The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

After a weak performance last week, Ethereum spot ETFs have recorded net inflows again, and market sentiment is gradually warming up. Ethereum's next upgrade is already on the way.

Historically, almost every technical upgrade has acted as a catalyst for price changes, with improvements in on-chain performance post-upgrade directly reflecting in ETH's valuation expectations.

This time, the Fusaka upgrade arriving on December 3 is broader in scope and deeper in impact.

It is not just an efficiency optimization but a significant upgrade to the entire Ethereum mainnet: Gas costs, L1 throughput, L2 capacity, node thresholds… almost every core metric that determines the network's vitality has taken a significant step forward.

If past upgrades made Ethereum "cheaper" or "faster," the significance of Fusaka lies in making Ethereum more scalable and sustainable.

As the protocol's functionality becomes increasingly complex, the demands on the underlying chain's capacity are rising, and with the rise of AI Agents and high-frequency interactive DApps, this upgrade will directly impact Ethereum's position in the next wave of Web3 applications.

So, what exactly has changed? If you want a quick overview, here is a visual summary of all the core changes in the Fusaka upgrade:

Improvements

Corresponding Mechanisms

DeFi

High-frequency/Interactive DApps

Wallet & UX

Stablecoins & Payments

Institutional/Asset Tokenization

Staking & Security

Developers & Innovation

Gas Fee Reduction

Blob Pricing Mechanism (EIP-7918)

L2 upload costs decrease → Rollup transactions cheaper; Gas fluctuations smaller → DEX slippage smaller

Game/NFT state writes cheaper; supports microtransactions

Transfer fees predictable → Better UX

Stablecoin transfers $0.001 → Micro-payments feasible

Institutions can migrate large assets to L2 at low cost

Validator fees stable → Higher participation

Rates more stable, less fluctuation, no need to worry about short-term gas or blob fee volatility. Developers can price on-chain services without concerns.

Gas Limits & L1 Throughput

Block Gas limit ↑ to 150 million (originally 45 million)

More transactions per block → Deeper order books, reduced flash loan congestion

Throughput per block increases, reducing queue times, smoother experience

Wallet transfers faster, UI can display "instant"

High-volume stablecoin batch settlements can be completed in a single block

Large-scale token issuance can be settled in one go

High block capacity ensures stable validator rewards

Multi-step DeFi strategies can be executed in a single block, reducing gas costs

Data Capacity & L2 Expansion

PeerDAS

Rollup can store richer order book data, reducing off-chain dependencies

8x Blob capacity → Game states, AI model snapshots, NFT metadata low-cost on-chain storage

Wallets reduce off-chain queries → UI loads faster

Stablecoin issuers can directly embed compliance data on-chain

Institutions can attach legal documents, KYC hashes, audit trails

Validators only need to download 1/8 of the blob → Home nodes feasible

Some complex computations and state validations can be completed directly on-chain

Transaction Speed & Pre-confirmation

Blob channel expansion + Pre-confirmation (EIP-7917)

Near-instant transaction confirmations → Reduces front-running

Confirmation actions faster → Real-time multi-user experience

Wallets instantly display "pre-confirmed" → Eliminates waiting anxiety

Payment applications can immediately show "sent"

Institutional settlements locked before block closure → Guarantees execution price

Block finality faster → Validators sync faster, reducing orphan blocks

Developers can design faster on-chain matching engines

Network Expansion Path (BPO Fork)

BPO (Blob Parameter Only) fork mechanism EIP-7892

TVL growth without hard forks → DEX liquidity stable

Game developers can plan long-term capacity upgrades through lightweight BPO forks

Wallets benefit from predictable upgrade paths → No UI disruptions

Payment systems can plan capacity upgrades in advance, avoiding interruptions

Institutions have more confidence in protocol expansion capabilities

Validators can upgrade incrementally → Hardware requirements stable

Contract designs have future scalability, easily coping with on-chain capacity growth

Validator Hardware Reduction

PeerDAS stores 1/8 of data + random sampling verification

More diverse validators → Enhanced decentralization → Safer DeFi

Game Rollups rely on a robust decentralized validator network

Users perceive higher network stability → Wallet reliability improves

Payment Rollups benefit from geographically distributed validators → Reduces latency

