Written by: Will A-Wang

In the crypto world, success and failure are often defined by cold on-chain metrics such as TVL and trading volume. While these are important, they fail to reach the dimension of "people" in real life. Whether it’s exchanges, consumer wallet apps, or DeFi, behind the pursuit of data lies the shadow of "people" in real life. How should we understand users? How should we design yield products? How should we do market promotion? Understanding the user logic behind the crypto yield market is crucial.

Thus, we compiled the Crypto Yield 2025 Retail Consumer Report, shifting our focus from on-chain data to the real voices of retail consumers (individual investors), attempting to understand how ordinary users view, trust, and use yield products. We focus on the following four questions:

What are the underlying motivations for consumers to earn yields?

What are the differences in trust levels and usage habits across different platforms?

What are the pain points and concerns hindering widespread adoption?

Looking towards 2025, what kind of yield products do retail users actually want?

By restoring the stories of "people," we hope to outline the true scale of the retail market and find the growth keys for the next stage of crypto yields.

Key Points

Crypto yield products are rapidly gaining popularity among retail investors, but adoption is highly concentrated on centralized platforms. It is estimated that around 20 million people globally earn yields through centralized exchanges (CEX), while only about 500,000 use decentralized finance (DeFi). The stark contrast indicates that mainstream users trust familiar custodial platforms more, while DeFi remains a "private domain" for early enthusiasts.

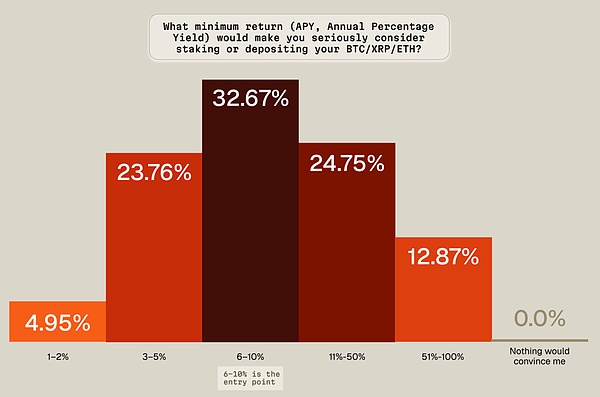

Research shows that retail investors are generally conservative and short-sighted in their yield decisions: over 60% have held crypto assets for less than a year, and only yields significantly higher than traditional finance can prompt them to switch—6% annualized is the "minimum attractiveness threshold," and single-digit APYs are hard to impress.

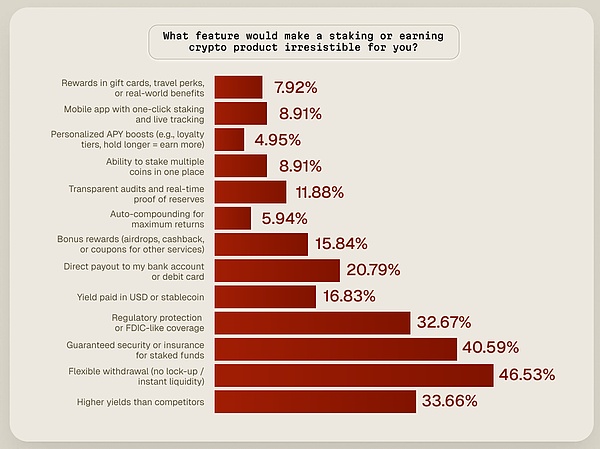

Trust and liquidity are the key factors. Nearly half of the respondents admitted that the number one reason they hesitate to engage with yield products is "fear of not being able to withdraw," followed by security concerns and lack of understanding. The ability to exit at any time and the safety of funds are more critical than the yield rate. When asked what features would make yield products "irresistible," flexible, no-lock-up instant redemption topped the list, followed by safety endorsements like insurance or custody; the yield rate itself ranked third.

Therefore, to expand the market, platforms must excel in the "basics" that retail investors care about most. If DeFi protocols want to break out of their niche, they need to make the experience "smooth with one click" and ensure safety is "visibly assured." Ultimately, products that are user-friendly, safe, and allow for instant deposits and withdrawals will outperform those that rely solely on high APYs but are filled with complex rules and lock-up conditions.

1. Retail Investor Yield Market Size

On-chain metrics like TVL and trading volume can track the flow of funds but cannot tell "how many people" are participating—these numbers are often distorted by whales, circular flows, and custodial institutions. Ultimately, the measure of adoption is "people," not "assets." This section will estimate the scale of retail user participation in crypto yields.

