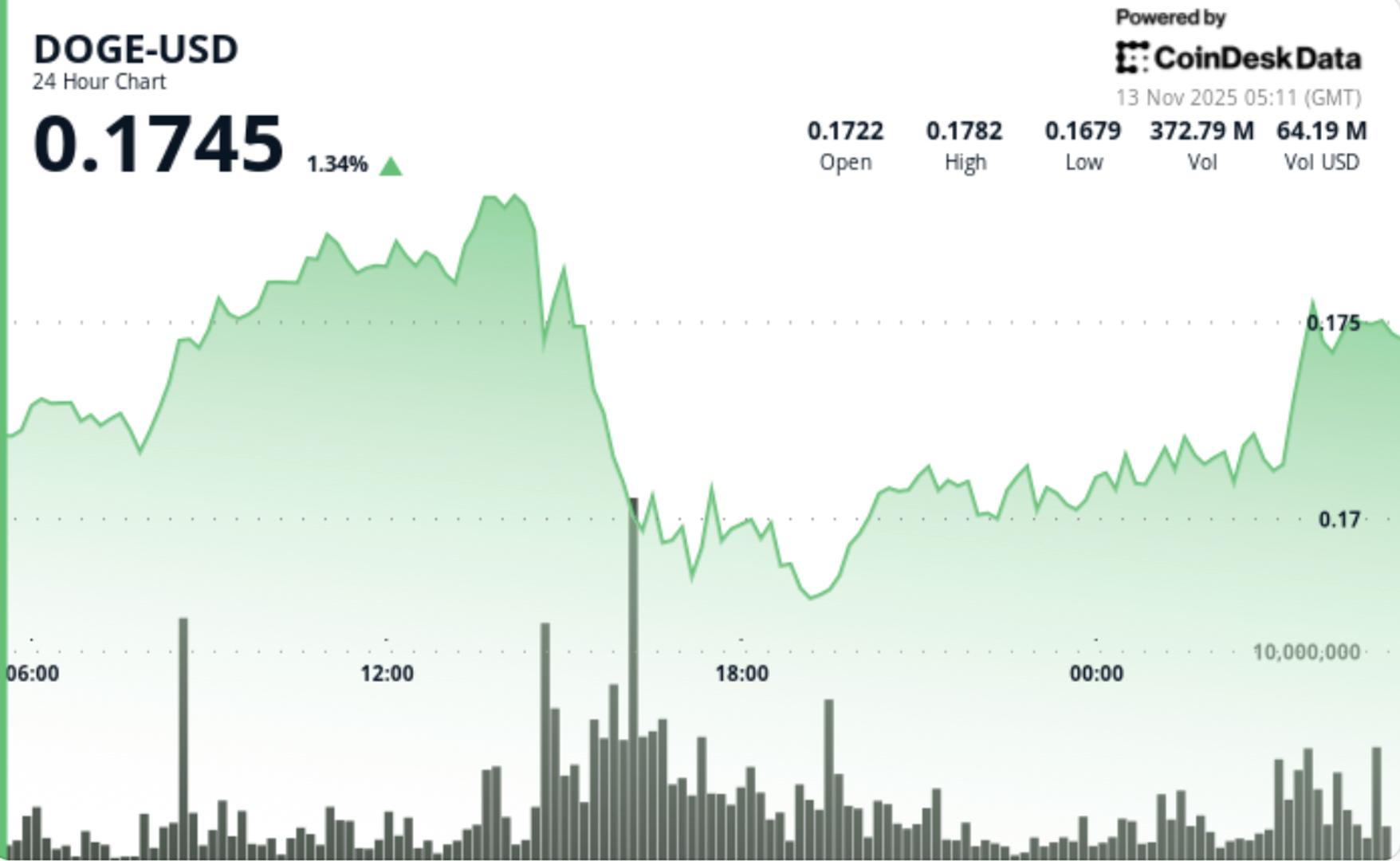

The memecoin broke below the critical $0.1720 level on heavy volume as sellers dominated the London session, testing the resilience of long-term technical support.

News Background

Dogecoin extended its decline Tuesday, tumbling 5.5% from $0.1831 to $0.1730 as bearish momentum accelerated across European trading hours. The sharp move unfolded within a $0.0121 range as price action confirmed a textbook lower-high, lower-low formation.

The breakdown gathered speed at 14:00 GMT, when trading volume exploded to 500.6 million tokens — 77% above the 24-hour average of 283 million. Heavy selling emerged at the $0.1789 resistance zone, triggering a cascade through successive support levels until buyers stabilized the move near $0.1719.

Despite modest stabilization late in the session, DOGE remained pinned near the lows. Attempts to rebound toward $0.1732 met immediate selling pressure, while elevated activity of 12.5 million tokens per hour during the recovery phase suggested distribution rather than accumulation.

Price Action Summary

DOGE’s session structure reflects deteriorating momentum with declining support strength. The failure to reclaim $0.1789 resistance validates a near-term bearish trend, while compression around $0.1730 highlights uncertainty among short-term traders.

The $0.1719 zone absorbed multiple retests, forming a fragile base that may define the next pivot for directional traders. Volume tapering from peak levels hints at temporary seller exhaustion, but without follow-through buying, the market remains vulnerable to another downside test.

Technical Analysis

With no major fundamental triggers, price action remains purely technical. DOGE’s breakdown below its short-term moving averages reinforces the broader bearish bias that has persisted since early November. The hourly RSI sits near 38, indicating mildly oversold conditions but not yet capitulation.

Market analyst Kevin (@Kev_Capital_TA) highlights the weekly 200-EMA near $0.16 as Dogecoin’s structural “line in the sand.” That level has held through six previous retests since summer, marking the boundary between cyclical pullback and long-term trend reversal.

A decisive close below $0.17 would shift sentiment decisively bearish, while sustained defense above $0.1720 may allow for a near-term consolidation phase or relief bounce toward $0.1760.

What Traders Should Know

The immediate focus is whether the $0.17 handle can hold under continued pressure. Institutional order-flow metrics suggest systematic de-risking rather than panic liquidation — leaving room for a technical rebound if volume subsides further.

Failure of the $0.1720–$0.1719 support cluster could expose the $0.1650–$0.1600 zone, where the weekly moving average sits as last-ditch structural support.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。