Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

RWA Market Performance

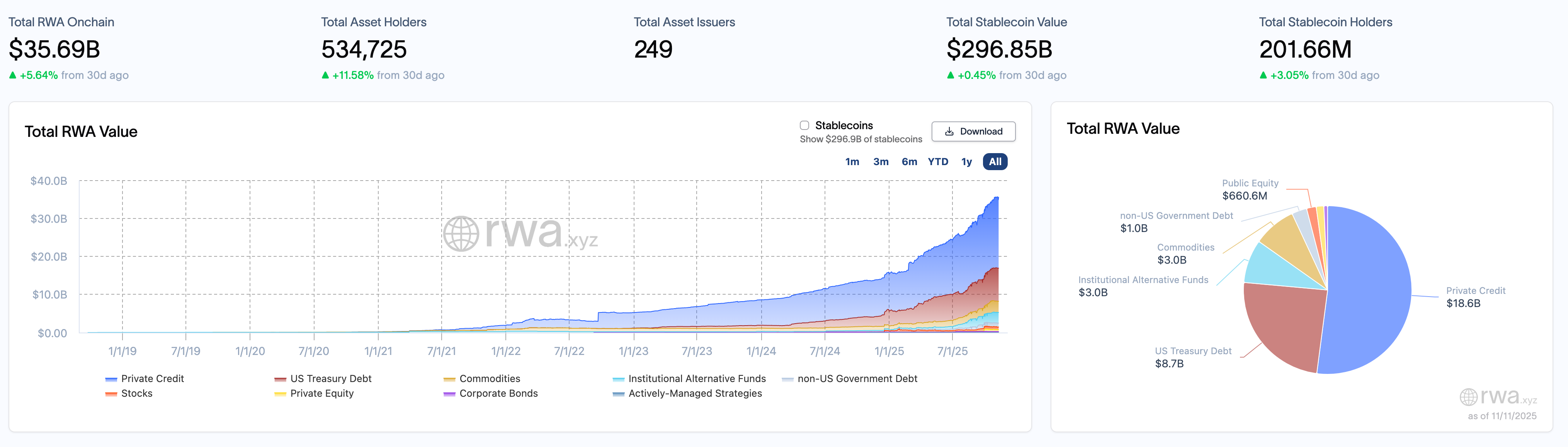

As of November 11, 2025, the total on-chain value of RWA is $35.69 billion, slightly down from $35.78 billion on November 5, a decrease of $90 million, or 0.25%. This marks the first slight pullback after six consecutive weeks of growth, with the market entering a short-term consolidation phase at high levels. The total number of asset holders increased from 530,943 to 534,725, with a weekly addition of 3,782 people, a growth of 0.71%, indicating a slight slowdown in user growth. The number of asset issuers rose from 242 to 249, adding 7 new issuers. In the stablecoin market, the total market capitalization increased from $294.62 billion to $296.85 billion, a growth of $2.23 billion, or 0.76%; the number of stablecoin holders also rose from 200.69 million to 201.66 million, an increase of about 970,000 people, or 0.48%.

In terms of asset structure, private credit remained stable at $18.6 billion this week, unchanged from the previous week, ending a previous trend of continuous growth. U.S. Treasury bonds saw a slight pullback, decreasing from $8.8 billion to $8.7 billion, a reduction of $100 million, or 1.14%. This week, commodity assets and institutional alternative funds showed no significant changes in large numerical ranges (or minor changes not discussed in this article), maintaining at $3 billion, with market demand for these two asset types remaining solid, neither increasing nor decreasing amid an overall downward trend. Public equity and total assets saw a slight pullback, decreasing from $670.8 million to $660.6 million, a reduction of 1.53%, remaining in a consolidation range for two consecutive weeks, possibly still in a phase of structural adjustment and valuation rebalancing. Non-U.S. government debt remained at $1 billion, while other minor asset categories (such as private equity) showed little change this week compared to other assets.

Trend Analysis (Comparison with Last Week)

This week, the total market capitalization slightly retreated, and the acceleration of user growth slowed. However, the asset structure is stabilizing, with on-chain private credit, U.S. Treasury bonds, and other core allocation assets maintaining their dominant positions, while commodity assets and institutional alternative funds remain stable. Some growth-type assets, such as public equity and minor funds, are in a valuation digestion phase. Stablecoin liquidity has slightly increased but has not significantly translated into new market capitalization for RWA. Until risk appetite rises significantly, the overall RWA market remains focused on "structural digestion."

Market keywords: consolidation, stability, differentiation.