We do not seek precise headcounts (which cannot be done on-chain) but rather provide a credible range of magnitudes: combining surveys, platform disclosures, and market benchmarks to estimate the number of retail users "actively earning yields" across CEX, DeFi, and various custodial products.

Looking at the market through "user numbers" rather than "fund amounts" allows us to restore the real, accessible space, predict the adoption curve, and provide a basis for product, compliance, and GTM decisions, rooting strategy in consumer behavior rather than abstract capital flows.

We also estimated the total number of "yield users" on both centralized exchanges (CEX) and decentralized finance (DeFi) to present the current scale of retail users actually using staking, wealth management, and other value-added products.

1.1 Estimating the Base of CEX Yield Users

We adopted a conservative approach to measure how many users of centralized exchanges (CEX) are actually participating in yield, staking, or "earning crypto" products. In reality, the actual adoption rate may be higher, with multiple data sources indicating that the penetration rate of major platforms is around 20% to 25% (or even higher).

First, let’s look at Binance. A survey conducted by Binance itself on 27,000 users shows that about 25% of users "actively use" Binance Earn, suggesting that a quarter of its users participate in yield products; an independent CryptoQuant 2024 industry survey found that 28% of crypto users have used exchange "earn" products. Out of caution, we lower the range to 10–15% and acknowledge that the actual participation rate of some exchanges is significantly higher.

Scale background: Binance announced that by the end of 2024, it had over 250 million registered accounts globally. Even if only 10% use earning products, the user count would reach 25 million; if we assume a 25% penetration rate, it would exceed 50 million.

Conclusion: A reasonable estimate suggests that about 20–30% of active users on Binance are using earning products (consistent with the 25% survey result), meaning tens of millions of users are earning yields.

Next, Coinbase's financial report provides hard evidence of user staking participation. As of Q4 2023, Coinbase customers actively staked $9.4 billion in crypto assets (retail side), which also includes institutional staking. In 2022, Coinbase customers earned over $440 million in staking rewards, which the company noted was equivalent to about 20% of its trading revenue that year, highlighting the popularity of staking among users.

User participation: By early 2023, over 3.5 million Coinbase customers had joined the staking rewards program.

Scale background: Coinbase is projected to have 120 million monthly active users by 2025.

Conclusion: At Coinbase, about a quarter of active users have used staking/yield features (millions of users), indicating that while this is a single-digit percentage of total registered users, it represents a significantly higher proportion among active users.

Finally, we rank the top five exchanges by publicly registered user numbers: Binance, Coinbase, Crypto.com, KuCoin, and OKX. Public data shows that the total number of registered accounts across these five exchanges exceeds 500 million. However, many users have duplicate accounts across multiple platforms, leading to inflated numbers. To arrive at a more realistic "real user" base, we apply a conservative adjustment: assuming that duplicate accounts account for about 55–60%, we estimate the unique user scale of the top five exchanges to be around 200–230 million.

In summary, the true number of users (after deduplication) across the top five centralized exchanges is approximately 200–230 million. Within this base, a conservative estimate suggests that 20–34 million people (10–15%) are actively using staking, wealth management, and other value-added products.

1.2 Estimating the Base of DeFi Yield Users

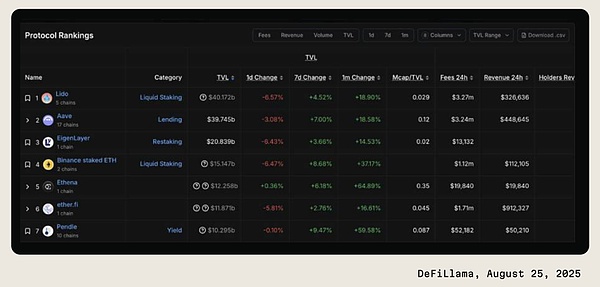

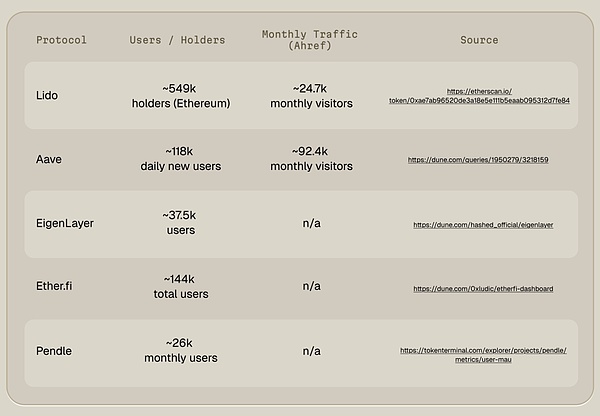

To understand the current battleground of DeFi activity, we focus on the top five "yield-generating" protocols ranked by TVL (covering staking, lending, and liquidity mining). While there are hundreds of other notable projects in the market, these five encompass the vast majority of funds and participants, providing a reliable estimate of magnitude.