Increased network decentralization, enhancing security

Lower entry barriers → Home node staking feasible → Increased participation, enhanced decentralization

Researchers can run testnets on low-spec hardware → Accelerating innovation

CLZ opcode & secp256r1 Pre-compile

-

ZK proof verification faster → Lower costs for private transactions

On-chain AI inference feasible, lower gas costs

Wallet signature verification faster → Better UI response

Payment protocols can use secp256r1 → Lower verification costs

Institutions can use P-256 compliant tokenization

Validators verify faster → Lower CPU load, supporting more nodes

Developers can build advanced cryptographic primitives (threshold signatures, batch verification)

Account Abstraction & Passkey

-

Supports ERC-20 paying gas → Lowers entry barriers for DeFi

Game accounts can be biometrically created instantly for quick login

Passwordless login → Smooth on-chain experience, increased wallet usage

Merchants can accept payments without managing ETH

Institutions can integrate hardware key signatures into compliance processes

Validators can support abstract accounts → Simplified node operations

Contract wallets can choose gas payment methods, natively supporting biometrics and hardware key logins, passwordless operations, secure and user-friendly, allowing developers more flexibility in on-chain design.

Next, we will explain the core logic of the Fusaka upgrade from both technical and practical impact perspectives.

This is not a technical report meant only for developers; we will explain it in a way that even technical novices can easily understand, helping you quickly grasp the key changes behind this upgrade. If you are not interested in the operational mechanisms, you can skip directly to the latter part to see how this upgrade will impact the Ethereum ecosystem and the experience of every user.

Core of the Fusaka Upgrade: Further Expansion

The core purpose of the following technical improvements is singular: to achieve further expansion while ensuring security and decentralization.

PeerDAS: From Full Storage to Sampling Verification

Blob is a new type of data block for Ethereum that stores a large amount of on-chain data, packaging Layer 2 transactions into a "big box," similar to a courier company delivering a large number of packages efficiently on-chain without occupying permanent storage space.

Before the Fusaka upgrade, each node had to verify data by fully storing each package like a courier company, resulting in overloaded warehouses, strained bandwidth, and skyrocketing node costs.

PeerDAS proposes a more elegant solution: no longer full storage, but network-wide sharding sampling.

Storage: Each blob is divided into 8 parts, and nodes only randomly store 1/8 of it, with the rest distributed among other nodes.

Verification: Through random sampling verification, the error probability is as low as 10²⁰–10²⁴. Nodes can quickly retrieve missing segments using erasure codes, easily reconstructing complete data.

It sounds simple, but it represents a significant improvement in data availability. This effectively means:

Node burden reduced by 8 times;

Network bandwidth pressure drastically reduced;

Storage shifts from centralized to distributed, further enhancing security.

Blob Pricing Mechanism

In the Dencun upgrade, Ethereum introduced blobs, allowing Rollups to upload data at a lower cost. Its fees are dynamically adjusted by the system based on demand. However, some limitations have emerged in practice:

When demand plummets, fees can drop to nearly zero, failing to reflect actual resource usage.

When demand surges, blob fees can spike instantly, causing Rollup costs to soar and block delays.

The severe fluctuations stem from the protocol's inability to perceive the complete price structure, adjusting prices solely based on short-term "consumption."

EIP-7918 in the Fusaka upgrade aims to address the issue of fluctuating fees. The core idea is to no longer allow blob fees to fluctuate indefinitely but to set a reasonable price range for them.

It adds a layer of minimum reserve price to the pricing system:

When prices fall below the execution cost threshold, the algorithm will automatically apply brakes to prevent fees from being pushed down to nearly zero;

At the same time, it limits the speed of price adjustments during high load, preventing fees from skyrocketing.

Another EIP-7892 makes Ethereum more friendly to Layer 2. It allows the network to dynamically fine-tune the blob's capacity, quantity, and size like turning a knob. There is no need to initiate a complete hard fork for parameter adjustments as was required before the upgrade.

When L2 needs higher throughput or lower latency, the mainnet can respond instantly to match these demands, significantly enhancing the system's flexibility and scalability.