Key Event Review

U.S. CFTC May Allow Use of Stablecoins as Tokenized Collateral in Derivatives Market

According to informed sources, the U.S. Commodity Futures Trading Commission (CFTC) is developing a tokenized collateral policy expected to be released early next year, which may allow the use of stablecoins as acceptable tokenized collateral in the derivatives market, potentially piloted first in U.S. clearinghouses with stricter regulations requiring more disclosures, such as position sizes, large traders, and trading volumes, as well as more detailed reporting of operational events.

According to Bloomberg, the Hong Kong government plans to issue digital green bonds denominated in USD, HKD, EUR, and CNY, with pricing expected as early as today. This will be the third issuance of digital bonds by the Hong Kong government since 2023. If this bond issuance is successfully advanced, it will be an important step towards normalizing bond tokenization and the tokenization of real-world assets (RWA). Analysts from CITIC Securities expect that within the next 2 to 3 years, native digital bonds in Hong Kong will transition from pilot projects to one of the standard options for high-quality corporate financing.

Bank of England: Proposes a £20,000 cap on individual stablecoin holdings

The Bank of England has proposed that 60% of assets supporting stablecoins can be held in short-term UK government bonds, and at least 40% must be held at the Bank of England. The Bank of England proposed a £20,000 cap on individual stablecoin holdings, while the limit for corporate holdings is set at £10 million.

Pakistan considers issuing rupee-backed stablecoins

Zafar Masud, chairman of the Pakistan Bankers Association (PBA), stated on Friday that Pakistan is seriously considering launching rupee-backed stablecoins and is developing a central bank digital currency (CBDC) prototype to enhance financial inclusion and reduce remittance costs. Masud warned that if digital assets are not regulated in a timely manner, Pakistan could lose up to $20 billion to $25 billion in crypto-related economic growth opportunities. The Deputy Governor of the State Bank of Pakistan revealed that the CBDC prototype is being developed with the assistance of the World Bank and IMF, with plans for a pilot before full rollout. Pakistan began inviting international crypto exchanges and VASPs to apply for licenses in September.

Circle submits comments on the implementation of the GENIUS Act

Circle announced that it has submitted comments to the U.S. Treasury regarding the implementation of the GENIUS Act, emphasizing the need for a comprehensive regulatory framework for stablecoins to ensure consumer protection, market fairness, and global interoperability. Circle proposed a series of policy principles, including protecting customer funds, achieving interoperability through mutual recognition, ensuring the same rules apply to the same activities, maintaining competitive balance domestically and internationally, setting clear consequences and "emergency" plans, and pointed out that rule-making should reinforce Congress's intent, providing clear and strong rules for all issuers engaging with the U.S. market while offering the American public transparent and easily understandable financial products and services.

Japan's Financial Services Agency (FSA) is considering establishing a new system requiring third-party institutions providing asset custody or trading management services for cryptocurrency exchanges to report and register with regulatory authorities before providing services. This proposal was discussed on November 7 at a meeting of the Financial System Council's working group, which advises the Prime Minister.

Current regulations only require cryptocurrency exchanges to manage user assets strictly, such as using cold wallets for storage, but do not impose corresponding requirements on related outsourcing service providers. The FSA plans to regulate such institutions through a registration system and require exchanges to only use registered custody or management systems to avoid theft of funds or system failures due to security vulnerabilities.

Reports indicate that the 2024 DMM Bitcoin theft incident (resulting in a loss of approximately 48.2 billion yen, equivalent to $312 million) originated from an outsourced trading system provider, Ginco. Most members of the working group support this new regulation, believing it will help enhance the transparency of crypto asset regulation.

The FSA expects to complete the policy report soon and plans to submit an amendment to the Financial Instruments and Exchange Act at the regular Diet session in 2026. Additionally, the agency is actively promoting local stablecoin projects, recently approving the first yen-pegged stablecoin, JPYC, and supporting stablecoin pilot programs involving major banks, including Mizuho Bank, Mitsubishi UFJ Bank, and Sumitomo Mitsui Banking Corporation.

Today, Japan's Financial Services Agency announced that it will support a joint issuance pilot experiment of stablecoins involving Mitsubishi UFJ Bank, Sumitomo Mitsui Banking Corporation, and Mizuho Bank. According to the FSA announcement, this pilot experiment will serve as the first supported case of the newly established "Payment Innovation Project (PIP)," aimed at promoting innovation in the payment sector. Institutions applying to participate in this project, in addition to the three major banks, include Mitsubishi Corporation (as a business participant), Progmat (providing issuance infrastructure), and Mitsubishi UFJ Trust and Banking Corporation (expected to be responsible for trust functions).

Brazilian Central Bank official: Algorithm-based stablecoins have been banned

Brazilian Central Bank official Vivan stated that crypto companies should assess the appropriateness of allowing customers to engage in complex cryptocurrency-related operations and have banned algorithm-based stablecoins, currently prohibiting the buying and selling of these assets. Agreements reached so far remain valid, but stablecoin activities must cease. Currently, the tax situation regarding cryptocurrencies remains unchanged. The definition and timeline for taxing cryptocurrency transactions equivalent to foreign exchange transactions will be determined by the tax authority.

