DeFi is no longer chasing yield, but rather sustainability.

Author: DropsTab x Drops Bot

Translation: Baihua Blockchain

By 2025, two major protocols in the industry—Uniswap and Hyperliquid—are proving that value capture is no longer about token releases, but about who can buy back and burn the tokens the fastest.

The blue-chip decentralized exchange Uniswap has finally activated its long-dormant "fee switch," enabling a deflationary burn model through its new UNIfication proposal. Meanwhile, the rising perpetual DEX Hyperliquid has been quietly and continuously buying back its tokens—allocating 97% of all trading fees to the automatic buyback of HYPE.

Both are rewriting token economics in real-time. However, their philosophies are entirely different.

Uniswap's Long-Awaited Fee Switch

For five years, Uniswap's "fee switch" has been on hold on GitHub—designed but never activated due to concerns over SEC scrutiny. This changed on November 10, 2025, when founders Hayden Adams, Ken Ng, and Devin Walsh submitted a proposal that redefined how UNI captures value.

At its core is a "fee-to-burn" model:

On v2, the protocol fee rises from 0% to 0.05%, while LP rewards decrease from 0.3% to 0.25%.

On v3, fees vary by pool—low-fee pools charge one-quarter of LP fees, while high-fee pools charge one-sixth.

All collected fees flow into a "token vault" smart contract, from which anyone can withdraw an equivalent amount of cryptocurrency by burning UNI.

Even Uniswap's Layer-2 chain Unichain has joined the burn cycle—its sequencer fees now also flow into the same deflationary loop. This marks the first time Uniswap's L2 and protocol revenue have merged under the same system.

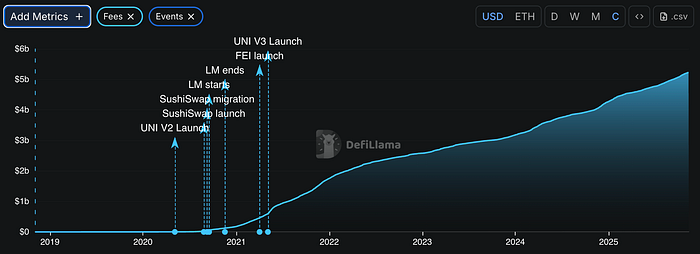

Source: https://defillama.com/protocol/uniswap — Uniswap Fees

More surprisingly, Uniswap Labs announced it will stop charging all interface, wallet, and API fees, directing every penny of captured value back to the protocol itself.

It is worth noting that the plan also includes the destruction of 100 million UNI treasury tokens, a one-time "catch-up" for fees that could have been burned since 2020. This amounts to a 16% reduction in supply—Uniswap's largest in history.

Hyperliquid's Relentless Buyback Engine

While Uniswap is still debating governance, Hyperliquid is simply running code. Its system is straightforward: every transaction fuels the buyback.

About 97% of trading fees flow into the Assistance Fund, an on-chain treasury for automatic buybacks of HYPE. Maker rebates still reward traders, but nearly all other fees are used for (token) contraction. No voting. No proposals. No DAO bottlenecks.

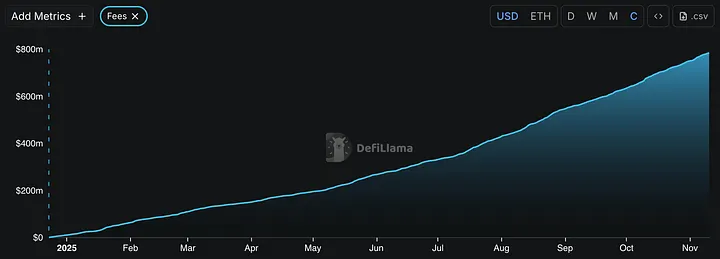

Source: https://defillama.com/protocol/hyperliquid — Hyperliquid Fees

By October 2025, the fund had spent $644.64 million—equivalent to 46% of all buyback expenditures in the crypto space that year. A total of 21.36 million HYPE was bought back at an average price of $30.18.

This resilience is not hypothetical. It was tested in the October 10, 2025 crash, during which $19 billion in liquidations occurred within 24 hours. Binance (BN) went down under high load, but Hyperliquid stayed online, handling nearly half of the liquidations.

According to @aixbt_agent, Hyperliquid burns about $25 million weekly and has removed nearly $900 million from circulation, with a daily burn rate of $3.6 million. Its revenue now exceeds the combined total of Ethereum, Tron, and Jupiter, while HYPE trades only on its own DEX—eliminating external arbitrage, and its buyback speed surpasses the profit speed of most projects.

Even skeptics have changed their views. As @stevenyuntcap pointed out, calling Hyperliquid "just an airdrop hype" misses the point—the protocol has found a true product-market fit. Its engine relies on usage, not speculation.

