Author: Oliver, Mars Finance

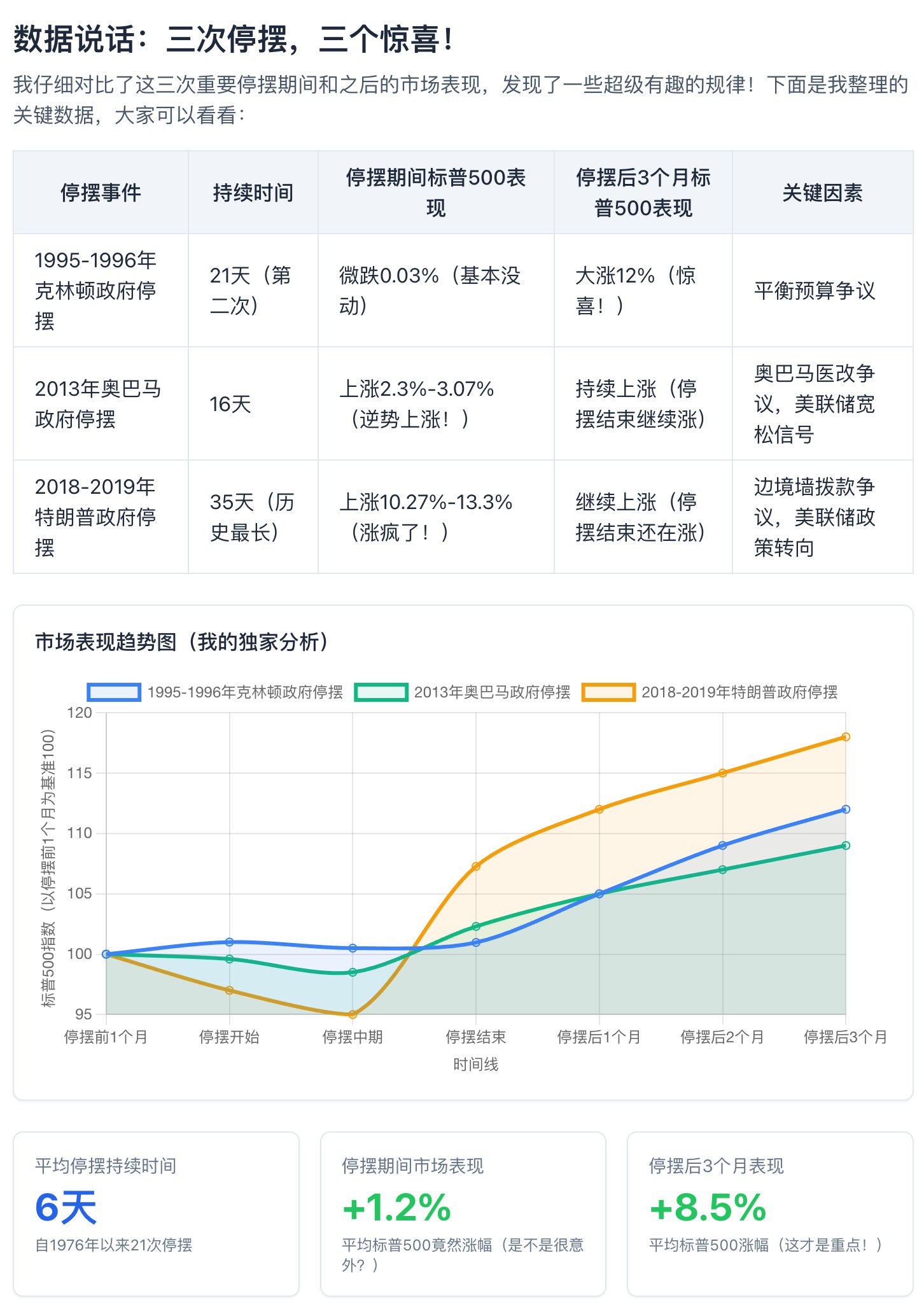

Regarding the impact of the U.S. government shutdown on the market, a widely circulated data chart reveals an astonishing historical pattern.

