe he may be preparing to liquidate a position worth over $1 billion.

Although his Twitter account has not been updated since 2018, this move perfectly confirms the "super rotation" theory. Some whales are shifting to ETFs for tax advantages or diversifying their assets through sell-offs.

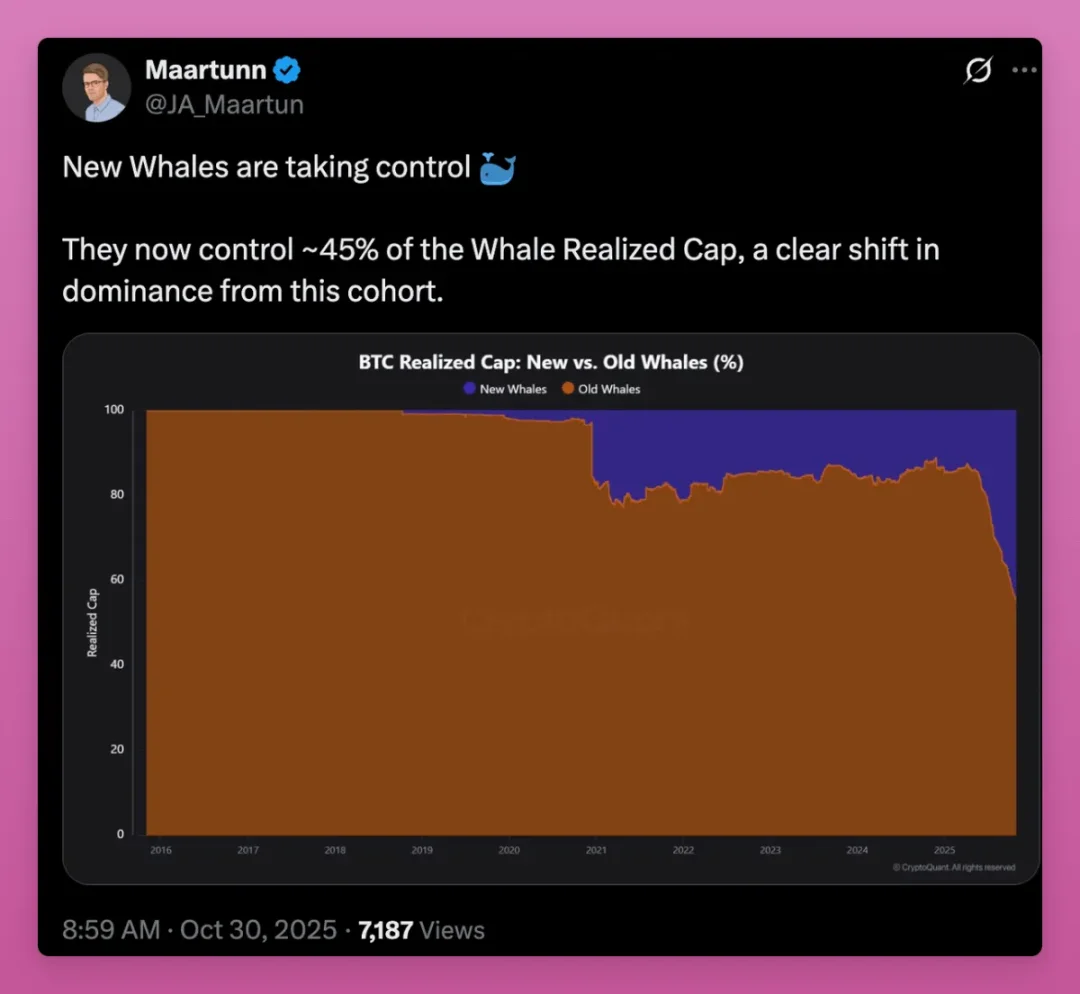

As tokens flow from veteran holders to new buyers, unrealized profit prices continue to rise, and a new generation of whales is taking over market dominance.

