The power demand of AI is difficult to meet, and mining companies have a natural advantage in transforming into computing centers.

Written by: Deep Tide TechFlow

This year, mining companies like IREN, CORZ, and HUT have transformed into AI data centers, with their stock prices increasing several times within the year. This article will outline the logic behind the price increases and the key factors that will influence future market trends.

Under the impact of the Bitcoin halving in 2024, miner competition, and the sluggish rise of BTC, crypto mining companies are accelerating their transformation into AI computing centers. Mining companies are utilizing existing power infrastructure to fill the computing gap for AI; by 2025, several mining companies are expected to achieve significant revenue and valuation increases through the development of AI/HPC (High-Performance Computing) businesses, ushering in a "Davis Double" moment for transforming mining companies (the Davis Double refers to a situation where a company's profit growth coincides with an increase in market valuation, leading to a substantial rise in stock prices).

1. The Profit Dilemma of Crypto Miners and the Rise of AI Computing Demand

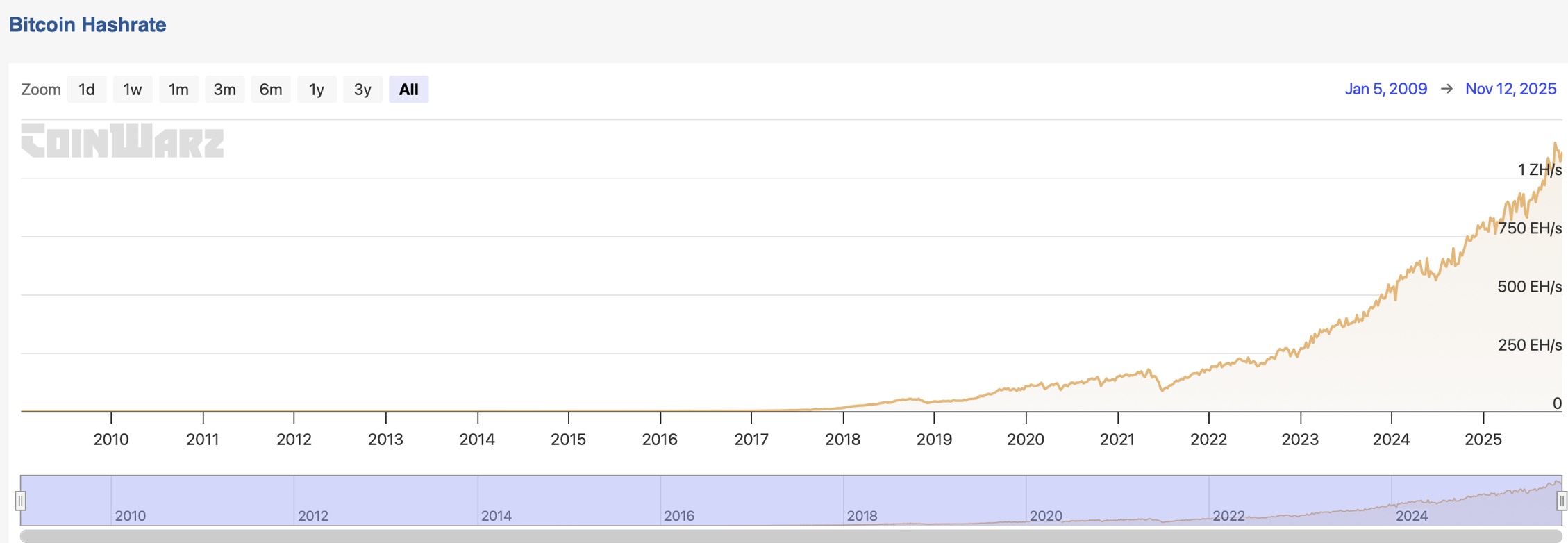

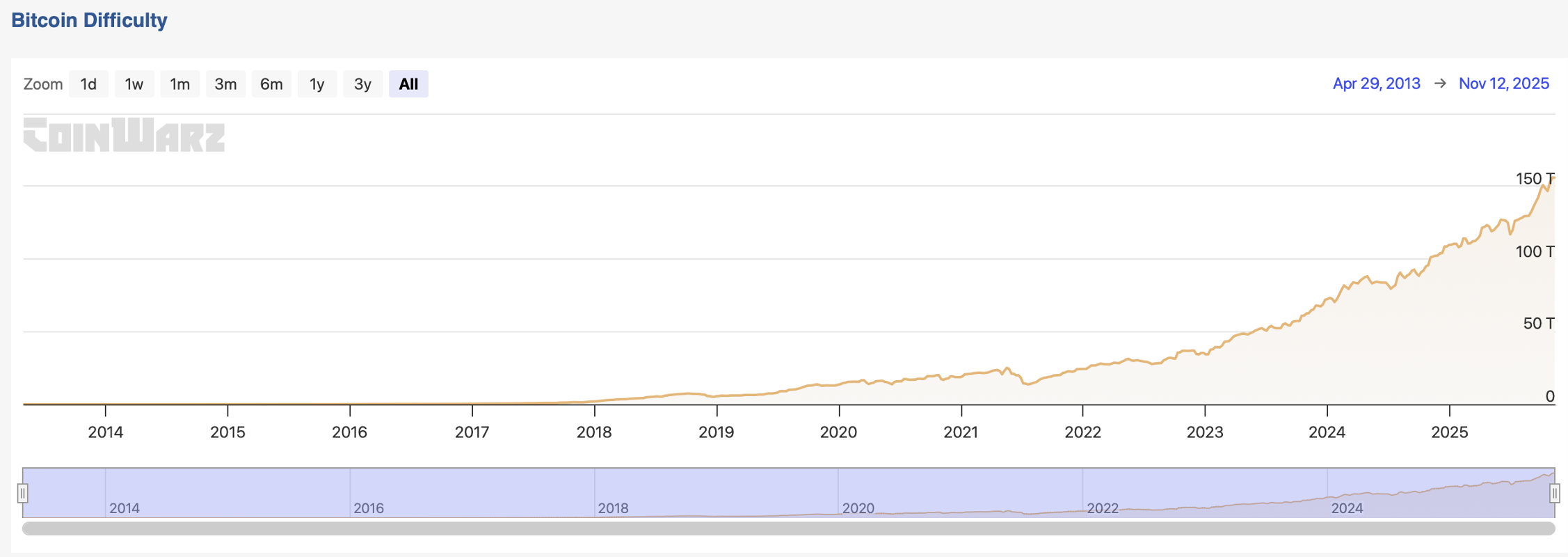

The fourth Bitcoin halving in April 2024 will reduce the block reward from 6.25 BTC to 3.125 BTC, coinciding with a historical high in total network computing power (over 1000 EH/s), approximately double that of April 2024; meanwhile, the price of BTC has only increased by about 60%, indicating that miners are facing further competition and deteriorating profits; some mining companies are seeing their shutdown prices approach $100,000.

