Based on strong long-term drivers from AI, the rise in memory prices has entered "uncharted territory," with profit prospects far exceeding market expectations.

Author: Jukan

Translated by: Deep Tide TechFlow

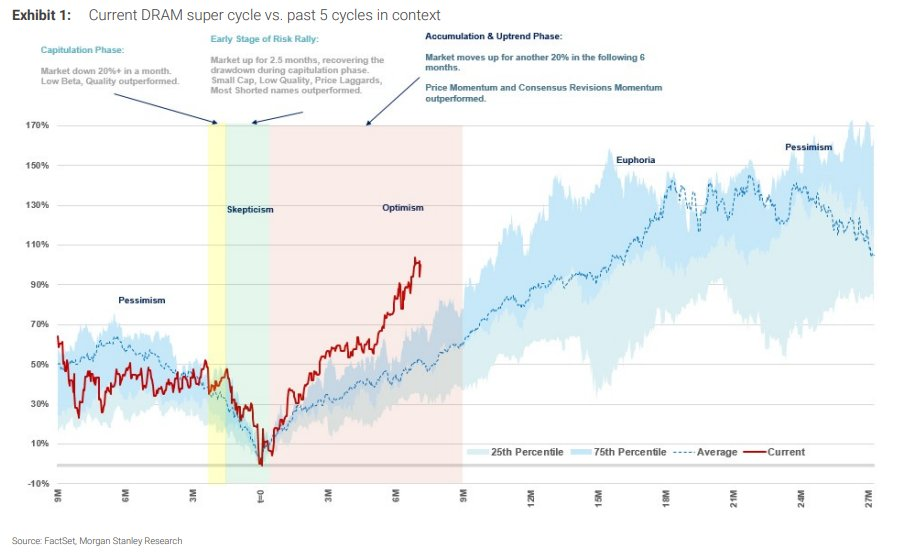

Morgan Stanley points out that a new round of memory "super cycle" driven by artificial intelligence (AI) has arrived, with its intensity and logic completely different from any previous cycle.

Morgan Stanley states that unlike the past, this cycle is dominated by AI data centers and cloud service providers, whose customers are less sensitive to prices, and inference workloads have become the main driving force behind general memory demand. Meanwhile, the latest channel checks show that server DRAM contract prices for the fourth quarter have soared nearly 70%, and NAND contract prices have risen by 20% to 30%, giving suppliers unprecedented pricing power.

The firm maintains an "Overweight" rating on SK Hynix and Samsung Electronics, expecting that the rise in memory prices will drive stock prices to new highs, and the profits of memory manufacturers will significantly exceed expectations.

Morgan Stanley notes that the core driving factors of this cycle have fundamentally changed in quality. Buyers are no longer traditional customers sensitive to prices, but rather giants in AI data centers and cloud services involved in building a computing infrastructure arms race.

For these companies, ensuring the supply of memory is a strategic "necessity," with price sensitivity dropping to historical lows. At the same time, the production of HBM (high bandwidth memory) is structurally eroding the capacity of traditional DRAM. Morgan Stanley emphasizes in its report:

"The uniqueness lies in the fact that current memory demand has evolved into a competition dominated by AI data centers (compute-intensive platforms) and cloud service providers, who are not as price-sensitive as traditional customers… The exponential growth in inference demand lays a solid foundation for this, which is also the reason why this cycle is fundamentally different from any previous cycle."

According to Morgan Stanley's latest channel checks, the price outlook for DRAM has turned sharply bullish in just two weeks. Fourth-quarter server RDIMM contract prices surged by about 70%, far exceeding the previous expectation of 30%. The spot price of DDR5 (16Gb) skyrocketed from $7.50 in September to the current $20.90, an increase of up to 336%. The quoting level for DDR4 also rose by 50%. Most contract transactions are expected to be finalized by the end of this month, but customer acceptance seems inevitable—due to concerns over further price increases and supply shortages.

NAND has become a key component of AI computing infrastructure and video storage. To address capacity constraints, prices for 3D NAND wafers (TLC and QLC) are expected to rise by 65% to 70% quarter-on-quarter. Nearline storage specifications are transitioning from 128TB to 256TB QLC SSDs. According to TrendForce's forecast, by 2026, enterprise-level SSD demand based on bits for servers is expected to grow by about 50% year-on-year. Samsung has limited bit production in the first half of 2025 due to the transition from V6 176-layer to V8 321-layer NAND, and capacity will only gradually increase in the second half of the year, resulting in this year's bit shipment growth rate being capped at 10%.

The market is often influenced by "peak fear," believing that once stock prices reach new highs, a reversal will follow. However, Morgan Stanley emphasizes that in this AI-driven market, the ultimate determining factor is profit growth, not historical valuations:

Currently, the price of server DRAM is $1/Gb, while at the peak of the cloud super cycle in the first quarter of 2018, it was $1.25/Gb. Considering the scale of AI infrastructure investment and the dynamic demand from hyperscale customers, the price peak of this cycle is very likely to exceed historical highs. Memory cycles typically last 4 to 6 quarters, and profits are gradually being realized. However, the key lies in the comparison with market expectations—markets show significantly higher enthusiasm for general memory prices. Valuation cannot predict future returns; it reflects supply and demand relationships rather than historical precedents.

Based on strong long-term drivers from AI, the rise in memory prices has entered "uncharted territory," with profit prospects far exceeding market expectations. This means that stock prices still have significant upside potential.

"As capital expenditures related to AI continue to expand, the proportion of memory in total spending may continue to rise—this will drive the price-to-book ratio (P/B) far beyond historical peaks. We believe this is a story of valuation expansion layered on top of cyclical profit recovery…

We believe that analysts' data revisions are always lagging—for SK Hynix and Samsung, our earnings forecasts for 2026 and 2027 are respectively 31% to 48% and 38% to 51% higher than the market consensus."

Overall, the driving factors of this memory "super cycle" are more enduring, with price increases exceeding historical records and profit prospects being more optimistic. Coupled with strong cyclical performance, this creates a rare investment opportunity for memory manufacturers with pricing power.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。