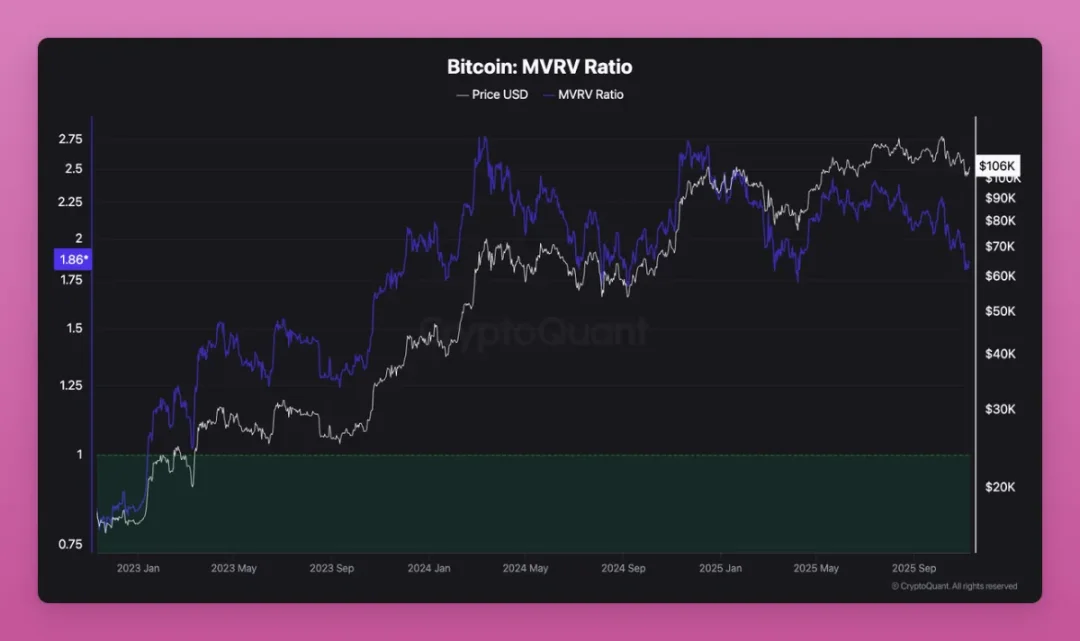

The rising MVRV ratio confirms this trend, as the average cost basis is shifting from early miners to ETF buyers and new institutions.

On the surface, this may seem like a bearish signal: whales have enjoyed substantial long-term gains, while new whales are facing unrealized losses. The current average cost basis is as high as $108,000, and if BTC continues to weaken, new whales may choose to sell.

However, the rise in MVRV actually indicates a diffusion of ownership distribution and market maturation. Bitcoin is transitioning from a few ultra-low-cost holders to a more distributed holding with a higher cost basis, which is essentially a bullish signal.

But what will happen to altcoins?

The Game of Ethereum

BTC has won, but what about ETH? Can we observe the same large rotation pattern in ETH?

Although the lagging price of ETH may be partly attributed to this, on the surface, ETH also appears to be successful: both have ETFs, DAT, and institutional attention (albeit of different natures). Data shows that ETH is in a similar transitional phase, just earlier and more complex.