To avoid confusion, we exclude assets backed by exchanges like Binance staking ETH and focus on pure on-chain DeFi scenarios. The snapshot date selected is August 25, 2025, which can represent recent user distribution and serve as a benchmark for estimating the DeFi yield audience.

We identified the top five protocols by TVL on DeFi Llama and used publicly available data sources to count their respective user addresses. Since there is no unified standard on-chain to accurately deduplicate, we rely solely on available public information for approximate estimates.

After aggregating the five protocols, we estimate the total number of DeFi yield audience to be around 500,000 to 700,000 unique users. Theoretically, further cross-referencing of address overlaps could be done, but for this report, precision to single digits adds no extra value; a magnitude perspective is sufficient.

1.3 Overall Picture of Crypto Yields

Combining official disclosures from exchanges, platform data, and conservative penetration rate assumptions, we estimate:

Over 20 million people have used Earn or staking products on centralized exchanges (CEX);

The number of independent users participating in staking, lending, and liquidity mining in decentralized finance (DeFi) is only about 500,000.

Specific numbers may fluctuate with market changes, but the magnitude difference is clear: CEX supports tens of millions of yield users, while DeFi remains in the niche stage of early adopters.

2. Insights into the Retail Yield Market

Knowing "how many people" is just the first half; the second half is "what do they actually want." Market size shows opportunity, while consumer preferences determine whether that opportunity can be realized.

Retail adoption depends more on human nature than on protocol design: motivations, trust, daily trade-offs. Why do they decide to use yield products? How do they trust that their money is safe? How much return is worth the risk? The answers can only come from directly listening to users.

This section breaks down the psychology of retail investors when facing yields: motivations, trust signals, platform preferences, barriers, risk tolerance, yield expectations, and the most effective ways to lower cognitive thresholds. These dynamics determine the growth ceiling—only when products align with real needs can user scale shift from "potential" to "actual."

2.1 Market Research

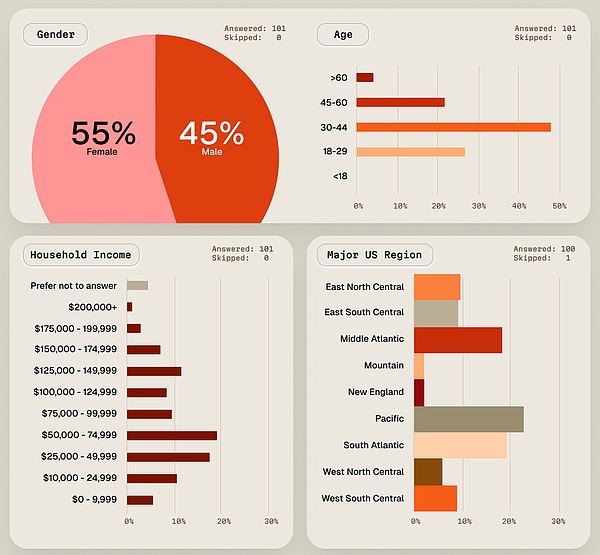

This research targets the general retail population in the United States, aged 18 to 99, covering all income levels. Among 150 valid samples, about two-thirds (67%) have held and used crypto assets, while one-third (33%) have never been exposed to them. To ensure the conclusions focus on "real behavior," we conducted an in-depth analysis of 101 active holders who are "in the circle," thereby eliminating noise from those with no experience.

The Motley Fool's "2025 Cryptocurrency Investor Trends Survey" indicates that approximately 21% of American adults own cryptocurrency, with penetration rates among millennials and Gen Z ranging from 20% to 30%, serving as a reliable reference for the national market.

