Bitcoin Treasuries (bitcointreasuries.net) found that firms such as Strategy, Strive, and Metaplanet are spearheading financial innovation with preferred shares and high-yield dividend structures, generating annual returns between 8% and 12%. Strategy, which now holds 640,808 BTC worth over $70 billion, continues to expand its preferred stock products internationally, targeting global investors.

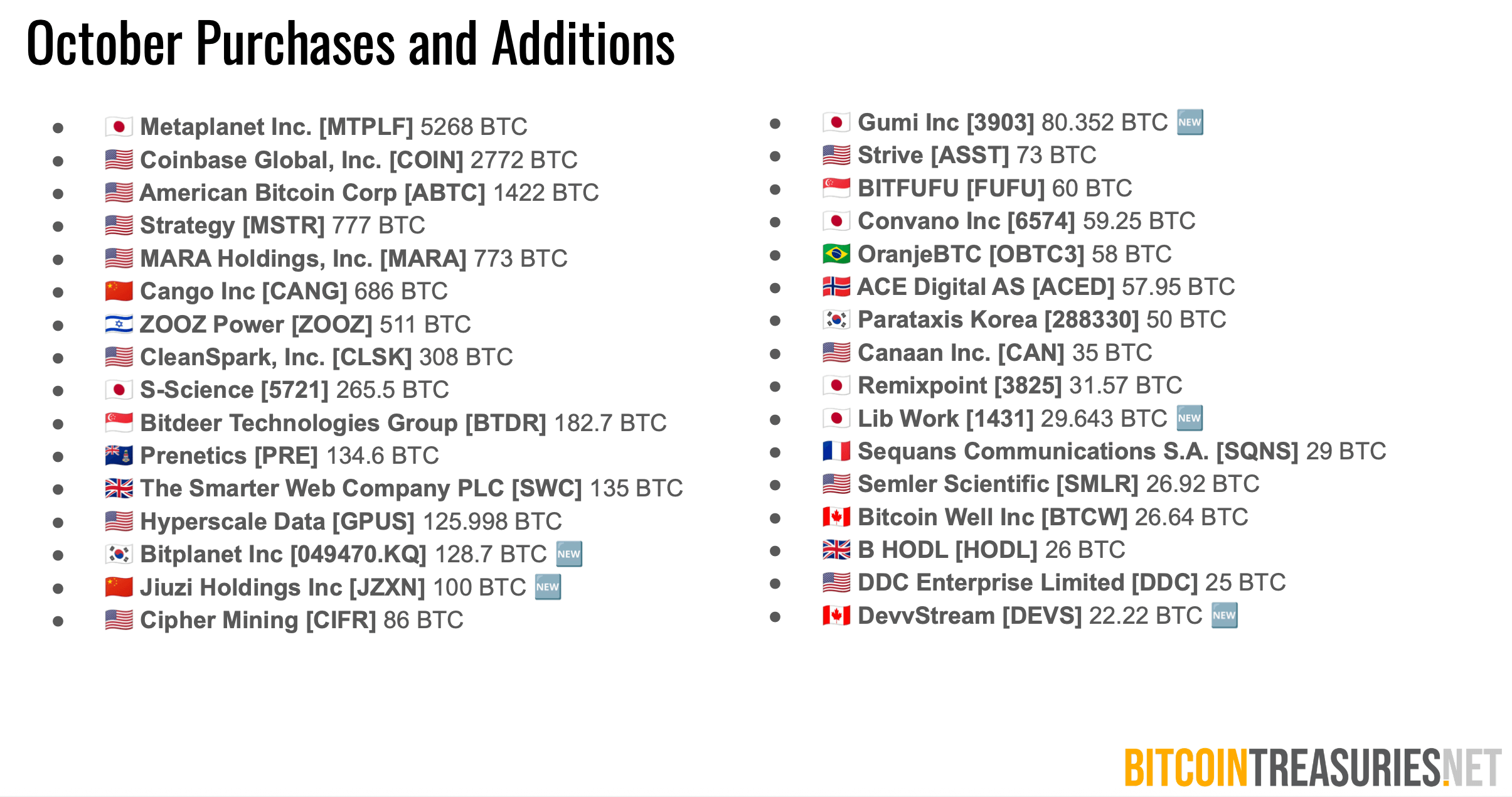

Meanwhile, Strategy’s dominance has slipped to 60% of all public bitcoin (BTC) treasury holdings—down from 75% at the start of 2025—as more corporations acquire substantial positions in bitcoin. Metaplanet, Coinbase, and American Bitcoin all made major purchases in October, helping total tracked holdings climb to more than 4.05 million BTC valued at $444 billion at month’s end.

Metaplanet emerged as October’s largest buyer, adding 5,268 BTC worth $615 million, followed by Coinbase’s 2,772 BTC purchase and American Bitcoin’s 1,400 BTC addition. Metaplanet is also rolling out perpetual preferred shares in Japan to grow bitcoin per share without dilution, while Strive launched its SATA stock, offering 12% annual dividends beginning Dec. 15, 2025.

Bitcoin Treasuries noted that these new funding mechanisms mark a shift from equity issuance to structured yield instruments, aligning digital assets more closely with traditional fixed-income products. “Preferred shares make it possible to expand Bitcoin holdings without dilution,” said Metaplanet President Simon Gerovich. “And grow bitcoin per share irrespective of mNAV,” the Metaplanet executive added.

Also read: Vivek Ramaswamy-Backed Strive Expands Bitcoin Treasury to 7,525 Coins

The report also revealed that coins like ethereum ( ETH) and solana ( SOL) are gaining ground in corporate balance sheets. ETH now represents 15% of total public treasury value, up from just 1% earlier this year, while SOL accounts for about 2-3%. Bitcoin still dominates at 82%, but multi-asset treasuries are becoming more common among listed companies.

Despite a slowdown in net bitcoin additions—14,447 BTC were added in October compared with 38,035 BTC in September—treasury holdings remain at all-time highs. Bitcoin Treasuries researchers attribute this to long-term accumulation strategies and minimal selling activity.

The bitcointreasuries.net analysis concludes that while Strategy’s share is shrinking, the broader sector is maturing. Pure-play Bitcoin treasury equities such as Capital B, Metaplanet, and Satsuma have outperformed the S&P 500 in 2025, suggesting that disciplined treasury management and yield innovation are gaining investor favor.

FAQ ❓

- What is digital credit in Bitcoin treasuries?

It’s a preferred share structure offering 8–12% yields, pioneered by Strategy and now adopted by Strive and Metaplanet. - How much Bitcoin do public companies hold?

More than 1.05 million BTC, part of the total 4.05 million BTC tracked by Bitcoin Treasuries. - Which company added the most Bitcoin in October?

Metaplanet led with 5,268 BTC, followed by Coinbase and American Bitcoin. - Are altcoins gaining traction in corporate treasuries?

Yes. Ethereum now makes up 15% of total treasury value, signaling growing diversification beyond bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。