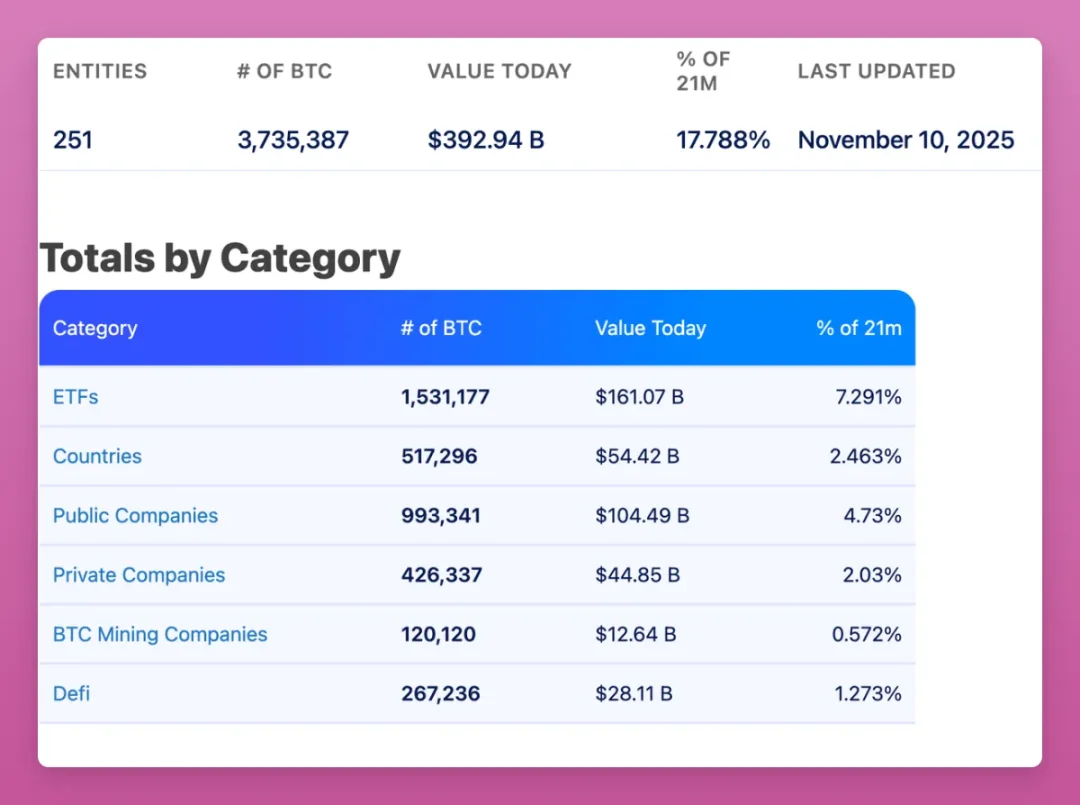

In fact, on a key dimension, ETH is rapidly approaching BTC: about 11% of ETH is held by DAT and ETFs…

While BTC has 17.8% held by spot ETFs and large treasuries. Considering Saylor's continued accumulation, the speed at which ETH is catching up is impressive.

We attempted to verify whether there is a phenomenon of old whales transferring to new whales in ETH as well, but due to the account model of ETH (which differs from Bitcoin's UTXO model), it is difficult to obtain valid data.

The core difference lies in: the transfer direction of ETH is from retail investors to whales, while BTC is from veteran whales to new whales.

The following chart visually presents the trend of ETH ownership shifting from retail investors to whales.

The realized price of large wallets (holding 100,000+ ETH) has rapidly increased, indicating that new whales are building positions at a higher cost, while retail investors continue to sell. The cost curves of various types of wallets (orange, green, purple) are converging, meaning that old cheap tokens have completed their transfer to new holders.

This kind of cost basis reset usually occurs at the end of accumulation cycles and on the eve of price explosions, structurally confirming that ETH supply is becoming more concentrated and stable.

Outlook for ETH

The logic of this rotation is based on:

The popularization of stablecoins and asset tokenization

The launch of staking ETFs

The implementation of institutional-level applications

This encourages whales and funds to continue accumulating, while retail investors, viewing ETH as a "gas fee tool" and impacted by emerging public chains, are losing faith.

Whales see ETH as an income-generating asset and collateral, firmly holding for long-term on-chain returns. As BTC establishes dominance while ETH remains in a gray area, whales are preemptively positioning for institutional entry.

The ETF + DAT combination makes ETH's holding structure more institutionalized, but whether it is still tied to long-term growth remains in question. The biggest concern comes from the case of ETHZilla selling ETH to buy back stocks; while there is no need for panic, it has set a dangerous precedent.

Overall, ETH still aligns with the rotation theory, but due to its more complex holder structure and richer application scenarios (such as liquidity staking leading to token concentration in a few large wallets), and more frequent on-chain activities, the rotation dynamics are not as clear as Bitcoin.

The Rise of Solana

Analyzing Solana's positioning in this rotation is particularly challenging (even identifying team wallets is fraught with difficulty), but there are still clues to follow:

