Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The macro market sentiment is being influenced by a complex interplay of multiple factors. The U.S. government shutdown crisis is expected to come to an end, and combined with weak employment data, this has boosted market expectations for a Federal Reserve interest rate cut, temporarily lifting the Dow Jones index. However, according to "Federal Reserve mouthpiece" Nick Timiraos, there are significant internal disagreements within the Federal Reserve regarding future policy paths, with officials engaged in heated debates over the persistence of inflation and the risks of a weak labor market, adding uncertainty to future interest rate decisions.

Meanwhile, the tech industry is embroiled in a fierce debate about AI, as SoftBank Group disclosed on Tuesday that it sold all its Nvidia shares and instead invested an additional $22.5 billion in OpenAI. Despite its quarterly earnings exceeding expectations, market concerns over an AI bubble led to a sharp decline in stock prices. Amid this speculative frenzy, soon-to-retire Warren Buffett issued a different voice through his "last letter," warning against the greed in the corporate world and reiterating his long-standing advocacy for long-term value investing philosophy. Looking ahead, analyst Banmu Xia predicts that the market may remain volatile in the short term, but with the Federal Reserve likely to halt balance sheet reduction in December, it will trend gently upward in the medium term, while a significant liquidity injection may have to wait until after May next year, potentially sparking a major rally.

Regarding Bitcoin, analyst Banmu Xia believes that Bitcoin has entered the early stages of a bear market and is currently undergoing a large fourth wave horizontal adjustment. In the short term, market sentiment leans towards hesitation and caution. Analyst Killa points out that if the price falls below the critical support of $104,000 and fails to recover, it may further dip to the $100,000 or even $98,000 range. He noted that BTC typically rebounds before the 14th of each month over the past five months, but this month still faces downward pressure. Daan Crypto Trades also mentioned that after the $104,000 CME gap is filled, there remains a noteworthy gap in the $92,000 area. Crypto Chase views $98,000 as an ideal long entry risk-reward point and expects that even in the worst-case scenario, the price may find institutional support at the $90,000 low. Despite short-term downward pressure, many analysts believe the correction is nearing its end. Swissblock indicates that risk signals have shifted to low risk, suggesting that selling pressure is easing. Currently, Bitcoin's price trend may lead to two scenarios: one is that the price re-establishes itself in the $108,500 to $110,000 range, confirming market risk stability and further rising; the other is that the price falls back to the $103,000 to $100,000 range, with the market possibly experiencing volatility again in the short term. Astronomer predicts that after the current correction ends, the target will be set at $112,000. From a longer-term perspective, the outlook is extremely optimistic, with 10T Holdings founder Dan Tapiero maintaining his target of $180,000 for this bull market, and Gert Van Lagen predicting based on wave theory that the next expansion may push Bitcoin into the $200,000 to $240,000 range.

Ethereum is facing critical technical resistance, with several analysts pointing out a dense resistance zone between $3,700 and $3,900. Michael van de Poppe believes that breaking through this area is essential to advance towards historical highs. If it fails to break through, it may face a correction, with the support zone identified by Man of Bitcoin located between $3,176 and $3,343, while Crypto Chase is focusing on potential accumulation positions in the $3,000 to $2,900 range, believing that the likelihood of the price falling below $2,600 is low.

Recently, Uniswap saw its price surge nearly 50% due to its foundation proposing to activate protocol fee switches and burn UNI tokens, but it later fell back from a high of $10.3 to $8.7 due to sell-offs from whale addresses (including one suspected to be Variant Fund) and comments from competitors deeming its timing inappropriate. Conflux (CFX) experienced a brief surge of over 40% this morning after announcing the launch of the offshore stablecoin CNHT0 supporting the RMB for "Belt and Road" trade settlements, but the gains were completely erased shortly after. Meanwhile, the privacy coin sector, which had previously seen significant increases, is now experiencing a correction, with Zcash (ZEC) dropping from a high of $750 to around $470. BitMEX co-founder Arthur Hayes stated that he might consider increasing his holdings if the price corrects to the $300 to $350 range.