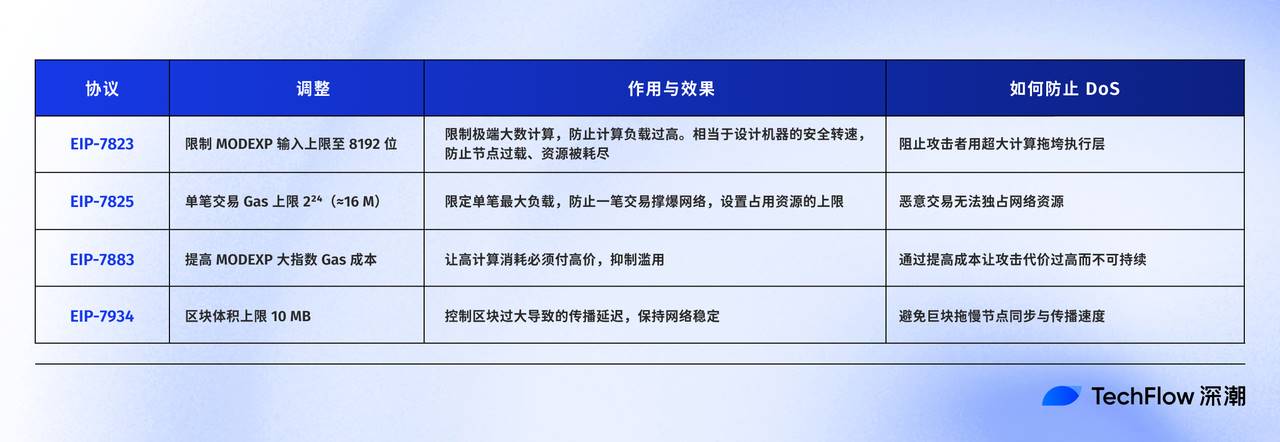

Security and Usability

Security

Expansion allows Ethereum to handle more transactions, but it also increases the potential attack surface. DoS attacks, or Denial of Service attacks, can lead to network congestion, transaction delays, or even node paralysis, significantly degrading the user experience and security of the entire chain.

Ethereum already has strong DoS resistance designs; these improvements are not fixes for defects but an additional layer of protection on the existing security framework.

In simple terms, if Ethereum is a highway, then the four EIPs of Fusaka are like simultaneously regulating vehicle speed (EIP-7823), vehicle weight (EIP-7825), toll fees (EIP-7883), and vehicle length (EIP-7934) on the highway, limiting computational load, transaction volume, operational costs, and block size from multiple dimensions. This allows for increased traffic flow while ensuring that all vehicles can pass quickly, maintaining Ethereum's robustness, smoothness, and resistance to attacks during expansion.

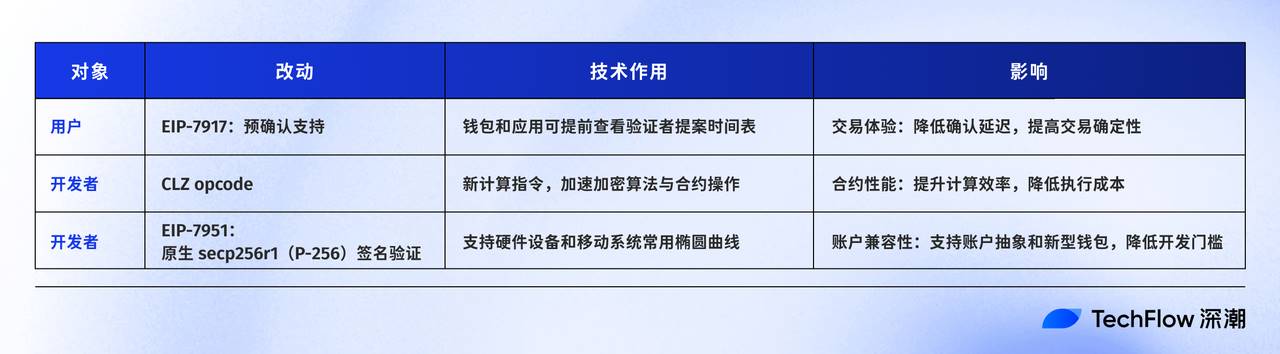

Usability

For users, using the highway analogy again: to understand pre-confirmation in one sentence, it means being able to reserve a parking space at the highway entrance, with the exit time locked in before the vehicle enters the station, with block confirmations almost instantaneously completed.