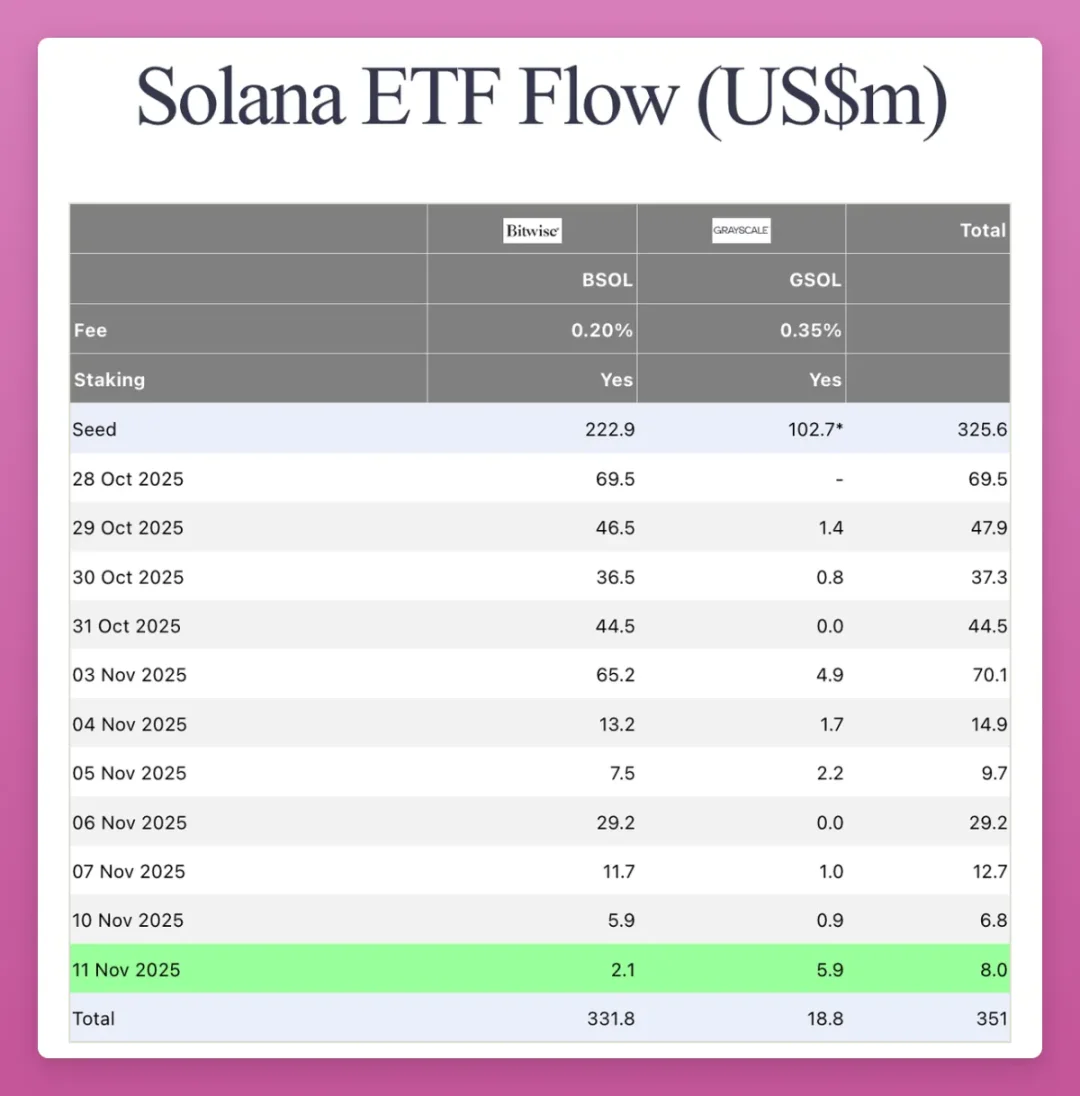

Solana is replicating Ethereum's institutionalization process. Last month, the U.S. spot ETF quietly launched without sparking much market discussion; although the total scale is only $351 million, it has maintained a daily net inflow of funds.

The early DAT layout for SOL is equally impressive:

2.9% of the circulating SOL (worth $2.5 billion) is already held by DAT. Thus, Solana has built a traditional financial infrastructure similar to BTC/ETH (regulated funds + corporate treasuries), with only the scale still lagging.

Although on-chain data is chaotic and supply remains concentrated in early teams and venture capital, tokens are steadily flowing to new institutional buyers through ETF/treasury channels. The large rotation has spread to Solana, just delayed by one cycle.

Compared to BTC and ETH, which are nearing the end of their rotation with imminent price explosions, SOL's trajectory prediction is actually more certain.

Future Direction

When BTC matures first, ETH follows behind, and SOL still needs time, where are we in the cycle?

The logic of past cycles is straightforward: BTC leads → ETH follows → wealth effect radiates to small-cap altcoins.

This cycle, however, is stuck in the BTC phase: even if BTC surges, early whales either move to ETFs or cash out, with no wealth spillover effect, only the lingering trauma of FTX and endless sideways trading.

Altcoins have given up competing with BTC for "currency" status, instead vying for practical value, yield capability, and speculative space, with most set to be eliminated.

Surviving areas include:

Public chains with real ecosystems: Ethereum, Solana, and a few potential projects

Products that can generate cash flow and value return

Assets with irreplaceable demand (such as ZEC)

Infrastructure that can capture fees and traffic

Stablecoins and real-world asset tracks

Continuously emerging crypto-native innovations

Other projects will ultimately be drowned out in the noise.

The activation of the Uniswap fee switch is a milestone: although not the first of its kind, this move forces all DeFi protocols to share profits with token holders, with half of the top ten lending protocols already implementing profit sharing.

DAOs are evolving into on-chain companies, and token value will depend on their ability to create and redistribute profits, which will also be the core battleground of the next round of rotation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。