Figure: Total network computing power reaches a new high

Data Source: Coinwarz

Figure: Mining difficulty reaches a new high

Data Source: Coinwarz

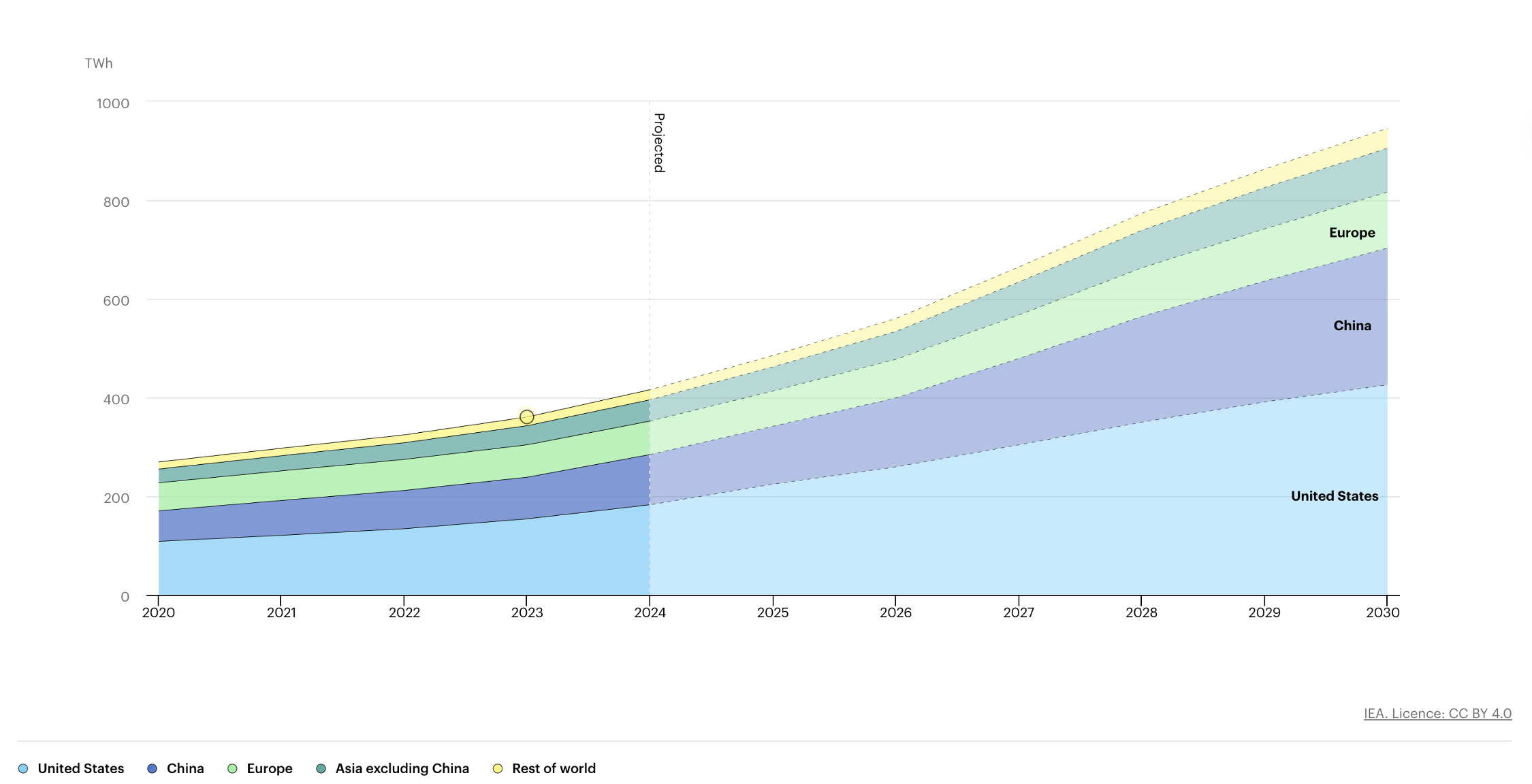

At the same time, the explosive growth of AI large models has created a massive demand for computing power, which is driven by electricity; energy has subtly become the "new oil" of our time. The International Energy Agency (IEA) predicts that global data center electricity consumption will double from 415 TWh in 2024 to 945 TWh in 2030, accounting for 2.5-3% of total global electricity; a report from the U.S. Department of Energy indicates that the load growth of AI data centers has tripled over the past decade and is expected to double again by 2028.

Figure: Data center electricity consumption is expected to reach 945 TWh by 2030

Data Source: International Energy Agency (IEA)

2. The Difficulty in Meeting AI's Power Demand and the Natural Advantages of Mining Companies Transforming into Computing Centers

The explosive growth in power demand driven by AI is currently difficult to meet, mainly due to:

Limited existing grid capacity, which cannot be rapidly expanded;

AI data centers require high-density base load power, which imposes high site selection requirements;

Utility companies find it difficult to predict the fluctuations in power demand from AI, leading to delays in power generation investments;

Key components like transformers and cables have production cycles, and it takes 2-5 years for data centers to go from planning to production;

The average approval time for power access for AI data centers is 12-18 months, and in some U.S. states, it can take as long as 3 years.

These factors have made qualified power and its supporting infrastructure scarce for training large AI models, while large mining sites already possess power permits, locked-in low-cost power contracts, and are located in areas with reliable low-cost power supply (such as Texas, USA, Quebec, Canada, and Iceland), along with mature substations, power access, cooling systems, and other infrastructure.

