Written by: ChandlerZ, Foresight News

On November 10, Coinbase announced the launch of an end-to-end token sale platform, aiming to establish a more sustainable and transparent new standard in the primary issuance phase of projects. Around this platform, Coinbase provides distribution and liquidity solutions for project parties targeting global retail users, while also allowing ordinary users, especially American investors, to once again have widespread participation opportunities in public token sales after many years. According to official disclosures, the first token sale will take place from November 17 to 22, with a one-week subscription window already confirmed.

The token sale platform launched by Coinbase is not coming out of nowhere; it is an extension of the acquisition completed on October 21 of this year, when Coinbase acquired the on-chain private investment platform Echo, founded by well-known figure Cobie in the crypto space, for approximately $375 million in cash and stock. After confirming the acquisition, Cobie tweeted that Echo would continue to operate as an independent platform, retaining its existing brand, but would integrate the public sale products of Echo's custodial public offering tool Sonar into Coinbase, and may introduce new methods internally within Coinbase.

In Coinbase's official statement, the new platform primarily aims to address the issue that many projects often fail to deliver tokens to real users during the issuance phase, making it difficult to establish sufficient liquidity in the secondary market. Coinbase hopes to build a clearer path between real user distribution and exchange liquidity through a unified sales process, transparent rule design, and strict information disclosure.

Shifting Rules Towards Real Users

In terms of specific mechanisms, Coinbase has not adopted the traditional first-come-first-served or simple lottery logic, but has designed a process centered around a request window and algorithmic allocation.

First, each token sale will open a limited-time request window, with a typical example being one week. Users do not need to compete for speed in a flash sale; instead, they can submit their desired purchase amount at any time during the entire window period. After the window closes, the platform will use an algorithm to calculate and determine the final allocation for each account.

Secondly, in terms of allocation logic, Coinbase explicitly adopts a filling-up-from-the-bottom algorithmic approach, prioritizing the requests of users with smaller purchase amounts, and then gradually filling larger requests until sold out. This design aims to limit the excessive concentration of supply by large purchase accounts, enhancing the distribution of tokens among a broader user base, thereby addressing the typical issue of a few large holders consuming most of the shares.

More specifically, Coinbase has introduced constraints on short-term selling behavior in its rules. The platform clearly indicates that if users sell new tokens shortly after they go live (for example, within 30 days), their priority for allocation in subsequent token sales may be affected. This means that the platform will, to some extent, prioritize allocation resources towards participants who genuinely believe in the project and are willing to hold and use the tokens in the medium term, thereby reducing the proportion of pure arbitrage from new token sales and strengthening the weight of so-called real users.

For ordinary users, this entire design brings several intuitive changes. Subscriptions no longer require timing and machine speed competition; allocation results are no longer solely determined by speed or lottery, but are jointly decided by overall participation during the window and the algorithm's distribution logic. At the same time, frequently selling newly acquired tokens in the short term may lower one's queue position in the next public offering.

Setting Higher Barriers for Issuers

If the above mechanisms are more about optimizing rules for users, then on the issuer side, Coinbase sets higher barriers through disclosure and lock-up clauses.

On one hand, issuers must provide users with a complete set of key disclosure information, including project overview, token economic model, team background, and related risk explanations. For participants, this means that before submitting a purchase request, they can obtain relatively complete project information on the same platform, rather than piecing it together from social media and various third-party channels.

On the other hand, Coinbase imposes strict constraints on the behavior of issuers and their affiliates in the secondary market. According to the rules, within six months after the tokens are publicly sold through the platform, issuers and their affiliates are prohibited from selling related tokens through over-the-counter (OTC) or secondary markets; if there are indeed sales arrangements, they must be approved by Coinbase in advance, publicly disclosed, and set with a lock-up structure, allowing the related tokens to be unlocked and settled only after six months. The goal of such clauses is to reduce the hidden selling under severe information asymmetry during the initial price discovery phase of the project and to improve the predictability of the overall issuance structure.

In terms of fee structure, Coinbase does not charge users a fee for participating in token sales. The fees are borne by the project parties, with the platform charging a certain percentage as a service fee based on the amount of USDC raised by the issuer through sales. This fee only applies to the token sale phase, and the official statement emphasizes that no additional listing fees will be charged. This makes the cost structure for projects clearer, and the issuance and listing phases are more transparently separated.