The data shows that looking back at the three major shutdowns in 1995, 2013, and 2018-2019, the average performance of the S&P 500 index during the shutdown was a slight increase of 1.2%. But the real "surprise" comes afterward: within 3 months after the shutdown ends, the S&P 500 averages a significant increase of 8.5%.

_source: _@BunnyTalks_

History seems to be telling us through data: the end of the shutdown is the true starting gun for a bull market.

And this historical pattern seems to perfectly predict everything that is about to happen.

So, what will be the specific mechanism driving that 8.5% increase after the "longest shutdown in history" ends in 2025? The answer is: a trillion-dollar "liquidity flood" triggered by the TGA "opening the gates."

As for why this time (when BTC fell below $99,000) feels so painful? This precisely proves that the "killing mechanism" in 2025 is unprecedented. This time, the "dollar shortage" caused by the Treasury's TGA account, this "trillion-dollar black hole," is structural.

But this not only does not overturn the historical pattern, but rather makes the "flood" rebound after the shutdown ends even more intense and certain.

However, before the "flood" arrives, another "black swan"—or rather, a large batch of "poor data"—will first impact the market.

40 Days of "Financial Black Hole": The Real Culprit Behind the Market Crash

For those in the crypto world who personally experienced the crash in early November, this shutdown is certainly not easy.

In the first week of November, Bitcoin not only failed to hold the $100,000 mark but even briefly fell below $99,000, hitting a six-month low.

What is the market panicking about?

It's not a black swan, nor a narrative collapse, but a mechanical "dollar shortage" created by the U.S. Treasury itself.

This "suction pump" is called TGA (Treasury General Account).

The TGA can be understood as the "central checking account" set up by the U.S. government at the Federal Reserve. All federal revenues (taxes, bond issuance) are deposited here, and all government expenditures (civil servant salaries, defense spending) are drawn from here.

Under normal circumstances, the TGA is a "transit station," receiving and spending money, maintaining a dynamic balance.

But the "government shutdown" broke this cycle. Due to Congress not approving the budget, most government departments closed, and the Treasury "could not spend as planned." The TGA became a financial black hole that only takes in but does not pay out.