Coinbase submitted feedback to the U.S. Treasury, urging it to strictly adhere to Congressional intent when formulating the implementation rules for the GENIUS Act, avoiding overregulation, particularly excluding non-financial software, blockchain validators, and open-source protocols. Coinbase's Chief Policy Officer pointed out that regulation should not treat third-party reward programs as "interest" to avoid contradicting the spirit of the Act. Coinbase also suggested treating payment stablecoins as cash equivalents for related tax and accounting issues. The GENIUS Act was signed in July 2025, establishing a federal regulatory framework for stablecoins in the U.S.

Standard Chartered Bank announced a partnership with Singapore's issuing agency DCS Card Centre to become the main banking partner for its stablecoin credit card product, DeCard. This card allows users to directly use stablecoins for everyday purchases, with Standard Chartered responsible for transaction settlement and reconciliation.

It is reported that DeCard will be launched first in Singapore, with plans to expand to other major markets in the future. Standard Chartered will provide virtual account and API services for this product, enabling instant recognition and settlement of transactions, thereby promoting the integration of stablecoin assets with traditional payment systems.

Hong Kong-listed company Hong Kong and China Gas announced that it has secured a HKD 100 million credit line from Chuangxing Bank as an underlying asset to complete its RWA tokenization project. This project is reportedly supported by Ant Group's Jovay Layer2 blockchain, with key financial and operational data to be instantly recorded on-chain.

Hot Project Updates

Ondo Finance (ONDO)

One-sentence Introduction:

Ondo Finance is a decentralized finance protocol focused on structured financial products and the tokenization of real-world assets. Its goal is to provide users with fixed-income products, such as tokenized U.S. Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, high-liquidity assets while maintaining decentralized transparency and security. Its token ONDO is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application in the DeFi ecosystem.

Latest Updates:

On November 8, Ondo Finance posted on the X platform apologizing for the recent surge in Ethereum Gas fees. In the past 24 hours, the trading demand for Ondo's tokenized stocks accounted for over 10% of Ethereum's Gas usage.

Previously, Ondo Global Markets announced the expansion of its stock tokenization platform to the BNB Chain. Ondo Global Markets was launched in September, and this expansion is reportedly based on Ondo's cross-chain strategy, which is currently live on Ethereum and plans to deploy on other blockchains. Data shows that Ondo Global Markets has surpassed $350 million in TVL within weeks of its launch in September, with a total on-chain trading volume of $669 million.

MyStonks (STONKS)

One-sentence Introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing and trading real-world assets like U.S. stocks on-chain. The platform achieves 1:1 physical custody and token issuance through a partnership with Fidelity. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins such as USDC, USDT, and USD1, and trade them around the clock on the Base blockchain. All transactions, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks aims to bridge the gap between TradFi and DeFi, providing users with a high-liquidity, low-barrier entry into U.S. stock investments on-chain, building a "Nasdaq of the crypto world."

Latest Updates:

On November 5, the MyStonks MSX platform officially launched the S1 points season and M Bean incentive mechanism. The platform will track points based on real trading and holding behaviors in U.S. stock spot, crypto-to-crypto contracts, and U.S. stock contracts, with automatic settlement of the previous day's points at 10:00 daily (UTC+8). M Beans serve as a core indicator of user trading activity and contribution, and will be used for future distribution and incentives of the platform token $MSX. The calculation of M Beans not only considers trading volume but also examines position duration, profit and loss performance, and team Boost levels to ensure fair incentives. The team Boost uses a T+2 update mechanism for automatic synchronization of bonuses, with historical trading points included in community incentives.

Previously, MyStonks platform announced a brand upgrade, officially changing its domain to msx.com, moving towards a new era of global financial technology. This upgrade not only simplifies access but also reflects a transition from meme culture to a professional international financial brand, showcasing its determination in digital financial innovation and global expansion. The msx.com team stated that it will continue to focus on users, drive technological innovation, and enhance the security and efficiency of digital financial services.

Related Links

Sorting out the latest insights and market data in the RWA sector.

《MSX Points Season S1 Complete Guide: How to Obtain "Dual Alpha" Through RWA U.S. Stock Trading》

Have you recently enjoyed the dividends of the U.S. stock market? RWA trading has also welcomed its first on-chain points system, where the higher the trading volume, position value, holding time, and daily realized profit and loss, the higher the priority for M Bean distribution.

China's AI is making a comeback globally, reshaping asset pricing with rational algorithms from investment styles to RWA logic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。