It is worth noting that assets issued through this platform will be included in Coinbase's listings roadmap. In other words, once a project enters the token sales phase, it is naturally linked to Coinbase's subsequent listing plans, and the market will generally view it as an asset with a clear listing path, although the specific listing time and trading pair arrangements will still depend on subsequent processes.

Global Coverage and the Return of American Retail Investors

In terms of regional coverage, Coinbase stated that the new platform will initially open retail participation to most regions globally and plans to further expand its support range in the future. More symbolically, this will become one of the first scenarios since 2018 where ordinary American investors can widely participate in public token sales within a compliant framework. Previously, in the context of the decline of the ICO boom and tightening regulations, American retail investors had long been excluded from most public offerings and relied more on the secondary market for post-sale purchases.

The rule system of this platform reintroduces American users as participants in the issuance phase, while also layering stricter information disclosure requirements, issuer lock-up obligations, and constraints on short-term behavior, attempting to find a balance between investor participation and investor protection structurally. For American users accustomed to trading new assets only in the secondary market after listing, this undoubtedly represents a significant expansion of participation pathways.

In terms of participation experience, users need to complete the registration of a Coinbase account, KYC verification, and meet local compliance requirements before they can submit USDC-denominated subscription requests within the request window. After the window ends, the platform will return the final allocation results based on the algorithm and automatically credit the allocated shares to the account after the tokens go live. The entire process bears some resemblance to traditional IPO subscriptions but introduces a more retail-friendly inclination through mechanisms like bottom-up filling. Relevant media have also mentioned that the platform plans to add limit orders and higher allocation functions targeting specific user groups in the future to further improve the connection between issuance and trading.

First Sale Selected Monad

According to the rhythm planning announced by Coinbase, the new platform is expected to maintain a frequency of about one token sale per month. Compared to the high-density public offering schedule, this controlled rhythm means that individual projects can gain more resource tilt and attention from the platform and community during the launch period, while also raising the entry threshold to some extent.

The first token sale is scheduled for November 17 to 22, with a one-week request window serving as the first complete exercise of this mechanism. Multiple media reports indicate that the first project to conduct a public offering through this platform will be the public chain startup Monad.

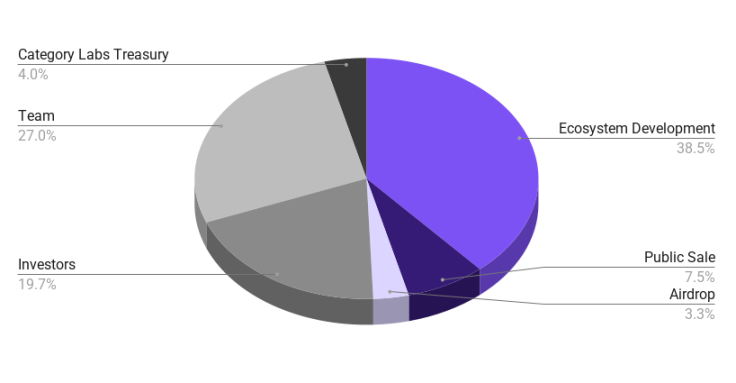

According to the token economics announced by Monad, its total token supply is 10 billion, of which 7.5% of the tokens will be sold at a fully diluted valuation (FDV) of $2.5 billion, with 3% of the tokens distributed through airdrops. The remaining ecological development accounts for 38.5%; the team accounts for 27.0%; investors account for 19.7%; and Category Labs treasury accounts for 4.0%.

The public sale of Monad tokens will take place from November 17, 2025, at 22:00 to November 23 at 10:00, with a maximum of 7.5 billion MON (7.5% of the initial supply) being sold at a price of $0.025 per token. The participation threshold is a minimum subscription of $100 and a maximum subscription of $100,000 (Coinbase One members may enjoy higher limits according to platform terms).

Overall, considering Coinbase's strong investment in Base in recent years, it is reasonable to expect more synergies between the two in the future: on one hand, the compliant public offering entry naturally facilitates more transparent user guidance and asset distribution on Base; on the other hand, high-quality projects native to Base are also more likely to be directed to Sonar/Coinbase's public offerings and subsequent listing paths. However, this still belongs to a strategic foresight assessment, and the official has not announced any mandatory binding or exclusive channels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。