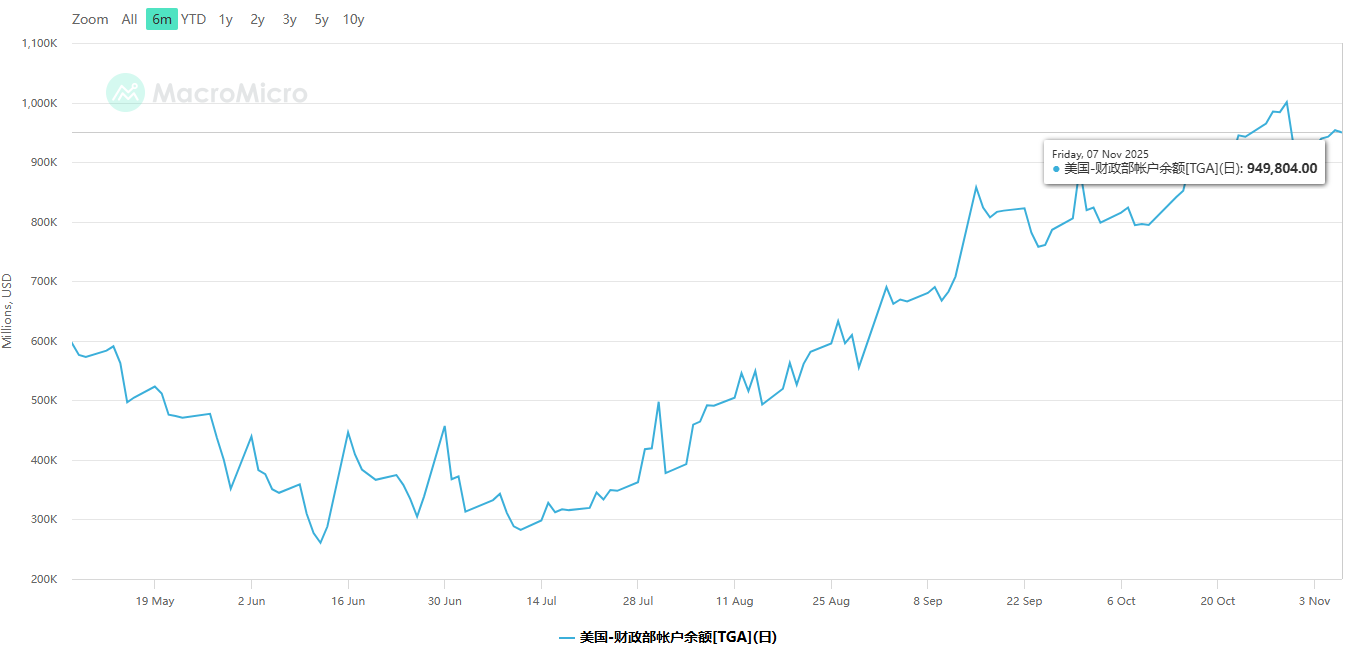

The data is astonishing. Since the shutdown began on October 1, the TGA balance surged from about $300 billion to over $1 trillion by the end of October.

In just 40 days, over $700 billion in cash was forcibly withdrawn from the market and locked in the Federal Reserve's vault.

A lack of money in the market can lead to "death."

This $700 billion liquidity vacuum was the last straw that crushed the crypto market. We saw BlackRock's IBIT forced to net outflow $403 million from October 28 to November 3, not because institutions were bearish on Bitcoin, but because their "dollars" became more expensive, forcing them to sell high-risk assets for cash.

We saw long-term holders (LTH) net sell 405,000 BTC within 30 days, cashing out over $4.2 billion, not due to a collapse of faith, but because "the landlord's family has no surplus grain."

October 31: The Shock Alarm of the "Dollar Shortage"

If the TGA is a "trillion-dollar black hole," then October 31 was the day this black hole nearly caused the financial system to "shock."

On this day, the "capillaries" of the U.S. financial system sent out two clear alarms, both setting records since the pandemic crisis in March 2020.

Alarm One: Interbank "borrowing costs" spiraled out of control.

There is a key interest rate that measures the true cost of "overnight borrowing" between banks. On October 31, this rate soared to 4.22%.

The terrifying aspect of this number is that the Federal Reserve's set "upper limit" for the policy rate is 4.00%. This means that due to the severe "dollar shortage," banks would rather pay "penalties" to borrow money. The actual cost in the market has already spiraled out of control, detached from the central bank's control.

Alarm Two: Banks collectively rushed to the Federal Reserve's "pawn shop."

When banks cannot borrow money in the market (even at "penalty rates"), they have only one last option: to pledge high-grade bonds to the Federal Reserve in exchange for "emergency" cash.

On October 31, the usage of this "emergency window" exploded to $50.35 billion.

These two data points combined translate to: by the end of October, the banking system was truly "short on cash." They first tried (Alarm One) to "bleed" each other at any cost, and when "bleeding" failed (Alarm Two), they began to collectively rush to the Federal Reserve's "emergency room."

And all this "downstream blockage" stems from the TGA's "upstream reservoir" only taking in but not paying out over the past 40 days.

Data Black Hole: The Federal Reserve's "Blindness" and Market "Panic"

Now, the "root cause" is about to be addressed. The TGA is about to "open the gates and flood."

Logically, the market should experience a V-shaped reversal. But the problem is that the 40-day government shutdown affected not only the cash flow of the TGA but also the operations of key data departments like the U.S. Bureau of Labor Statistics (BLS).