2. Key Data (as of November 12, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $103,547 (YTD +10.66%), daily spot trading volume $60.7 billion

Ethereum: $3,452 (YTD +3.44%), daily spot trading volume $32.04 billion

Fear and Greed Index: 26 (Fear)

Average GAS: BTC: 1.02 sat/vB, ETH: 0.067 Gwei

Market share: BTC 59.4%, ETH 12.0%

Upbit 24-hour trading volume ranking: LSK, XRP, BTC, ETH, SOIL

24-hour BTC long-short ratio: 48.35%/51.65%

Sector performance: L2 sector down 4.6%, AI sector down 3.89%

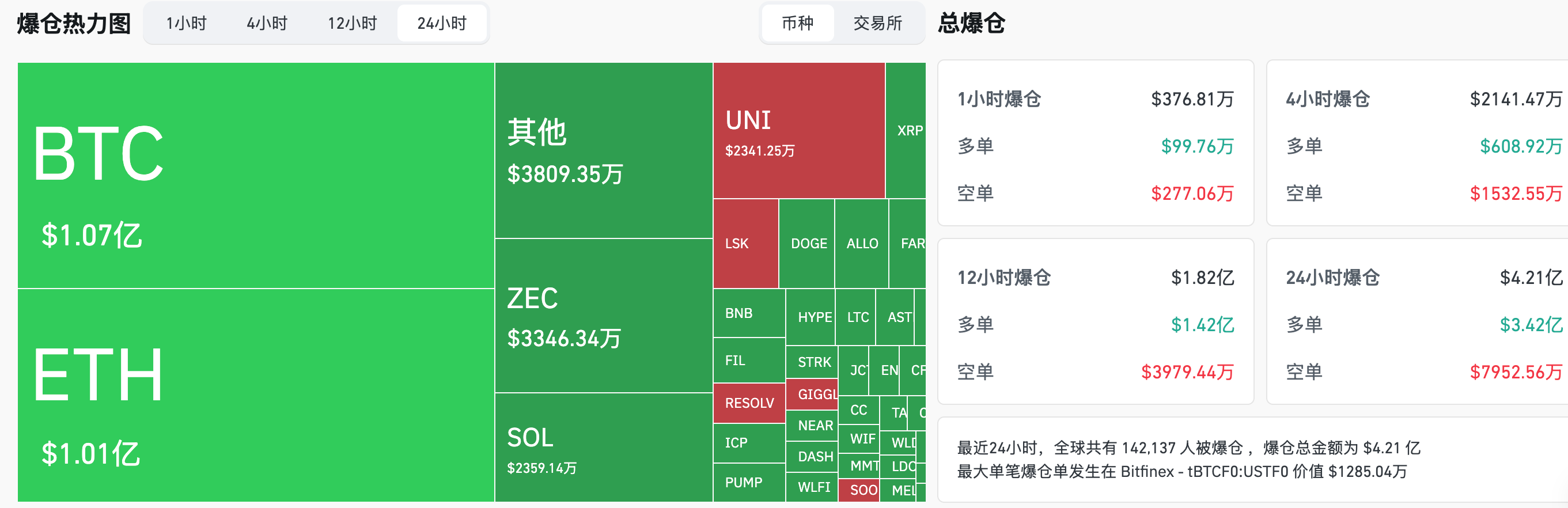

24-hour liquidation data: A total of 142,137 people were liquidated globally, with a total liquidation amount of $421 million, including $107 million in BTC, $101 million in ETH, and $33.46 million in ZEC.

3. ETF Flows (as of November 11)

Bitcoin ETF: +$524 million

Ethereum ETF: -$107 million

Solana ETF: +$7.98 million, net inflow for 11 consecutive days

4. Today's Outlook

Binance contracts will delist MANAUSD and EGLDUSD coin-based perpetual contracts on November 13

Ethereum treasury company SharpLink will announce its third-quarter financial results on November 13

U.S. October CPI YoY: Previous value 3%, expected value 3% (November 14, 21:30)

peaq (PEAQ) will unlock approximately 84.84 million tokens at 8:00 AM on November 12, accounting for 5.57% of the current circulating supply, valued at approximately $6 million.

Avalanche (AVAX) will unlock approximately 1.67 million tokens at 8:00 AM on November 13, accounting for 0.33% of the current circulating supply, valued at approximately $28.2 million;

Cheelee (CHEEL) will unlock approximately 20.81 million tokens at 8:00 AM on November 13, accounting for 2.95% of the current circulating supply, valued at approximately $13.4 million;

The largest declines among the top 100 cryptocurrencies today: Starknet down 15.6%, SOON down 12.5%, Zcash down 10.9%, Official Trump down 9.4%, ASI Alliance down 8.3%.

5. Hot News

JPMorgan has launched the deposit token JPM Coin for institutional clients

Coinbase and stablecoin startup BVNK have canceled a $2 billion acquisition deal

Stablecoin giant Tether has invested heavily to poach from HSBC, increasing its gold reserves

Lido proposes to execute automatic buybacks using LDO/wstETH liquidity

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。