For developers: Fusaka optimizes the execution environment, enhancing contract computation efficiency, reducing the costs of complex operations, and supporting hardware keys, fingerprints, and mobile device logins, simplifying account management and user interaction.

Practical Impact

Setting technology aside, how significant are the changes in user experience and the ecosystem? Just look at the image to understand:

Due to space limitations, here are some points that might be of particular interest:

Staking Will Become Safer and More Stable

In the past, becoming an Ethereum validator was more like a professional sport—high hardware thresholds, complex operational processes, and data synchronization times that could take days made it daunting for ordinary users. The Fusaka upgrade is truly bringing this into the "common era."

With the launch of the PeerDAS mechanism, nodes only need to sample download and store about 1/8 of the data fragments when verifying blob data availability, significantly reducing bandwidth and storage costs. What is the result?

Before the Fusaka upgrade, according to the official Ethereum.org blog, 32 ETH validators could run nodes stably on devices with only 8 GB of memory. The upcoming Fusaka upgrade will further reduce the bandwidth and storage requirements for validators. Let's look at the data intuitively:

In the Fusaka testnet, the bandwidth required to become a validating node is about 25 Mb/s.

Compared to the domestic network environment, by the fourth quarter of 2024, the average download rate for fixed broadband in our country is expected to reach 99.14 Mb/s.

In other words, most household devices can run Ethereum validating nodes and enjoy native staking rewards.

Fusaka makes household-level nodes a reality—no longer just professional operators, more household devices can join the network validation, collectively ensuring Ethereum's security while directly sharing staking rewards.

This is a true strengthening of decentralization. The lowering of operational thresholds means more independent validators can join, and more validators lead to a more stable, resilient, and decentralized Ethereum.

From an investor's perspective, this also optimizes the risk structure of staking: when validating nodes are no longer concentrated among a few large operators, the chain can maintain stability under high loads; volatility decreases, and the yield curve becomes smoother.

High-Frequency Interaction: Fusaka Opens the Era of "Real-Time Ethereum"

In the Web3 world, DeFi, payments, and AI Agents share a common bottleneck: they all require a real-time responsive network.

In the past, Ethereum was secure but not smooth enough. The rhythm of one block every 12 seconds was sufficient for large single transactions; however, for continuous instruction calls from AI Agents and millisecond-level settlements for on-chain payments, this rhythm is clearly too slow.

Fusaka changes all of that.

With PeerDAS, increased gas limits, and reduced L2 costs, Ethereum becomes more suitable for supporting high-frequency interactive applications.

We may soon witness a more instantaneous and explosive Ethereum ecosystem.

Let’s detail DeFi:

Fusaka not only enhances throughput but also directly optimizes the operational experience of DeFi. Lending, synthetic assets, and high-frequency trading protocols can "run faster and at lower costs."

Here are a few examples of common protocols:

Aave: Loan liquidation windows shortened, liquidation fees decreased. This is due to lower L2 upload costs, allowing liquidation transactions to be packaged faster, reducing slippage and delay risks.

Synthetix: Instant settlement times for synthetic assets reduced, contract interaction fees decreased. The increased blob capacity allows for larger contract calls without restrictions, making fund operations more efficient.

High-Frequency DEX: Pool depth increased, large trades no longer produce significant slippage. The driving force behind this is the expanded block gas limit and lower L2 upload fees, significantly enhancing liquidity utilization.

Conclusion

The potential brought by the Fusaka upgrade is immense; it may become the most ecologically driven, third milestone-level upgrade for Ethereum since the Merge and Dencun.

From an 8-fold increase in on-chain data capacity, a sharp drop in transaction fees, and several-fold increases in throughput, to lowered validator thresholds—these changes combined will unleash vitality in the Ethereum ecosystem in this new phase following the Fusaka upgrade.

We should all closely observe: after Fusaka, will Ethereum usher in a brand new growth cycle?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。