This is the first "big test" the market is about to face, and it is also the source of the "golden pit."

Morgan Stanley economists have already warned: the employment data for September (to be released as early as this Friday) will be "patched together," and the CPI, PPI, and PCE for October—the inflation indicators most favored by the Federal Reserve—may not even be released at all.

Because data collectors were on shutdown, the inflation data for October "was not collected at all."

This creates a perfect "data black hole" just before the Federal Reserve's meeting in December.

Federal Reserve Chairman Powell has always emphasized that his decisions are "data-driven." And now, he has "no data to rely on."

This will bring enormous uncertainty to the market in the short term. The market has never feared "bad news" as much as it fears "inability to price." When Wall Street's elite traders find themselves unable to predict the Federal Reserve's next move, their first reaction is to sell risk assets until uncertainty is resolved.

We are likely to see an extremely unusual scenario: the market first cheers and rises for the good news of "government reopening" and "TGA flooding"; then (perhaps this Friday), when that "poor" September employment report is released, the market suddenly wakes up, realizing that the Federal Reserve has become "blind," triggering a panic sell-off.

Trillion-Dollar "Flood" Meets "Data Black Hole" = The Last "Golden Pit"?

This is precisely the most exquisite point of contention in the current market.

On one hand, we have a certain, long-term massive benefit: the TGA's $1 trillion "flood."

More importantly, based on our in-depth research, the "sponge" used to absorb this flood—RRP (Reverse Repurchase Agreement)—has seen its balance drop from $2.2 trillion to less than $80 billion.

This means that the $1 trillion liquidity released by the TGA will have no buffer, directly overflowing into bank reserves and flooding into risk assets. This is almost a foregone conclusion of "massive liquidity injection."

On the other hand, we have a sudden, short-term massive uncertainty: the shockwave of the "data black hole."

What happens when these two events overlap?

A perfect "golden pit" created by "uncertainty."

This may be what the material refers to as the "last boarding area before the arrival of a small bull market."

Astute traders are waiting for this "dislocation." They know that "massive liquidity injection" will eventually come, but they also know the market will first be spooked by "poor data."

If the market experiences a sharp correction this Friday or early next week due to an "uninterpretable" employment report or "missing" CPI expectations—such as dipping back down to $99,000 or even lower liquidation zones—it is likely not the beginning of a new bear market, but rather the last "smash and accumulate" before the trillion-dollar liquidity "flood" arrives.

The Real "Storm": When "New Water" Meets "New Channel"

What makes the bears even more desperate is that once the market "digests" this "data black hole"—perhaps the Federal Reserve will be "forced to be dovish," ignoring inflation data in the name of "financial stability" (i.e., SRF soaring by $50 billion)—the TGA's "new water" will meet the "new channel" after regulatory resumption.

The government reopening means the SEC will also resume operations.

Analysts at Bitunix are concerned that "accelerated regulatory scrutiny" may bring negative news, but the mainstream market expectation is clearly more optimistic.

Because in September, the SEC already approved the "general listing standards," which is seen as greatly "expediting" the ETF approval process. What the market is waiting for is no longer BTC or ETH, but a series of compliant products like SOL, XRP, ADA, DOT that will bring massive new funds to the market.

Now, let's put all the pieces together:

- Faucet (TGA): About to release $1 trillion in liquidity.

- Reservoir (RRP): Nearly depleted, unable to absorb the flood, liquidity will directly overflow.

- Water Channel (SEC): About to resume operations, ready to approve a new batch of "altcoin ETFs."

This is the true meaning of "government reopening." The short-term "data black hole" it brings may create a panic sell-off, but this is likely the last "boarding area" before the arrival of the trillion-dollar liquidity feast.

After all, when the TGA's "new water" meets the SEC-approved "new channel," we will no longer be discussing "whether it will warm up," but rather "when the next altcoin season will ignite."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。