This report does not aim to estimate the "national cryptocurrency ownership rate," but rather to depict the real behaviors and pain points of "retail holders" regarding yield products. The proportion of respondents with crypto experience is significantly higher than the national average, ensuring that the conclusions focus on the user experience "within the active retail ecosystem," which is more instructive for understanding product-market fit.

This sample forms the foundational profile of mainstream daily users in 2025, useful for observing the real behaviors, preferences, and pain points of retail consumers when facing crypto yield products. The sample presents a typical "crypto profile" in terms of age, income, and technology acceptance: young, proficient in digital tools, and primarily from middle to high-income groups, all of which are above the national average. This demographic is currently the most active in the crypto market and most willing to experiment with yield products, making it possible to observe their motivations, pain points, and preferences, which can directly reflect the real needs and future trends of the retail sector.

This research focuses only on the five assets with the highest retail ownership, rather than listing long-tail tokens. The benefits of this approach are:

Clearer insights and stronger statistical significance, directly corresponding to where retail yield behaviors actually occur;

Shortened questionnaire options, reducing recall bias among respondents and eliminating noise from those with minimal token holdings;

Yield tools, liquidity, and infrastructure are most mature among the top five assets, making the conclusions more actionable.

These five leading assets account for the vast majority of retail holdings and trading volume, thus also being the focal point for yield decision-making.

2.2 Holding Period

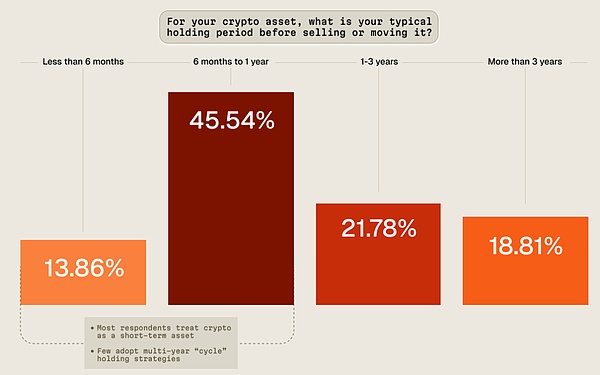

Most respondents have a relatively short holding period for crypto assets:

Over 60% typically sell or transfer their assets within a year;

Those holding for more than three years are a very small minority, indicating that "long-term holding" is not common in this retail sample.

Despite the industry's emphasis on a "four-year cycle" and advocating for long-term holding, the data shows that ordinary retail investors do not follow this strategy. On the contrary, short-term thinking and frequent rebalancing are the mainstream, further confirming that they view crypto assets as speculative tools rather than long-term allocations.

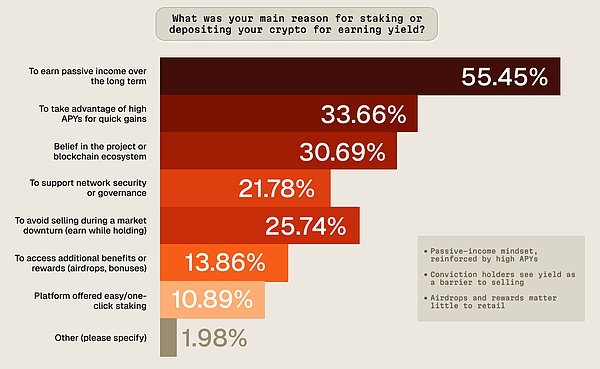

2.3 Motivation for "Earning Crypto"

For most retail holders, yield is seen as a form of passive income, but the prerequisite is that the APY must be "attractive enough." In other words, as long as the interest is enticing, they feel their coins are "working for them," even if they don't have time for short-term trading.

For those who are firmly optimistic about their held assets, yield serves another psychological purpose: providing a reason to "not sell." By staking or earning interest on their coins, they can hold onto them with peace of mind during bear markets, turning idle tokens into "productive assets," thereby reinforcing their confidence in long-term holding.

At the same time, "crypto-native" incentives like airdrops, points, and task rewards hardly pique the interest of retail users. Mainstream users are not as enthusiastic about chasing these incentives as insiders; their motivations are more pragmatic—they want cash flow and account discipline, not ecological gimmicks.

2.4 Preferred Yield Platforms

When earning yields, retail investors overwhelmingly place their funds in centralized exchanges (47.2%); the second most popular option is "consumer-grade" financial apps with wallet functions (22.77%), while direct interaction with DeFi is minimal (5.94%); about a quarter of respondents have never participated in any yield-generating products (23.76%).