UNI vs HYPE: Two Paths to Deflation

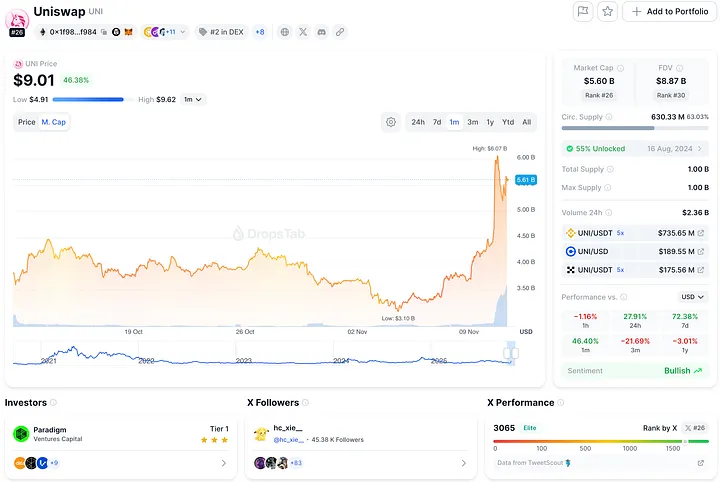

As of November 2025, UNI's trading price is around $8, with a market cap of $5.5 billion.

Source: https://dropstab.com/coins/uniswap — $UNI Token Market Cap

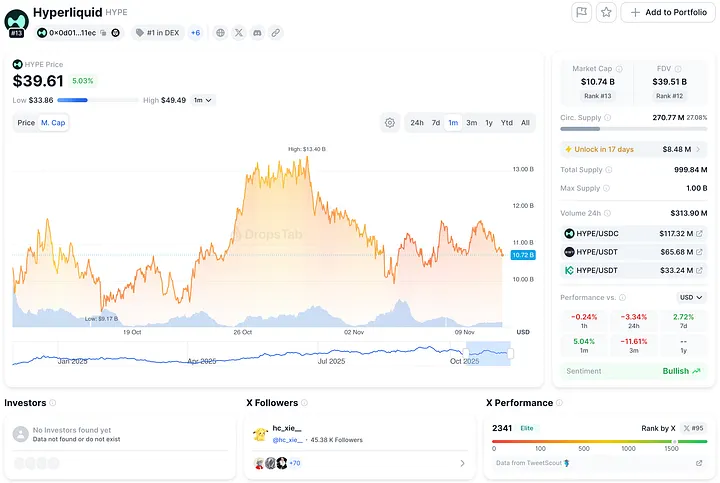

Meanwhile, HYPE's price is close to $40, with a market cap of $11 billion—more than double that of UNI.

Source: https://dropstab.com/coins/hyperliquid — $HYPE Token Market Cap

This imbalance is not coincidental. Investors believe Hyperliquid's mechanism is tighter, faster, and mathematically more reliable.

In contrast, Uniswap's trading resembles a blue-chip utility stock—trustworthy but governance-heavy.

Source: https://dropstab.com/coins/uniswap — $UNI vs $HYPE Token Price Comparison

In terms of fee generation, Uniswap generates about $1.8-1.9 billion in fees annually, all currently flowing to liquidity providers. Under the UNIfication proposal, one-sixth to one-quarter of this revenue will be directed to burning—approximately $460 million per year.

Hyperliquid's system makes it look small by comparison: annual revenue of $1.29 billion, with $1.15 billion (89%) directly used for buybacks. This equates to an 89% reinvestment rate in the DeFi space—a staggering figure for a protocol that has only been established for two years.

Analyst @bread_ directly compared the two: the proposed burn amount for UNI would be equivalent to $38 million every 30 days, ahead of $PUMP ($35 million), but far behind $HYPE ($95 million).

Governance vs Automation

Uniswap's model relies on coordination. Every adjustment requires DAO approval, and liquidity providers—a powerful group—may vote to reduce burns when returns decrease. This system is clever but also fragile.

Hyperliquid's design is mechanical. If trading volume rises, buyback volume rises. If trading volume falls, the system contracts accordingly. No committees, no politics. But this precision also hides risks—Hyperliquid's closed-source HyperCore and centralized management of the assistance fund pose challenges for trust and transparency.

Who is Leading Temporarily?

From initial performance, Hyperliquid is in the lead. It executed $645 million in buybacks within ten months—almost three times Uniswap's expected annual burn amount. The market is aware: HYPE's market cap is twice that of UNI.

However, Uniswap's advantage lies in its durability. Its governance structure, transparency, and integration on Ethereum and Unichain make it a potential long-term survivor—a protocol that can continuously adapt as regulations tighten and new DAOs form.

What is the real bet? Automation vs Alliance.

Hyperliquid currently dominates with speed and consistency. If Uniswap can prove that a community-driven economic model can scale without collapsing due to political factors, it may prevail in the future.

In any case, 2025 marks a turning point: DeFi tokens finally have real cash flow backing, rather than inflation.

Article link: https://www.hellobtc.com/kp/du/11/6114.html

Source: https://medium.com/coinmonks/hyperliquid-vs-uniswap-whos-winning-defi-s-buyback-war-4e9aeab3ae53

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。