Additionally, mining companies typically own large amounts of land, buildings, and network connections in suitable locations for rapid deployment of AI computing power. These natural advantages make the transformation of mining companies into data centers a seamless process. The following mining companies are of particular interest:

1. IREN Ltd (Stock Code: IREN)

IREN was established in Australia in 2018, aiming to meet the cryptocurrency mining demand with renewable energy; from 2018 to 2021, it rapidly expanded and began laying out data centers in North America; it went public on NASDAQ in 2021 and started deploying GPU cloud platforms and signing AI computing contracts between 2023 and 2024, gradually shifting its data center focus from Bitcoin mining to AI/HPC services. In 2024, it rebranded as IREN Limited, marking a full transformation into a digital infrastructure company.

Compared to other miners, IREN has completed its energy procurement and data center operations through a self-built system and strategically positioned itself before the 2024 Bitcoin halving, successfully avoiding the impact of a sharp decline in mining revenue post-halving, thus demonstrating stronger growth elasticity and foresight.

Currently, IREN has secured 2.9 GW of power capacity, with six completed and under-construction data center parks, and its unit energy cost is at the industry's lowest level of about 3.5 cents/KWH. Its positioning in green energy has also attracted ESG-focused clients and investors. IREN has received endorsement from NVIDIA, becoming one of its excellent partners, and on November 3, signed a $9.7 billion cooperation deal with Microsoft.

2. Core Scientific (Stock Code: CORZ)

Core Scientific was established in 2017 and was once one of the top BTC mining companies in the U.S. It went public through a SPAC in 2022 but filed for bankruptcy that same year due to the BTC crash and debt issues; after restructuring, it relisted in January 2024 and quickly entered the AI/HPC service business leveraging its infrastructure advantages.

In 2024, Core Scientific signed a 12-year cooperation agreement with AI cloud service provider CoreWeave to provide up to 200 MW of infrastructure hosting services, with expected total revenue exceeding $3.5 billion; in 2025, CoreWeave proposed to acquire Core Scientific for about $9 billion, but this offer was voted down by Core Scientific's shareholders in October, who believed that the company had greater potential for independent development.

3. Hut 8 (Stock Code: HUT)

Hut 8 was established in 2017 and went public on NASDAQ in 2021, being one of the earliest cryptocurrency mining companies in North America; a key turning point in its transformation was the merger with USBTC in November 2023, enhancing its computing power scale and acquiring USBTC's high-performance computing and AI cloud service business, thus transforming into a diversified digital infrastructure company.

In 2024, Hut 8 raised $150 million through convertible bonds to build AI-related infrastructure; in August 2025, it plans to construct four new sites, adding 1.5 GW of capacity; in March 2025, it partnered with the Trump family to establish American Bitcoin Company, with Eric Trump serving as Chief Strategy Officer, and Hut 8 obtained 80% equity in the new company by providing mining machines; the company has since gone public on NASDAQ in September 2025, and Hut 8 has attracted market attention due to its political and business connections with the Trump family.

Figure: IREN has increased by 987% this year, HUT by 249%, and CORZ by 131%

Data Source: TradingView

3. Key Points and Risks for Future Market Trends

- In the short term, focus on the signing of large contracts and the scaling of upstream capital.

The customer concentration in the AI/HPC business is extremely high, with companies like CoreWeave, Microsoft, and Google handling most of the business demand. It is essential to closely monitor the Capex (capital expenditure) guidance from upstream companies; if Capex guidance is raised in Q4, it can reasonably be inferred that the AI/HPC business demand for transforming mining companies is growing; simultaneously, the signing of orders and execution pace are also more intuitive indicators to watch.

- In the long term, pay attention to the expandable power scale of mining companies, their ability to maintain low electricity prices, and whether AI can continue to expand to ensure sustained growth in power demand, which will support high valuation levels in the AI/HPC sector. Additionally, data centers are capital-intensive businesses, so it is crucial to monitor the companies' financing capabilities and financial health; the risk of fixed asset depreciation due to technological advancements; and the fact that this sector is still in the narrative and investment phase, necessitating caution against excessive speculation and the risk of performance not meeting expectations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。