The core of this phenomenon is not just "who offers the highest rates," but "where users are already located":

Trust and accountability: Familiar big brands, customer service hotlines, proof of reserves, and easy export of 1099/tax forms make newcomers feel "there's someone to turn to if something goes wrong."

Usage barriers and experience: A single username and password to log in; fiat deposits, withdrawals, trading, and earning all completed in one place; no need to install on-chain wallets, write down seed phrases, or worry about gas fees, bridging, or slippage.

Predictable yields: The page clearly states "annualized 6.5%," with options for "instant access" or "automatic earning"; compared to the real-time fluctuating APYs and governance token rewards in DeFi, it appears simpler and safer.

Default path dependency: Assets are already sitting on the exchange, and a quick click on "Earn" incurs almost zero transfer costs.

Perceived risk differences: Smart contract vulnerabilities sound "far away," while the specific risk of "losing funds forever due to sending to the wrong address" is very concrete—thus users simply hand over their private keys to the platform.

Conclusion: Although DeFi is far ahead in innovation and composability, the mainstream retail population remains within the "trade equals earn, earn equals yield" closed loop of exchanges. These findings also align with the earlier "market size" estimates—active users of CEX yield products outnumber those in DeFi by an order of magnitude.

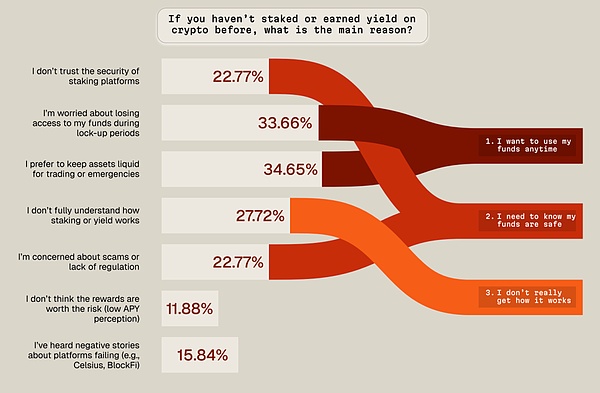

2.5 Three Major Barriers to Participating in Yield Products

Liquidity concerns: The ability to withdraw at any time is a hard requirement. Any "lock-up" prompt will lead ordinary investors to think of being unable to cut losses in extreme market conditions, thus avoiding it altogether.

Safety doubts: News of platforms going bankrupt or projects collapsing reinforces the impression that "high yield equals high risk." For most people, losing principal is scarier than low yields.

Understanding barriers: Concepts like staking, on-chain contracts, impermanent loss, and slashing are obscure and difficult to understand. Once information exceeds their cognitive comfort zone, the default decision is "to avoid."

Conclusion: The barriers to yield adoption are not "not wanting interest," but rather "fearing not being able to get it back, fearing the platform is unreliable, and fearing not understanding." Only by making products as accessible as demand deposits, with brand endorsements like banks, and as easy to understand as money market funds, will retail funds truly flow in.

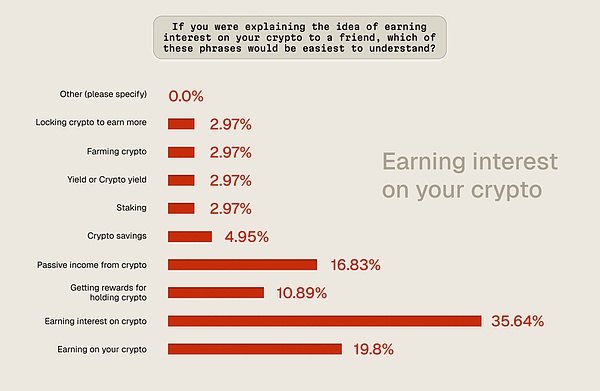

2.6 Word Choices for Describing "Crypto Yields"

Language determines the understanding threshold. When retail respondents were asked which expression was easiest to understand, the overwhelming winner was: "earning interest on your crypto."—it directly corresponds to bank savings, requiring no additional technical background.

The second-ranked expression was: "passive income from crypto." This also borrows from traditional financial concepts, making yields relatable. In contrast, jargon like "staking, yield, farming" is virtually ignored by mainstream users. These terms are commonplace in the crypto-native community but only create a sense of distance for outsiders.

Conclusion: To promote retail adoption, yields must be packaged in "understandable and memorable" everyday financial language—first making it clear, then making it reassuring, and only then will people invest.

2.7 Minimum Annualized Yield That Retail Investors Find Appealing

1–2% is almost ignored, and 3–5% also fails to generate interest—even if it exceeds bank savings or government bonds. For most retail holders, 6% is a hard threshold: only when this number is met or exceeded do they consider it worthwhile to move assets from their spot wallets to "earning" accounts.

The logic is simple: crypto itself is already a high-risk asset, and yields are viewed as "risk premiums" rather than stable interest. Users do not necessarily benchmark against safety and sustainability, but rather against the expectation that "crypto should offer more enticing returns." This also explains why those "limited-time high yields" of ten or twenty percent, even if only maintained for a few days, can instantly capture attention: they align with the public's expectation that "the crypto space should be more profitable."

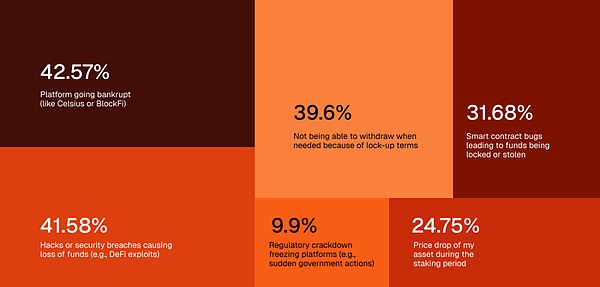

2.8 Why Retail Investors Fear "Yields"

In the eyes of retail investors, the biggest risk of yield products is not "low interest," but rather "losing principal" or "not being able to withdraw when needed." This is manifested in:

Sudden bankruptcy or exit of the platform;

Hacking incidents or contract attacks;

Smart contract vulnerabilities leading to fund evaporation;

Lock-up clauses rendering the redemption button "grayed out," leaving them helpless during market crashes.

They are not indifferent to yields; rather, they cannot be sure "whether their money is safe and whether they can exit at any time." Therefore, to expand the audience, platforms must prioritize "trust, transparency, and liquidity" over yield rates in their competition.

To win the hearts of retail investors, first reveal these three cards:

Regularly publish proof of reserves, completely isolating customer assets from company funds;

Redemption rules should be clear—"how long it takes, whether it's T+0, and whether there are early withdrawal fees" should be explicitly stated;

Explain risks in plain language: do not avoid stating "there is a possibility of losing principal in extreme situations," nor use "code is law" as a shield.

First, reassure them, then entice them, and only then can the yield market truly break out.

2.9 Drivers of Retail Adoption

In a crypto market with fluctuations of 10% or more, what attracts users the most is not high APY, but rather the ability to "leave whenever they want." Instant, no-lock withdrawals provide investors with peace of mind: if the market changes or they need money unexpectedly, they can withdraw back to their spot wallet with one click—control is always in their hands.

This also explains why exchanges are currently far ahead: they prominently display the signals of "liquidity + security," making yields appear as "a bonus" rather than "risk compensation."

Insights for product managers and marketers:

First, prove that users can withdraw at any time;

Next, demonstrate that funds are protected (proof of reserves, insurance, compliant custody);

Finally, present attractive interest rates.

Incentives, airdrops, and multi-layer rewards can only serve as decoration on this "foundation"; otherwise, no matter how high the annualized yield, it won't retain users.

3. Conclusion

The crypto yield market in 2025 presents a "dual-track reality":

One track is a massive centralized one—tens of millions of retail investors steadily earning interest through custodial platforms;

The other track is a small decentralized one—only hundreds of thousands of geeks "self-farming" on-chain.

Retail investors remain cautious: they demand the ability to withdraw at any time, yields must be higher than traditional financial products, and they prioritize safety over returns. Most are indifferent to single-digit APYs, with only yields above 6% being worth moving money.

The roadblocks are always "trust" and "access": fears of platform collapses, hacking, lock-ups, and incomprehensible rules. For substantial growth, products must prioritize liquidity, transparency, and simplicity over yield rates.

Language is also crucial—terms like "staking" and "yield farming" create distance, while "earning interest on your crypto" is instantly understood. Mainstream adoption will first rely on familiarity before discussing innovation.

Looking ahead, the winners will not be those with the highest APYs, but those with the most user-friendly experience, clear protections, credible returns, and easy access. The retail wave of crypto yields will not rely on high interest rates to push adoption, but rather on being "understandable, easily accessible, and trustworthy" to gain confidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。